Arweave has gone beyond simple storage solutions and ventured into AI narratives, possibly showing signs of replicating a re-rating similar to $NEAR.

Author: ReveloIntel

Translation: Deep Tide TechFlow

Preface

Arweave, a relatively unknown protocol for a long time, has recently attracted market attention due to its new AO (Actor Oriented super parallel computer) system. The performance of the $AR token has also surpassed the market as a result. Arweave is not only expanding its application in decentralized storage, but also stepping into the field of artificial intelligence. This article will provide a detailed introduction to Arweave's transformation and analyze what this means for investors.

Main Content

Last week, we briefly introduced why Arweave—an established and usually unremarkable protocol—has become more interesting. The main reason is AO (Actor Oriented), a super parallel computer built on top of Arweave. This newly added feature has led to recent outstanding performance of the native AR token compared to the market, which is unusual for the token. Despite this significant effort, another catalyst has been hinted at…

Arweave is primarily a decentralized storage solution, but it is now expanding its product into the field of AI through its AO computer. AO may soon launch its own token, but currently AR is the only way to participate in this possibility. AR is also a mature project and one of the few tokens in the industry with 100% FDV unlock.

Exposure to Relative Strength

In the current market, characterized by high volatility and rapid declines, reallocating assets to those showing relative strength is key to staying in the market.

