Original | Odaily Planet Daily

Author | Nan Zhi

Yesterday, Botanix Labs announced that it has raised a total of 11.5 million US dollars, with participation from Polychain Capital, Placeholder Capital, and others. The funding will be used to build a decentralized EVM equivalent BTC L2 Botanix.

Spiderchain combines the usability of EVM with the security of Bitcoin. Since the launch of the testnet in November 2023, there have been over 200,000 active addresses. In this article, Odaily will analyze the unique mechanisms of Botanix and the interactive process of the testnet.

Botanix

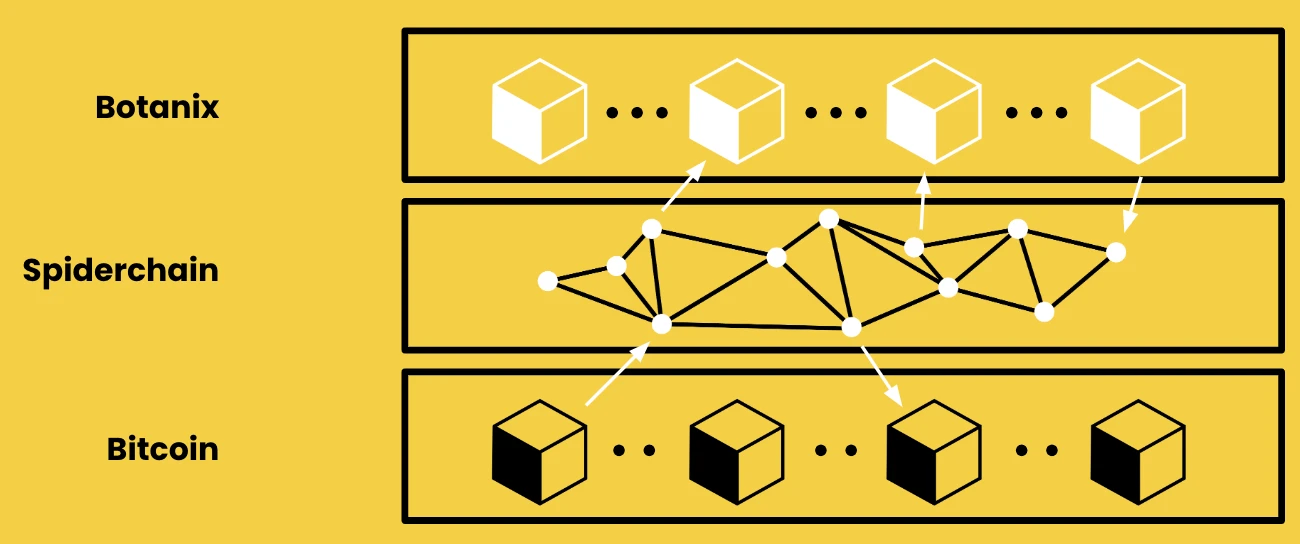

According to the official definition, Botanix is a decentralized Turing-complete L2 EVM built on Bitcoin, consisting of two core components: Ethereum Virtual Machine (EVM) and Spiderchain.

The EVM uses a PoS mechanism, aiming to provide usability and versatility through EVM, while leveraging the security of the Bitcoin network's PoW mechanism. User rights (Staking) are equivalent to the amount of Bitcoin staked in a multi-signature wallet.

Spiderchain, on the other hand, is the core mechanism of Botanix. Spiderchain is a dynamic, constantly changing, decentralized multi-signature wallet that protects the security of Bitcoin assets on Botanix. Spiderchain has pioneered the concept of "decentralized multi-signature wallets," which are protected by a random subset of participants, achieving a high level of decentralization. The official definition may be too convoluted and difficult to understand, so we will provide an analysis in the following section.

Spiderchain

BTC L2 does not have an official definition. One solution is to build an EVM network (i.e., a Layer 2 network for Bitcoin), where users deposit assets into an official multi-signature wallet and then "map" them to the EVM network. After the cross-chain interaction between L1 and L2, subsequent user operations are only related to the EVM network and no longer consume resources from the Bitcoin network. Transferring assets out of this type of L2 is equivalent to destroying assets in the EVM network and then releasing them to users from the multi-signature wallet. At this point, the security of the assets in the multi-signature wallet becomes the primary concern for users. Several major L2 assets in the past were actually controlled by the official party, raising concerns and pain points about the risk of "running away."

Spiderchain aims to solve the centralization problem of multi-signature wallets for asset management. The name "Spiderchain" is derived from the concept of a multi-signature wallet, where each "leg" of the spider represents a different participant. Each block randomly selects a group of participating nodes and multi-signature wallets, managed by this group of participants.

Spiderchain refers to these nodes as Orchestrators. With each block mined on the Bitcoin mainnet, new multi-signature wallets are synchronously generated to manage the stored Bitcoin assets. The selection of nodes to manage these wallets is handled by a Verifiable Random Function (VRF). Each group consists of approximately 100 nodes, and the randomness and continuous changes avoid the risk of single-point control and malicious attacks from project superuser privileges.

