According to incomplete statistics from Odaily Star Daily, there were a total of 32 blockchain financing events announced domestically and abroad from April 29th to May 5th, which is a decrease from the previous week's 29 events. The disclosed total financing amount is approximately $168 million, showing an increase from the previous week's $194 million.

Last week, the project with the highest investment amount was asset tokenization company Securitize ($47 million), followed closely by RWA market Ironlight ($12 million).

The specific financing events are as follows (Note: 1. Sorted by disclosed amount; 2. Excluding fund-raising and M&A events; 3. * denotes "traditional" companies with some business involving blockchain):

On May 1st, real-world asset tokenization company Securitize completed a $47 million financing round, led by BlackRock, with participation from Hamilton Lane, ParaFi Capital, Tradeweb Markets, and Aptos Labs. Securitize will use the proceeds from this round to accelerate product development, expand its global footprint, and further strengthen its partnerships in the financial services ecosystem. Joseph Chalom, Global Head of Strategic Ecosystems at BlackRock, has been appointed to the board of Securitize.

On May 2nd, RWA market Ironlight completed a $12 million financing round, with individual investors from Wall Street participating. Specific investor information has not been disclosed at this time.

On May 3rd, Mirror's parent company, Reflective Technologies Inc., revealed that it secured $10 million in financing from Electric Capital, with additional support from a16z crypto, Union Square Ventures, and Variant, to develop a new product, Kiosk.

H&T, a cryptocurrency accounting firm, secures $10 million financing, led by Orbs

On April 30th, cryptocurrency accounting firm Harris and Trotter Digital Assets (H&T) announced the completion of a $10 million strategic financing round, led by Orbs, with participation from Re7 Capital and Kingsway Capital. This round of financing was conducted in the form of priced equity financing, valuing H&T at $85 million.

Backed, a Swiss tokenized asset issuer, completes a $9.5 million financing round, led by Gnosis

On April 30th, Swiss tokenized asset issuer Backed announced the completion of a $9.5 million financing round, led by Gnosis, with participation from Exor Seeds, Cyber Fund, Mindset Ventures, Stake Capital Ventures, Blockchain Founders Fund, Blue Bay Capital, and Nonce Classic. This round of financing will help Backed accelerate its private token issuance services and onboard more asset management companies onto the blockchain.

On May 3rd, cross-chain DeFi protocol EYWA completed a $7 million seed financing round, led by Michael Egorov, the founder of Curve Finance, with participation from Fenbushi Capital, GBV Capital, Big Brain Holdings, Marshland Capital, Mulana Capital, and others.

Modular liquidity protocol Mitosis secures $7 million financing, led by Amber Group

On May 2nd, modular liquidity protocol Mitosis announced the completion of a $7 million financing round, led by Amber Group and Foresight Ventures, with participation from Big Brain Holdings, Folius Ventures, Citizen X, GSR, Cogitent Ventures, No Limit Holdings, Digital Asset Capital Management, Pivot Global, Everstake, and a group of angel investors.

On April 30th, the UK-based cryptocurrency trading platform X10 announced the completion of a $6.5 million financing round, with participation from Tioga Capital, Semantic Ventures, Cherry Ventures, Starkware, Cyber Fund, and a group of angel investors.

On May 3rd, in addition to acquiring Web3 content publishing platform Mirror, Paragraph announced the completion of a $5 million financing round, with participation from Union Square Ventures (USV) and Coinbase Ventures. Colin Armstrong, founder of Paragraph, will serve as CEO, and Denis Nazarov, founder of Mirror, will serve as an advisor.

On May 1st, Web3 wine market Baxus announced the completion of a $5 million strategic round of financing, led by Multicoin Capital, with participation from Solana Ventures, Narwhal Ventures, FJ Labs, and a group of angel investors.

On April 30th, Celestia's ecological liquidity staking protocol MilkyWay completed a $5 million seed round of financing, with Binance Labs and Polychain Capital co-leading the round, and participation from Hack VC, Crypto.com Capital, and LongHash Ventures.

On May 1st, the cryptocurrency voting service platform Agora announced the completion of a $5 million seed round of financing, led by Haun Ventures, with participation from Coinbase Ventures, Seed Club Ventures, and Consensys Ventures.

On May 3rd, multisignature non-custodial platform Volta announced the completion of a $4.1 million seed round of financing, with participation from Fika Ventures, Haven Ventures, Soma Capital, Dispersion Capital, and Uphonest Capital. The new funds will be used to accelerate the development of its self-custody solution.

