Yesterday (6MAY), the three major US stock indexes collectively closed higher as risk sentiment warmed, and the 10-year Treasury yield fell below the 4.5% mark. According to Jinshi, Richmond Fed President Barkin believes that the full impact of rate hikes has not yet fully materialized, and believes that the current restrictive interest rate level is sufficient to curb demand. In addition, the latest Federal Reserve bank lending survey shows that more banks tightened loan standards in the first quarter.

Source: Investing

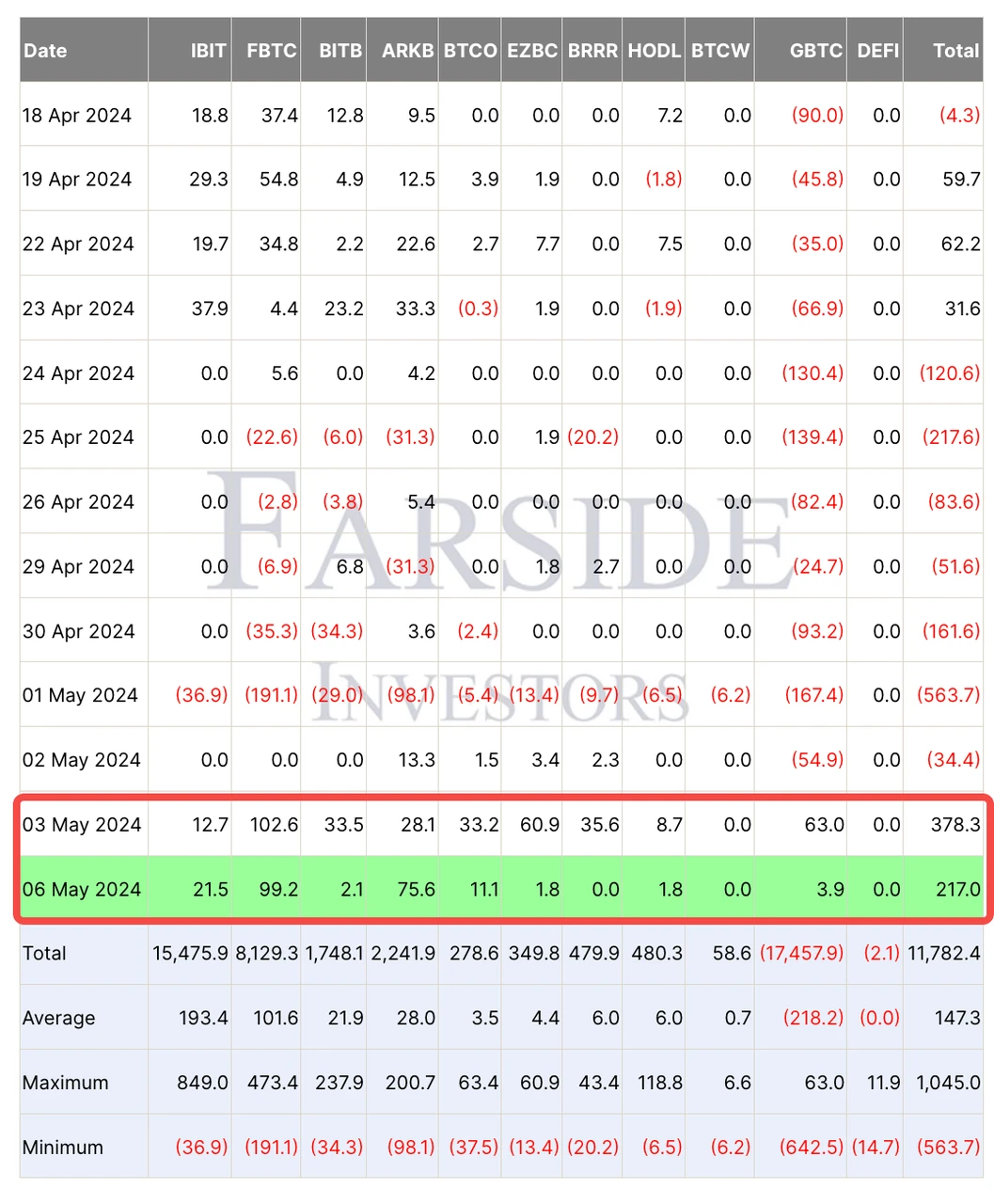

In the cryptocurrency market, Grayscale's GBTC ETF saw two consecutive days of positive fund inflows, with a total market increase of $378 million and $217 million respectively, with FBTC contributing the majority of the flow. In terms of price, BTC briefly broke through $65,000 after the options settlement yesterday, and the RSI index just revealed an overbought signal before pulling back to $63,000. After today's settlement, it once again broke through $64,000.