In addition, the nodes of Spiderchain also have the characteristic of permissionless participation, allowing anyone to contribute assets to become Orchestrator nodes, ensuring an adequate number of nodes. According to official disclosures, it currently supports 10,000 to 100,000 full nodes, thereby achieving decentralization.

Therefore, looking back at the official definition of "Spiderchain is a dynamic, constantly changing, decentralized multi-signature wallet," it becomes easier to understand.

In addition to these features, the operational logic of Spiderchain is similar to that of regular nodes. Users can freely join in creating nodes, but if malicious operations or other misconduct occur, the assets staked by the nodes will be confiscated (slashed). The security follows a PoS security model, ensuring security as long as the number of malicious nodes is less than that of other Orchestrator nodes.

Funding Details

According to Rootdata, Botanix has completed two rounds of funding:

The seed round was completed on May 7, 2024, with a funding amount of 8.5 million US dollars, with participation from Polychain Capital, Placeholder Capital, Valor Equity Partners, as well as a series of angel investors including Andrew Kang, Fiskantes, Dan Held, The Crypto Dog, and Domo.

The pre-seed round was completed in June 2023, with a funding amount of 3 million US dollars, with participation from UTXO Management, Edessa Capital, XBTO Humla Ventures, and others.

Testnet Interaction

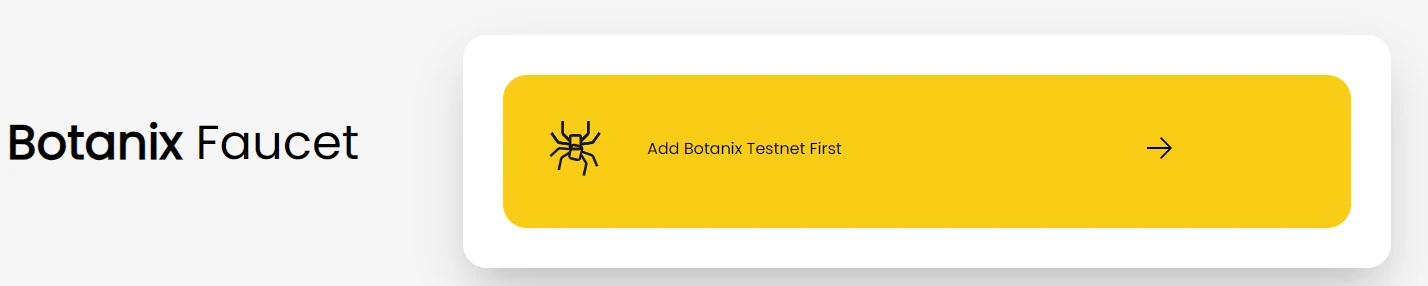

- Enter the official Faucet, click to add the test network to the wallet

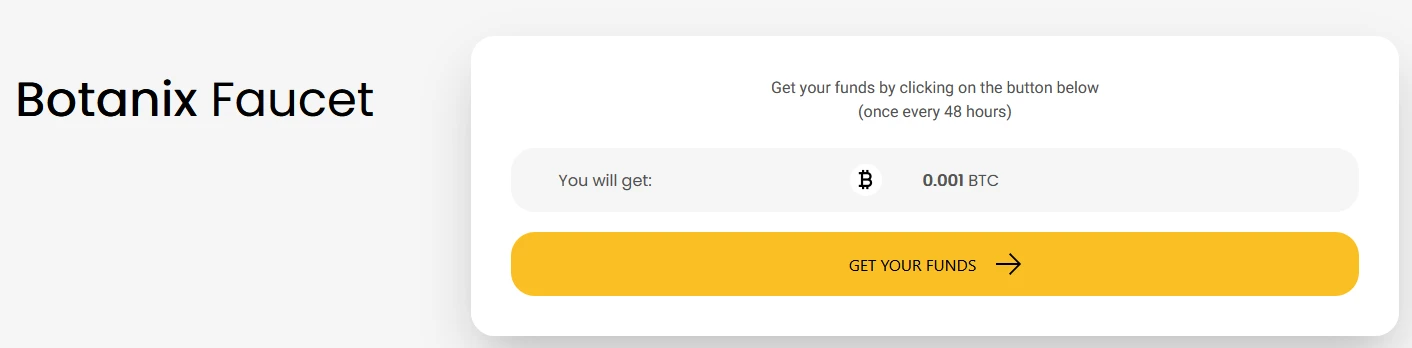

- Click to claim the test tokens on the network. If unable to claim on this site, you can go to other sites for claiming:

https://dripdripdrip.xyz/botanix-testnet

- Currently, Botanix has launched two applications: AvocadoSwap and Bitzy. The latter requires an Access Code for use, which users can obtain by following the official X account and sending a private message.

However, it is worth noting that Botanix has not promised the rights of participants in the testnet. Readers should decide whether it is worth participating in bulk interactions.

Conclusion

Botanix's Spiderchain solution is an important step towards decentralization in the direction of EVM-based BTC L2, and the funding amount places it in a relatively high tier among various BTC L2 solutions. According to official disclosures, the mainnet is about to be launched, and readers can keep a long-term focus on it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。