在加密市场,Celsius Network 的平台代币$CEL近日迎来了令人瞩目的大幅上涨。数据显示,截至5月6日,$CEL在过去24小时内的涨幅达到惊人的91.85%,远超其他币种。这一显著的价格波动,引发了圈内广泛的关注和讨论。

此次暴涨事件的直接触发点可追溯到5月1日的一项重大动作:在破产重组过程中的Celsius Network宣布销毁了其持有的几乎全部平台代币,共计6.52亿枚$CEL,占总量的94%。这一大规模的代币销毁行为显著减少了$CEL的市场供应量,使之从原先的数亿枚降至仅剩4055万枚。

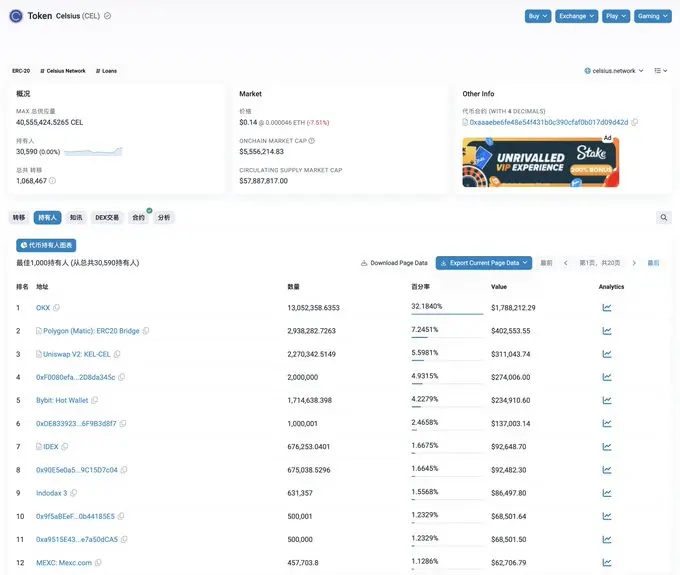

在此次代币销毁后,$CEL的市场行情得到了显著改善,其市值也由销毁前的561万美元急剧上升。$CEL的交易活动持续在多个主流交易所中进行,例如OKX、Bybit、Bitget、Gate和MEXC,显示出其流动性和市场关注度均有所增加。此次事件不仅为Celsius Network带来了市场的正面关注,也为加密货币领域增添了新的讨论焦点。

暴涨背后:Celsius Network的代币销毁与市场反应

在理解Celsius Network(CEL)代币价格暴涨的因素时,最关键的一环是其破产重组后采取的代币销毁行为。2022年7月,Celsius申请了第11章破产重组,并提出了名为“MiningCo交易”的计划,该计划专注于比特币挖矿,以改善债权人的偿还方案。这一策略在2023年底得到了法院的批准,并于2024年初正式实施,使Celsius能够向债权人分配超过30亿美元的加密货币和法定货币。

在2023年9月,Celsius提交了一份申请,计划在重组生效日销毁其控制下的所有$CEL代币。具体操作于2024年4月30日展开,Celsius通过将6.522亿枚$CEL代币发送至一个空地址来执行销毁,这些代币占了先前总供应量的94%,市值约为4.15亿美元。此次销毁后,$CEL的流通供应量大幅减少至约4060万枚。

销毁行为的直接结果是对市场供需状况的极大影响。代币总量的急剧减少,加上市场对Celsius破产重组成功的积极反应,共同推动了$CEL价格的激增。从0.13美元的低位开始,$CEL在短短一周内价格飙升至0.58美元,涨幅高达到291%。日涨幅甚至一度达到90%,最高价格为0.5899美元。

Celsius的这一策略在财务上也反映出其对代币价值的重视。在重组计划中,Celsius提出,不论最终如何处理这些代币,应为每个$CEL代币赋予具体的价值,估值为0.25美元。这一估值在销毁后由于市场供应紧缩而显得尤为重要。

