撰文:Alex Thorn, Gabe Parker

编译:深潮TechFlow

引言

比特币和更广泛的流动性加密货币市场在 2024 年第一季度大幅上涨,导致整个行业重新燃起乐观情绪。加密风险投资市场似乎正在反弹,尽管根据 4 月中旬撰写本文时的可用信息,数据似乎比市场情绪略显暗淡。总体而言,创始人和投资者报都表示,与前几个季度相比,融资环境更加活跃。在连续3个季度的交易数量和资金投资下降之后,第一季度均有所上升。虽然流动性加密货币市场的上涨可以提振风险投资界的情绪,但年初寻求的降息似乎不太可能发生。顽固的通胀数据,加上美国经济普遍强劲,导致美联储官员发表大量鹰派言论,因此,期货市场已将2024年降息的预期从今年1月的7次降息下调至1-2次。更高的利率将继续对寻求筹集资金的风险基金构成挑战,因此,寻求从这些基金获得投资的初创公司也将面临挑战。

交易数量环比增长超过50%,但投资资金仅增长29%。吸引大量风险投资关注的类别包括比特币 Layer2、再质押和开发者工具等基础设施以及游戏。交易规模环比持平,但估值增长了近100%,这表明资金仍然紧张,但创始人能够利用市场情绪的改善,以较少的稀释度筹集资金。

加密市场风险投资

交易数量和投资资金

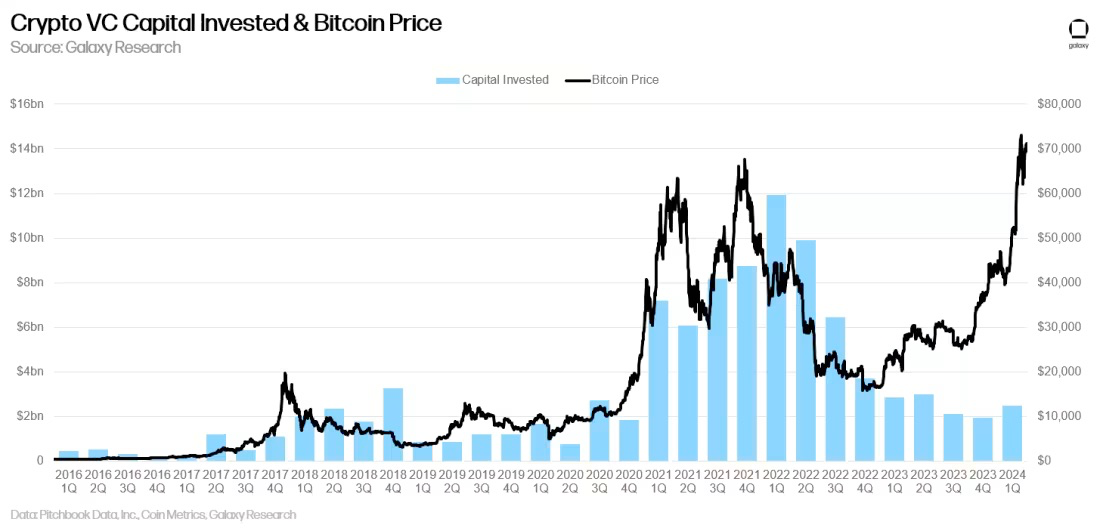

2024 年第一季度,风险投资者向加密货币市场和区块链公司投资了 24.9 亿美元(环比增长 29%),涉及 603 笔交易(环比增长 68%)。

这是 3 个季度以来投资资金和交易数量的首次增长,或许预示着2023 年第 4 季度是“底部”,但季度增长的持续性--以及更有意义的增长--将在未来几个季度证实这一点。

