Original | Odaily Planet Daily

Author | Nan Zhi

Today, the average Ethereum gas fee once dropped below 4 gwei, hitting a new low in nearly three years. Does the bottoming of gas fees mean the market has bottomed out? What impact does it have on the ecosystem and users? Odaily will analyze this in this article.

Market Trend Connection

When the Ethereum mainnet gas skyrockets, it is often during a hot market or the launch of star projects, such as the DeFi bull market, the launch of otherdeed, and so on. On the other hand, when the mainnet gas is sluggish, does it indicate the market has bottomed out and is about to rebound?

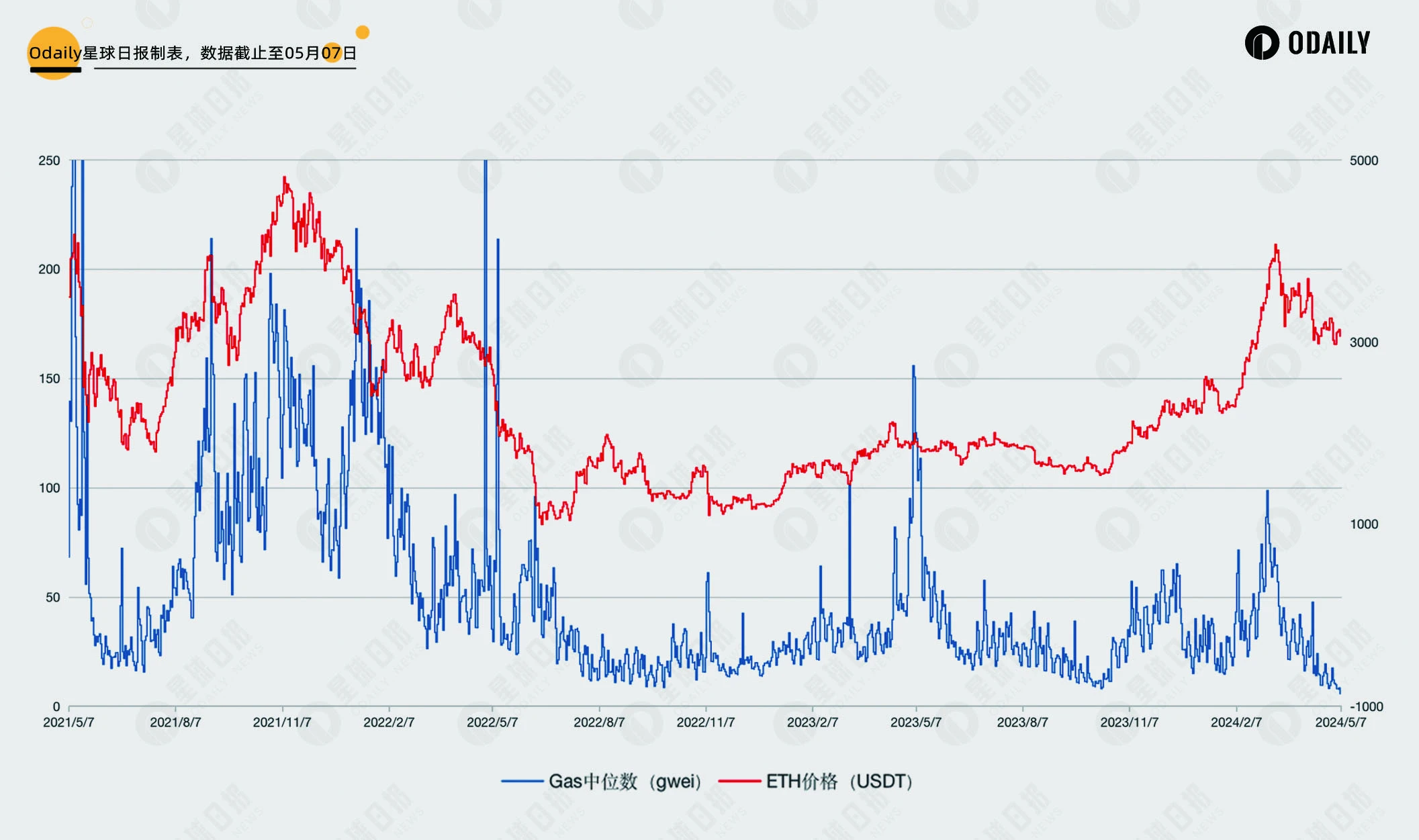

Odaily has compiled the daily average gas fees on the mainnet from May 7, 2021, to the present for three years. There have only been 16 days and 3 periods when the daily average gas fees on the mainnet were below 10 gwei, which were at the end of September 2022, the first half of October 2023, and since April 20 this year (also since the Bitcoin halving).

The lowest points for ETH over the past three years were on June 19, 2022 (995 USDT), January 1, 2023 (1196 USDT), and January 4, 2024 (2211 USDT). The trend charts for both are as follows, from which we can draw the first conclusion:

The sluggishness of Ethereum gas is the result of the market downturn, but it is not the direct driving force for the market to reverse, and it is not necessarily linked to the absolute bottom.