On April 29th, the cryptocurrency trading ecosystem LazyBear announced the completion of a strategic financing of 4 million USDT, with participation from Gogeko Labs, DWF Labs, Shadow Labs, Salad Labs, Bees Network, REI Network, IBIT, Crypto Bullish, SYNBO Protocol, Bazaars, Sypool, Bitcoin Gbox, GemX Crypto, and Wikibit. LazyBear is a cryptocurrency trading ecosystem targeting retail traders.

On May 2nd, according to official sources, Web3 content distribution platform Metale Protocol recently announced the completion of a $2 million seed round extension financing. As of now, the total amount of seed round financing has reached $4 million.

On May 4th, on-chain data API developer Airstack announced the completion of a $4 million seed round of financing, led by Red Beard Ventures, with participation from SuperLayer, Polymorphic Capital, Superscrypt, Hashed Emergent, Delta Blockchain Fund, CSP DAO, NGC Ventures, Primal Capital, Kyber Ventures, and Resolute Ventures. Specific valuation information has not been disclosed at this time.

On May 5th, DeFi protocol Amphor, incubated by hedge fund MEV Capital, announced the completion of a $4 million seed round of financing, with participation from over 80 angel investors in the cryptocurrency industry. The project aims to simplify ordinary investors' participation in the DeFi field using algorithmic and on-chain technology solutions. Specific valuation data has not been disclosed at this time, and the new funds will be used for team expansion, building its technology stack, and expanding to other blockchain networks.

On May 2nd, according to Japanese media reports, Web3 game company Games for a Living completed a 50 million yen (approximately $330,000) financing, with investors including Supercell, the company behind the mobile strategy game "Clash of Clans," and angel investor Mitch Lasky.

On April 30th, Web3 game company GFAL completed a $3.2 million seed round of financing, with participation from Supercell and MitchLasky. GFAL launched the GFAL token in the first quarter of 2023, raising $4.4 million, and its token market value is currently $52 million.

On April 30th, LayerZero ecosystem's full-chain NFT protocol Holograph announced the completion of a $3 million strategic financing, led by Mechanism Capital and Selini Capital, with participation from Northrock Capital under Hal Press, Arca, Courtside Ventures, and Hartmann Capital. As of now, Holograph's total financing amount has reached $11 million.