投资资金&比特币价格

虽然加密货币领域的风险投资通常与比特币价格相关,但在过去一年中,这种相关性已被打破,比特币自 2023 年 1 月以来大幅上涨,但风险投资活动却大多萎靡不振。2024 年第一季度,比特币大幅上涨,虽然投资资金也有所上升,但投资活动仍远未达到比特币上次交易价格超过 60,000美元时的水平。加密货币行业原生催化剂(比特币 ETF、再质押、模块化、比特币L2等新领域)和宏观逆风(利率)共同造成了显著的分歧。

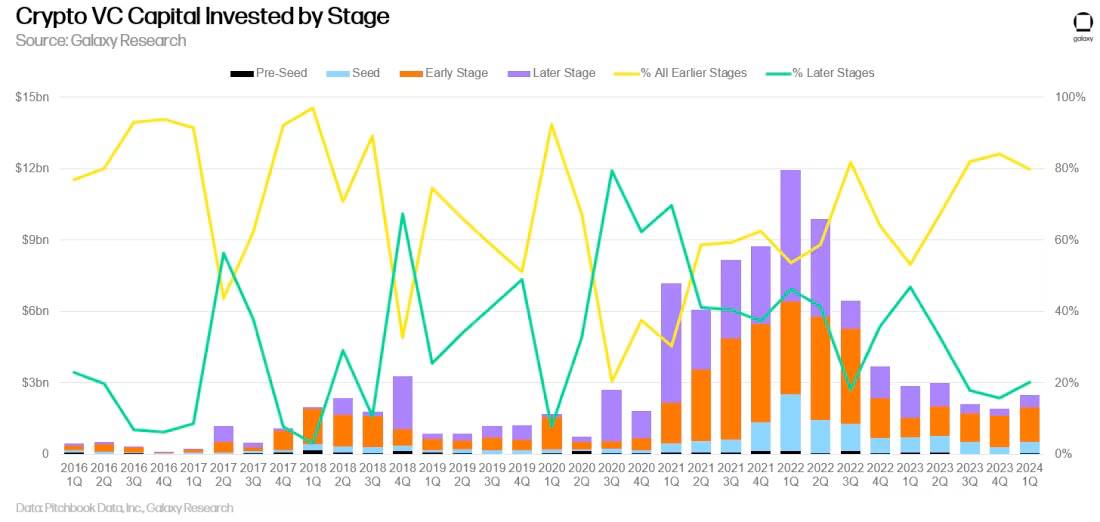

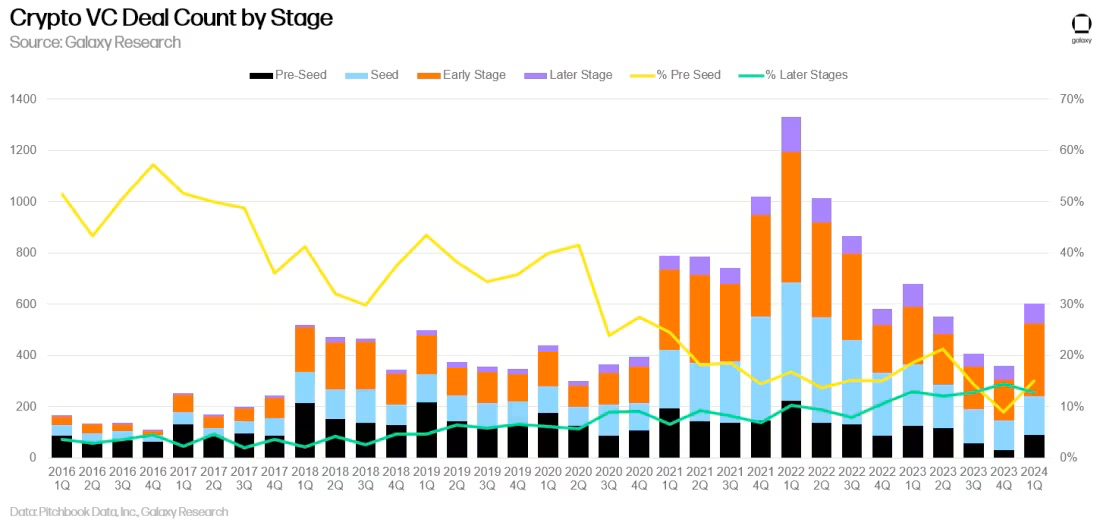

按阶段划分的风险投资

2024年第一季度,约80%的资金流向了早期的公司,而20%流向了后期创立的公司。由于以加密货币为重点的早期风险基金仍然活跃,而且许多基金仍在 2021 年和 2022 年依靠自己的筹款来维持生机,因此引人注目的早期公司仍然能够获得资金。但许多大型综合风险投资公司已经退出了该行业,或者大幅减少了风险敞口,这使得后期创业公司更难融资。

