作者:白丁 & Jomosis,极客web3

导语:Restaking 与 Layer2 是以太坊生态在本轮周期中的重要叙事,两者都旨在解决以太坊已有的问题,但具体路径却有所异同。相较于 ZK、欺诈证明等底层细节极其复杂的技术手段,Restaking 更多是对下游项目进行经济安全上的赋能,看上去只是叫人质押资产并获取奖励,但其原理绝非想象的那么简单。

可以说,Restaking 如同一把双刃剑,在赋能以太坊生态的同时,也带来了巨大的隐患,当前人们对 Restaking 的态度众说纷纭,有人说它给以太坊带来了革新和流动性,也有人说它过于功利并在加速加密市场的崩盘。

毫无疑问的是,要判定 Restaking 是灵丹妙药还是饮鸩止渴,只有搞清楚它在做什么,为什么要做,如何做,才能得出客观而清晰的结论,这对于判定其Token的价值,也具有重要的参考意义。

提到Restaking ,Eigenlayer 必然是绕不开的案例,搞清楚 Eigenlayer 在做什么,就搞清楚了 Restaking 在做什么。本文将以 Eigenlayer 为例,以最清晰易懂的语言介绍 Eigenlayer 的业务逻辑与技术实现方式,分析 Restaking在技术和经济上对以太坊生态的影响,以及对整个Web3的意义。

Restaking及相关名词的解释

大家都知道,Restaking 是指“再质押”,它最早扎根于以太坊生态,而且是在2022年以太坊转型 POS 后火热起来的。什么是“再质押”呢?我们先介绍一下 Restaking 的前置背景,即PoS、LSD、Restaking,这样就能对Restaking有一个较为清晰的定位。

1. POS(Proof of Stake)

Proof of Stake 又名“权益证明”,是一种按照资产质押量来概率性分配记账权的机制。与 POW 不同,后者按照网络参与者的算力来分配记账权,目前普遍认为,POW 比 POS 更去中心化更贴近于 Permissionless。

2022年9月15日巴黎升级启动,以太坊正式从 POW 转变为 POS,完成了主网和信标链的合并,2023年4月的上海升级则允许 POS 质押者赎回自己的资产,确定了 Staking 模式的成熟化。

2. LSD(流动性质押衍生品协议)

众所周知,以太坊PoS质押挖矿的利率是比较有吸引力的,但散户难以获取这部分收益。除去对硬件设备的要求外,原因有二:

第一,Validator 的质押资产量必须是 32 ETH 或其倍数,庞大的资产量让散户望尘莫及。

第二,在2023年4月上海升级前,用户质押的资产无法取出,资金的利用效率太低。

针对这两个问题,Lido 横空出世。它采取的质押模式为联合质押,即“拼团质押,利润均分”,用户将自己的 ETH 存放于 Lido 平台上,后者将其聚合起来作为运行以太坊 Validator 时质押的资产,这便解决了散户资金不足的痛点。

其次,用户将自己的 ETH 质押于 Lido 上,会1:1置换出锚定 ETH 的 stETH 代币。stETH 不但能随时换回 ETH,还能作为一种与 ETH 等价的 Token,在 Uniswap、Compound 等主流 DeFi 平台上作为 ETH 的衍生代币来参与各种金融活动,这便解决了 POS 以太坊的资金利用率太低的痛点。

由于 POS 是将流动性强的资产做质押进行挖矿,所以 Lido 为首的产品被称为“流动性质押衍生品”(Liquid Staking Derivatives),也就是我们常说的“LSD”。像上文提及的 stETH,被称为流动性质押代币,英文为“Liquid Stake Token”,就是“LST”。

我们不难发现,被质押到PoS协议中的ETH是真正的原生资产,是真金白银,而 stETH 这样的 LST 是凭空产生的,相当于 stETH 借用 ETH 的价值直接多印了一份钱,一份变成了两份,这便可以理解为经济学中所谓的“财政杠杆”。财政杠杆对于整个经济生态的作用并不是单纯的好或坏,要结合周期和环境具体分析。这里要记住的是,LSD为ETH生态加了第一层杠杆。

