Title: "Why This Cycle Is Cooked"

Author: David Hoffman

Translation: Ladyfinger, Blockbeats

Editor's Note: In the rapid development of cryptocurrency, market structure and capital flow are facing unprecedented challenges. The EIGEN airdrop event has not only triggered widespread discussions on the current market dynamics but also exposed significant divergences between private and public markets. This article aims to provide an in-depth analysis of the complex factors behind this phenomenon, including the surplus of venture capital, regulatory intervention, and how these factors affect the interests of retail investors. By reviewing the evolution of different token issuance models, we attempt to provide readers with a comprehensive perspective to understand the structural issues in the current market and explore possible solutions.

Introduction

The EIGEN airdrop has sparked discussions about the divergence between private and public markets. The point-based, high FDV airdrop model driven by large private rounds of financing is causing structural problems for the cryptocurrency.

Point-based programs have turned into low-circulation tokens worth billions of dollars, which does not constitute a stable or sustainable balance. However, due to a convergence of factors including the surplus of venture capital, lack of new entrants, and heavy regulatory pressure, we find ourselves trapped in this model with no way out.

Evolution of Token Distribution Models

The token issuance models have been constantly changing, and here are the eras we have experienced:

- 2013: Proof of Work (PoW) forks and Fair-Launch Meta

- 2017: Initial Coin Offering (ICO) model

- 2020: Era of liquidity mining (DeFi Summer)

- 2021: Non-Fungible Tokens (NFT) minting

- 2024: Point-based and airdrop model

Each new token allocation mechanism has its own advantages and disadvantages. Unfortunately, this particular mechanism started from the structural disadvantage of the retail industry, which is a natural consequence of the relentless regulatory spotlight hovering over the industry.

