_Original Title: Crypto & Blockchain Venture Capital – Q1 2024》

Authors: Alex Thorn, Gabe Parker

Translation: DeepTechFlow

Introduction

Bitcoin and the broader liquid cryptocurrency market saw a significant increase in the first quarter of 2024, leading to renewed optimism across the industry. The crypto venture capital market appears to be rebounding, although data available as of mid-April suggests a slightly subdued market sentiment. Overall, founders and investors alike have indicated that the funding environment is more active compared to the previous few quarters. After three consecutive quarters of declining transaction volume and capital investment, there was an increase in the first quarter. While the rise in the liquid cryptocurrency market can boost sentiment in the venture capital world, the sought-after rate cuts at the beginning of the year seem unlikely to occur. Stubborn inflation data, coupled with a generally robust U.S. economy, has led to a plethora of hawkish comments from Federal Reserve officials, causing the futures market to reduce the expected rate cuts for 2024 from 7 in January to 1-2. Higher rates will continue to pose challenges for risk funds seeking to raise capital, and as a result, startups seeking investment from these funds will also face challenges.

Transaction volume increased by more than 50% compared to the previous period, but investment funds only increased by 29%. Categories that attracted a lot of attention from venture capital include Bitcoin Layer2, re-staking, developer tools, and gaming infrastructure. Transaction volume remained flat, but valuations increased by nearly 100%, indicating that funds are still tight, but founders are able to raise funds with less dilution due to improved market sentiment.

Crypto Market Venture Capital

Transaction Volume and Investment Funds

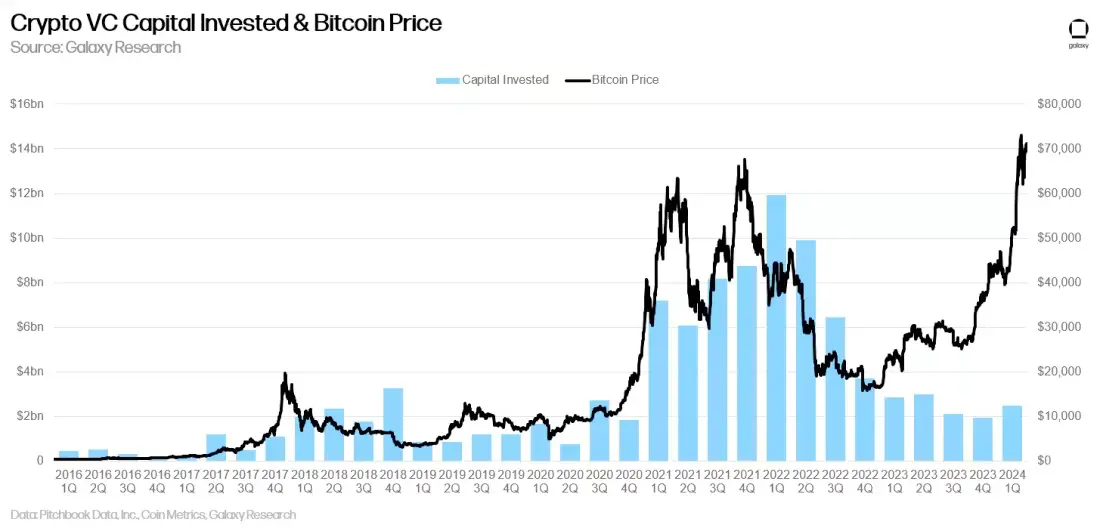

In the first quarter of 2024, venture capitalists invested $2.49 billion (a 29% increase) in the cryptocurrency market and blockchain companies, involving 603 transactions (a 68% increase).

This is the first increase in investment funds and transaction volume in three quarters, perhaps indicating that the fourth quarter of 2023 was the "bottom," but the sustainability of the quarterly growth—and more meaningful growth—will be confirmed in the coming quarters.

Investment Funds & Bitcoin Price

While venture capital in the cryptocurrency space is typically correlated with Bitcoin prices, this correlation has been broken over the past year, as Bitcoin has surged since January 2023, but venture capital activity has largely languished. In the first quarter of 2024, Bitcoin saw a significant increase, and although investment funds also rose, investment activity still fell far short of the levels seen the last time Bitcoin traded above $60,000. Native catalysts in the cryptocurrency industry (Bitcoin ETFs, re-staking, modularization, Bitcoin L2, and other new areas) and macro headwinds (interest rates) have contributed to significant divergences.

