Original Title: April 2024

Author: Grayscale

Translation: BitpushNews Yanan

- Influenced by the tightening macroeconomic environment, the cryptocurrency market experienced a certain degree of pullback in April. Of particular note is the significant decrease in the probability of a rate cut by the Federal Reserve this year due to the robust growth of the US economy and sustained high inflation levels, which undoubtedly brought downward pressure to the cryptocurrency market.

- However, from the overall development trend of the cryptocurrency industry, the market outlook remains optimistic. The halving of Bitcoin, the increasingly active Ethereum ecosystem, and the potential positive progress in stablecoin legislation in the United States all demonstrate the industry's strong growth momentum.

- The Grayscale research team believes that, under the premise of maintaining a stable overall macro market environment, cryptocurrency prices are expected to usher in new upward momentum in the second half of 2024.

After experiencing seven consecutive months of growth, the price of Bitcoin encountered a 15% decline in April 2024, which also led to a downward trend in the entire cryptocurrency market. Despite a series of positive fundamental news in April, such as the Bitcoin halving and significant progress in stablecoin legislation in the United States, these positive factors did not completely offset the market pressure brought about by the tightening macroeconomic environment.

After considering the risk-adjusted factors (i.e., incorporating the volatility of each asset into the evaluation scope), we found that the return rates of Bitcoin and Ethereum are at a moderate level compared to traditional assets (as shown in Figure 1). In April, the prices of gold and oil showed an upward trend, partly due to escalated tensions in the Middle East. However, at the same time, most other mainstream asset categories showed a downward trend.

Of particular note is the poor performance of long-term government bonds. This is mainly due to market expectations of an increase in inflation rates, which in turn will lead to an increase in real interest rates (i.e., interest rates adjusted for inflation). In addition, global stock indices generally declined, and the volatility of stock and bond markets also intensified.

Figure 1: Tightening macro trends affecting the trends of various assets in April

The core reason for this market weakness seems to lie in the strong nominal growth of the US economy, which has made the prospect of a rate cut by the Federal Reserve increasingly uncertain. In early April, the US Department of Labor released a report indicating that the number of employed persons increased by about 300,000 in March, with an average monthly increase of about 275,000 in the first quarter. Subsequent reports also showed that the "core" Consumer Price Index (CPI) had an annualized growth rate of over 4% for the third consecutive month. With the release of a series of strong economic data, statements by Federal Reserve officials in public appearances seem to suggest that the possibility of a rate cut is gradually diminishing.

At the end of March, the market generally expected the Federal Reserve to cut interest rates three times by the end of 2024, with each cut being 25 basis points. However, by the end of April, this expectation had been significantly reduced to only one rate cut, also by 25 basis points (see Figure 2). This change reflects the market's repositioning of the future monetary policy of the Federal Reserve.

As Bitcoin is to some extent seen as an alternative currency system competing with the US dollar, the rise in real interest rates over the past month may have supported the value of the US dollar to some extent. At the same time, this change in interest rates has also had a direct impact on the price of Bitcoin.

Figure 2: Market currently believes that the number of Federal Reserve rate cuts will be relatively few

Although the market currently generally believes that the number of Federal Reserve rate cuts will be relatively few (as shown in Figure 2), news from last month revealed some important macro trends that may support the demand for Bitcoin for a considerable period of time.

Specifically, media reports have indicated that if Trump is re-elected, his second term government may take a series of policy measures, including attempting to weaken the independence of the Federal Reserve (The Wall Street Journal), intentionally devaluing the US dollar (Politico), and imposing penalties on countries seeking to conduct more bilateral trade in non-dollar currencies (Bloomberg). These potential policy directions undoubtedly increase the uncertainty of the US dollar's prospects and may have an impact on alternative currency systems such as Bitcoin.

We have already discussed the importance of these macro policy issues in previous reports, especially in the upcoming elections, these issues are of great significance. Although the current election campaign is still in its early stages, the latest reports have highlighted the potential uncertainty that the election may bring to the medium-term prospects of the US dollar. This uncertainty, in turn, may affect the medium-term trend of cryptocurrencies such as Bitcoin.

Despite the macro market environment becoming more challenging, the cryptocurrency market in April still emerged with many positive factors. The most noteworthy of these is undoubtedly the successful completion of the Bitcoin halving on April 20th. This halving reduced the new coin issuance rate of the Bitcoin network from approximately 900 coins per day to about 450 coins per day.

