夏日的希望由热浪唤醒,Sui 的增长时代由 Turbos 加速带到现实。

在 Turbos 的助力下,Sui的高效和低时延将和 DeFi 产生奇妙的化学反应。

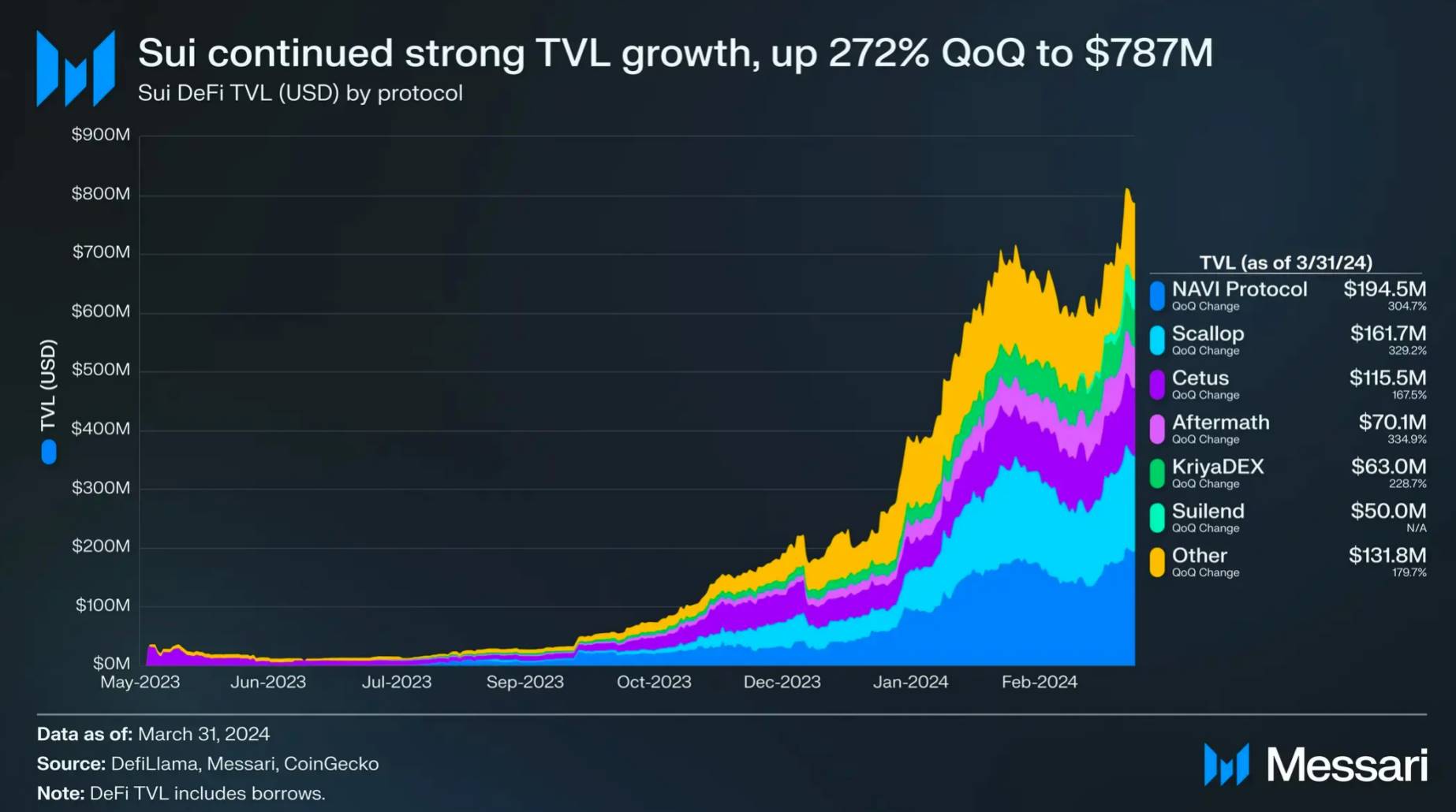

在 Messari 近期发布的 Sui 报告中,Sui 网络 DeFi 的 TVL 数据开始暴涨至 7.87 亿美元,其中的主角就是今天要介绍的 Turbos Finance,以及他们创造的流动性管理的新篇章 —— SUI-USDC 自动重平衡金库。