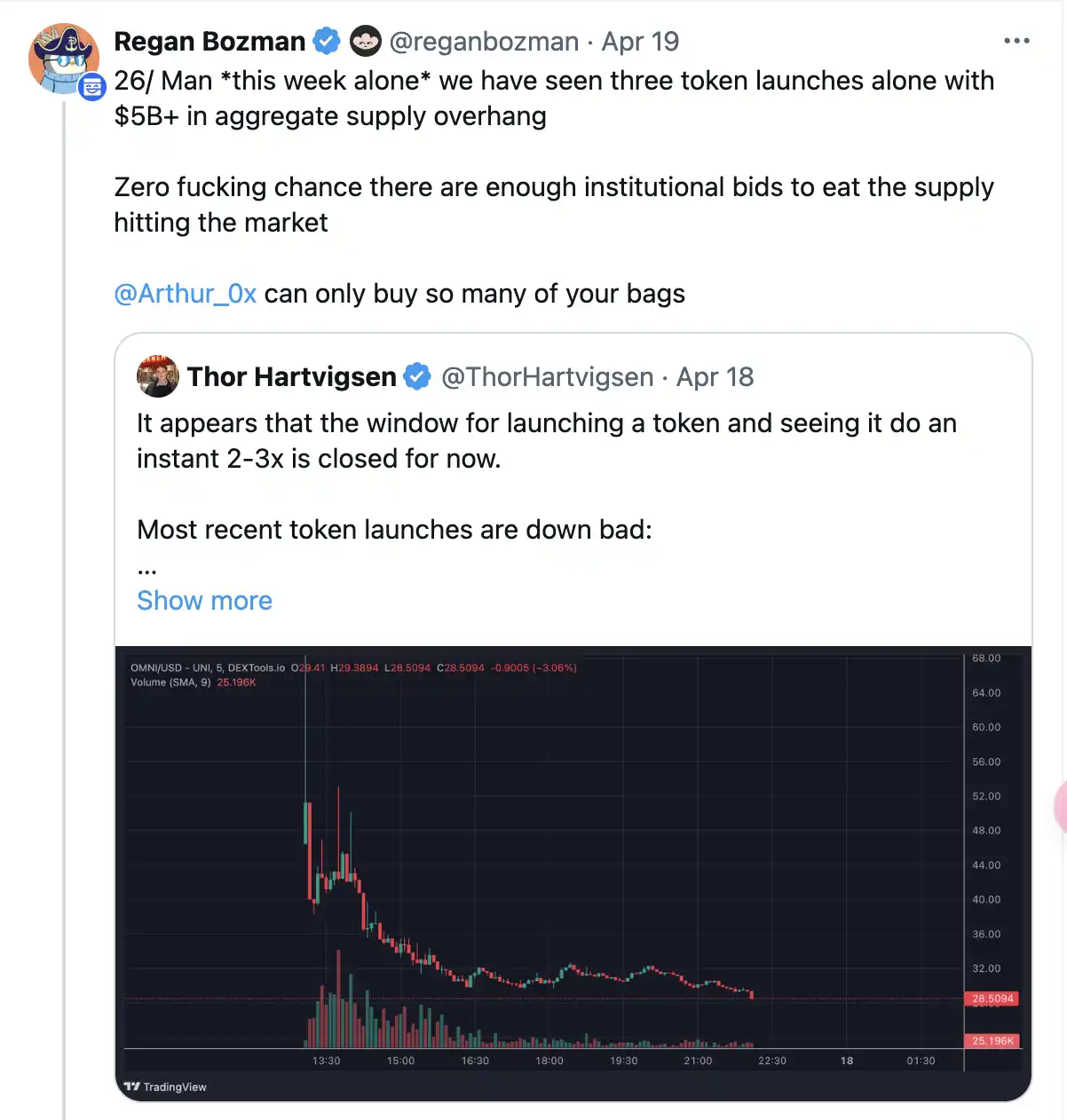

Surplus of Venture Capital and Disadvantages of the Retail Market

Currently, there is an oversupply of venture capital in the cryptocurrency. Despite 2023 being a bad year for venture capital fundraising, the funds raised in 2021 are still substantial, and raising funds from venture capital remains a continuous activity in the crypto field.

Currently, there are plenty of well-funded venture capital firms willing to lead with valuations of tens of billions of dollars, which means that crypto startups can remain private for longer. This is reasonable because if the current token prices are multiples of their last round of financing, even late-stage venture capitalists can still profit from it.

The problem is that when a startup issues tokens publicly at a valuation of $10 billion to $100 billion, most of the upside has already been captured by earlier participants, meaning no one will get rich by buying a token worth $100 billion.

Due to the structural disadvantage for public market capital, the atmosphere in the cryptocurrency industry is deteriorating.

People want to get rich with their internet friends and form strong online communities and friendships around this activity. This is the promise of cryptocurrency, a promise that is currently unfulfilled.