3. Restaking(再质押/重质押)

Restaking 再质押,顾名思义,是将 LST 代币作为质押资产,用于参与更多的 POS 网络/公链的质押活动,以获得收益,同时帮助更多的 POS 网络提升安全性。

LST资产质押后又会获得一个1 : 1的质押凭证,以便进行流通,被称为LRT(Liquid Restaking Token),如质押stETH,即可获得 rstETH,同样可以用于参与 DeFi 和其他链上活动。

也就是说,LSD 中凭空产生的 stETH 等 LST 代币,又被质押一次,再凭空产生一份新的资产,即 Restaking 后出现的 LRT 资产,为 ETH 生态加上了第二层杠杆。

以上是 Restaking 赛道的背景由来,读到这里肯定会有一个问题:杠杆越多经济系统就越不稳定,LSD 这层还可以理解,解决了散户无法参与POS以及提高资金利用效率的问题,而 Restaking 这层杠杆,存在的必要性是什么?为什么要将本就凭空产生的 LST 再次质押?

这涉及到技术和经济两个层面。针对这个问题,下文将对 Eigenlayer 的技术构造进行简要梳理,再分析 Restaking赛道的经济影响,最后在技术和经济两方面对其进行综合评估。

(截止现在,本文出现了很多英文缩写,其中 LSD、LST、LRT 是核心概念,后文将会多次提及。我们可以再度加强记忆:以太坊 POS 质押的 ETH 是原生资产,与质押的 ETH 锚定的 stETH 是 LST,把 stETH 在 Restaking 平台再质押后得到的 rstETH 就是 LRT)

Eigenlayer 的产品功能

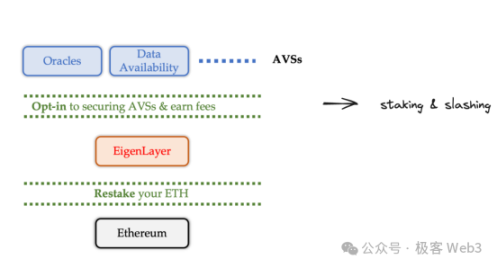

我们要先明确 EigenLayer 在产品功能上要解决的核心问题:为一些底层安全基于POS的平台提供来自于以太坊的经济安全性。

以太坊因其可观的资产质押量,具有极高的安全性。但是,如果是一些在链下执行的服务,如 Rollup 的排序器、或者 Rollup 的验证服务,它们在链下执行的部分并不受以太坊控制,无法直接获得以太坊的安全性。

如果想获得足够的安全性,它们就要搭建自己的AVS(Actively Validated Services,主动验证服务)。AVS 是为 Defi、游戏、钱包等终端产品提供数据或者验证服务的「中间件」,典型的例子有提供数据报价服务的「预言机」、还有能为用户稳定提供数据最新状态的「数据可用性层」。

但是搭建新的 AVS 相当困难,因为:

1. 新 AVS 的搭建成本很高,需要经过很长的时间。

2. 新 AVS 的质押往往使用项目方自己的原生Token,这类Token共识远不如ETH。

3. 参加新网络 AVS 的质押,会让质押者错过以太坊链上质押的稳定收益,这会消耗机会成本。

4. 新 AVS 的安全性远低于以太坊网络,经济上的攻击成本很低。

如果有一个平台可以让初创项目方直接租用来自于以太坊的经济安全性,上述问题便可以得到解决。

Eigenlayer 便是这样的平台。Eigenlayer 的白皮书名为“The Restaking Collective(再质押的集合)”,具有“Pooled Security(共享安全池)”和“free market(自由市场)”两大特性。