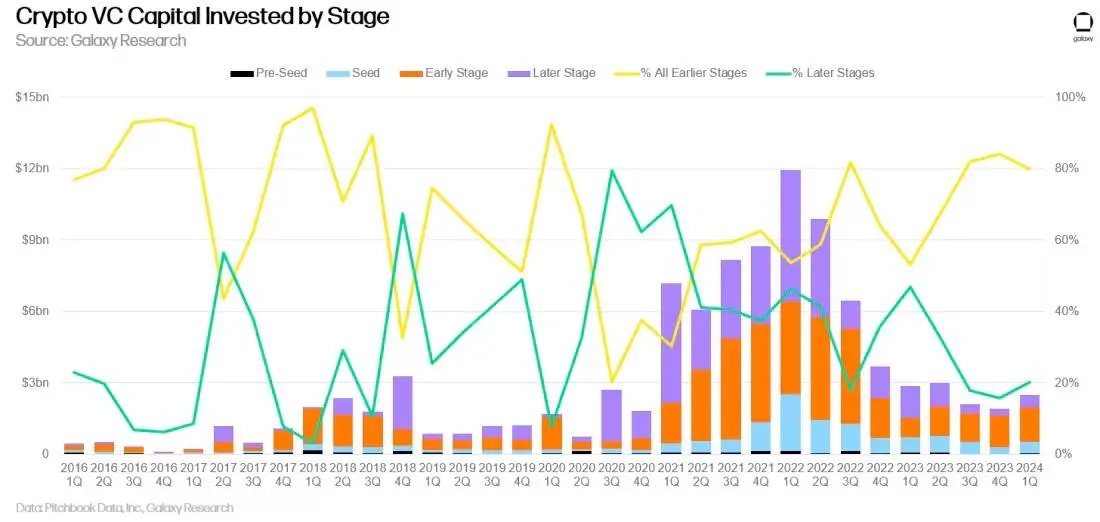

Venture Capital by Stage

In the first quarter of 2024, about 80% of the funds flowed to early-stage companies, while 20% flowed to later-stage startups. Notable early-stage companies are still able to raise funds as cryptocurrency-focused early-stage risk funds remain active, and many funds relied on their fundraising in 2021 and 2022 to stay afloat. However, many large integrated venture capital firms have either exited the industry or significantly reduced their risk exposure, making it more difficult for later-stage startups to raise funds.

In terms of transactions, the share of pre-seed round transactions increased slightly in the first quarter, indicating growth in newly established startups.

Valuation and Transaction Size

In 2023, valuations of venture-backed cryptocurrency companies saw a significant decline, reaching the lowest median pre-money valuation since the fourth quarter of 2020. However, despite the median transaction size remaining stable, valuations rebounded in the first quarter of 2024. The data indicates that founders were able to raise the same amount of funds as in the last quarter of 2023, but with less dilution. Meanwhile, the dynamics of the entire venture capital ecosystem were quite the opposite—median transaction size decreased by 50% compared to the previous period, while the median pre-money valuation remained essentially unchanged, indicating that founders had to sell more equity to raise the same amount of funds. The increase in valuation may stem from the high market sentiment in the first quarter—despite the lack of more funds, founders were still able to leverage the improved market sentiment to achieve higher valuations.