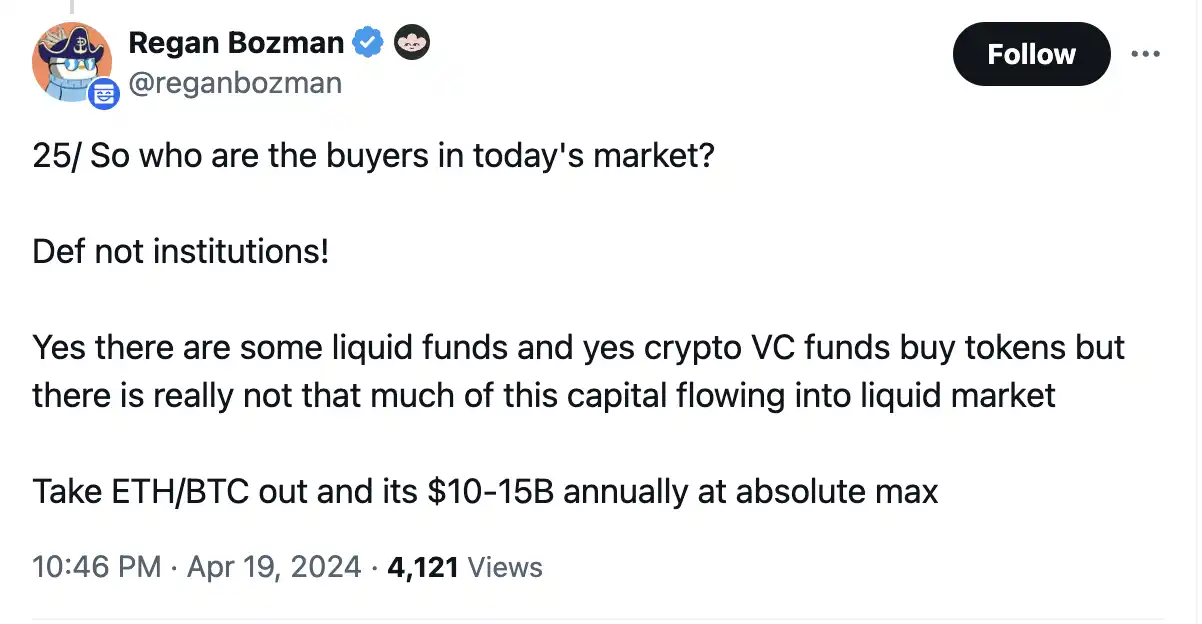

Billions of Unlocks but No New Entrants

The combination of several data points should raise concerns:

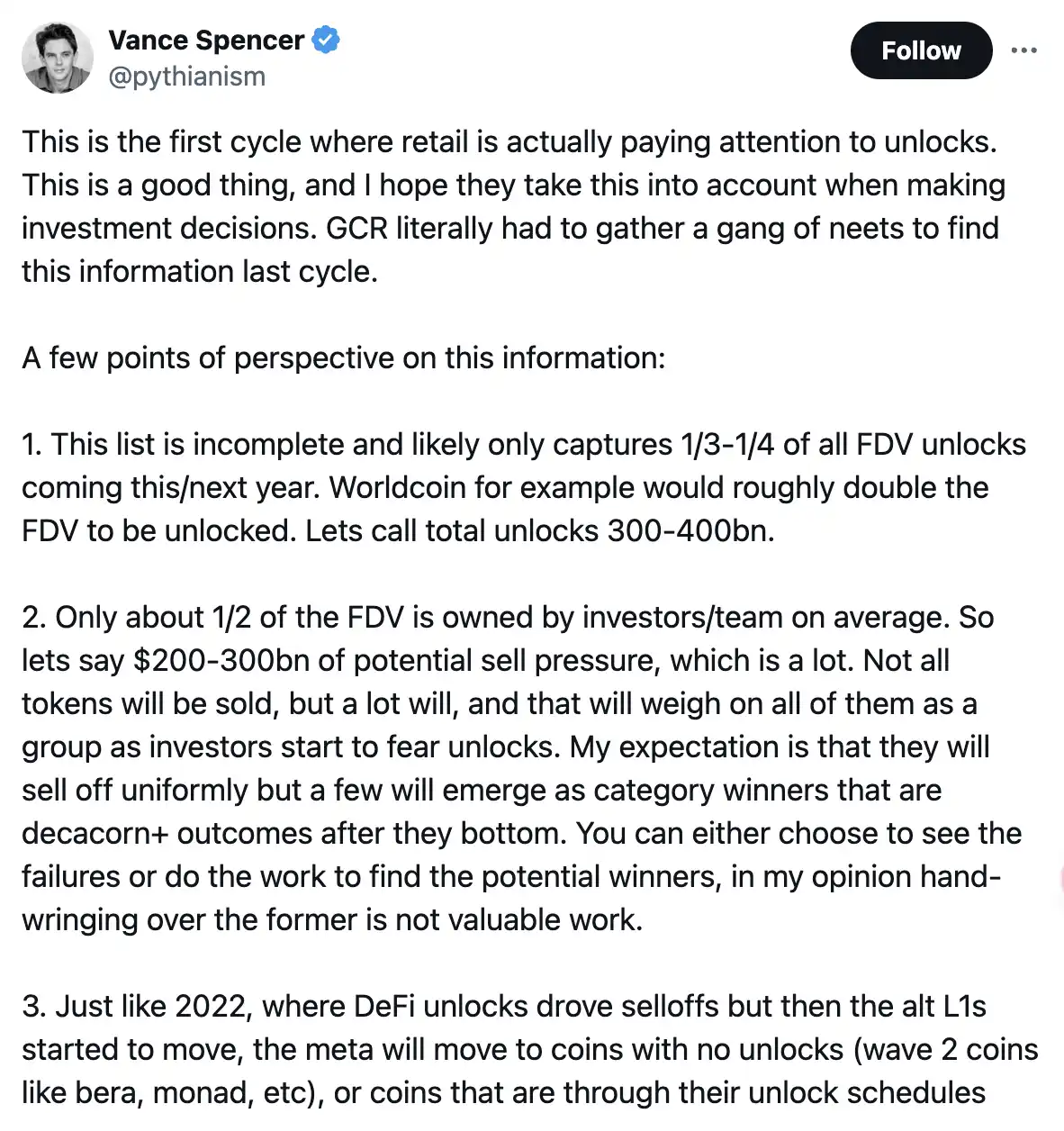

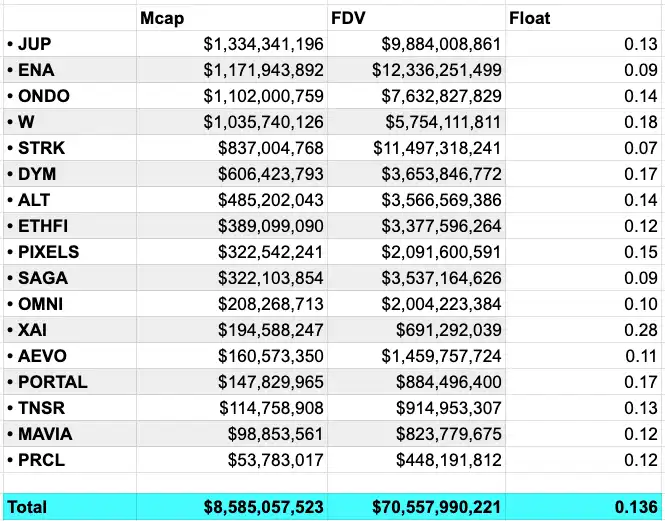

Vance's rough estimate indicates that there will be $200 billion to $300 billion of venture capital unlocking pressure in 2024 and 2025.