除了 ETH 质押外,EigenLayer 收集了以太坊的质押凭证,组成一个安全性租赁池,吸引想赚取额外收益的质押者进行再质押,再将这些质押资金提供的经济安全性向一些 POS 网络项目方出租,这就是“Pooled Security”。

相较于传统 DeFi 系统中不稳定、随时可能变动的 APY,Eigenlayer 对质押收益和惩罚规则都用智能合约明码标价,供质押者自由挑选,赚取收益的过程不再是一种不确定的赌博,变成了公开透明的市场买卖,这就是“free market”。

在这个过程中,项目方可以租用以太坊的安全性,避免自己搭建 AVS,而质押者获得了稳定的 APY。也就是说,Eigenlayer 在提高生态安全性的同时,也为生态上的用户提供了收益。

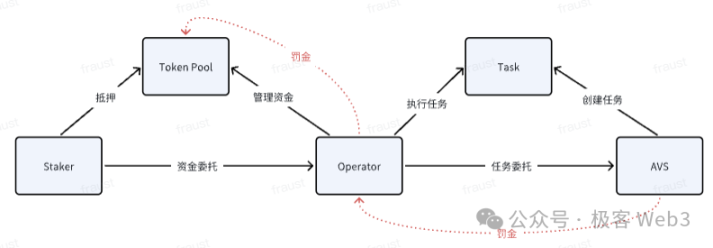

Eigenlayer 提供的安全性的流程由三个角色完成:

- 安全的出借方——Staker (质押者)。Staker质押资金以提供安全性

- 安全的中介方——Operator (节点运营商)。负责帮助 Staker 管理资金的同时,帮助 AVS 执行任务。

- 安全的接收方—— 预言机等中间件的 AVS。

(图源:推特@punk2898 )

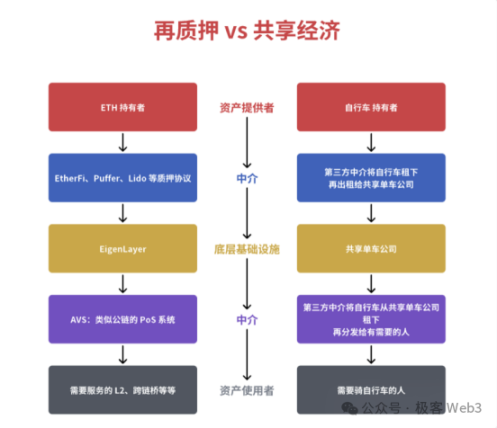

有人对 Eigenlayer 做过一个形象比喻:用共享单车类比 Eigenlayer 的上下游。共享单车公司相当于 Eigenlayer,它为 LSD、LRT 资产提供市场服务,相当于共享单车公司对自行车进行管理。自行车就相当于 LSD 资产,因为都是可以被租用的资产。骑行者就相当于需要附加验证的中间件(AVS),就如骑行者租用自行车一样,AVS 租用 LSD 等资产获得网络验证服务,保障自身的安全。

在共享单车模式中,需要用押金和违约责任约束用户支付押金,防止对车辆进行恶意破坏,而 Eigenlayer 则通过质押和罚款机制,防止参与验证的 Operator 作恶。

智能合约角度的 EigenLayer 交互流程

Eigenlayer 提供安全性的核心思想有两个:质押和罚没。质押为 AVS 提供了基础的安全性,罚没提高了任一主体的作恶成本。

质押的交互流程如下图所示。

在 Eigenlayer 中,跟质押者产生交互的主要是TokenPool合约 。质押者通过 TokenPool 可以执行的操作有两种:

质押——Staker 可以将资产质押到TokenPool 合约中,并指明让特定的 Operator来管理质押的资金。

赎回——Staker 可以从 TokenPool 中赎回资产。

Staker 赎回资金要经过三个步骤:

1)Staker 将赎回请求加入请求队列中,需要调用 queueWithdrawal 方法。

2)Strategy Manager 检查Staker指明的Operator是否处于冻结状态。

3)如果 Operator 没有被冻结(后文有详细描述),Staker 就可以发起 complete withdrawal流程。

这里要注意,EigenLayer给予了 Staker 充分的自由,Staker可以将质押金变现转回自己账户,或将其变成质押份额重新质押。

按照 Staker 是否能亲自运行节点设施参与 AVS 网络,可以将 Staker 分为普通的质押者和 Operator。普通质押者为每个 AVS 网络提供 POS 资产,而 Operator 负责管理 TokenPool 中质押的资产,并参与至不同的 AVS 网络,以确保每个 AVS 的安全。这其实有点像 Lido 的套路。

Staker和 AVS 之间像是被割裂的安全供应方与需求方。Staker往往不了解AVS项目方的产品,无法对其产生信任,或者也没有精力去直接运行设备参与进AVS网络中;同样地,AVS项目方往往无法直接触达Staker。双方虽为供需关系,但缺少一个连接彼此的中介。Operator的作用便在于此。

一方面,Operator帮助质押者管理资金,而质押者对于Operator往往有信任假设,EigenLayer官方解释这种信任与 Staker在LSD平台或币安质押比较类似;另一方面,Operator 帮助 AVS项目方运营节点,如果Operator违反了限制条款,作恶会被Slash,使其作恶成本远超作恶收益,通过这种方式让AVS对Operator建立信任。就这样,Operator 在质押者与 AVS 之间形成了信任中介。