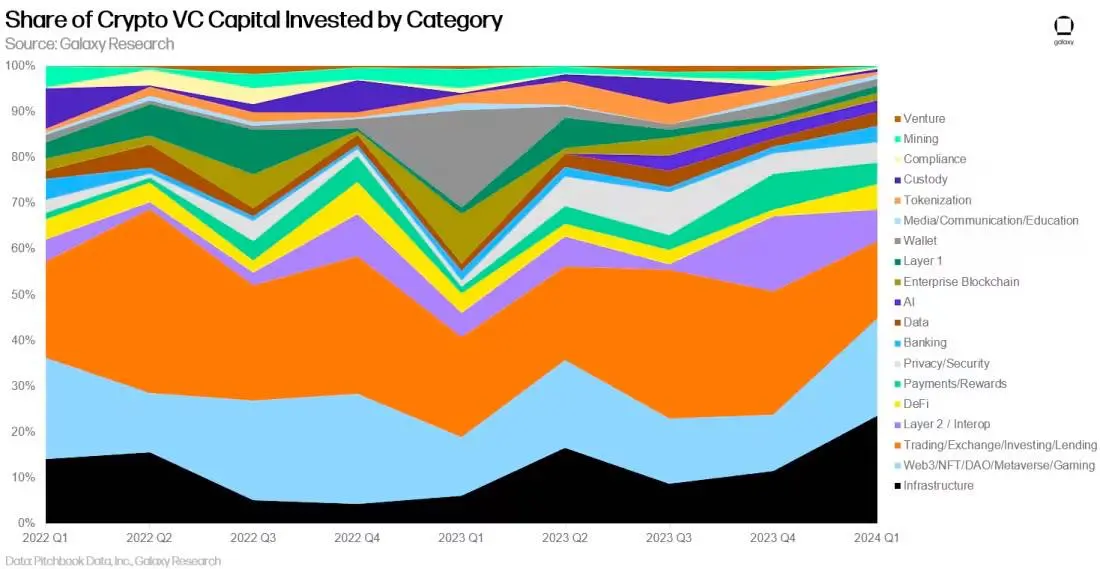

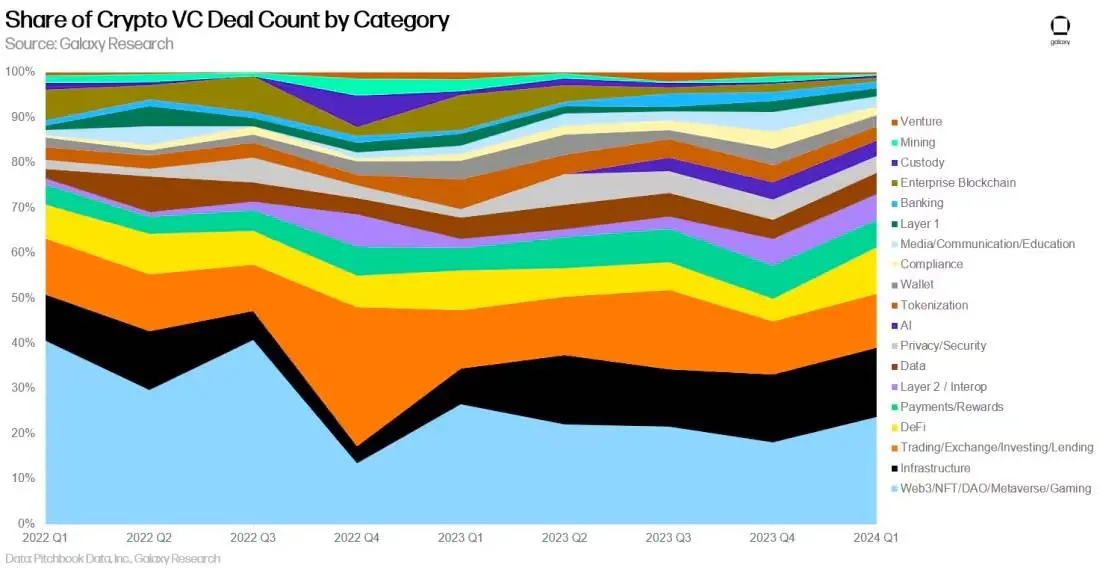

Investment by Category

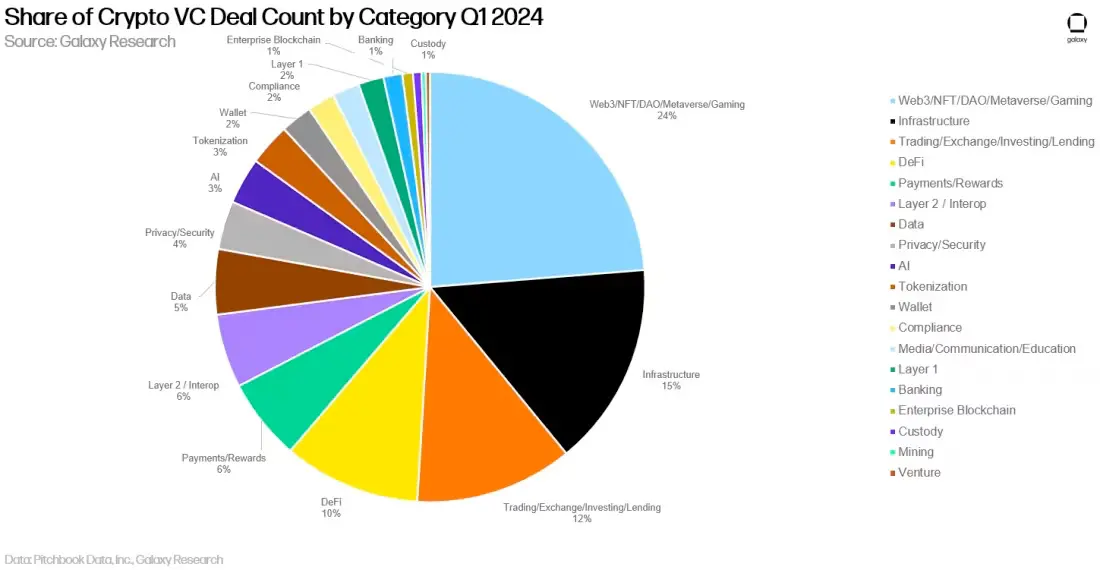

In the first quarter of 2024, the "Infrastructure" category received the largest share of cryptocurrency venture capital funding (24%), led by EigenLayer's $100 million financing.

Web3 and Trading companies followed closely, accounting for 21% and 17% of investment funds, respectively.

In terms of transaction volume, Web3 led with a 24% share, primarily due to an increase in gaming-related transactions.

Infrastructure and Trading followed, accounting for 15% and 12% of all transactions completed in the first quarter of 2024.