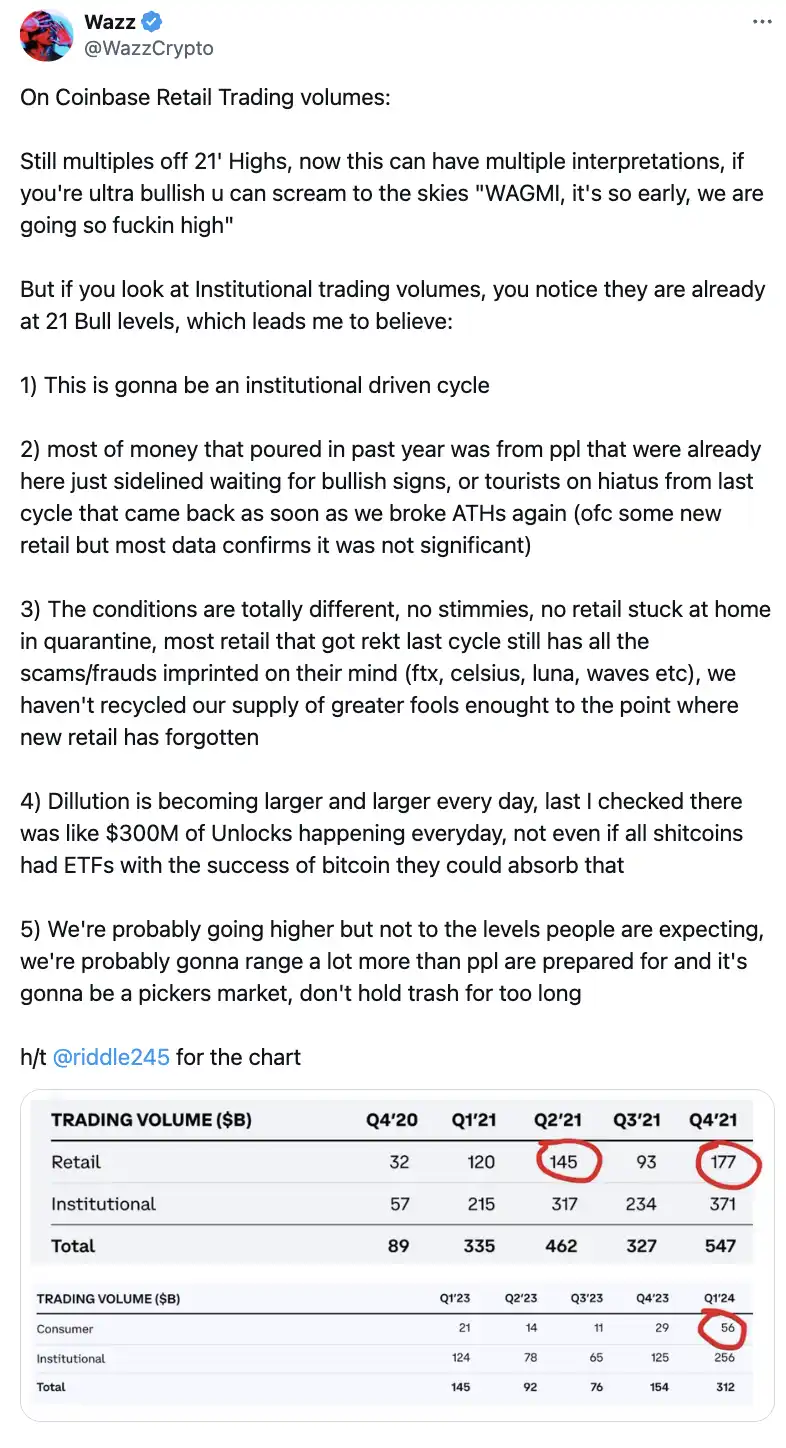

Coinbase's second-quarter report further proves the lack of new market participants, at least not in scale.

Due to the lack of significant new entrants in this cycle, venture capital significantly exceeds the demand for these capital outcomes.

Market Dynamics Under SEC Regulatory Pressure

By limiting the ability of startups to raise capital and issue tokens more freely, the SEC is encouraging less regulated capital flow towards the private market.

The SEC's excessive intervention and regulation of token nature are weakening the value of public market capital, as startups cannot exchange their token trading for public market capital without triggering massive hemorrhaging from their legal teams.

The Importance of Cryptocurrency Compliance for Market Balance

As the cryptocurrency industry progresses, it has gradually become more compliant.

In 2017, when I entered the crypto space during the ICO frenzy, ICOs were promoted as a democratized way of investing and raising capital. Of course, ICOs eventually evolved into exploited scams, but nonetheless, it was a story that attracted me and many others to the potential of cryptocurrency for the world. However, when regulatory agencies clearly viewed these transactions as unregistered securities sales, the ICO model came to an end.

Then the industry turned to liquidity mining, and went through a similar process.

With each cycle, the cryptocurrency managed to obscure the way it distributes tokens to the public, and with each cycle, this process became more difficult to conceal. This process is crucial for the decentralization of projects and is the essence of our industry.