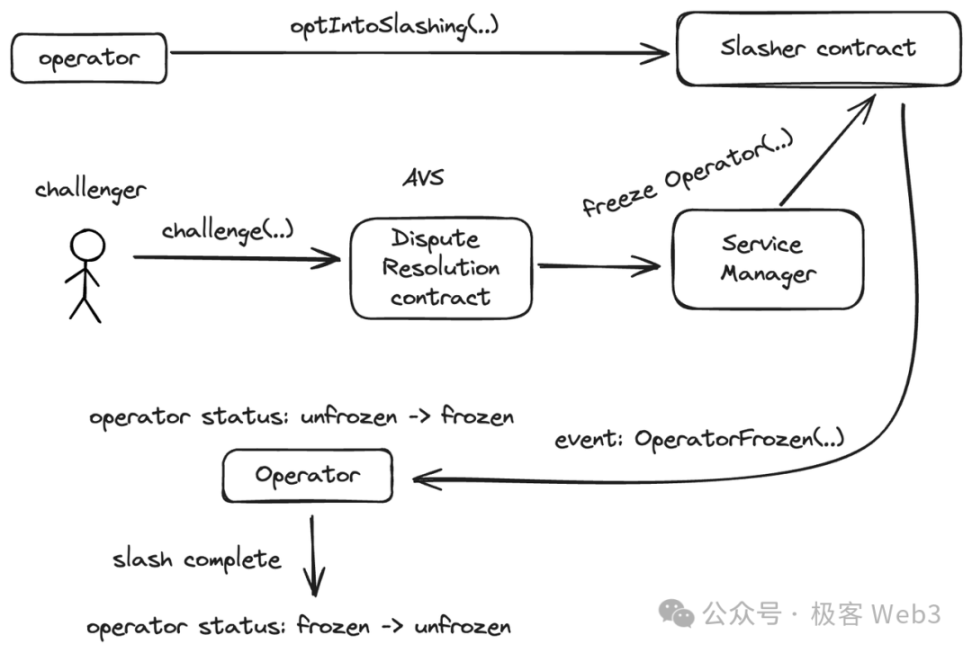

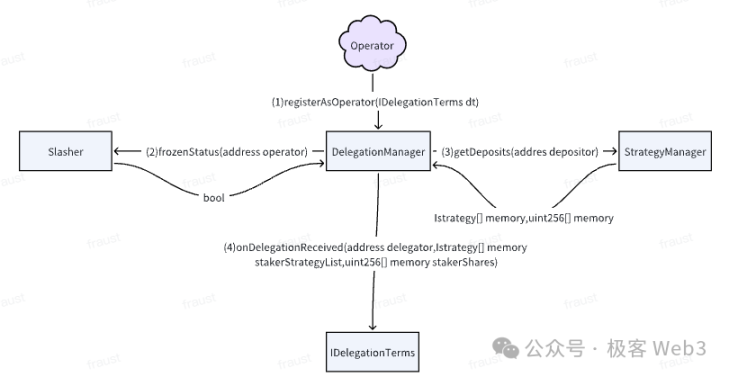

Operator要入驻Eigenlayer平台,要先调用Slasher contract的optIntoSlashing函数,允许Slasher contract对Operator进行约束/惩罚。

之后,Operator 要通过Registery contract进行注册,Registery contract会调用Service Manager的相关函数,记录下Operator的初次注册行为,最后将消息传输回 Slasher contract。至此Operator的初始化注册方才结束。

下面再来看罚没相关的合约设计。在 Restaker、Operator 和 AVS 中,只有 Operator 会成为罚没的直接对象。刚刚提到过,Operator 想要入驻Eigenlayer平台,必须在 Slasher contract 合约中注册,授权 Slasher对Operator执行罚没操作。

当然,除了Operator之外,罚没过程还涉及到其他几个角色:

1. AVS:Operator 接受 AVS 运营委托的同时,还要接受 AVS 提出的罚没触发条件和罚没标准。这里要强调两个重要的合约组件:dispute resolution contract 和 Slasher contract。

Dispute resolution contract 为解决挑战者的争议而设立;Slasher contract 会在挑战窗口期结束后,冻结 Operator 并执行罚没操作。

2. Challenger挑战者:任何入驻Eigenlayer平台的人都可成为挑战者。若其认为某个Operator 的行为触发了罚没条件,就会开始类似OP的欺诈证明流程。

3. Staker:对Operator的罚没,也会使相应的Staker蒙受损失。

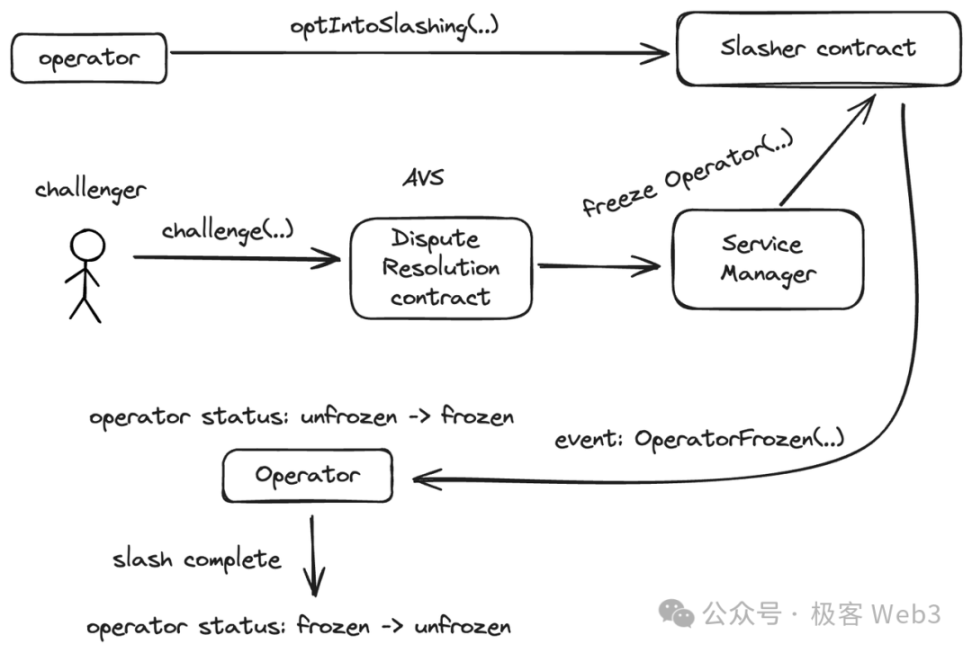

对 Operator 的罚没执行流程如下:

1)挑战者调用AVS单独设立的 Dispute Resolution合约中的 challenge函数发起挑战;

2)如果挑战成功,DisputeResolution合约会调用 ServiceManager 的 freezeOperator 函数,令Slasher Contract 触发 OperatorFrozen事件,将指定Operator的状态从 unfrozen 变为 frozen,之后进入罚没流程。如果挑战失败,Challenger会受到一定的惩罚,此举是为了防止有人恶意的挑战Operator。

3)罚没流程结束后,Operator的状态会被重置成 unfrozen,继续运转。

在执行罚没操作的过程中,Operator 的状态始终是被冻结的“非活跃状态”。该状态下,Operator 不能管理 staker 质押的资金,选择将资金质押给这个Operator的质押者也不能提款。这就像是戴罪之身必须伏法,不能任其逍遥法外。只有当前的惩罚或者冲突解决了,Operator 未被 Slasher 冻结,才可以去进行新的交互。

Eigenlayer 的合约都遵循上述冻结原则。 在 staker 向 operator 质押资金的时候,会通过is Frozen() 函数检查 Operator 的状态;在质押者发起赎回押金的请求时,仍然会用 Slasher合约的 isFrozen 函数检查 Operator 状态。这是 Eigenlayer 对AVS 的安全以及 Staker 利益的充分保护。

最后要说明,在 Eigenlayer 之中 AVS 也并不是无条件地获取以太坊的安全性。尽管项目方在Eigenlayer上获取安全性的过程比自己搭建AVS简单的多,但如何吸引 Eigenlayer 上的 Operator 来提供服务,吸引更多的质押者为自己的POS系统提供资产,仍然是个问题,这可能需要在APY上下苦功夫。

Restaking对加密市场的经济影响

毫无疑问Restaking是当前以太坊生态最火热的叙事之一,而以太坊又占据了Web3的半壁江山,再加上各种Restaking项目已经汇聚了极高的TVL,对于加密市场的影响是举足轻重的,并可能持续整轮周期。我们可以从微观和宏观两个角度去分析。

微观影响

我们要认清,Restaking对以太坊生态各个角色的影响并不是单一的,同时带来了收益和风险。收益可以分为以下几点:

(1) Restaking确实增强了以太坊生态下游项目方的底层安全,这对于后者的长期建设和发展是利好;

(2) Restaking解放了ETH和LST的流动性,使ETH生态的经济流通更顺畅,繁荣度更高;

(3) Restaking的高收益率吸引ETH和LST的质押,减少了活跃的流通量,对Token价格有利好;

(4) Restaking的高收益率也吸引了更多资金进入以太坊生态。

而同时,Restaking也带来了巨大的风险:

(1) Restaking中,一份IOU(金融要求权)在多个项目中被作为质押物,如果这些项目之间没有适当的协调机制,可能导致IOU的价值被过度放大,从而引发信用风险。如某一时刻,多个项目同时要求兑现同一份IOU,那么这份IOU是无法满足所有项目的兑现要求的。这种情况下,如果其中一个项目出现问题,可能会引发连锁反应,影响到其他项目的经济安全。

(2) 相当一部分的LST流动性被锁定,如果LST的价格相对于ETH波动更大,而质押用户又无法及时取出LST,有可能蒙受经济损失;同时,AVS的安全性也来源于TVL,LST价格的高波动对AVS的安全也会造成风险。