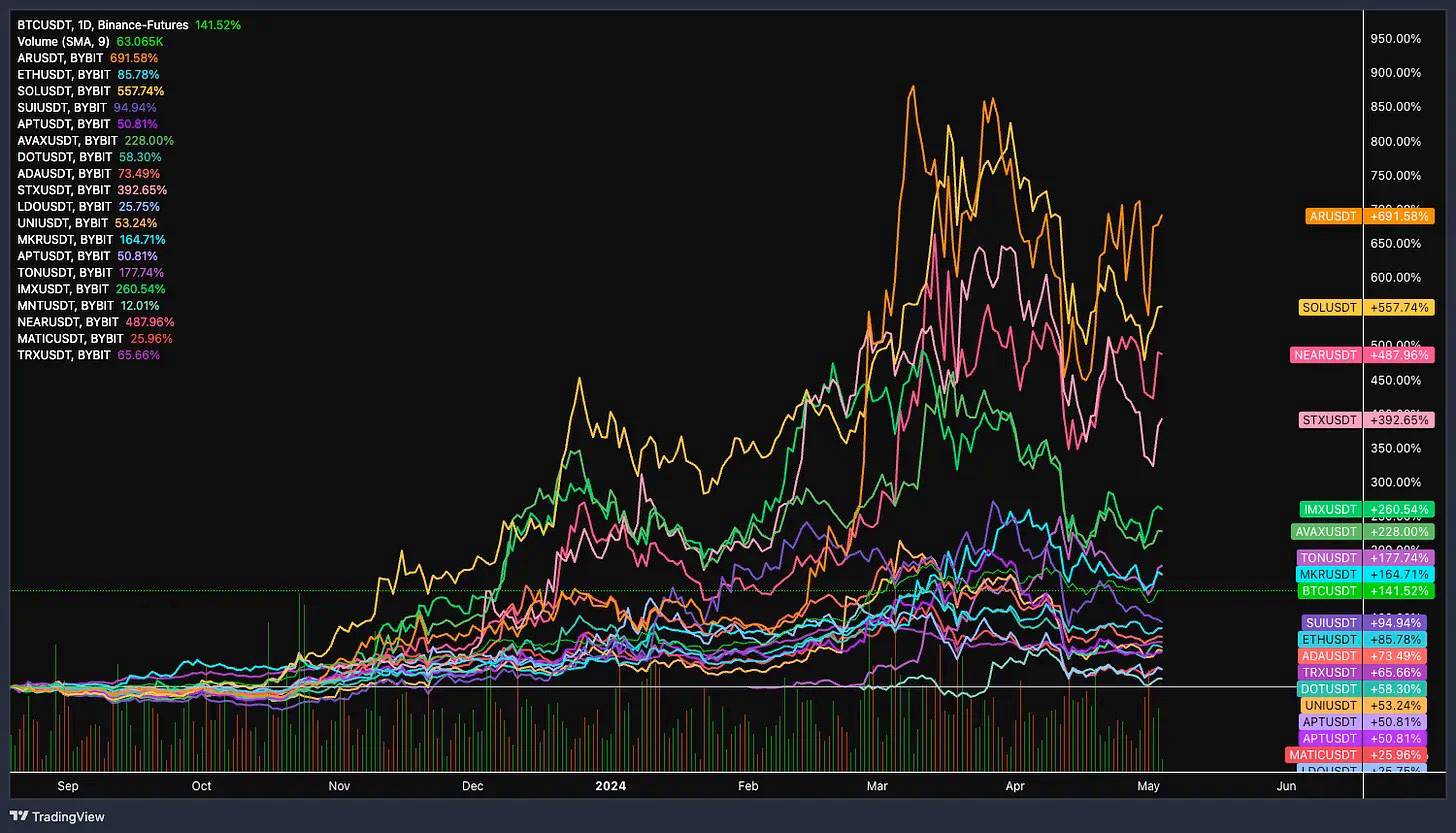

$AR has performed prominently in the recent market adjustment, showing unusual resilience as BTC dominance strengthens and other token prices trend downward. These rapid capital flows provide an excellent opportunity to shift capital from underperforming assets to higher quality projects or "fast horses."

This tactical rotation takes advantage of assets like $AR that show relative strength in the market downturn, allowing the portfolio to potentially gain incremental returns during market rebounds.

Conversely, continuing to hold weaker, underperforming assets in this scenario increases the risk of exacerbating losses in deteriorating market conditions.

Overall, this creates a favorable environment for hedging trades, allowing for strategic investment that hedges and protects against the overall market risk impact without blindly buying into $AR.

In summary, Arweave is generally considered a decentralized data storage solution, often grouped with storage platforms such as Filecoin, Storj, Siacoin, and ShadowDrive. However, Arweave has gone beyond simple storage solutions and ventured into AI narratives, showing signs of possibly replicating a re-rating similar to $NEAR. The latest initiative, AO super parallel computer, aims to address the challenge of achieving infinite scalability and incubate an ecosystem that can support multiple high-growth market areas, such as AI, DePIN, autonomous agents, and more.