在公链的爆发期,其生态往往也有更多参与机会,无论是参与交易还是当 LP 提供流动性,都有机会分享早期采用者的独特收益,而这一次,来到了 Turbos 的时间。

Sui 生态老兵,Turbos来势汹汹

目前,Sui 的 DEX 日交易量达到 7800 万美元,作为 Sui 生态的 OG,Turbos 已经来到抢跑位置。

Turbos 成立于 2022 年,由 Mysten Labs 提供支持,并在 2023 年获得了 Jump 和 Sui 基金会的大力支持,创始人 Ted Shao 在加密行业具备多年经验。

随着区块链技术的不断演进,Sui 作为一个高效能、模块化,面向大众的区块链平台,越来越受到全球用户的青睐。然而,资产的配置与管理在此生态系统中任重道远。而今,Turbos 悄然现身,携带其革命性的特性,为 Sui 上的资产和流动性管理揭开了新的一页。

Turbos 选择 Sui 去构建一种流动性层,可以提供具有集中流动性做市商 (CLMM) 模型和衍生品交易功能的自动做市商 (AMM) 去中心化交易所,CLMM(Constant Liquidity Market Maker)是一种流动性模型,允许 LP 以恒定的流动性水平持续参与市场,并通过算法自动调整价格。

而在众多区块链中,只有 Sui 能满足如此高性能的需求,Turbos 的总交易量已经突破 10 亿美元,3 月 20 日单日交易量达到 3000 万美元,并在最近的交易量中一直保持着强劲的增长势头。

