撰文:hitesh.eth

编译:Luccy,BlockBeats

编者按:

Berachain 是一个基于 Cosmos SDK 构建的兼容 EVM 的 Layer 1 区块链,并采用 Proof of Liquidity 共识机制保护。Berachain 代币经济首次引入三代币系统的 Bera 网络,拥有网络 gas 代币 BERA、生态算法稳定币 HONEY 和不可转移的 Bera 治理代币 BGT。

目前 Berachain 项目 Discord 社区已有超过 50,000 名成员,超 100 个团队在最近发布的开发网络(Devnet)的本地版本上构建新的和现有的协议。

加密研究员 @hmalviya9 从 DeFi 流动性入手解析 Berachain 的机制和代币经济学。

Berachain 是一个神秘的项目,绝大多数加密货币 Twitter 用户对他们真正想要构建的东西一无所知。这篇文章将表达我对 Berachain 的真实想法。

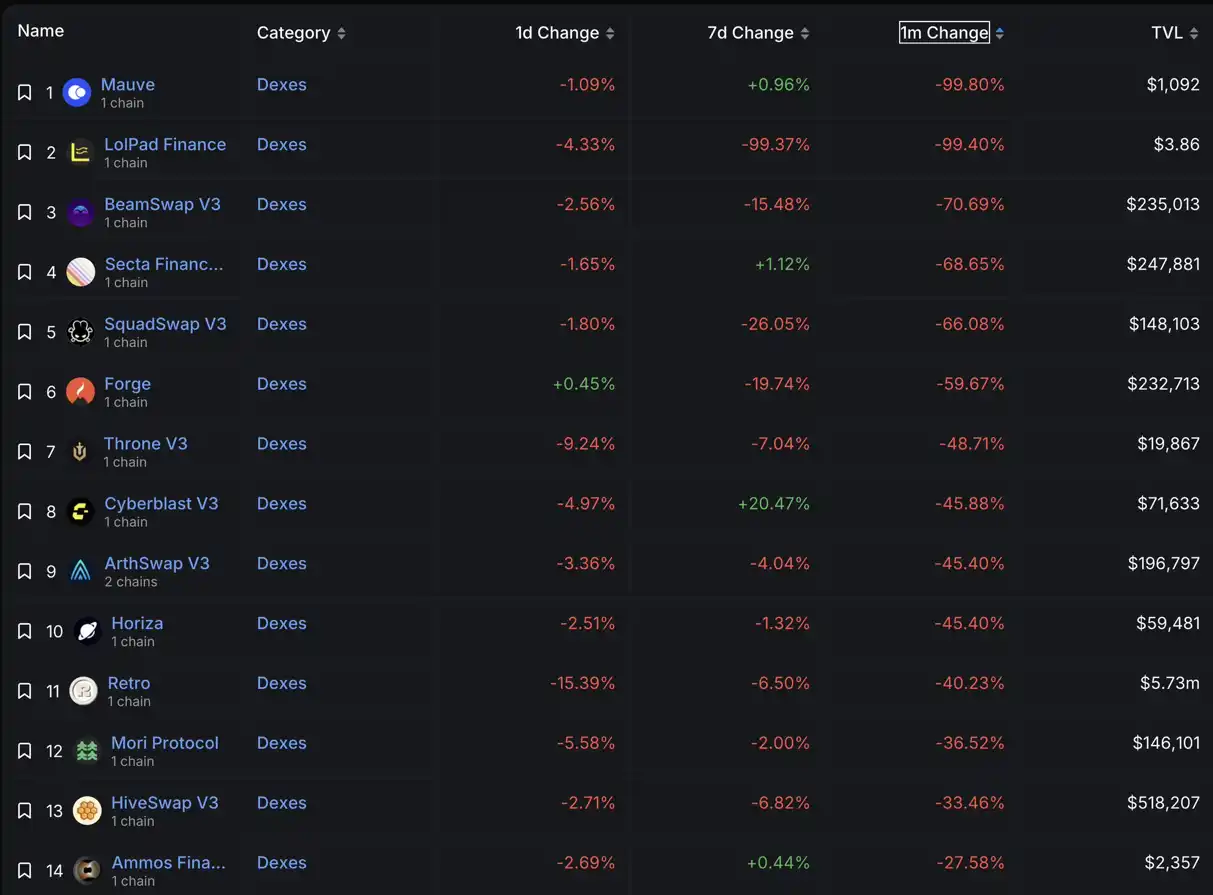

DeFi 面临着一个无尽的流动性问题。新的协议经常难以吸引流动性,导致许多新的基础设施失败,并最终变成了一个被忽视的地方。

DeFi 的流动性问题与经济安全问题非常相似。在 Eigenlayer 出现之前,为新的 web3 服务协议提供经济安全保障非常困难。现在变得容易了,因为 Eigenlayer 构建了一个协调层,将 ETH 验证者与 web3 服务协议连接起来。