Source: Farside Investors; TradingView

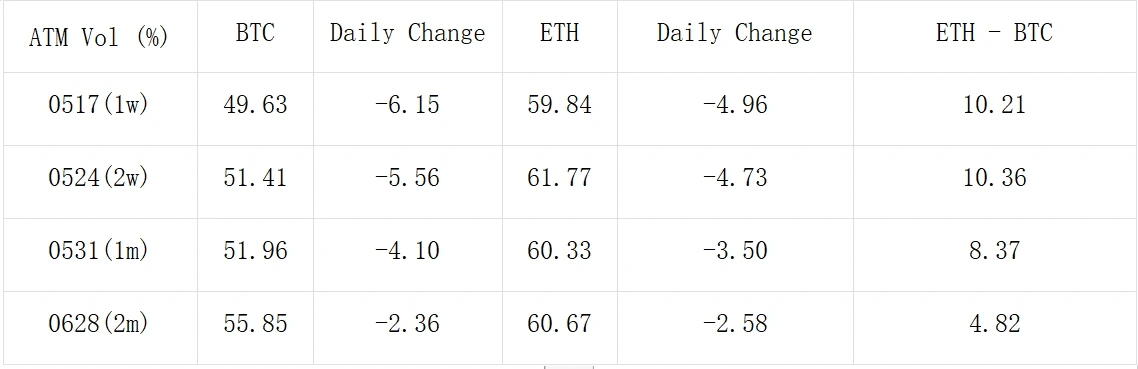

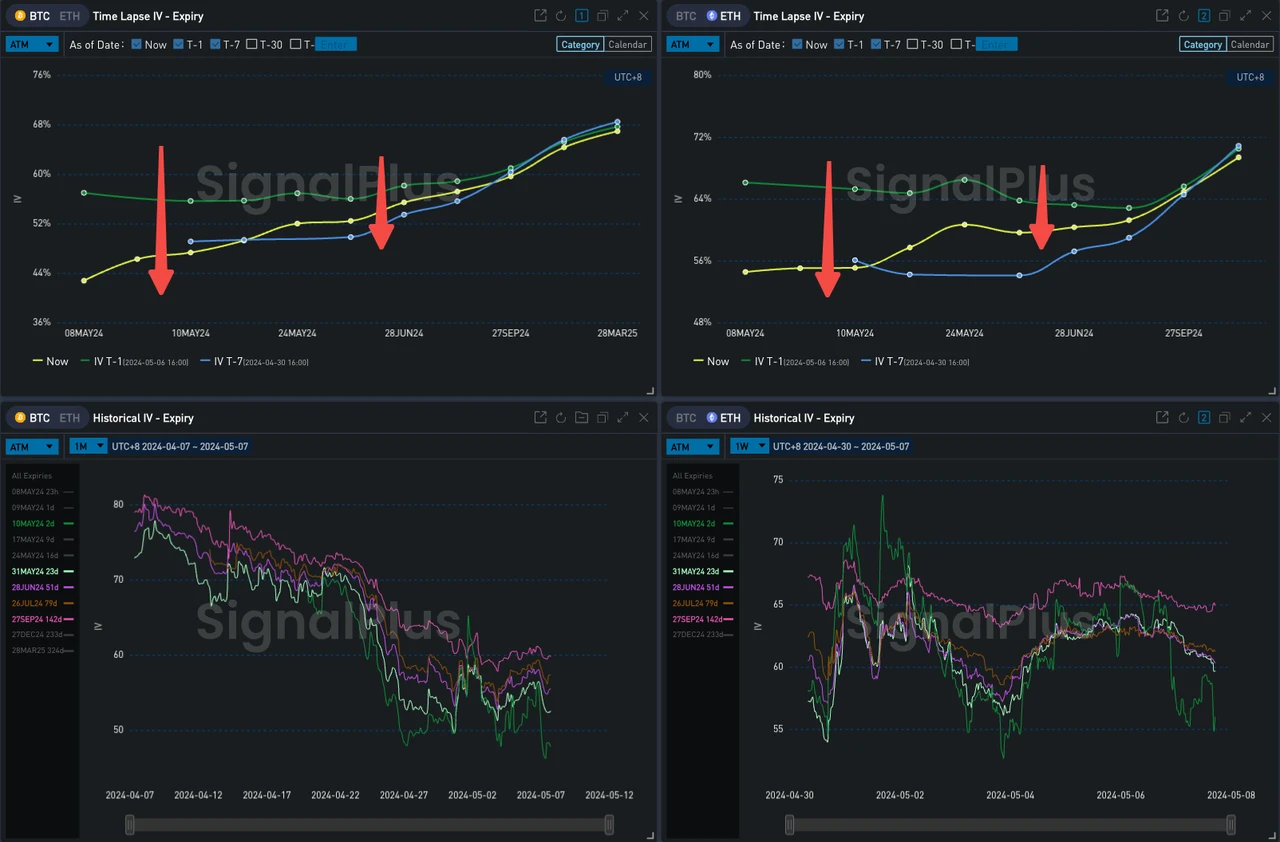

In terms of options, the implied volatility level significantly decreased after the price retraced from its high point, with the BTC/ETH front-end IV dropping by about 5%. Looking at the ATM curve, BTC's Tenor curve has steepened after the retracement, while ETH has maintained a local high point on 24MAY24. It is worth noting that the SEC's decisions on the VanEck ETH Spot ETF and Grayscale ETH Futures on May 23 and May 30 may bring about uncertainty and risk.

Source: Deribit (as of 7MAY 16:00 UTC+8)