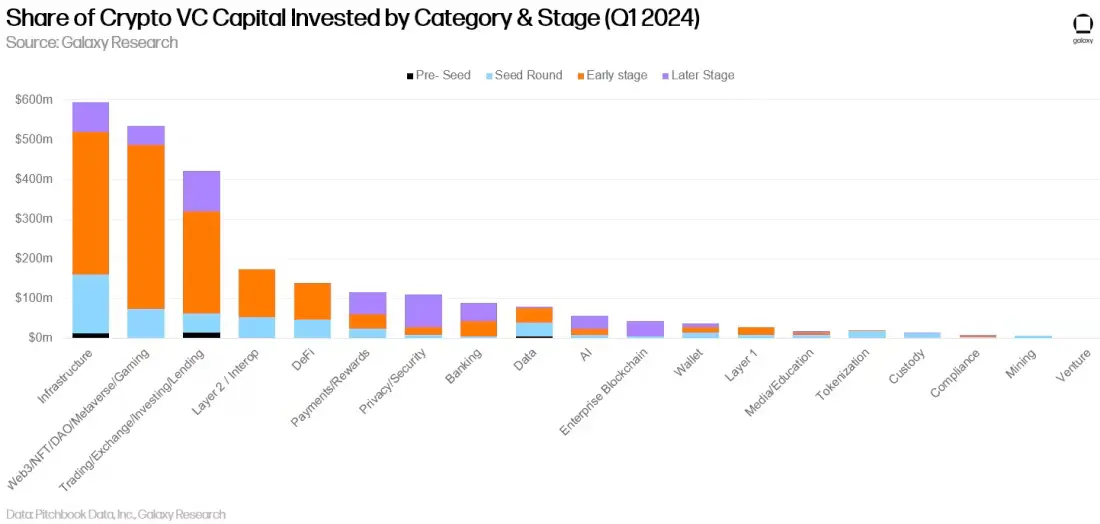

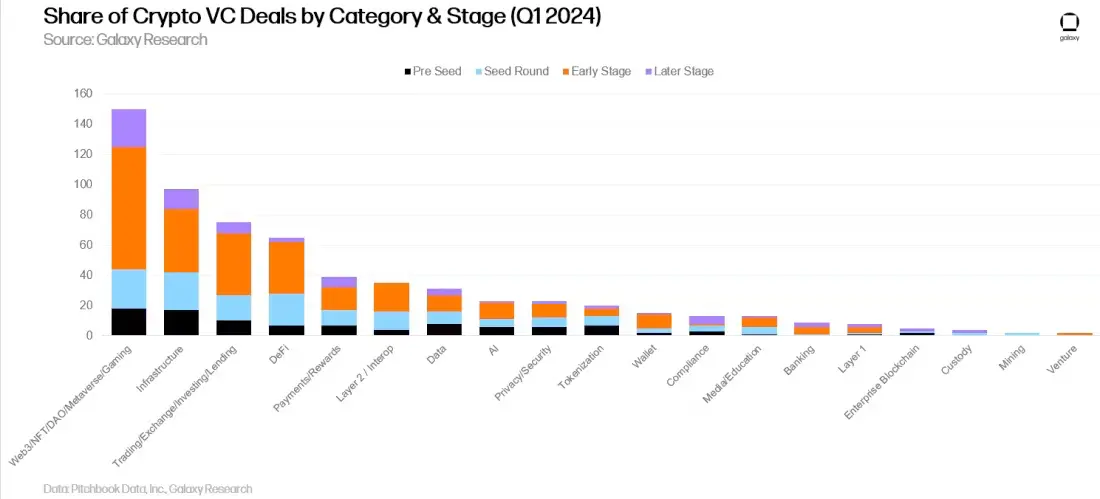

Investment by Stage and Category

By segmenting investment funds and transaction volume by category and stage, it is possible to gain a clearer understanding of which types of companies are raising funds in each category. The vast majority of funds for the Infrastructure, Web3, and Trading categories flowed to early-stage companies and projects.

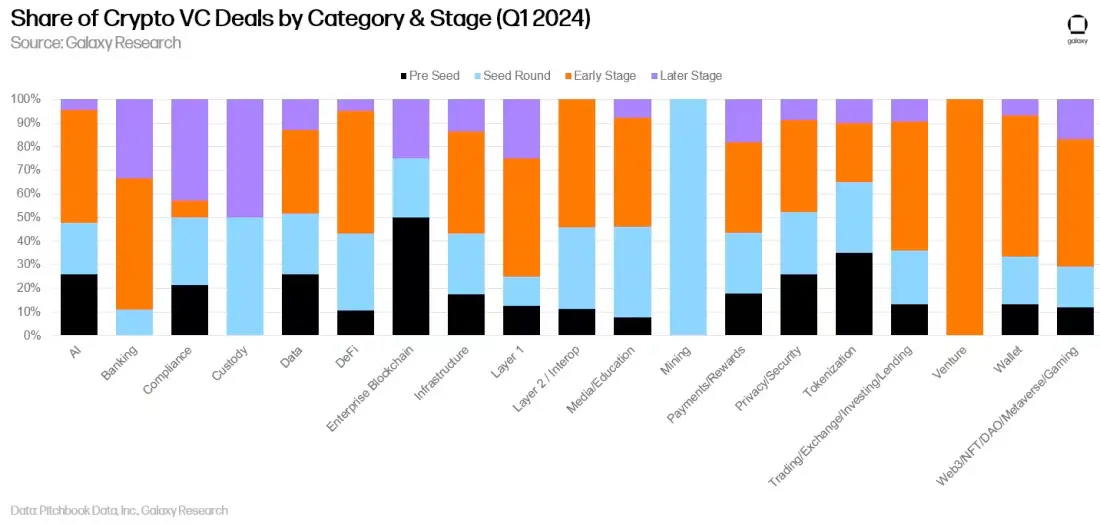

Examining the share of funds by investment stage for each category provides insight into the maturity of each investable category.

Transaction volume also tells a similar story. Most transactions completed in almost all categories involve early-stage companies and projects.

Examining the share of transactions completed by stage within each category provides a deeper understanding of the various stages within each investable category.

