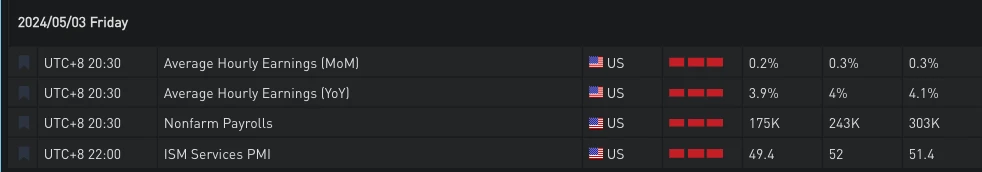

Last Friday, positive macroeconomic news emerged. The US April non-farm payroll data was significantly lower than expected, and the hourly wage growth also cooled, strengthening the market's bet on two interest rate cuts by the Federal Reserve this year. The yield on US Treasuries fell noticeably, with the two-year and ten-year yields at 4.791% and 4.474% respectively.

On the other hand, geopolitical crises have eased, with the Israeli Prime Minister expressing willingness to suspend fighting in the Gaza Strip in exchange for hostages. If an agreement is reached successfully, it will bring positive news to the risk market.

Source: Signalplus, Economic Calendar

Source: Investing

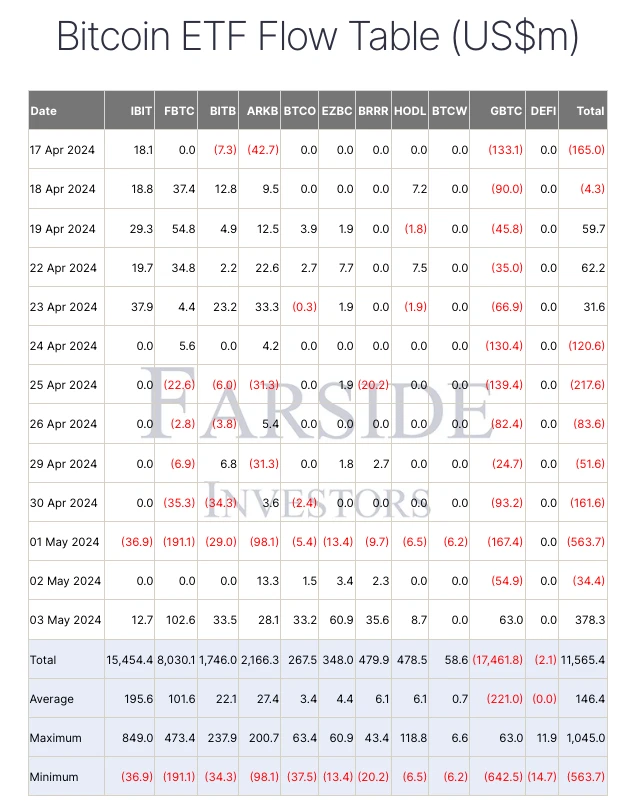

In the context of improved risk market sentiment, the cryptocurrency sector also received a major piece of good news: GBTC's Flow finally reversed, achieving a positive inflow. This represents a weakening of the BTC short selling force and a reduction in selling pressure. Looking at the coin price, since last Friday, the market has gradually realized the macroeconomic positives and the expectations of liquidity injection from the US dollar. BTC has risen from around 59,000 to 65,000, completely recovering the lost ground from the previous week.

Source: Farside Investors; TradingView

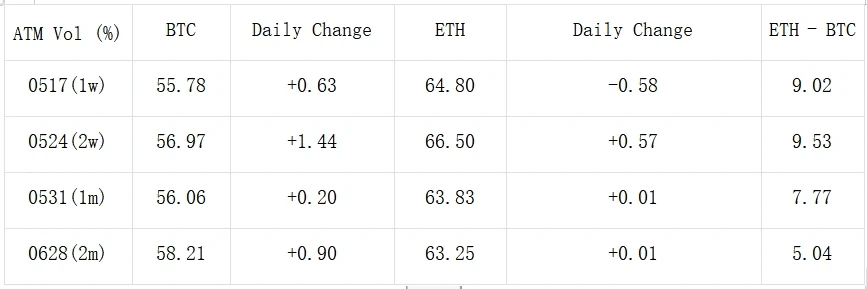

In terms of options, the recent rise in actual volatility has driven up the front-end implied volatility. Currently, the IV levels for BTC and ETH are around 56% and 65% respectively. ETH's overall Vol Premium is significantly higher than BTC's, and its front-end implied forward IV includes the uncertainty brought by the US SEC's rulings on the VanEck Ethereum spot ETF (May 23) and the grayscale Ethereum futures (May 30).