持续进化,技术力至上

用户往往对技术缺乏感知,而 Turbos 则致力于将技术平民化,让其有机会造福更多 Web3 原住民,Turbos 可以自动帮助用户参与收益分享。

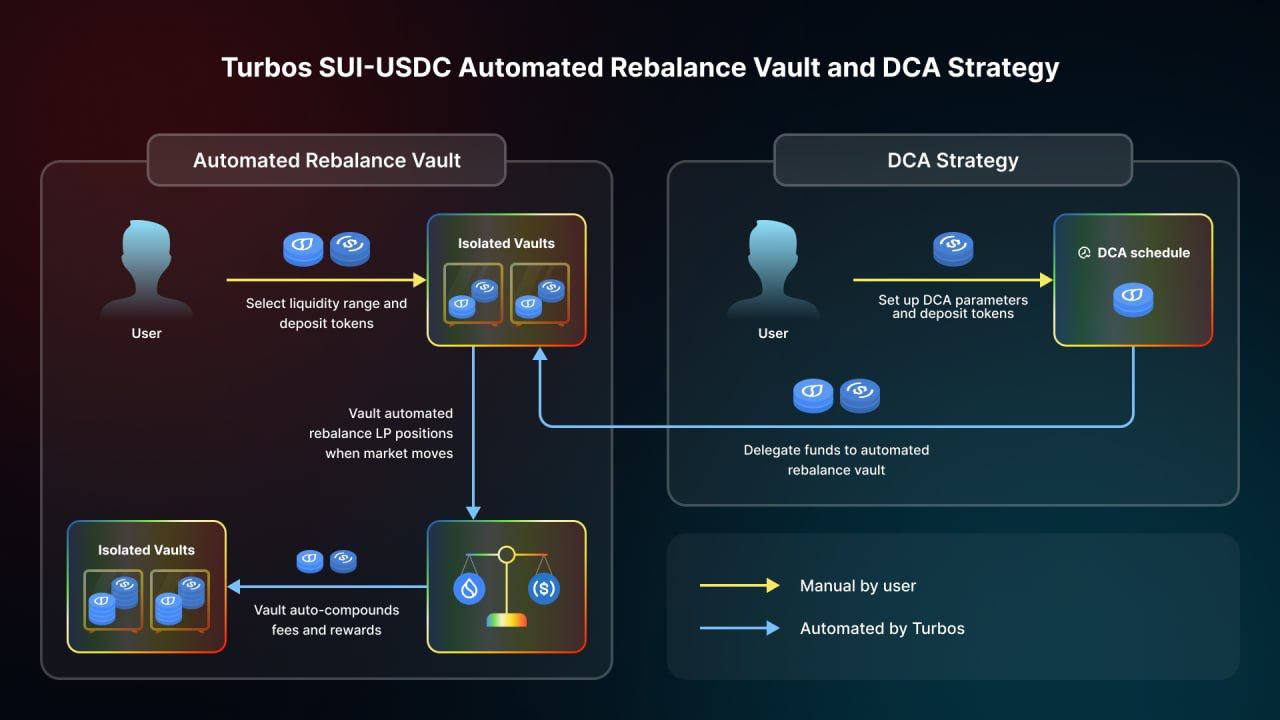

Turbos 正在引领 Sui 生态系统的流动性创新,在Sui 生态中各类 DeFi 的快速发展中,Turbos 近期重点推出在 Sui DEX 中的两个创新流动性策略,希望可以为市场参与者提供了新的机遇。分别是基于 CLMM DEX 创新的 SUI-USDC 自动重平衡金库和 SUI-USDC DCA 策略。

先谈谈集中流动性做市(CLMM),这是旨在通过一种创新的方式来优化流动性提供策略,与传统的流动性模型不同,CLMM 不依赖于外部的价格,能够以去中心化模式运转。其能够为用户提供实时且精确的代币定价,这对于现货和衍生品交易尤为重要。

从 Turbos 过往的发展来看,CLMM 模式结合新的策略让 Turbos 能够在 Sui上提供杠杆集中流动性,具体而言:

-

Automated rebalance vaults 是一种流动性管理工具,它可以通过智能合约自动调整流动性池中资产的比例,以维持预设的流动性范围和优化交易费用收益。这种机制有助于降低流动性提供者面临的无常损失风险,并提高资本效率。

-

DCA 策略:SUI-USDC DCA 策略,减少价格波动带来的影响。

其中,DCA 策略将打开系统性投资的新途径,而自动重平衡金库机制不仅将打开 Sui DeFi 的新时代,还将为整个 DeFi 畅想流动性管理的新篇章。

简而言之,Turbos 预计推出的 SUI-USDC DCA 是通过自动复利费用和奖励,简化了流动性提供者对的形成过程,允许用户通过单一代币存款自动配对,吸引用户。

DCA 不仅有望提高 TVL 和交易量,还可以通过 DCA LP 功能减少价格波动的影响。这种模式不仅提高了资产管理的效率,还增强了安全性。

Turbos的策略通过自动化的设计,极大地优化了用户体验。用户不再需要频繁地手动干预,金库的自动重平衡和奖励的自动复利功能,使得用户可以更加专注于投资策略本身,而不是日常的管理任务。此外,提款和认领过程的简化,也为用户带来了更高的灵活性和便利性。

Turbos的这两个策略不仅为Sui生态系统带来了创新,也为整个 DeFi 领域提供了新的发展视角。通过通过提高资本效率、降低风险、优化用户体验,Turbos正在引领一场关于流动性管理和投资策略的革命。随着这些策略的上线,市场也会期待 Turbos 继续推动DeFi的发展,并为用户带来更加丰富和高效的投资工具。

Turbos 的技术创新是其在 Sui 上持续向上生长的底层力量,而在生态的发展上,Turbos 也和 Sui 建立了紧密的合作关系。

自动重平衡金库:流动性管理的新篇章

近期,Turbos 推出自动重平衡金库策略,用户不仅可以通过选择期望的流动性范围并提供SUI 和 USDC代币,还可以更可控的模式参与到这一交易模式中。

上线不到24小时,金库已经累积了 368K TVL 及超过 1000美元的手续费和激励。

简单而言,Turbos 将这些代币配对形成对应金库的 NFT,代表用户在金库中的份额。不仅确保了用户在流动性池的平衡贡献计算方式,而且通过预设的 SUI 和 USDC 配比,用户可以体验更高效的资本效率。