在交易方面,第一季度的种子轮前的交易份额略有增加,这表明新成立的初创公司有所增长。

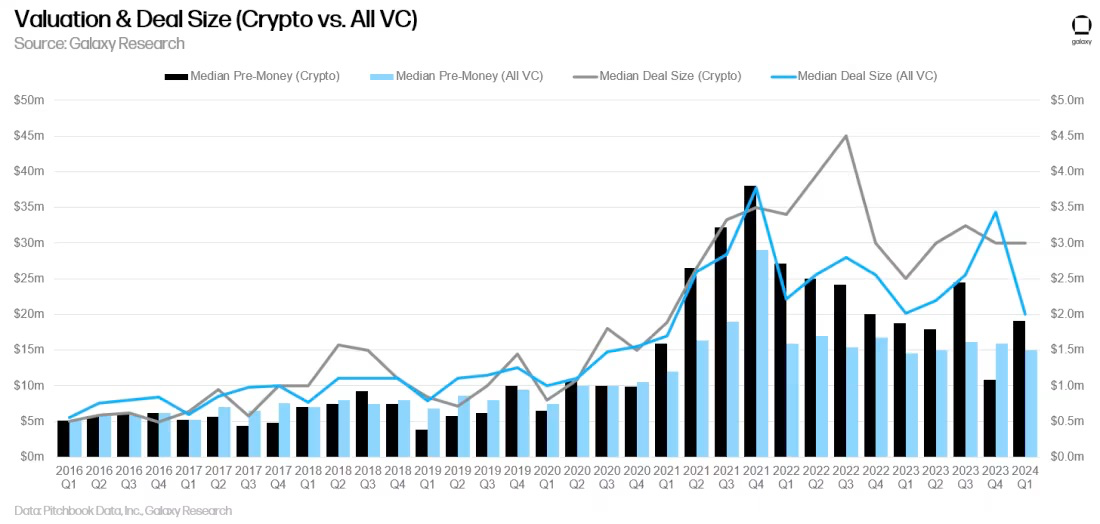

估值和交易规模

2023 年,风险投资支持的加密公司估值大幅下降,第四季度达到了自 2020 年第四季度以来的最低投前估值中位数。然而,尽管交易规模中位数环比保持稳定,2024 年第一季度的估值仍出现反弹。数据表明,与 2023 年最后一个季度相比,创始人能够筹集到相同的资金,但稀释程度较低。与此同时,整个风险投资综合体的动态却恰恰相反--交易规模环比下降了50%,而投前估值中位数基本持平,这表明创始人不得不出售更多股权来筹集相同的资金。估值的上升可能源于第一季度市场情绪的高涨--尽管缺乏更多的资金,创始人仍能利用市场情绪的好转获得更高的估值。