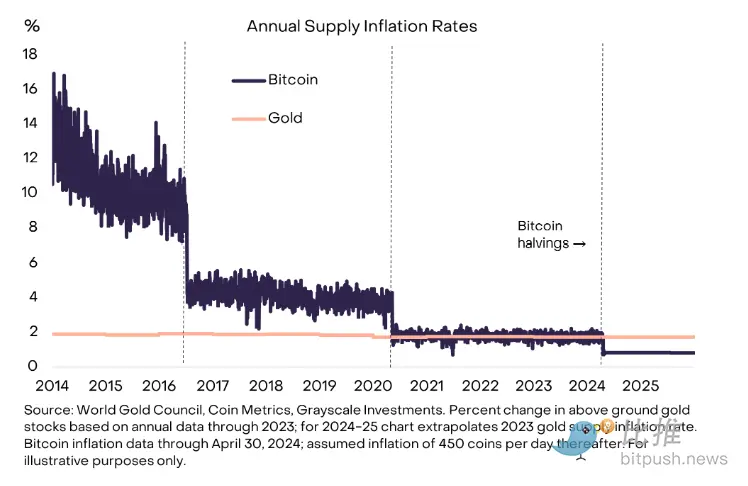

After the halving, the inflation rate of the Bitcoin network—i.e., the annualized rate of new coin issuance relative to the existing supply—decreased from about 1.7% to about 0.8%. It is worth noting that before the Bitcoin halving, its inflation rate was basically on par with the supply inflation rate of gold, but now, the inflation rate of Bitcoin has significantly decreased (as shown in Figure 3). When calculated based on the current market price of Bitcoin in US dollars, the reduction in the daily issuance of Bitcoin actually means that its annual supply growth has decreased by about $10 billion.

Figure 3: Bitcoin's inflation rate is lower than that of gold

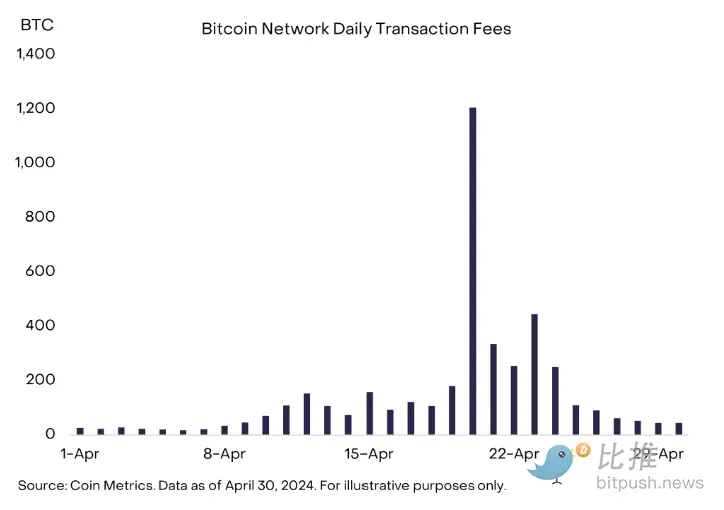

On the day of the halving, Bitcoin transaction fees saw a significant increase, mainly due to the emergence of Runes. Runes is a new type of alternative token standard on the Bitcoin network created by the same developers who launched Ordinals. Data shows that on the day of the halving, miners charged approximately 1200 BTC in transaction fees, a significant increase compared to the previous daily average of 70 BTC. In the following days, daily transaction fees remained between 250 and 450 BTC until the end of the month before showing a downward trend (as shown in Figure 4). However, the high fees have made small transactions on the Bitcoin network too costly, which may weaken Bitcoin's properties as a medium of exchange (for example, the average transaction fee on the day of the halving was $124). Although the outlook is still unclear, we tentatively predict that Bitcoin transaction fees will rise in the medium term to ensure miners' income. At the same time, we also need to look for more extensive scaling solutions to make Bitcoin payments more cost-effective and network usage more convenient.

Figure 4: Bitcoin transaction fees surged before and after the halving

In April, the performance of Ethereum once again fell short of Bitcoin, and the reason behind this may be the significantly reduced probability of the approval of an Ethereum spot ETF in the United States. According to data from the decentralized prediction platform Polymarket, as of the end of May, the probability of an Ethereum spot ETF obtaining regulatory approval in the United States had plummeted to 12%, far below the 21% at the end of March and the 75% at the beginning of January.