The current cycle is facing the most relentless regulatory scrutiny, and as a result, lawyers for venture capital-backed startups are facing the greatest compliance challenge the industry has ever seen: distributing tokens to the public without being sued by regulatory agencies.

Impact of Compliance on Market Balance

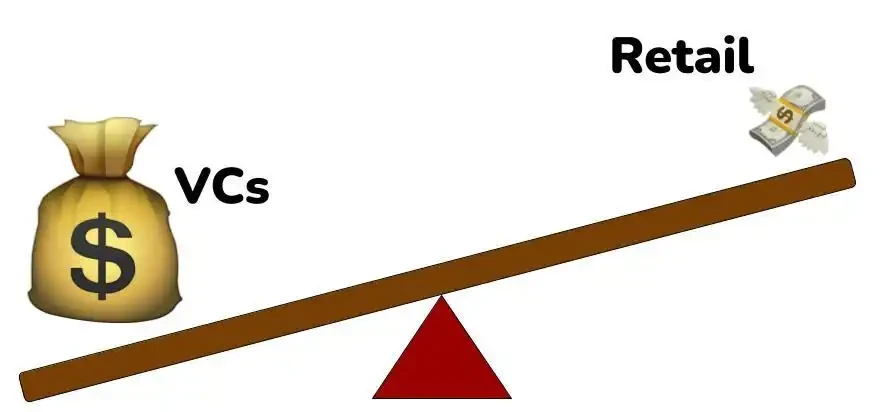

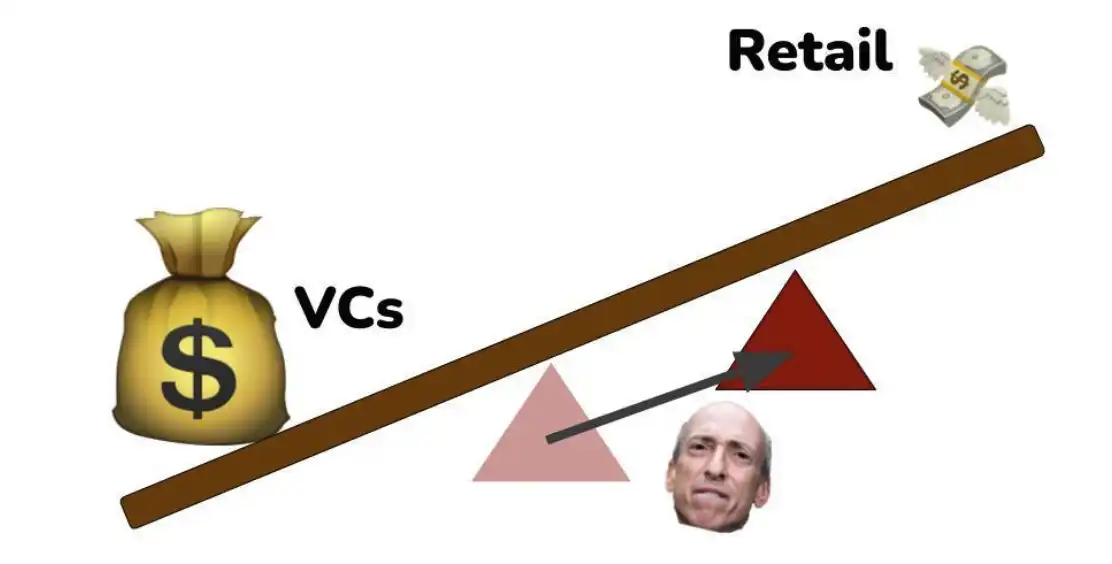

Compliance has shifted the balance point between public and private markets heavily towards the private side, as startups can choose to simply accept venture capital rather than violate securities laws.

The position of the balance point between private and public capital is determined by the extent of regulatory control over the cryptocurrency market.