此外,值得注意的是,尽管Celsius只能销毁其手中持有的代币,并强调无法取消所有$CEL代币交易或停止交易所交易,但市场对于其代币价格的反应仍然显著。这一市场动态不仅反映了加密市场对重大事件的敏感性,也展示了投资者对于供需变化的快速响应。

综上所述,Celsius Network的代币销毁行为直接引发了市场供应的显著变化,并在短期内导致了$CEL价格的大幅上涨。这一事件不仅标志着Celsius在破产重组后的战略调整,也展现了加密市场对此类重大时间的高度反应性。

关于Celsius Network

Celsius Network是一个集中式金融(CeFi)平台,由Alex Mashinsky、Daniel Leon 和 Nuke Goldstein 于2017年共同创立。作为一个创新的加密货币借贷平台,Celsius专注于为用户提供全面的银行及金融服务,使其在加密经济中获得稳定的收益。

该平台的核心功能包括为用户提供超额抵押贷款的能力,以较低的利率借出,同时通过存入的加密资产来赚取高额利息。此外,Celsius还提供了法币的入口和出口服务,以及用于日常支付的数字钱包。用户主要通过Celsius开发的移动应用程序完成各种操作,该应用支持多达33种不同的加密货币。

Celsius的商业模式基于吸引用户存款并赚取高利率收益,同时将这些存款出借给机构客户以产生收益。这种模式在平台初期获得了巨大的成功,但也暴露了平台在风险管理上的不足。2022年7月,由于严重的财务危机,Celsius不得不申请破产保护。

在Celsius的生态系统中,$CEL代币扮演着至关重要的角色。这种原生代币不仅用于提高存款的收益率和获得贷款利息的折扣,还可以使持有者有资格获得各种忠诚度等级,进而享受额外的福利。平台声称其将80%的收入用于为用户提供高利率回报和低借贷成本,从而确保了用户利益的最大化。

除了借贷和存款服务外,Celsius还涉足了比特币挖矿业务,进一步多元化其收入来源。尽管如此,随着加密市场的波动和经济环境的变化,Celsius面临的挑战逐渐增多,最终导致其破产重组。在经历了一系列的法律和财务重整后,Celsius目前正寻求通过战略调整重新获得市场的信任与支持。

总的来说,Celsius Network经历了从其创立之初的辉煌到后来的破产挑战,反映了加密市场的动态性和不确定性,同时也展示了CeFi平台在现代金融生态系统中的潜在影响力和风险。

总结:Celsius代币暴涨事件的反思与影响

Celsius Network的代币暴涨事件不仅是一个市场现象,也是一次加密领域风险与机遇并存的生动展示。这一事件强调了几个关键的加密市场动态,同时也为投资者和平台运营者提供了重要的洞察。

首先,Celsius的代币$CEL的大幅上涨展示了供需关系对加密市场的直接影响。通过销毁大部分流通中的代币,Celsius显著减少了$CEL在市场上的供应量,这在短时间内推动了代币价格的急剧上升。这种策略虽然有效,但也引发了关于市场操纵和透明度的讨论,突显了在加密市场发起重大事件时需要维护的公平性和透明度。

其次,$CEL代币的价格飙升反映了市场对Celsius重组成功和未来潜力的乐观预期。这种情绪的变化是投资者信心的一个指标,表明即使在经历重大财务和法律困境后,加密企业仍有可能通过战略调整重新获得市场的支持。

此外,该事件也提醒了投资者在动态且有时候是不透明的市场中进行决策的风险。尽管短期内可能获得显著的收益,但这种高波动性也可能带来相应的风险,特别是在缺乏足够市场信息的情况下。

最后,Celsius代币的暴涨也应促使监管机构更加关注加密市场的稳定性和透明度问题。随着加密市场继续成熟,预计会有更多的监管措施被引入,以确保市场的健康发展和对投资者的保护。

综上所述,Celsius代币的暴涨事件不仅是一次市场价格的快速上升,而且是对加密市场运作机制、投资者行为、平台策略及监管环境的全面考验。这一事件为加密货币参与者提供了宝贵的经验,强调了在加密货币这一不断演变的领域中,灵活应对和深思熟虑的决策的重要性。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。