在自动重平衡的设计中,Turbos 从产品的流动性管理到做市和交易的全流程,都进行了自主设计和精细打磨,明显区别于现有市场上的同类产品,具体而言,具备多个特性:

独具匠心的个性化位置与范围管理

不同于其他平台的统一式管理方式,Turbos 让 Sui 用户可以进行个性化的位置和范围管理。

在 Turbos 平台上,每个用户可以根据自身的策略制定资产的精准定位,无论是选择稳健的中心区域还是追求较高回报的激进边缘,均能由用户自主掌控。这种个性化的服务,无疑为用户提供了前所未有的资产管理自由度。

高频次自动调整位置

Turbos 平台通过SUI独特的费率设计机制,支持用户高频次自动调整资产位置。这意味着在市场波动时,Turbos能够实时响应,自动调整资产位置,以维护理想的资产配置,进行有效的风险管理。

从而,用户就能够在动荡的市场中,保持资产管理的灵活性和高效性,这种策略非常灵活,便于才华横溢的交易员获取更高的收益。

可以发现,Turbos为用户提供了一种设定后可自动运作的系统。用户只需存入单一代币或代币对,余下的工作便由Turbos负责。此系统贴心设计,让收益变得轻而易举,无需用户经常性地干预。

Turbos的协议特性中包含自动均衡,即使LP(流动性提供者)的资产位置跌出活跃范围,系统也会进行自动调整,确保持续最优化。此外,其自动复利功能,使用户能够轻松收集奖励,并通过复利的力量,经历财富的积累与成长。

重新定义SUI上的资产管理

Turbos的出现,不仅仅是技术上的一次突破,它代表了一种全新的资产管理哲学——方便、高效且利益最大化。在SUI链上,用户追求的不仅是回报的最大化,还有管理的便捷性和时间的自由。

通过不断调整 SUI-USDC 交易对的资金配比,金库能够在目标流动性范围内保持平衡,这不仅有助于最大化交易费收益,还能有效减少非永久性损失的风险。此外,用户通过持有金库 NFT,可以被动地累积包括交易费和其他激励在内的奖励,用户可以通过多种渠道获得收益。

作为一块崭新的画布,SUI以开放和包容的姿态欢迎各种创新应用的加入。而Turbos就像那绚烂多彩的颜料,为这幅画布增添了绚丽的一笔。无论是资深的资产管理者,还是初入此界的新手,Turbos都能提供最为贴心和有效率的服务,让每一笔投资都充满无限可能。

结语 :Turbos 发展提速,真实收益为王

Talk is Cheap. Show me your APY.

在今年的公链竞争中,Move 系公链站稳阵脚,Solana 宕机,Ton 门槛高,Sui 已经默默耕耘数年,终到啼鸣之刻,此时当奋进,而Turbos敏锐的认识到 APY 才是吸引用户的真正法宝。

Turbos 还专门推出了为 Sui-Move 语言设计的创新智能路由机制,这是 Sui 系 DEX 的首创,对于这个新兴的生态系统来说是一个重大的突破,可以实现更高效的 SWAP 水平。

Turbos 希望能为更多用户展现 Sui 上 DeFi 的收益回报水平,以 SUI/USDC 池为例,目前的 APY 高达 672%,基于 CLMM 自动再平衡策略,可以积极管理您的 SUI-USDC 配对头寸,不断调整流动性范围,以优化市场走势。自动为用户在有利的价格范围内自动调整流动性,并在单个金库中自动累积应计费用和奖励,最终实现远超现有 DeFi 产品的收益率。

Turbos一直认为,生态的发展最终要回馈到用户身上,为此,Turbos 为流动性提供者提供SUI 代币激励到主流的交易对如SUI-USDC、TURBOS-SUI、USDC-USDT 和 haSUI-SUI 等交易对用,为用户提供丰厚的激励。

作为当前Move系最活跃的生态 Sui,同时借助技术创新和长期激励,老牌DeFi Turbos 也将在这一轮 Sui 浪潮中与生态并肩同行,将 Sui 打造为 DeFi 领域的第一梯队。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。