现在,ETH 验证者可以直接在 Eigenlayer 上为新的 web3 服务提供安全保障,项目可以简单地专注于创新和产品设计,安全问题基本上解决了。

就 DeFi 流动性而言,如果我们找到一种方式,新的 DeFi 应用的流动性池可以直接通过验证者抵押的代币池获得流动性,而你作为抵押者可以通过代币通胀、交易费、交换费和区块捕获费获得奖励,简单来说就像有 4 倍的奖励提升。

那将会很疯狂,对吧?

作为抵押者,我不会拒绝这样的奖励提升。而作为 DeFi 项目所有者,我会很乐意将我的应用接入这样的区块链基础设施,它可以通过验证者直接处理我的流动性。Berachain 是解决 DeFi 流动性问题所需的基础设施。

他们建立了一种名为 Proof of Liquidity 的共识机制,抵押者将把他们的抵押代币委托给验证者并获得奖励,只有在他们在支持的资产池中提供流动性后,才能检索他们的抵押代币。

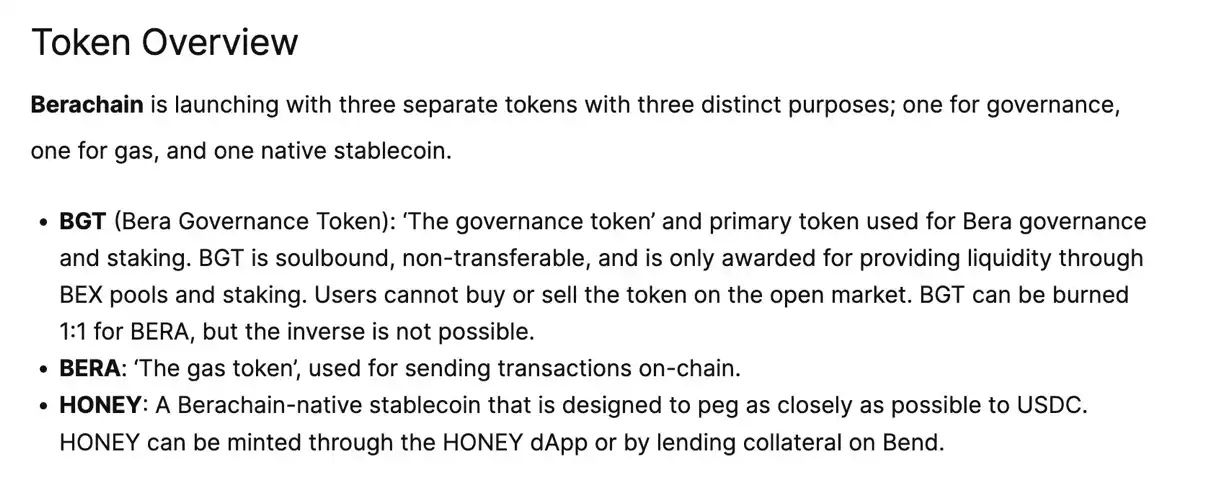

Berachain 有 3 种代币:

· BGT(抵押和治理代币)

· BERA(gas 费代币)

· HONEY(与 USDC 挂钩的稳定币)

BGT 在 Berachain 生态系统中起着抵押和治理代币的作用。实际上你无法铸造 BGT,但可以用 BGT 兑换 BERA。

BGT 是一种不可转让的代币,类似于 SBT。赚取 BGT 的唯一途径是在 Berachain 生态系统的本地 DeFi 应用的流动性池中提供流动性。截至目前,他们有 3 个本地 DeFi 应用:

· BEX - 基于 AMM 的去中心化交易所,类似于 Uniswap

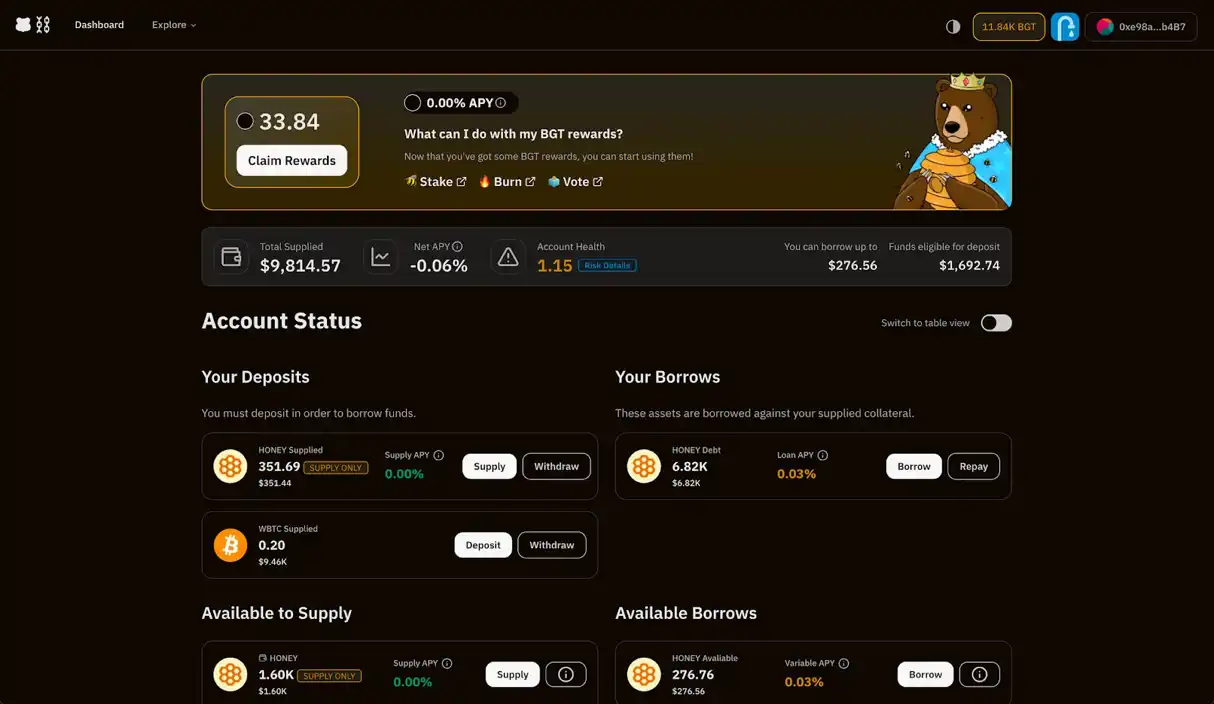

· BEND - 像 Aave 一样的借贷协议

· BERPS - 像 GMX 一样的 Perps 交易所

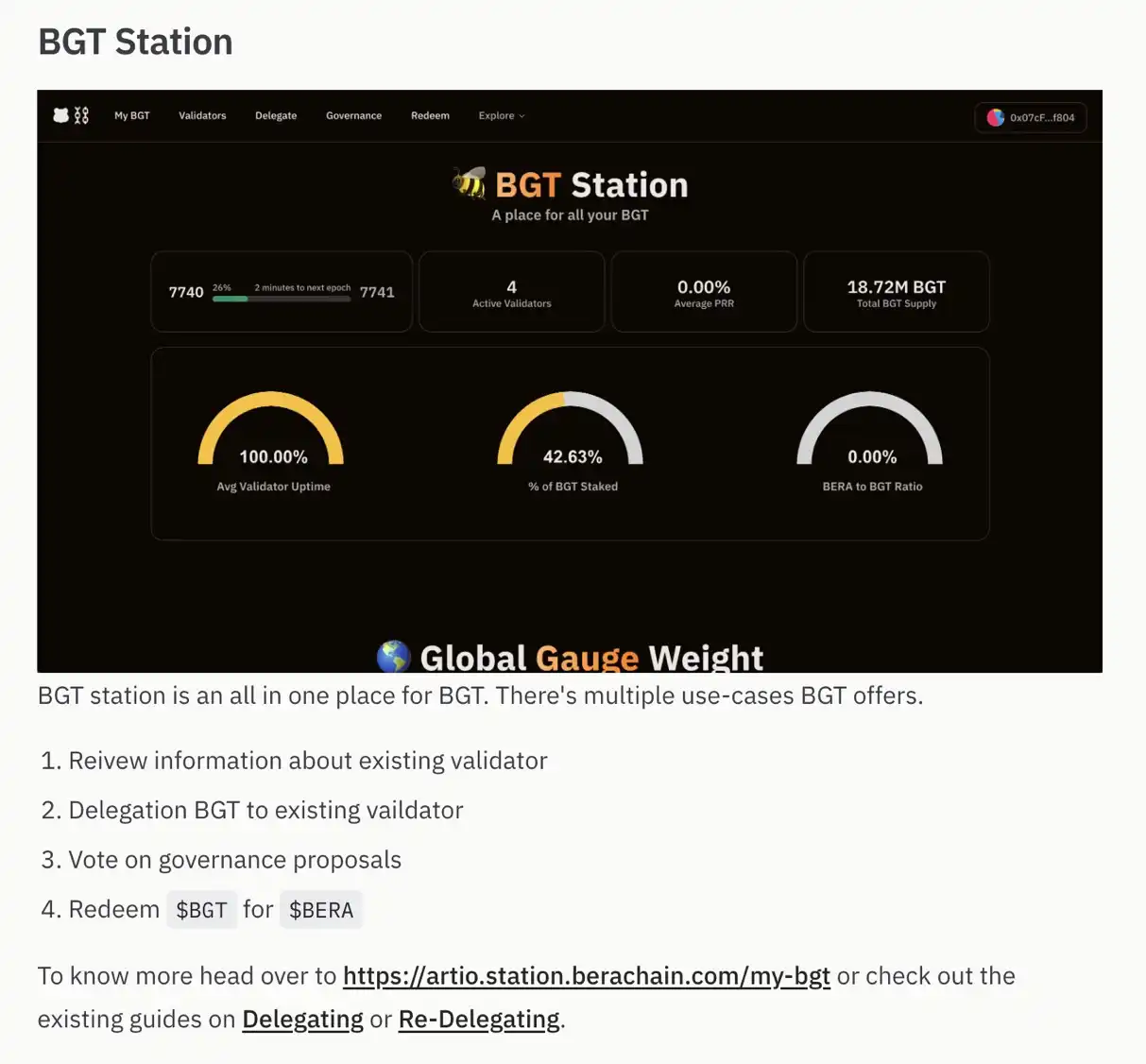

为了获得 BGT 的发放,你需要在这些 dapp 支持的任何资产中提供流动性。将由治理决定向哪些流动性池分发多少 BGT,作为 DAO 成员,你将在这方面发挥关键作用。

验证者还可以贿赂你以批准他们对某些流动性池的期望代币通胀。一旦你抵押了 BGT,你就可以成为治理的一部分,赚取贿赂,同时还可以获得 BGT 的代币通胀奖励和捕获费。

作为抵押者,你可能会从 BEX、BPerps、BEND 和区块捕获费中获得费用奖励。你的基本代币通胀奖励将获得 4 倍的加成,你还能在决定将多少比例的代币通胀分配给流动性池方面发挥作用。

在 Berachain 上的交易费将以 BERA 支付,Berachain 将烧掉 100% 的交易费,将优先费用传递给验证者,类似于以太坊和 Polygon。

Berachain 正在打造他们自己的并行 EVM,名为 Polaris,这将为 ETH DeFi 生态系统提供一个接入 Berachain 的通道。

只要人们保持足够的动力提供流动性,围绕 Berachain 的整个飞轮就会有效运转,只要他们继续获得有利可图的年化收益率,他们就会保持动力。

当主网上线时,看到整个事情如何运作将会很有趣。我喜欢这个概念,也很愿意进一步探索这个生态系统。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。