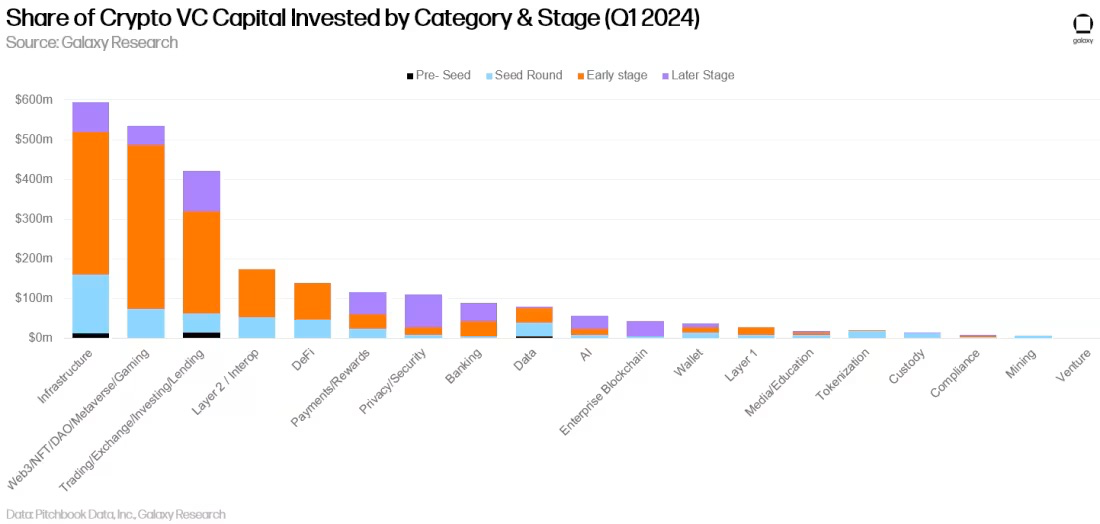

按类别划分的投资

2024 年第一季度,“Infrastructure”类别的公司和项目筹集到的加密风险投资占比最大(24%),以EigenLayer 1 亿美元的融资为首。

Web3 和Trading公司紧随其后,分别占投资资金的 21% 和 17%。

就交易数量而言,Web3 以 24% 的份额领先,这主要是由于游戏相关交易的增加。

Infrastructure和Trading紧随其后,分别占 2024 年第一季度完成的所有交易的 15% 和 12%。

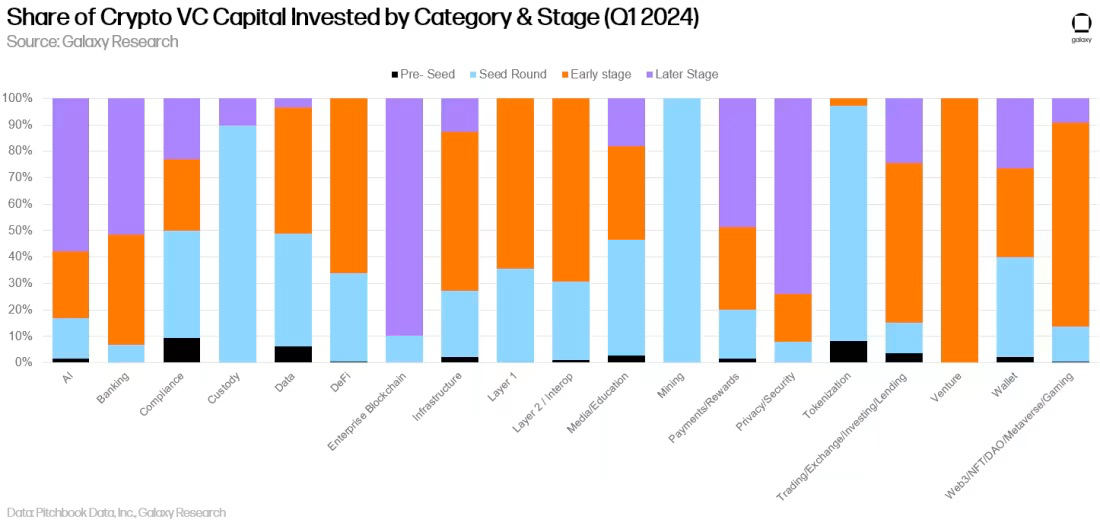

按阶段和类别划分的投资

按类别和阶段细分投资资金和交易数量,可以更清楚地了解每个类别中哪些类型的公司正在筹集资金。Infrastructure、Web3 和Trading类别的绝大多数资金都流向了早期公司和项目。

