The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of cryptocurrency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreens!

Just finished talking about the impact of the listing, and there was a direct downturn recently. This kind of impact indeed makes Lao Cui very unpredictable. Indeed, the trend of the market is becoming more and more unpredictable. Let's start with the macroeconomy. Many friends cannot truly understand the significance of the listing of Bitcoin and Ethereum ETFs in Hong Kong. They have been focusing on the flow of Asian capital, thereby ignoring the essence of the listing. Lao Cui's focus is on the pricing of assets and the channels of foreign exchange circulation. The most difficult assumption is that if the other side really shuts down our overseas settlement system, the circulation of foreign exchange can at least be realized into Hong Kong dollars through the cryptocurrency circle in the Hong Kong Stock Exchange.

At the level of Hong Kong dollars, the process of converting to RMB is quite simple. Therefore, in the trading rules of the Hong Kong Stock Exchange, ETFs can not only be purchased with Hong Kong dollars, but also directly with cryptocurrency. Of course, what Lao Cui is talking about is under the most difficult circumstances, but what the country considers is definitely more comprehensive than what we individuals think. The pricing power of circulating currency is indeed very important. The issue of virtual assets is not that trading is illegal, but its value can only be realized by the buyer. If there is no buyer to take over, the cryptocurrency itself has no value. Don't think that this concept is very radical; these examples still exist in reality. Do you think the value of Salvadoran paper currency is still high? All currencies themselves do not have value, including legal tender, and it is only with strong capital endorsement behind them that they can be realized.

To put it bluntly, those in power have given it purchasing power. Simply put, legal tender can be used to purchase a country's inherent assets in the market, from the level of national debt to a single screw. These are all purchasing powers granted by a country. So, the issue of centralization should be clear to everyone. The so-called decentralization of the cryptocurrency circle actually weakens whose ability? All countries, in general, have the right to issue and price, which is mostly in their own hands. This also highlights the nature of the cryptocurrency circle, the inherent decentralization, which has led to everyone losing the right to issue, so it is very difficult to control the right to price. The right to price is basically given to the buyer, as long as the buyer is willing to purchase, then the cryptocurrency circle will continue to form a market. The current pricing is still based on legal tender, and the concept of using legal tender to endorse virtual currency has been changed. This ensures the purchasing power of this thing. In January of this year, the Americans first passed the spot ETF, and everyone can understand that the US dollar has endorsed it.

That is, the US dollar guarantees its purchasing power, and everyone has also seen its explosive power since it started at around 20,000 and has surged to the 70,000 range. The addition of the Hong Kong dollar is also to compete for the pricing share, which is why I directly passed the Ethereum ETF in one step. Especially the uniqueness of Hong Kong has directly led to the inability of the mainland to participate directly, which is also a disguised protection of everyone's assets. The significance of the passage is more to open a circulation channel, rather than to actively involve everyone. Most of the funds in our country still want everyone to flow into the A-share market. This issue will not be discussed in detail, and the specific trend will be discussed later.

