Author: LiChris

On April 20, 2024, when the Bitcoin block height reached 840,000, it ushered in the fourth halving of mining rewards, reducing from 6.25 BTC to 3.125 BTC. Although this event did not cause much turbulence in the price of Bitcoin on that day, looking at this reduction from a higher perspective, we may have a different discovery. Especially compared to the previous three reductions, this reduction event has quietly planted a seed full of imagination and infinite possibilities for the future development of the Bitcoin ecosystem and even for the development of the cryptocurrency industry.

Is Bitcoin just a payment tool?

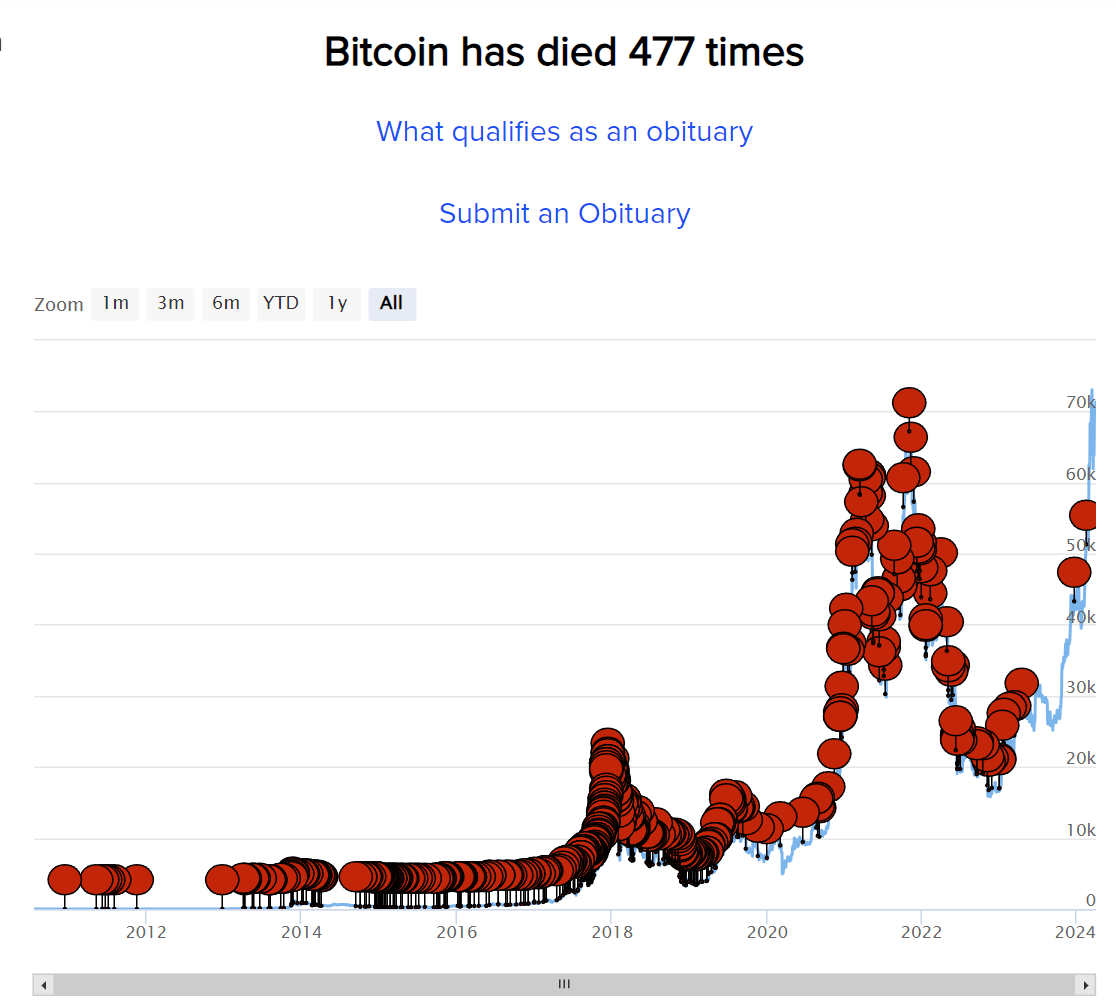

In October 2008, Satoshi Nakamoto released the Bitcoin whitepaper, clearly defining it as "a peer-to-peer electronic cash system" in the title. In the more than ten years that followed, whether in people's understanding or actual application, Bitcoin has been mostly confined to such a cage - an innovative, unregulated payment system that is not very user-friendly. Although