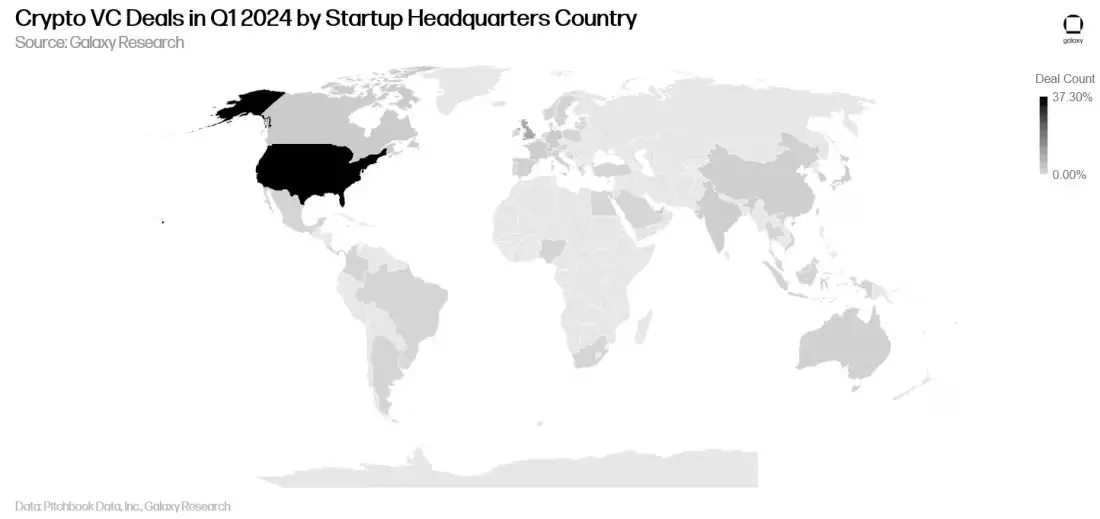

Investment by Geographic Location

Despite the challenging regulatory environment, companies headquartered in the United States continue to complete the most financing transactions and raise the most funds from venture capitalists. In the first quarter of 2024, over 37.3% of transactions involved companies headquartered in the United States. Singapore accounted for 10.8%, the UK for 10.2%, Switzerland for 3.5%, and Hong Kong for 3.2%.

Companies headquartered in the United States attracted 42.9% of venture capital funds. Singapore accounted for 11.1%, the UK for 9.7%, Hong Kong for 7.9%, and France for 5.6%.

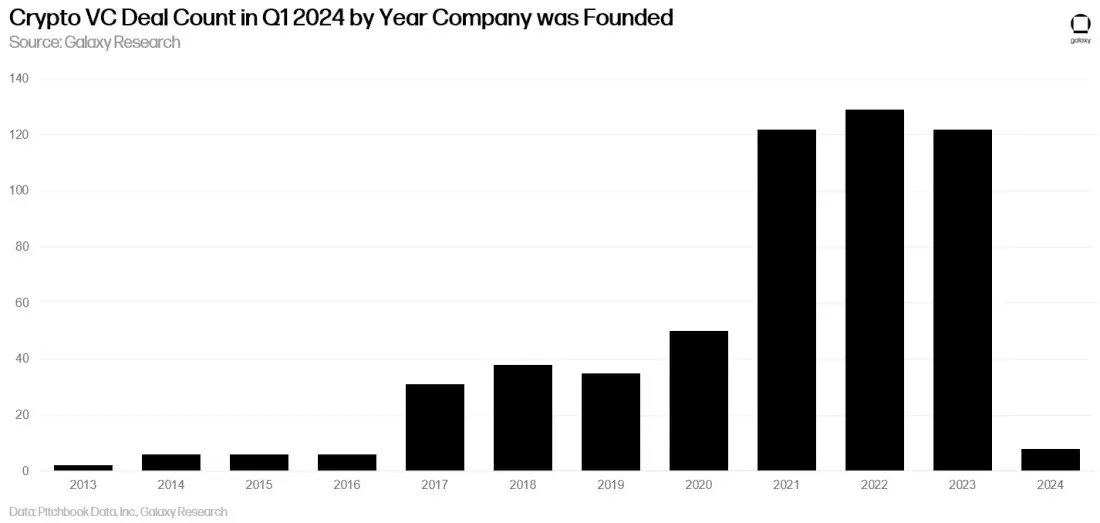

Investment by Vintage

The vast majority of transactions completed in the first quarter of 2024 involved startups founded in 2021-2023, which is to be expected given that 2024 has just begun.

In terms of fundraising, companies founded in 2020-2022 received the most investment.

Cryptocurrency Venture Capital Financing

Raising funds for cryptocurrency venture funds remains challenging. The macro environment and turbulence in the cryptocurrency market infrastructure have led some investors to no longer commit to cryptocurrencies to the same extent as in 2021 and 2022. At the beginning of 2024, investors widely believed that interest rates would be significantly reduced in 2024, but throughout the first quarter, strong inflation data dampened expectations for rate cuts this year, helping to maintain a challenging fundraising environment for venture capitalists. While the total amount of funds allocated to cryptocurrency venture funds decreased compared to the previous period, the number of new funds increased, with at least 22 new funds announced.