Source: Deribit (as of 6MAY 16:00 UTC+8)

Source: SignalPlus

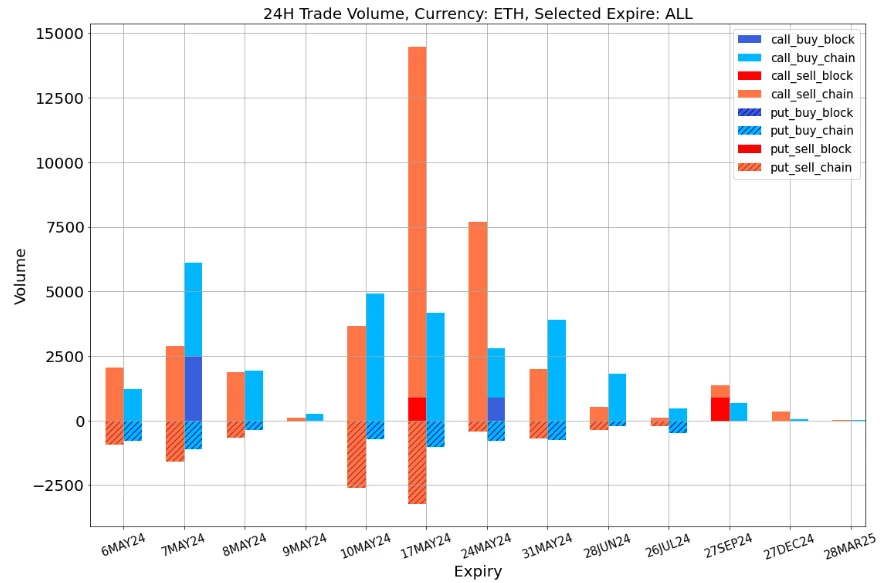

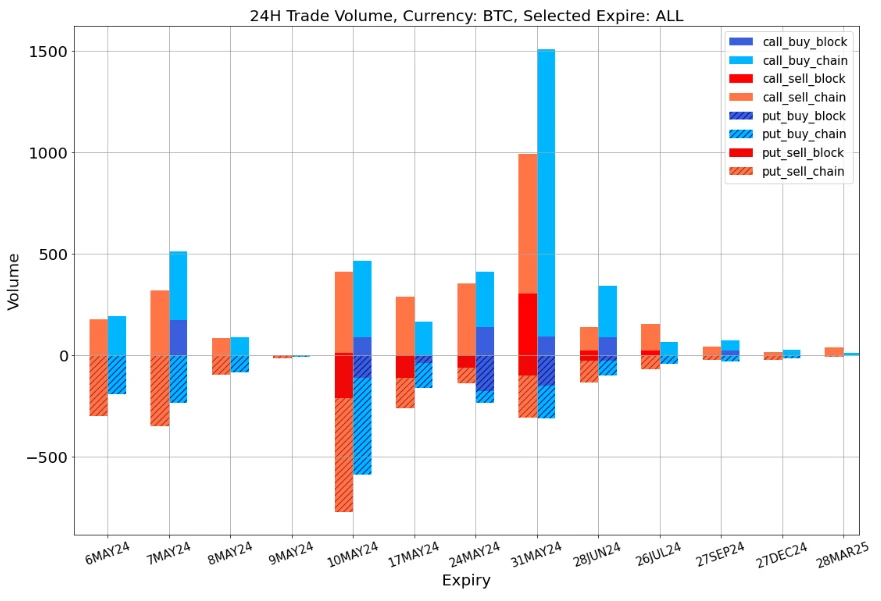

In trading, the bullish option selling pressure for ETH in mid-May is strong, mainly concentrated in the 17MAY24 and 24MAY24 3600-C. As for BTC, traders are selling short-term put options near 62,000/61,000, showing confidence in this rebound. At the same time, they are buying a large number of OTM call options for May 31, showing optimism about BTC's upward potential this month.

Data Source: Deribit, ETH overall trading distribution, strong bullish option selling pressure in mid-May

Data Source: Deribit, BTC overall trading distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。