entrepreneurs have been continuously striving to improve transaction efficiency and the scalability of the Bitcoin network, there has been no breakthrough progress. This has become evidence for Bitcoin opponents. The website 99bitcoins has an interesting statistic, recording the number of times mainstream media has "declared the death of Bitcoin" since 2010.

However, it is obvious that with the 477 "death notices" came the continuous growth of Bitcoin amidst skepticism. It has now become a new financial entity with a market value exceeding $1.2 trillion, ranking tenth in the global asset rankings. So, what force is driving Bitcoin to achieve such remarkable results in just 15 years? Here, let's take a look back at the time points of each of Bitcoin's halvings.

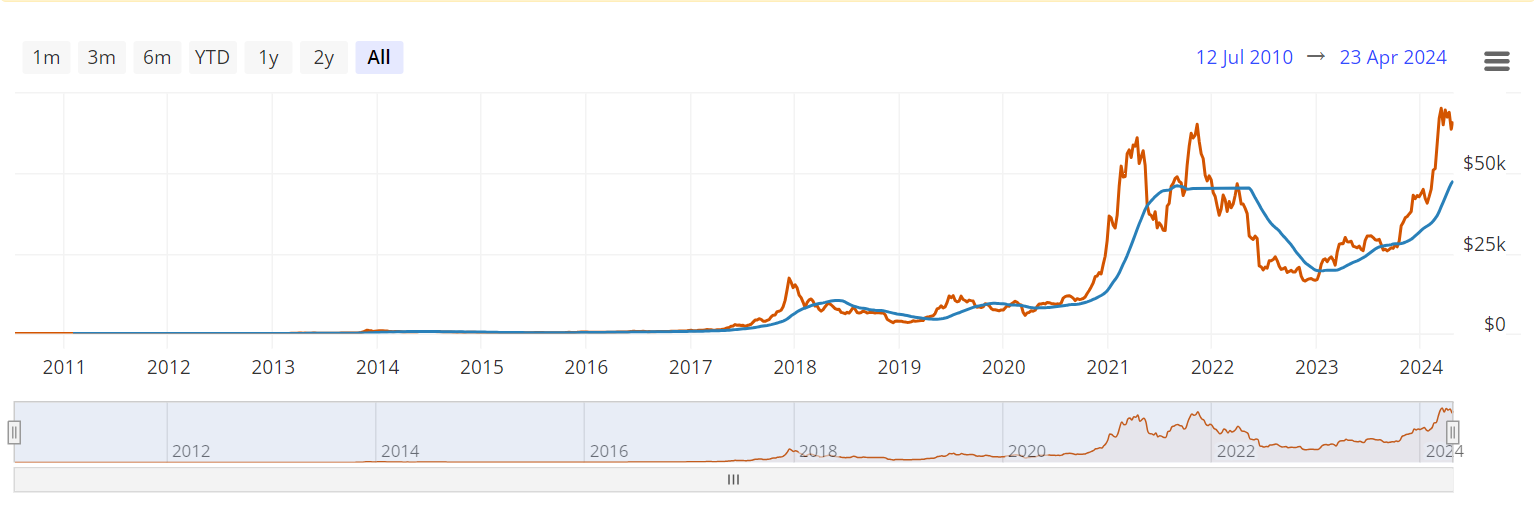

The first halving of Bitcoin occurred in November 2012, reducing the mining reward from 50 BTC to 25 BTC, and then the price of Bitcoin reached the highest point of the first bull market in November 2013 - exceeding $1180.