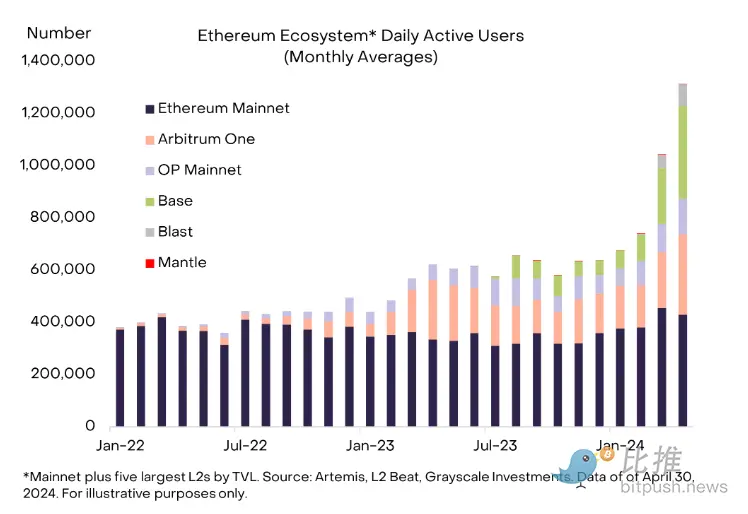

However, what we should pay attention to is that on-chain activities in the Ethereum ecosystem have not been affected by this, but have instead shown a continuous growth trend. Especially in April, driven by Base and Arbitrum, the number of daily active users in the Ethereum ecosystem has climbed to 1.3 million (see Figure 5).

Although the recent returns have been less than satisfactory, we remain optimistic about Ethereum. We believe that Ethereum is expected to benefit from the deepening trend of tokenization.

Figure 5: Continuous development of the Ethereum ecosystem

This month, there have been several exciting positive developments in the stablecoin field. On April 17th, Senators Lummis and Gillibrand jointly introduced a bipartisan bill aimed at establishing a clear legislative framework for stablecoins. The proposal is comprehensive, requiring stablecoin issuers to hold a one-to-one reserve to ensure the stability of the stablecoin's value, and also proposes corresponding consumer protection measures, such as introducing assistance from the Federal Deposit Insurance Corporation (FDIC) in the event of a failure. Of particular note, the proposal explicitly calls for a comprehensive ban on algorithmic stablecoins.

As legislative progress is made, payment giant Stripe also announced a major move. The company will allow its customers to use USDC stablecoin for payments on networks such as Ethereum, Solana, and Polygon. For these rapidly developing projects, Stripe's decision is undoubtedly a positive signal.

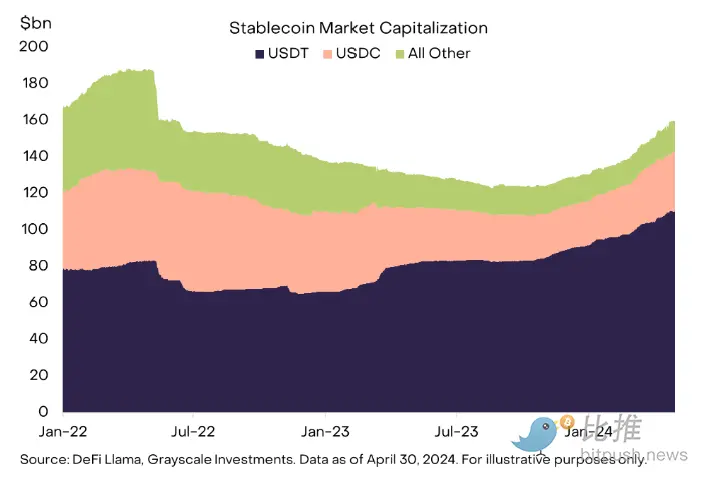

In 2024, the stablecoin market has seen significant growth, with its total market value rapidly rising from $130 billion in January to $160 billion now, a 23% increase in just five months.

It is worth mentioning that since early 2023, Tether (USDT) has maintained a dominant position in the stablecoin market with outstanding performance. According to the data in Figure 6, Tether currently occupies 69% of the total market value of stablecoins, showing overwhelming dominance. However, despite Tether further expanding its market-leading position in 2023, other stablecoins are also actively competing, presenting a diversified competitive landscape.

USDC, issued by the US company Circle, has shown strong growth in 2024. According to statistics, its market value has increased by 36% so far, significantly higher than Tether's 20% growth during the same period.