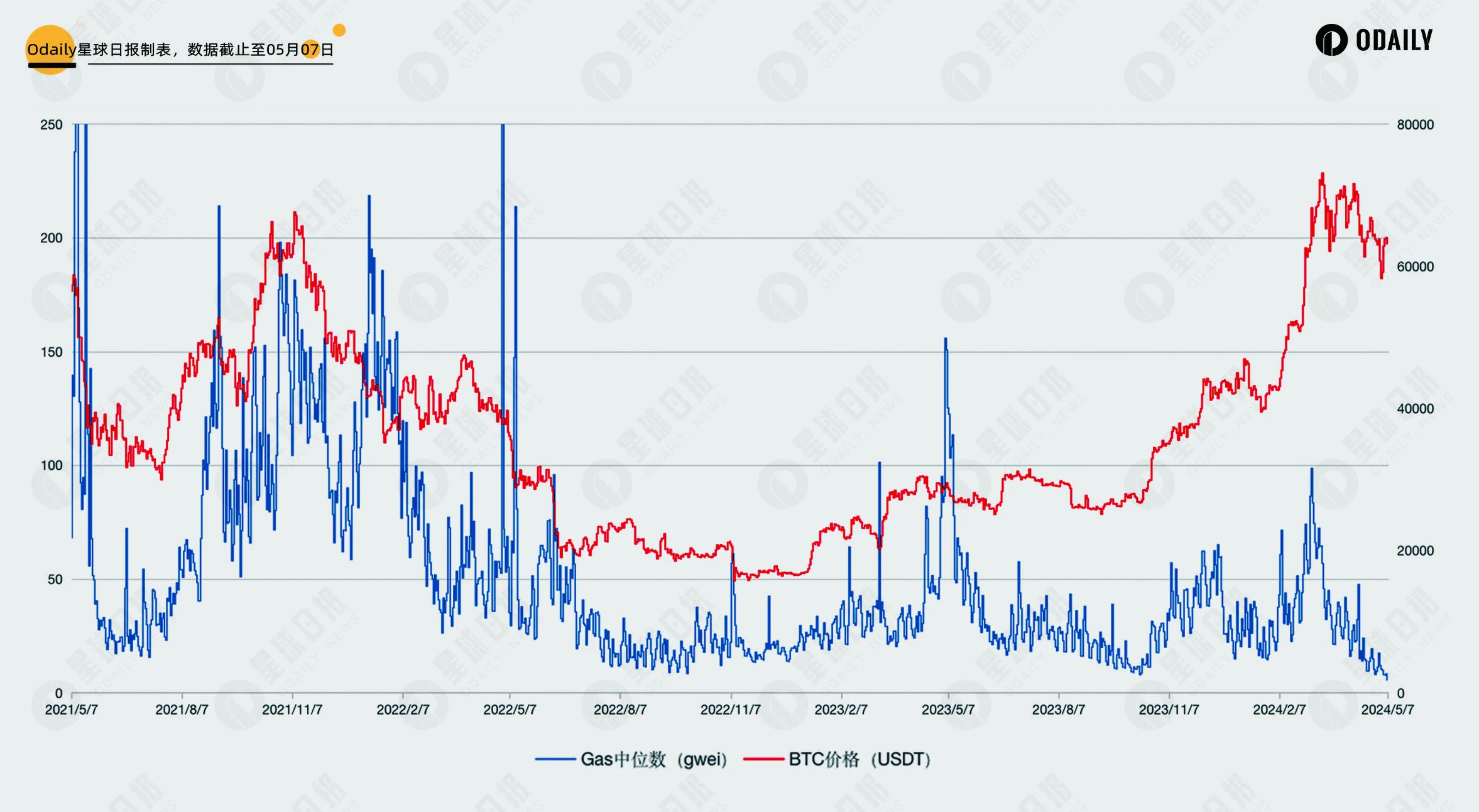

When we compare the Ethereum gas fees with the BTC market trend, do we reach the same conclusion? The trend charts for both are as follows. Although the bottom of Bitcoin occurred much later than ETH in November 2022, it is still not within the same range as the bottom of gas fees, and the above conclusion still holds true.

However, there is another pattern in the charts: The trend of gas fees develops in the same direction as the price. When the market is down, gas fees often decrease in sync, and vice versa. For example, the bottom of gas fees in October 2023 also coincided with extreme price points in the preceding and following months. The downward trend in prices in April this year was also accompanied by a downward trend in gas fees.

This means that although it does not equate to the absolute bottom, the bottoming of gas fees increases the possibility of a reversal to an upward trend, which is one of the potential conditions. Readers can use the trend of gas fees as a reference for the market and pay attention to when the reversal forms a trend of rising gas fees.