通过对每个类别投资阶段的资金份额来检查,可以了解每个可投资类别在投资者眼中的成熟程度。

交易数量也讲述了类似的故事。几乎所有类别中完成的大部分交易都涉及早期的公司和项目。

检查每个类别中按阶段完成的交易份额,可以深入了解每个可投资类别的各个阶段。

按地理位置划分的投资

尽管监管环境很棘手,但总部设在美国的公司继续完成最多的融资交易,并从风险投资者那里筹集到最多的资金。在 2024 年第一季度,超过 37.3% 的交易涉及总部位于美国的公司。新加坡为10.8%,英国为10.2%,瑞士为3.5%,香港为3.2%。

总部设在美国的公司吸引了42.9%的风险投资资金。新加坡为11.1%,英国为9.7%,香港为7.9%,法国为5.6%。

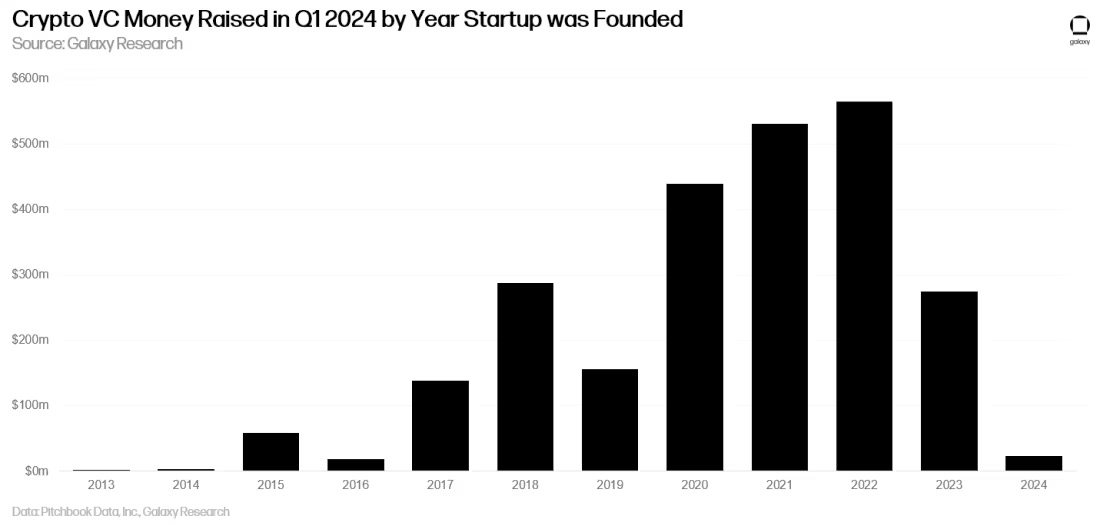

按队列划分的投资