On an annual basis, the average size of funds in 2024 continued to decline, but the median slightly increased.

In terms of the source of allocator funds, cryptocurrency-focused funds are still struggling to raise funds from traditional allocators, accounting for only a small portion of the newly allocated funds in the first quarter.

Key Points

Sentiment and activity are improving, but still far below previous bull market levels. Although the digital asset market has rebounded significantly from the lows of 2023, venture capital investment lags behind. In previous bull markets, such as 2017 and 2021, there was a high correlation between venture capital funding and the prices of liquid cryptocurrencies. However, in 2023 and 2024, venture capital remains well below previous levels while cryptocurrencies rebound. There are several reasons for the stagnation in venture capital: a high-interest rate environment dampens risk appetite; lingering sentiment weakness in the crypto market after the 2022 boom; and possibly a lack of late-stage companies able to absorb large amounts of venture capital. Therefore, in terms of funds and transaction volume, early-stage companies account for the largest share of venture capital activity. In fact, despite only a slight increase in total investment, the number of transactions has increased by 50%, with most transactions occurring in Series A or earlier financing.

Early-stage transactions lead the way in the first quarter. Continued focus on early-stage transactions signals long-term health for the broader cryptocurrency ecosystem. While later-stage companies have been struggling to raise funds, entrepreneurs are finding investors willing to invest in new, innovative ideas. These projects and companies are building expanded solutions, games, tools, and services at the intersection of artificial intelligence and cryptocurrency.

Bitcoin ETFs may put pressure on funds and startups. The introduction of spot-based Bitcoin ETFs in the United States provides a convenient way for investors of various sizes to gain exposure to Bitcoin. While highly liquid Bitcoin is not entirely the same as investing in crypto startups, it may meet the demand of some investors and allocators for exposure to the cryptocurrency ecosystem. ETFs are regulated, offered by almost all brokerage platforms, have low fees, and high liquidity. Bitcoin ETFs may also challenge stocks tied to cryptocurrencies, which have been an investment channel for the industry in the past.

Bitcoin L2 projects have piqued the interest of venture capital investors. In the first quarter of 2024, one of the most concentrated bets for cryptocurrency venture capitalists was investing in Bitcoin L2 projects. The emergence of Ordinals in 2023, followed by the creation of the BRC-20 token standard, and now the Runes token standard, have led people to view Bitcoin as a platform network, not just a currency network. Dozens of teams are trying to build new second-layer networks on Bitcoin, with many teams relying on and leveraging layer-two scaling technologies developed in the Ethereum ecosystem (such as optimistic rollups, zk rollups, re-staking primitives, bridging protocols, etc.), and venture capitalists have poured a lot of money into these transactions.

Web3 and trading categories continue to dominate in terms of transaction volume and funds, but there has also been a significant increase in infrastructure transactions. Both in terms of funds raised and transactions completed, Web3 and trading categories still lead the way, but in the first quarter of 2024, "infrastructure" actually ranked first in terms of funds and second in terms of transactions. This category is indeed broad (all three categories are broad), but the infrastructure category broadly includes staking, restaking, platform tools, sequencing services, or other tools for blockchain developers and users. EigenLayer's $1 billion funding round led infrastructure funding.

While newly established small funds have started to achieve some fundraising success, fund managers still face a challenging environment. In the first quarter, the number of newly established funds increased by 22%, but the total amount of funds allocated to cryptocurrency-focused venture fund management companies continued to decline. It is understandable that the average fund size ($108 million) decreased compared to the previous period, while the median fund size ($65 million) only slightly increased. As mentioned, since 2022, with several venture-backed cryptocurrency companies going bankrupt and rising interest rates in the United States, cryptocurrency venture funds have struggled to raise funds, reducing allocators' risk appetite. If the prices and launch rates of liquid cryptocurrencies continue to grow, and some large venture funds successfully raise large-scale funds, we expect the venture capital market to relax again, and managers will achieve greater success.

The United States continues to dominate the cryptocurrency startup ecosystem. While the United States maintains a clear lead in transactions and funds, regulatory resistance in the United States may force more companies to go abroad. If the United States wants to maintain its position as a long-term center of technological innovation, policymakers should be aware of how their actions or inaction will affect the cryptocurrency and blockchain ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。