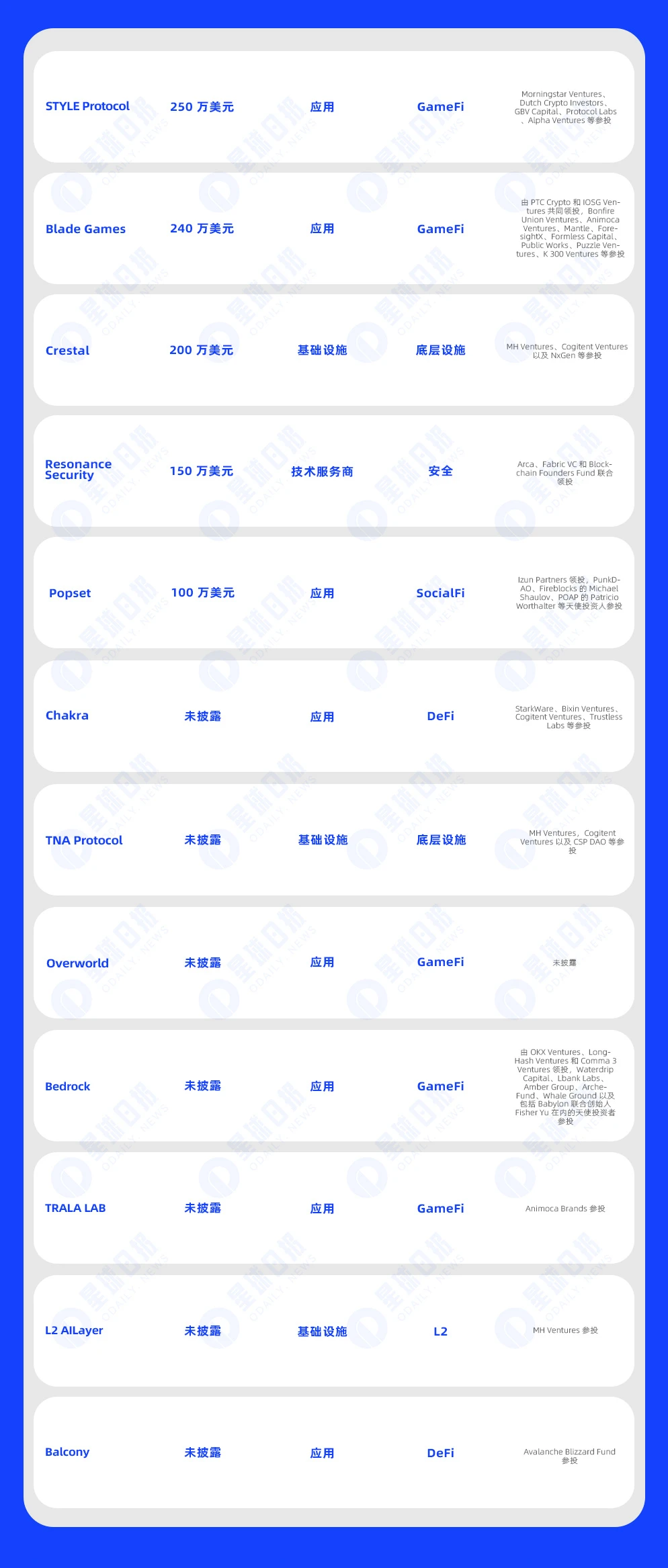

On April 30th, the game NFT integration protocol STYLE Protocol announced the completion of a $2.5 million seed round of financing, with participation from Morningstar Ventures, Dutch Crypto Investors, GBV Capital, Protocol Labs, Alpha Ventures, and others.

Blade Games completes a $2.4 million seed round of financing, led by IOSG Ventures and PTC Crypto

On May 1st, the on-chain game studio and infrastructure provider Blade Games completed a $2.4 million seed round of financing. This round was co-led by PTC Crypto and IOSG Ventures, with participation from Bonfire Union Ventures, Animoca Ventures, Mantle, ForesightX, Formless Capital, Public Works, Puzzle Ventures, K300 Ventures, and others.

On May 4th, the dynamic modular service platform Crestal announced the completion of a $2 million Pre-Seed round of financing, with participation from MH Ventures, Cogitent Ventures, and NxGen. The new funds will be used to accelerate the development of modular services.

On May 2nd, Web3 comprehensive network security service provider Resonance Security completed a $1.5 million Pre-Seed round of financing, co-led by Arca, Fabric VC, and Blockchain Founders Fund. The new financing will be used to further accelerate expansion.

On May 2nd, according to official sources, the on-chain social app Popset announced the completion of a $1 million Pre-Seed round of financing, led by Izun Partners, with participation from PunkDAO, Michael Shaulov of Fireblocks, Patricio Worthalter of POAP, and other angel investors.

On April 30th, the Bitcoin re-staking protocol Chakra, based on zero-knowledge technology, announced the completion of a new round of financing on the X platform, with participation from StarkWare, Bixin Ventures, Cogitent Ventures, Trustless Labs, and others. Specific amount and valuation information has not been disclosed at this time.

On April 30th, TNA Protocol announced the completion of its first round of financing, with participation from MH Ventures, Cogitent Ventures, and CSP DAO. Specific financing amount has not been disclosed at this time. It is reported that TNA is a Bitcoin domain name protocol aimed at improving its usability and expanding the scope of its assets and primitives.

On May 2nd, DWF Ventures announced its investment in the blockchain game studio Overworld on the X platform. According to its introduction, Overworld recently announced plans to launch a new NFT series and will also launch Overworld Arena.

On May 2nd, the multi-chain liquidity re-staking protocol Bedrock announced the completion of a financing round, aimed at accelerating the development of its liquidity re-staking solution and further driving its growth. This round of investment was led by OKX Ventures, LongHash Ventures, and Comma3 Ventures, with participation from Waterdrip Capital, Lbank Labs, Amber Group, ArcheFund, Whale Ground, and angel investors including Fisher Yu, co-founder of Babylon.

On May 2nd, TRALA LAB announced the completion of a new strategic round of financing, with participation from Animoca Brands. Specific financing amount and valuation data have not been disclosed at this time. TRALA LAB is a subsidiary of the Korean listed game company Joycity. After receiving investment from Animoca Brands, the two parties will collaborate in the global Web3 GameFi field. It is reported that TRALA LAB plans to focus on building a long-term sustainable gaming platform and plans to integrate a series of AAA-level global game IPs on zkSync.

On May 2nd, according to official sources, the EVM-compatible Bitcoin L2AILayer (formerly AINNLayer2) announced the completion of a new round of financing, with participation from MH Ventures. The specific amount has not been disclosed. It is reported that the two parties will work together to build a Bitcoin Layer2 solution, providing a good experience for users and developers.

On May 3rd, the U.S.-based blockchain infrastructure company Balcony announced the completion of a Pre-Seed round of financing, with participation from Avalanche Blizzard Fund. Specific amount and valuation information have not been disclosed at this time. The new financing will be used to expand operations and development work.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。