在 2024 年第一季度完成的交易中,绝大多数都涉及成立于 2021-2023 年的初创企业,鉴于 2024 年才刚刚开始,这也在情理之中。

在筹集资金方面,2020-2022 年成立的公司获得的投资最多。

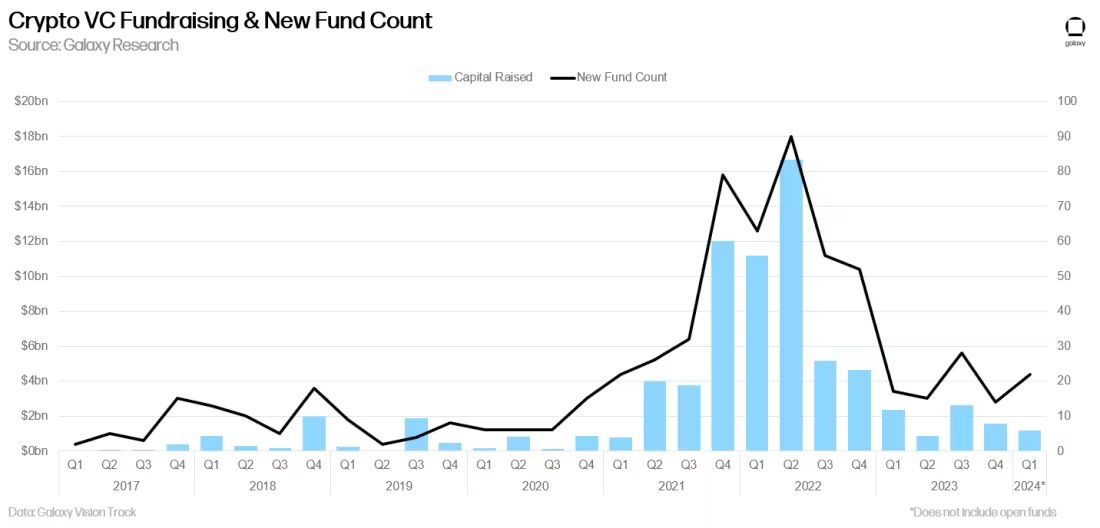

加密风险投资融资

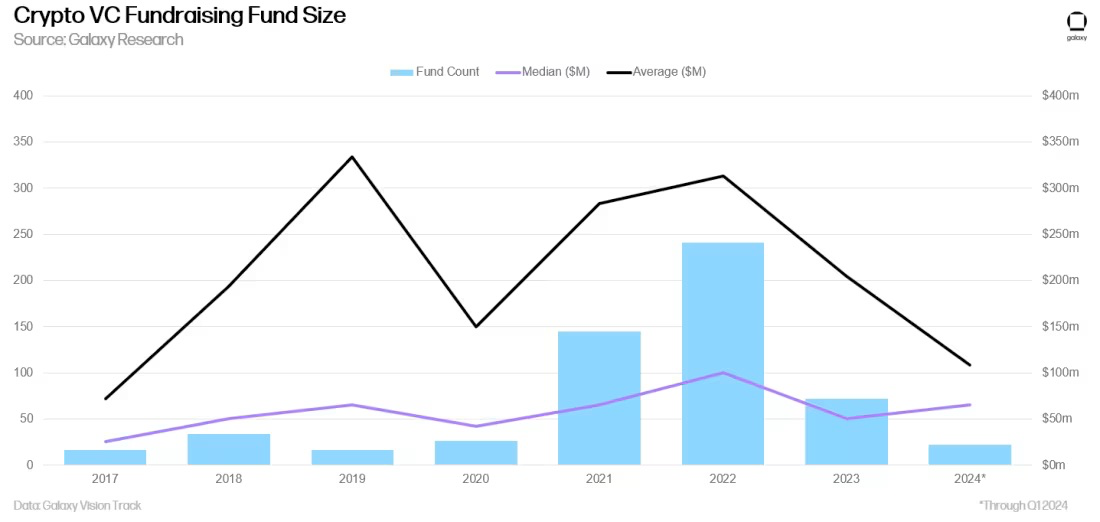

加密风险基金的筹资仍然充满挑战。宏观环境和加密货币市场基础设施的动荡结合在一起,使一些投资人不再像 2021 年和 2022 年那样对加密货币做出同等程度的承诺。2024 年伊始,投资者普遍认为利率将在 2024 年大幅下调,但在整个第一季度,强劲的通胀数据削弱了对今年降息的预期,这有助于维持风险投资人艰难的筹资环境。虽然分配给加密风险投资基金的资金总额环比下降,但新基金的数量却有所增加,至少有 22 支新基金宣布成立。