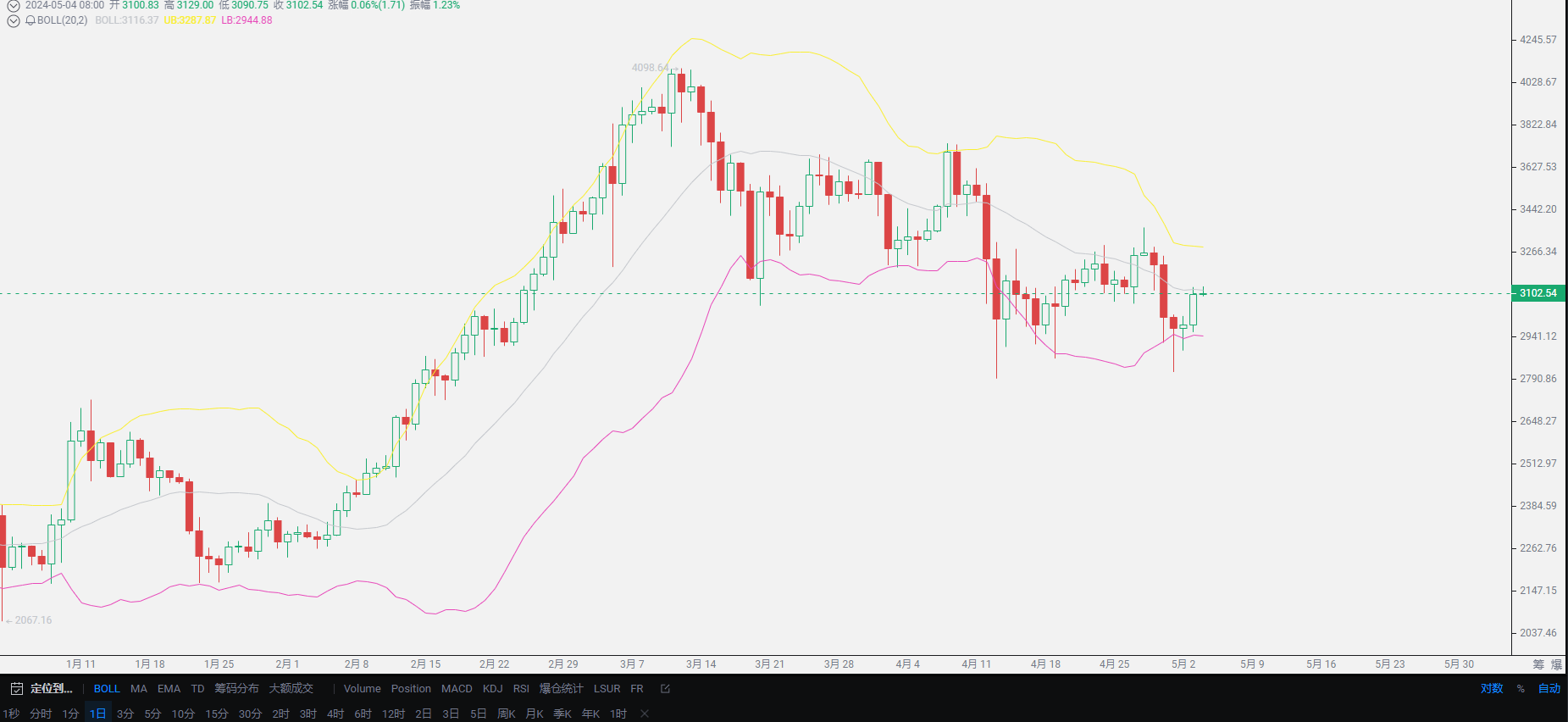

As long as everyone understands this logical issue, the subsequent trend is still very easy to see more clearly. Through this round of rise, the movement of funds can be seen, and Asian capital is indeed facing a big problem. Growth has not arrived, but has instead opened a new round of downward wide-ranging fluctuations. This is also the issue that Lao Cui discussed before, and the key is still to pay attention to the movement of funds and the price of USDT. At the beginning of the listing, the price of USDT directly rose from around 7.3 to around 7.38, which also pushed the market to continue its downward momentum. As for the so-called bear market issue that everyone is concerned about, it is too early to worry about it.

It can be said that several rounds of downturns are almost all the operations of retail investors. During this period, some assets did indeed flee, but the repair actions, the long side is still working hard. The good news in the cryptocurrency circle does have the hope of opening a new round of bull market phase for the entire year, but the current situation is still influenced by the overall environment. Capital has also seen its value space, but is suffering from the lack of funds to flow. Especially Asian capital is almost facing a new round of encirclement. For the trend of the cryptocurrency circle, there is currently no way to draw out funds to invest. It is not that everyone is disappointed with the cryptocurrency circle, leading to the decline, especially at the current high level. Everyone is not choosing to withdraw funds from the cryptocurrency circle, which is already the biggest affirmation of the cryptocurrency circle.

In Lao Cui's view, even if there is a downturn, the bear market will not come to too low a point. This is where the problem may be greater for short positions being trapped, rather than long positions being trapped. As long as capital can draw out funds to invest in the cryptocurrency circle, it will not be too difficult to reach a higher level given the favorable trend of the cryptocurrency circle this year. Especially, as long as the overall environment shows signs of recovery, opportunities for a reversal will come at any time. Everyone may see the problems in the cryptocurrency circle as setbacks and difficulties, but in Lao Cui's view, falling to the bottom is an opportunity. Currently, the overall environment can be said to be extremely extreme. The entire cryptocurrency circle still presents a vigorous upward trend this year, and the growth situation is still the best among all financial industries. It is not easy to maintain a growth state in such adverse conditions, let alone such a rapid trend.

For the subsequent trend, everyone can still buy at the low point, and the overall trend is still within our control. The layout of long positions in this round did not make much profit, but fortunately there was no loss. Everyone entering the market must ask Lao Cui. The article only provides a general trend situation, and specific personal situations still require a certain plan. Creating new lows can be considered for entry. Everyone, don't urge me anymore, Lao Cui has given up the five-day May Day holiday and is open for business today. For those who can't stand such big fluctuations, you can take a look at BNB!

Lao Cui's message: Investment is like playing chess. A master can see five steps, seven steps, or even a dozen steps ahead, while a low-level player can only see two or three steps. The high-level player considers the overall situation, plans for the general trend, does not focus on one move or one territory, and aims for the ultimate victory. The low-level player fights for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently gets trapped.

Original article created by the public account: Lao Cui Shuobi. If there is any infringement, please contact the author to delete.

This material is for learning and reference only and does not constitute buying or selling advice. Buying or selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。