The second halving of Bitcoin occurred in July 2016, reducing the mining reward from 25 BTC to 12.5 BTC, and then the price of Bitcoin reached the highest point of the second bull market in November 2017 - $19,000.

The third halving of Bitcoin occurred in May 2020, reducing the mining reward from 12.5 BTC to 6.25 BTC, and then the price of Bitcoin reached the highest point of the third bull market in November 2021 - $69,000.

At the time of the first halving, Bitcoin was still in a relatively niche circle, and based on the highest price in November 2013 and the total mining volume at the time, the total market value was less than $20 billion. However, even so, Bitcoin quickly gained attention from Wall Street capital in the following years, and in 2017, multiple Bitcoin futures ETFs successfully listed, attracting significant purchases of Bitcoin through trusts such as Grayscale, which greatly contributed to the soaring prices of Bitcoin in 2017 and 2021.

So, what different expectations will the continuous influx of Wall Street capital and this Bitcoin halving bring to the market for future development? In simple terms, it is a larger narrative.

Inscriptions, perhaps just a dessert in the Bitcoin ecosystem

The term "ecosystem" seems somewhat unfamiliar and distant for the Bitcoin network, as security was given top priority in Satoshi Nakamoto's original design, sacrificing a considerable amount of efficiency and scalability.

However, with the rise of inscriptions represented by the Ordinals protocol, we are excited to discover that similar to NFTs in the Ethereum network, NFTs can also be perfectly replicated in the Bitcoin network through Ordinals, without the need for side chains or tokens other than Bitcoin, and can be used without changing the Bitcoin network. Inscriptions have the same permanence, immutability, security, and decentralization as Bitcoin.

Looking back, although the Ordinals protocol was proposed by developer Casey Rodarmor on January 21, 2023, the practice of assigning a unique serial number to each sat and allowing users to track each sat on the blockchain through this unique serial number was proposed by a BitcoinTalk forum user with the ID @jl2012 as early as October 2012. However, due to objective conditions at the time, it did not attract much attention from the community.

With a rich ecosystem based on Ethereum as a reference, we can now more easily understand and accept this new concept of inscriptions. For example, we know that inscriptions do not necessarily have to represent non-fungible tokens; users can also create secure tokens and other assets based on Bitcoin. Since Ordinals inscriptions are completely on-chain, stored in taproot transaction scripts, this means that the Ordinals protocol has revived the huge potential for tokenizing assets on the highly secure and decentralized Bitcoin blockchain. Not only that, it is also a means of directly and permanently storing digital content on the chain - something rare in the NFT field.

As a result, Ordinals is actually receiving more and more attention, including from veteran players of NFTs on Ethereum and other public chains. Although the price of ORDIs, the token of the Ordinals protocol, has risen significantly since its issuance, we believe that the true impact of Ordinals has not yet been fully revealed. The future of the Bitcoin ecosystem has only revealed the tip of the iceberg, and there is still a broader market that developers need to explore and develop.

The Ethereum ecosystem cannot do without L2, what about the Bitcoin ecosystem?

The flourishing scene of the Ethereum ecosystem is obvious, not only becoming the largest ICO platform, but also gathering various sectors such as DeFi, GameFi, SocialFi, and more. However, inevitably, it also faces the impossible trilemma. In the process of vigorous ecosystem construction, how to improve efficiency has always been an unavoidable topic, as every participant in the ecosystem is unwilling to bear high gas fees, often reaching hundreds of dollars or more.

Therefore, we see the presence of L2 developers, whether it is the error-proofing used by Optimistic Rollups or the validity proof used by zk-rollup, the core is to execute smart contract state changes off-chain and verify them on-chain, thereby increasing the throughput of the blockchain and reducing costs.