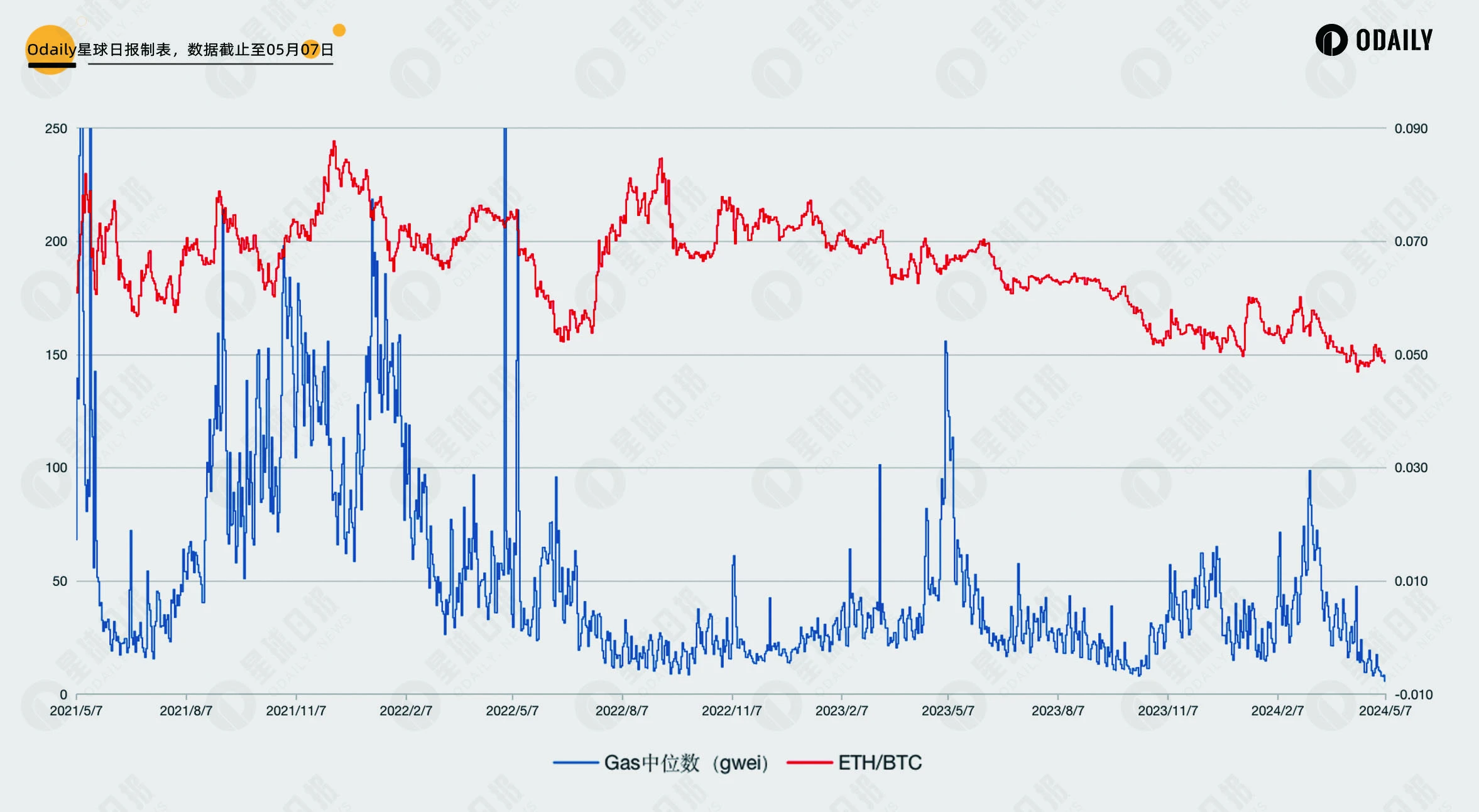

Finally, comparing the ETH/BTC exchange rate with the trend of gas fees, the exchange rate has been continuously declining for over a year. If we understand the mainnet gas fees as a measure of the prosperity of the Ethereum mainnet, regardless of whether it is high or low, it cannot reverse the trend of the exchange rate, indicating that the declining trend of the mainnet is difficult to reverse.

Ethereum Mainnet Interaction

For users, low mainnet gas fees also provide excellent opportunities for some operations. Odaily has compiled some regular operations as follows:

- L2 mainnet cross-chain

Based on past experience, using the official cross-chain bridges between the Ethereum mainnet and L2 will be one of the criteria for airdrops. Currently, the mainstream projects that have not yet issued tokens include zkSync, Linea, and Scroll, with their respective links as follows:

zkSync: https://portal.zksync.io/bridge

Linea: https://bridge.linea.build

Scroll: https://scroll.io/bridge

(Note: Whether there will be token airdrops and whether airdrops will consider official bridges is still uncertain. This is only for reference.)

- Register/Renew ENS domain names

The 1-year fee for an ENS domain name is 0.016 ETH, and at the current gas fee of 7 gwei at the time of writing, the network fee is approximately 0.0029 ETH, which is a significant "discount" compared to usual. If you choose to register for a 5-year period, the network fee accounts for only 26% of the total cost. If the operation is conducted at a price of 5 gwei, the network fee is only 0.0022 ETH.

- Clearing low-value tokens

At the gas fee of 5 gwei at the time of writing, the cost of authorizing a token transaction on Uniswap is 1 USDT, and the cost of conducting a swap is approximately 5 USDT. Users can choose whether to clear based on the value of the token.

Gas-Related Tools

This section will list some gas-related tools as a reference for users who are not familiar with on-chain interactions.

First is the most commonly used tool, Etherscan, which provides the most accurate data on gas fees and supports browser plugin installation. However, it is worth noting that the estimated operation fees provided by this tool, such as for Uniswap swap operations, are often higher. It is recommended that users check on other sites.

Cointool and MCT are websites that provide relatively accurate estimates of operation fees and support gas queries for multiple chains. They also support browser plugin installation.

In addition, Odaily has created a Dune query code and data panel for the historical gas trend of Ethereum for readers to refer to.

Conclusion

For users, low gas fees allow them to more fully participate in various projects in the ecosystem, but fundamentally, it signifies a decline in the prosperity of the ecosystem. EIP-1559 has endowed ETH with self-feedback characteristics, and after the London upgrade, the fees contributed by various L2s to the Ethereum mainnet have significantly decreased, and the narrative of Restaking is also close to being realized. Ethereum and ETH urgently need new directions for development to rebuild the growth flywheel of price and value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。