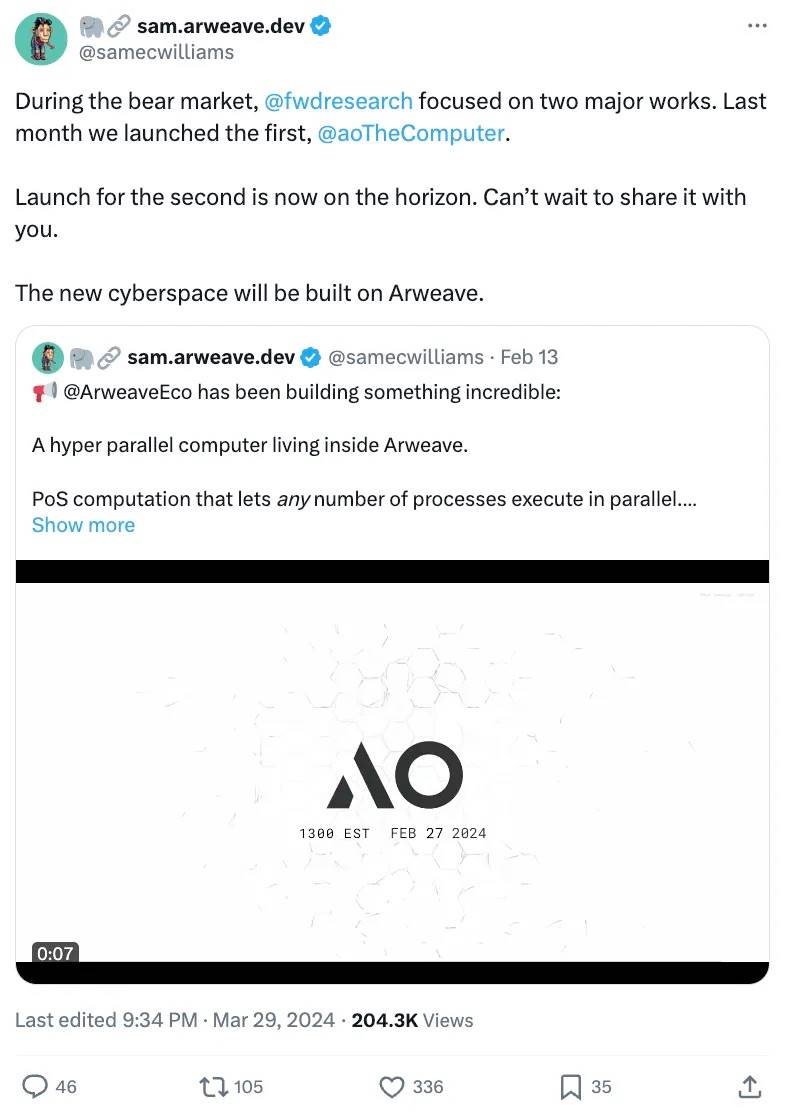

Although the market has already digested the AO released in February, we can still expect another major catalyst to arrive soon.

Considering that Arweave can now be classified as an AI project, releasing this news on May 22, coinciding with Nvidia's financial report, would be a very good timing.

Key Information Points

Arweave aims to keep data "as unchanged as possible for as long as possible."

Inspired by Bitcoin's proof of work mechanism, Arweave modified this concept to accommodate large-scale data storage.

Users pay a one-time upfront fee to store data on the network, with a portion used to cover the initial storage cost for 200 years, and the rest going into a donation fund to cover future storage costs.

With the decrease in storage costs, tokens in the donation fund may not enter circulation for a long time, creating deflationary pressure.

$AR has the highest mcap/FDV ratio in the industry, contrasting with the negative sentiment surrounding low circulation and high FDV tokens.

Currently, the only way to get ahead of AO is by holding $AR.

Arweave's founder, Sam Williams, has been hinting at releasing another ambitious project similar to AO.

As AO continues to expand and attract more users and applications, the demand for Arweave's storage capacity is expected to grow accordingly.

Arweave has performed well for most of the bull market, making it an attractive long-term investment for hedging trading strategies.

In recent weeks, the price of $AR has soared relative to $BTC and has shown resilience in the overall market downtrend.

Arweave is not only a storage network, but is now at the intersection of cryptocurrency, DePIN, and AI, recently entering the top 50 in token market cap rankings.

Background on Arweave

The Arweave team is led by Sam Williams, who currently serves as CEO. Williams graduated with first-class honors in Computer Science in 2014 and pursued a Ph.D. at the University of Kent. During this time, Williams' research focused on distributed systems and their scalability, laying the foundation for Arweave's unique data storage method.

Since May 2017, Williams' team has been collectively driving the development of Arweave, transforming the project from a simple conceptual framework into a functional decentralized storage network. Notable members and contributors to this ecosystem include William Jones (co-founder and former CTO) and Tate Berenbaum (current CEO of Community Labs, a venture studio focused on building and accelerating the adoption and development of the AO ecosystem).

The token sale in June 2018 raised approximately $8.7 million for Arweave. A year later in November 2019, Arweave raised $5 million from a16z, USV, and Multicoin to build the "permaweb." These same investors doubled down in March 2020, providing $8.3 million in funding for Arweave alongside Coinbase Ventures.

Overview: Like Bitcoin, but for Data

Operating as a decentralized storage solution, Arweave utilizes a blockchain-based protocol to provide permanent data storage. This is achieved through an economic model that involves charging a one-time data storage fee, which is expected to cover the indefinite preservation of data. This model leverages the concept of donations, where upfront payments help fund long-term storage.

At the core of this vision is the $AR token, which provides a global hard drive to ensure permanent storage. This not only allows the network to act as a data repository, but also helps power the construction of a vast application ecosystem built on top of AO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。