Figure 6: Continuous growth of stablecoin market value

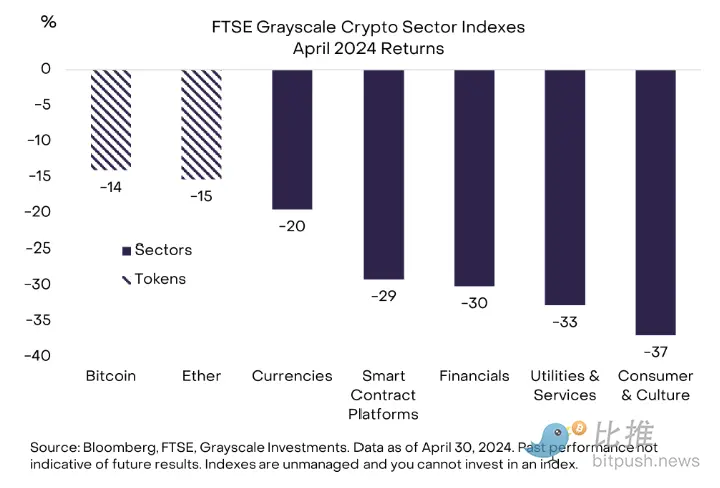

Both Bitcoin and Ethereum outperformed the FTSE Grayscale Cryptocurrency Industry Index in April. The index covers 243 tokens (or "altcoins") in five cryptocurrency sub-markets (Figure 7). The best-performing cryptocurrency sub-market in April was the currency sector (mainly due to the relatively stable price of Bitcoin), while the worst-performing was the consumer and culture sector. The weakness in this sector also reflects the downward adjustment trend after the strong rise of meme coins in March.

Figure 7: Weak performance of all five cryptocurrency sub-markets in April

In most cases, the market's pullback clearly reflects a widespread decline in market sentiment. However, upon closer analysis, we find that certain specific thematic trends are still worth paying close attention to. For example, after risk adjustment, the investment return rates of some decentralized exchange (DEX) tokens are still relatively low. Another notable example is Worldcoin (WLD), which experienced a steep 45% decline in price in April. Despite the positive news that the WLD team announced they are building an Ethereum-based L2 network and actively exploring cooperation opportunities with OpenAI, these positive developments did not effectively boost the token price. More concerning is that the WLD team plans to further increase token supply through a new private placement, a move that may exert further downward pressure on the price.

There are also positive developments in other projects worth noting: Toncoin (TON) has recently performed well, surpassing Cardano (ADA) to become the seventh largest asset in the cryptocurrency field. The project further announced deep integration with the instant messaging tool Telegram and launched a series of community and developer incentive measures, undoubtedly adding more attractiveness.

Additionally, over the past 30 days, the market's attention has been drawn to SocialFi—a decentralized social media application. Particularly noteworthy is the FriendTech platform, which innovatively provides creators with an opportunity to generate revenue from online communities. On FriendTech, users can trade "keys" linked to Twitter accounts to access exclusive chat rooms. According to data from the analysis company Kaito, the popularity of FriendTech peaked in September 2023.

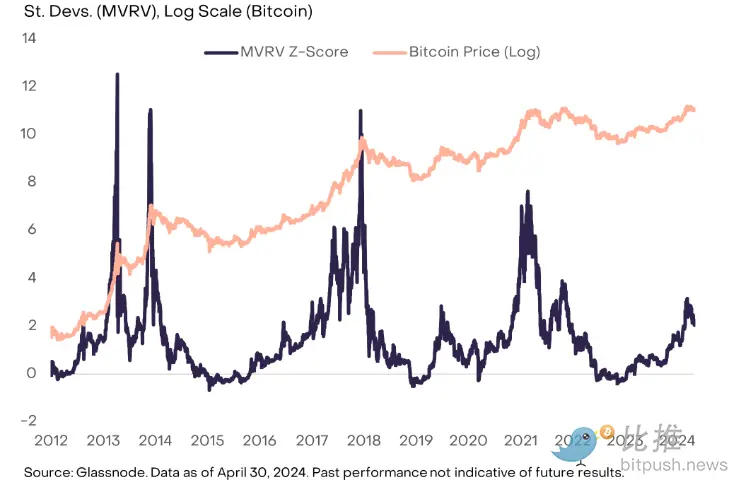

At the end of March, we judged that Bitcoin was entering the "fifth inning" of the current bull market cycle. Using a baseball game analogy, we may now have progressed to the "seventh inning": Bitcoin's valuation has declined, and the inflow of funds from Bitcoin spot ETFs has slowed. At the same time, indicators reflecting speculative trader positioning (such as perpetual futures funding rates) have also declined. Given the expected shift in Federal Reserve monetary policy, the temporary stagnation of the current uptrend seems reasonable—after all, the rise in real interest rates constitutes a fundamental adverse factor for Bitcoin.

However, from a broad perspective of the macroeconomy, the outlook still seems optimistic: the US economy is entering a soft landing trajectory, Federal Reserve officials are signaling a possible rate cut in the future, and the results of the November election seem unlikely to trigger stricter fiscal policies. In addition, indicators used to measure Bitcoin valuation, such as the MVRV ratio, are currently far below the peak values of previous cyclical highs (see Figure 8). As long as the macroeconomic outlook remains stable, we believe that the price of Bitcoin and the total market value of cryptocurrencies are still expected to continue to rise this year.

Figure 8: Bitcoin valuation shows lower than previous peak values

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。