According to the statistics from l2beat.com, the assets locked in Ethereum L2 have shown a rapid growth trend since September 2021, currently locking more than 12 million ETH, worth over $387 billion, accounting for over 10% of the circulating market value of ETH.

Another point to note is that the TPS of the Ethereum network is approximately 27, while the Bitcoin network has only about 5, more than five times less than the former. According to statistics from the Twitter account @bitrabbit.btc, after BRC20 started trading on April 24, 2023, in about 7 months until the end of November of the same year, the UTXO of the Bitcoin network quickly surged to 140 million. In contrast, Bitcoin had only accumulated about 87 million UTXOs in the past 14 years, and of the additional 50 million UTXOs, 40 million were extremely small transactions of 100-1000 sat, which may not be processed for decades or even forever based on the current TPS calculation, and objectively constitutes a kind of spam transaction similar to a DDOS attack on Bitcoin. From another perspective, if the Bitcoin ecosystem continues to develop, the demand for efficiency will inevitably be higher than that of Ethereum, and there will be a greater need for innovative Bitcoin L2 solutions to face this reality and severe problem.

Zulu Network, building a bridge between Bitcoin and Ethereum

When it comes to Bitcoin L2, in addition to well-known projects such as Stacks, RSK, Liquid, etc., new solutions such as Zulu Network, Merlin, BitVM, BEVM, etc. have also provided new ideas. However, today let's first introduce the proposal put forward by Zulu to expand the functionality of the Bitcoin network by introducing a two-layer architecture. This is the first entrepreneurial project to propose this solution in the Bitcoin L2 track.

How to understand the proposal brought by Zulu to "introduce a two-layer architecture"? In simple terms, it is divided into two steps - ZuluPrime (L2) elevates BitFi (Bitcoin DeFi) to a new level through EVM, while ZuluNexus (L3) innovatively extends the native functions of Bitcoin through UTXO. ZuluPrime, as the second layer of Bitcoin, emphasizes EVM compatibility and provides stable and mature decentralized financial (DeFi) applications and financial services for the Bitcoin network, while also making it possible to use BTC and BRC20 tokens on different dApps without switching to other ecosystems. On the other hand, ZuluNexus is positioned as the second layer of ZuluPrime, essentially acting as the third layer of Bitcoin. It adopts a hybrid virtual machine (VM) design, which, although incompatible with EVM, supports UTXO and account types. This solution creatively integrates the stable needs of the overall architecture with the efficiency requirements of ecosystem construction.

Furthermore, relying solely on EVM compatibility faces challenges such as limitations on ecosystem innovation and application scenarios, while fully retaining UTXO characteristics carries inherent risk issues. In order to address these issues and promote the rapid deployment of DeFi protocols on the Bitcoin network, Zulu cleverly proposed the concept of a two-layer architecture design.

In addition, according to Jinse Finance, in April 2024, Zulu Network announced the completion of a $3 million Pre-Seed round of financing, with investors including Cryptogram Venture (CGV), D11 Labs, Web3.com Ventures, Satoshi Labs, and other well-known investment institutions in the industry.

Conclusion

In the survival rules of the cryptocurrency industry, it has never been about big fish eating small fish, but rather fast fish eating slow fish. The "fast fish" here not only refers to strong action, but more importantly, the ability to have a keen perception and judgment of industry development trends and the ability to act on them. This point has been verified more than once in the competition in various tracks. Facing the eve of the outbreak of the Bitcoin ecosystem, only by seizing the opportunity to get involved can one have the opportunity to gain a foothold. If we roughly estimate the TVL scale of Ethereum L2 mentioned above, when the Bitcoin ecosystem develops to a stage of similar prosperity, the cake of Bitcoin L2 will reach a scale of hundreds of billions or even trillions of dollars. It is undoubtedly a vast blue ocean, and Zulu Network and many Bitcoin L2 developers have a promising future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。