Source: SignalPlus

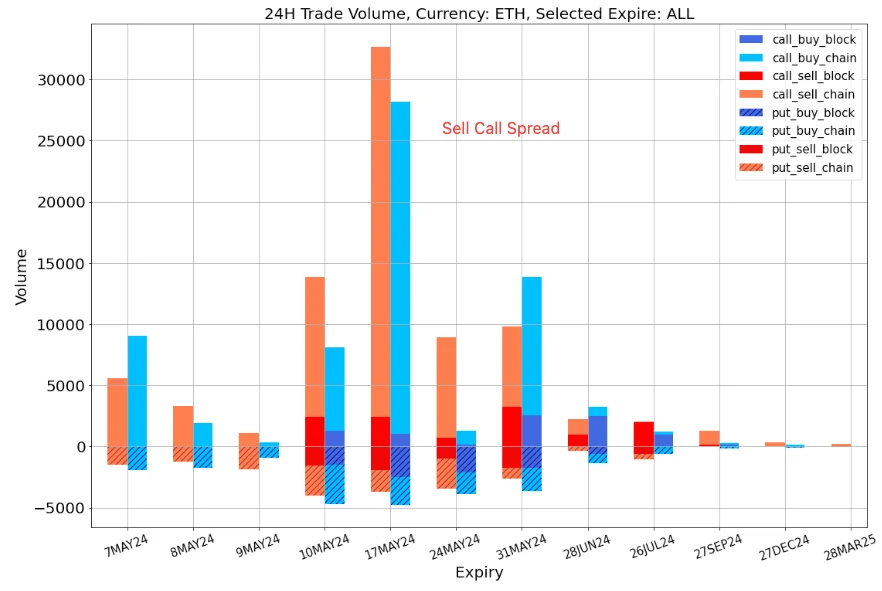

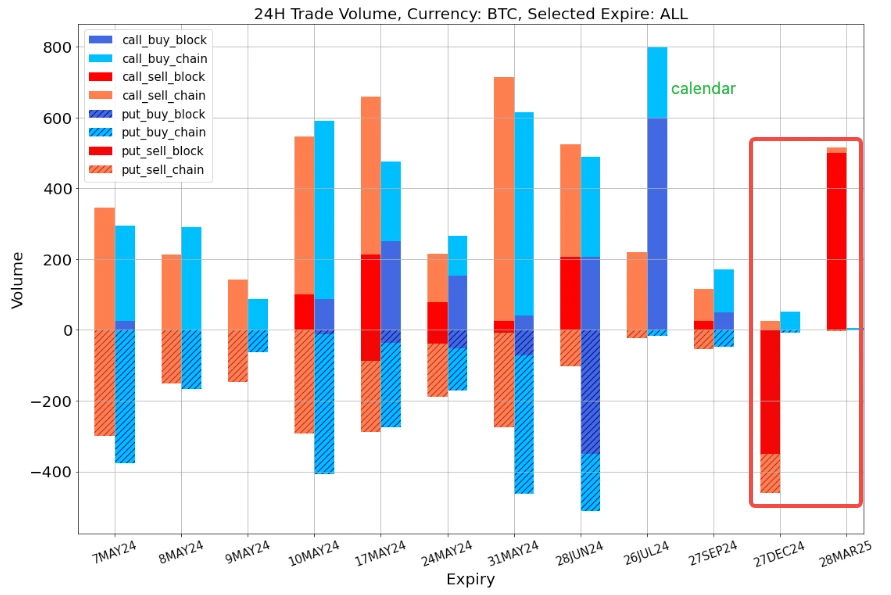

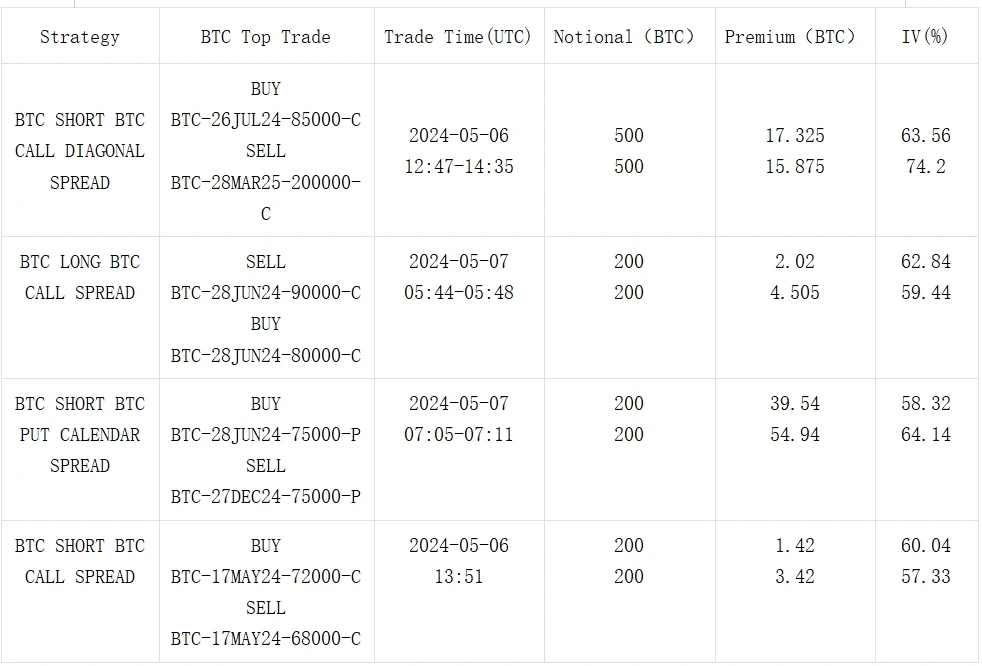

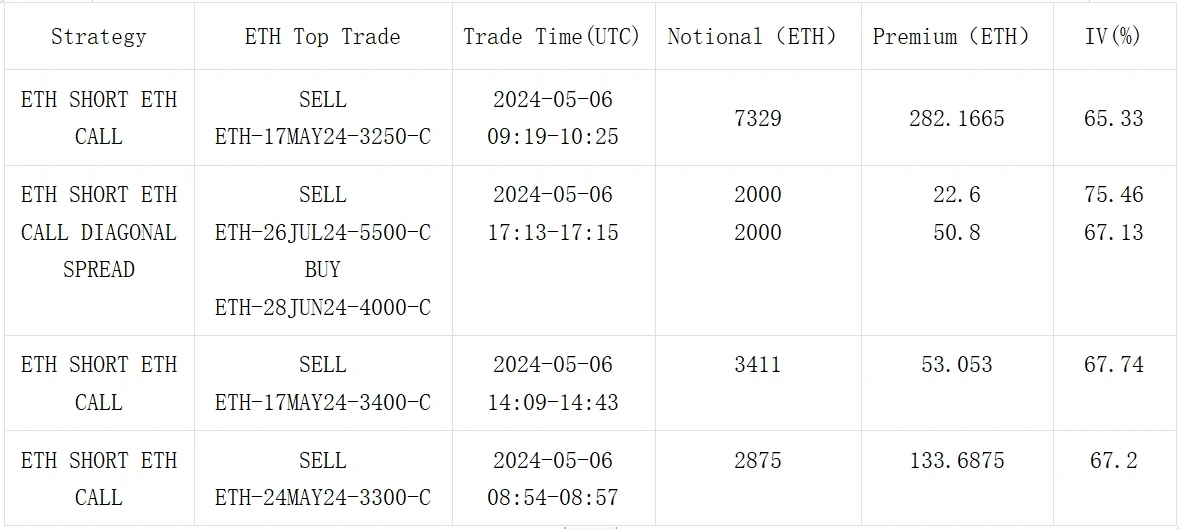

In trading, ETH transactions are concentrated in the sale of front-end bullish strategies, with the most representative being the sell 3250 vs buy 3400 call spread formed on 17MAY, with a cumulative trading volume approaching 12,000 contracts per contract. As for BTC, the largest transaction was the purchase of 26JUL24-85000-C (500 BTC) paired with the sale of 28MAR25-200000-C (500 BTC) in a calendar bullish spread strategy. Due to the distant strike price of the sold leg, the overall cost is only about 1.45 BTC.

Data Source: Deribit, ETH trading overall distribution, 17MAY Sell 3250-3400 Call Spread

Data Source: Deribit, BTC trading overall distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。