天下熙熙,皆为利来;天下往往,皆为利往!大家好,我是你们的朋友老崔说币,专注数字货币行情分析,争取为广大币友传递最有价值的币市信息,欢迎广大币友的关注与点赞,拒绝任何市场烟雾弹!

讲完近期走势,也综合了国际的金融环境与大家讲解,相信各位对于未来的走势,有了一定的认知。由于近期币圈有回暖的迹象,导致各位的观点也是众说纷纭。老崔想强调一点,不要等行情来临就开始牛市来临,有下跌迹象就是熊市爆发。整体的金融环境并不支持币圈有大的波动,当然各位如果觉得近期的波动比特币在5000点上下流转,算是大波动的话,那就当老崔这个观点不成立。本轮的上涨,几乎与香港的上市,没有太大的关联,最终的原因大多还是老美的非农数据影响,终于不堪重负,公布出了真实的数据。

前期我们也讲过,老美的数据层面的影响。虽然的数据非常不靠谱,导致币圈的波动还是比较平庸。一旦真实的数据展现,依旧对金融圈层的打击较为强烈。同时大家也可以反推一下老崔的观点,USDT的波动是否能够影响到币圈的走势。这两天也是讲U价格再度打了下来,7.30附近的USDT还是能够支持币圈持续上行,U价格只要不持续上涨,空头的情绪就会持续减弱。当然这点并不代表着牛市即将来临,对于牛市的观点始终要持有保守的态度。降息不来临,牛市始终不会前行。

把目光调回到香港这个地方,大部分人都觉得本轮的增长是来自于香港上市的余威,老崔反而不这么认为,很直白的观点就是资金的动向,目前亚洲层面几乎没有太大的波动。这点也是印证了,我们之前的猜想,目前港内的ETF上市更多是偏向于打开外汇的通道,交易层面还是次要用途。理清了这个观念,基本大家就能够看清楚未来的走势,本轮的上涨高点,就是看老美的降息时间线。非农数据的暴露,更多原因还是外部资金并未到位,也间接导致,降息时间可能会提前来临。

老崔的主张一贯是希望大家以开放性的思维,去看待每一个市场。任何措施的落地,也一定是有利有弊。比方说本轮香港的上市,就出现了时间差,大部分人都觉得上市之后,会迎来一波牛市,结果来了一波急速下跌。没有老美非农数据的救场,本轮很可能就稳定在比特币55000-60000区间的争夺。同样,大家不要忽略掉老美的数据层面,降息这个问题,永远是高于所有金融市场的消息层面影响,除开军事层面,降息的决策会决定着所有金融市场未来3-5年的走势。只要降息,来临币圈的牛市就会正式启动。