- If there were no accredited investor laws, this pivot would be more balanced.

- If there were clear regulatory pathways for compliant token issuance, the difference between public and private markets would narrow.

- If the SEC did not wage war on cryptocurrencies, our market would be fairer and more orderly.

As the SEC does not provide clear rules of the road, we end up with a complex and chaotic point-based model that leaves everyone dissatisfied.

Limitations of Current Token Issuance Models

The information provided by points to retail users is very limited, as it is not clear what they actually receive. From the perspective of an overly interventionist SEC, the team may risk exposing themselves to securities law violations if they explicitly state what the points actually are.

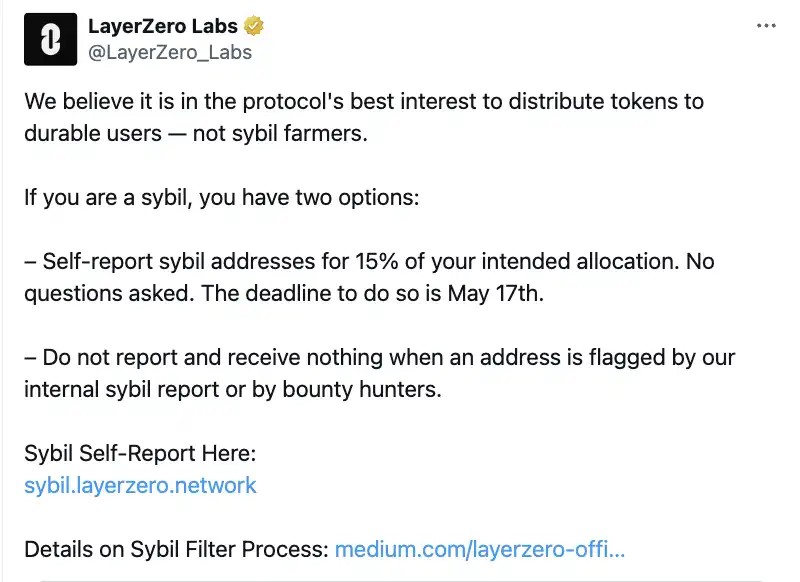

Points do not provide protection for investors, as providing protection for investors would first require giving this process regulatory legitimacy. As we find ourselves in an extremely dire conclusion, the discussions between witches and the community have put LayerZero in a dilemma.

LayerZero's recent announcement of a plan for witches to self-identify has sparked Kain Warwick to defend the witches, stating that they are a group of people who significantly support LayerZero's metrics and have raised the perception of LayerZero in the market.

In reality, there is no distinction between community members and witches. Since ordinary crypto participants have no way to participate in the private market, the only way they can gain exposure is by making commitments and meaningful activities on platforms where they want tokens.

Without allowing small investors to write small checks to early rounds of crypto projects, the current token issuance model forces users to perform so-called witching for projects they believe in. As a result, no community has come together to get rich in this cycle, as they did with LINK in 2020 or SOL in 2023. The current token issuance model does not facilitate early exposure for the community at low valuations.

In response, attacks on airdropped startups by the mob on Twitter are becoming more common. This is the inevitable result of the community's inability to express its desires as effective stakeholders in projects, creating an atmosphere of "no representation, no taxation!"

There is even another potential danger: mercenary capital exploiting tokens for dumping. Without the ability for small investors to invest in the early stages of startups, these highly coordinated investors must compete with toxic mercenary farmers for airdrops, with no distinguishable difference between the two.

The Future of the Market: Seeking a New Balance

The drawbacks of the point-based model have become evident and unsustainable. Both the SEC and scammers will exploit it and attempt to profit from it.

Ultimately, we will have to turn to a different strategy, hoping that this strategy can benefit more early community stakeholders without triggering the wrath of the SEC. Unfortunately, this is only a pipe dream without regulatory exemptions for token issuance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。