按年度计算,2024 年基金平均规模持续下降,但中位数略有上升。

就分配者资金流的来源而言,以加密货币为重点的基金仍在努力从传统分配者那里募集资金,他们在第一季度新分配的资金中只占很小一部分。

关键要点

-

情绪和活动正在改善,但仍远低于之前牛市期间的水平。虽然数字资产市场从 2023 年的低点大幅回升,但风险投资却明显滞后。之前的牛市(如 2017 年和 2021 年),风险投资的资金与流动加密资产价格之间的相关性很高,但在 2023 年和 2024 年,风险投资仍远低于之前的水平,而加密货币则出现反弹。风险投资停滞不前的原因有很多:高利率环境抑制了风险偏好;2022 年大爆发后,加密市场仍然存在疲软情绪残;还有可能是缺乏足够多的能够接受大额风险投资资金的后期成立的公司。因此,从资金和交易数量来看,早期阶段的公司在风险投资活动中所占的份额最大。事实上,尽管投资总额环比仅小幅增长,但交易数量却增长了 50%,其中大部分交易发生在 A 轮或更早的融资中。

-

早期交易在第一季度独领风骚。对早期交易的持续关注预示着更广泛的加密货币生态系统的长期健康发展。虽然后期阶段的公司一直在努力筹集资金,但创业者们正在为新的、创新的想法找到愿意投资的投资者。这些项目和公司正在人工智能和加密货币的交叉点上构建扩展解决方案、游戏、工具和服务。

-

比特币ETF可能会给基金和初创公司带来压力。美国推出的基于现货的比特币 ETF 为各种规模的投资者提供了获取比特币风险敞口的便捷途径。虽然流动性较高的比特币显然与加密初创公司投资不完全相同,但它可能会满足一些投资者和配置者对加密货币生态系统曝光的需求。ETF受到监管,几乎所有经纪平台都提供,费用低,流动性高。比特币 ETF 有可能也会挑战与加密货币挂钩的股票,这些股票过去一直是该行业的投资渠道。

-

比特币L2项目引起了风投投资者的浓厚兴趣。2024年第一季度,加密风险投资者最集中的押注之一是投资比特币L2的项目。2023年的Ordinals的出现,随后创建的BRC-20代币标准,以及现在的Runes代币标准,促使人们将比特币视为一个平台网络,而不仅仅是一个货币网络。数十个团队试图在比特币上构建新型的第二层网络,其中许多团队依赖并利用了以太坊生态系统中开发的分层扩展技术(即optimistic rollups、zk rollups、re-staking primitives、bridging protocols等),风险投资者也为这些交易投入了大量资金。

-

Web3和交易类别仍然在交易数量和资金方面占据主导地位,但基础设施领域的交易也有所激增。无论是从筹集的资金还是完成的交易来看,Web3和交易类别仍然处于领先地位,但是在2024年第一季度,“基础设施”在资金方面实际上排名第一,在交易方面排名第二。这个类别确实很广泛(这三个类别都很广泛),但基础设施类别广泛包括质押、再质押、平台工具、测序服务或其他面向区块链开发人员和用户的工具。EigenLayer的10亿美元融资轮引领了基础设施资金的投资。

-

尽管新成立的小型基金已开始取得一些筹资成功,但基金经理们仍面临着艰难的环境。第一季度,新成立的基金数量环比增长达到 22只,但分配给以加密货币为重点的风险基金管理公司的资金总额继续下降。可以理解的是,基金平均规模(1.08亿美元)环比下降,而基金规模中位数(6,500万美元)仅略有上升。如上所述,自2022年以来,随着几家风险投资支持的加密货币公司的破产和美国利率的上升,加密风险投资基金一直难以筹集资金,这降低了配置者的风险偏好。如果流动加密货币的价格和推出率继续增长,并且一些大型风投基金成功筹集了大规模资金,我们预计风投市场将再次放松,经理们也将获得更大的成功。

-

美国继续主导加密行业初创企业生态系统。虽然美国在交易和资金方面保持着明显的领先优势,但美国的监管阻力可能会迫使更多公司走出国门。如果美国要长期保持技术创新中心的地位,政策制定者就应该意识到他们的作为或不作为会如何影响加密货币和区块链生态系统。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。