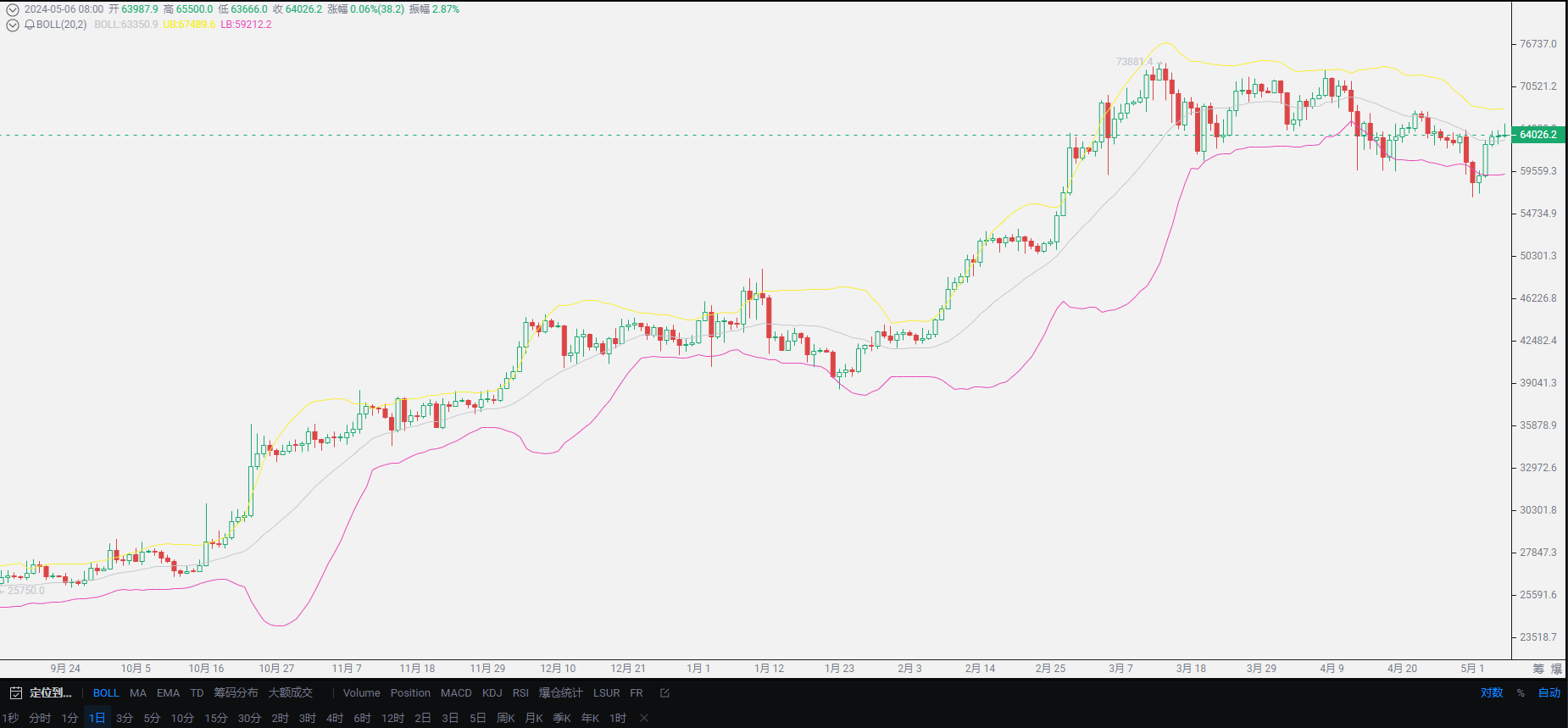

对于短期来看,无论是合约还是现货的用户,相信这两天也是赚到了一部分利润,比特币60000点位的进场,目前可以准备离场。这个点位对比起整体的下跌情况,确实不算是比较完美的进场点位,好在也算是吃到了一部分的红利。不只是各位有着绝对低点的想法,老崔也会出现这种差错,事实证明,老崔也并非大家所想的无所不能,跌破6W关口直下56000位置,这一步老崔确实超出了认知。也出现了许多朋友,都在质疑老崔为什么不选择57000进场多单,非要等到6W关口的企稳才会选择进场蛰伏?

对于这个问题,老崔在此做一个统一的回答:首先老崔并没有预知未来的能力,如果老崔拥有这个能力,各位是接触不到老崔这个层面。老崔所做的工作只能是,帮助更应该说是协助大家,如何在缩小风险的同时去扩大我们的盈利。可以说老崔的做法,通常都是偏向于保守的一方,所以合约高杠杆,甚至是满仓的各位币友,可以找找其它的分析师。与共识者同行,共赢是老崔的理念。6W关口无法企稳,就不用谈多头趋势的来临,极速下跌的情况,老崔也无法保证底部位置是否企稳,所以等待才是最合理的做法。一旦确定了底部的位置,才是我们出手的时机。每一轮的进场目标达成,随时都可以出场入袋为安。

对于后市来讲,我们无法盲目看涨,本轮的现货与合约的盈利目标基本已经达成,比特币企稳65000的关口才会有下一轮的趋势展开,目前来看触及关口的压力依旧强大,各位最好还是等待一下老崔的通知。当然这并不意味着短期看空的趋势,没有这么绝对的行情走势,目前来看行情还是偏向于多头的走势,即使各位的多单没有出场,也可以继续等待合适的出场时机。

原文创 公众号:老崔说币 如有侵权 请联系作者删除

老崔寄语:投资犹如下棋,高手能看出五步,七步甚至十几步,而棋艺低只能看出两三步,高者顾大局,谋大势,不以一子一地为重,以最终赢棋为目标,低者则寸土必争,多空频繁转化,只争一时短线,结果频频受困。

本材料仅供学习参考,不构成买卖建议,据此买卖,后果自负!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。