(3) Restaking项目的质押资金最终都存放在智能合约中,数目非常庞大,这导致资金过于集中,若合约被攻击,将产生巨大损失。

微观经济风险是可以通过调节参数、变通规则等手段来缓解的,限于篇幅,这里不展开详述。

宏观影响

首先要强调,Restaking的本质是一种多重杠杆。加密市场受周期影响非常明显,想要了解Restaking对于加密领域的宏观影响,必须要先搞清杠杆和周期的关系。Restaking给ETH生态加了两层杠杆,前文有提及:

第一层:LSD使得质押的ETH资产及其衍生产物凭空增加了一倍的价值。

第二层:Restaking质押的并非全是ETH,还有LST和LP Token,而LST和LP Token都是凭证Token,并不是真金白银的ETH,也就是说Restaking产生的LRT是建立在杠杆之上的资产,相当于第二层杠杆。

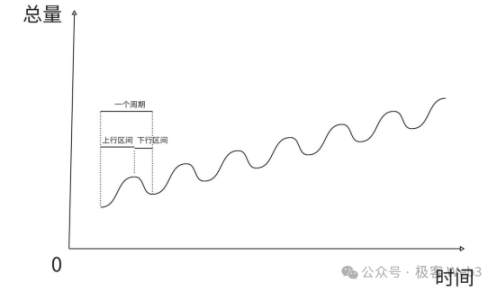

那么杠杆对于一个经济系统到底是有利还是有害?先说结论:杠杆一定要放在周期中探讨,上行区间中,杠杆会加速发展;下行区间中,杠杆会加速崩盘。

社会经济的发展便如上图,升久必降,降久必升,一升一降为一个周期,经济总量会在这种周期循环中螺旋式上升,每一轮周期的底部都会比之前更高,整体的总量也越来越大。当前加密市场的周期十分明显,正处于比特币四年减半期,在减半过后的前2-3年,大概率处于牛市,后1-2年往往处于熊市。

但是,比特币减半周期虽与加密经济的牛熊周期大致相同,但前者并不是后者的根本原因。真正造成加密经济牛熊周期的,是这个市场上杠杆的累积与破裂。比特币减半只不过是资金涌入加密市场、杠杆出现的诱因。

杠杆累积和破裂导致加密市场周期更替的过程是怎样的呢?如果大家知道杠杆一定会破裂,又为什么在上行时,要加杠杆?其实,加密市场和传统经济的底层规律是一样的,我们不妨先从现实经济发展中寻找规律。在现代经济系统的发展中,杠杆一定会出现,且必须要出现。

其本质原因是上行区间内,社会的生产力发展使得物质积累速度过快,而过于富余的产品要想在经济体系中流通起来,就要有足够多的货币。货币可以增发,但不能随意、无限地增发,否则经济秩序会崩溃。但如果货币量难以满足物质富余后所需的流通量,就容易导致经济增长出现停滞,这个时候怎么办?

既然不能无限增发,就要提高经济系统中单位资金的利用率。杠杆的作用便是提高单位资金利用率。这里举一个例子:假设100万美元能买一套房子,10万美元能买一辆车,房子可以抵押借贷,抵押率是60%,也就是抵押房子可以借得60万美元。如果你有100万美元,在没有杠杆,不允许借贷的情况下,你只能选择买1间房子或者10辆车;

如果有杠杆,允许借贷,你可以买1套房子和6辆车,这样你的100万美元是不是可以当160万美元花了呢?从整个经济体系来看,如果没有杠杆,货币流通量只有那么多,大家的消费能力被遏制,市场的需求无法快速增长,供给侧自然也不会有太高的利润,那么生产力就会发展得没有那么快甚至回退;

而加上杠杆后,货币量以及消费能力的问题就快速得到了解决。所以说,在上行区间内,杠杆会加速整个经济的发展。有人会说,这不是泡沫吗?没事的,上行区间内,会有大量的场外资金和商品涌入市场,此时泡沫没有破裂风险。这类似于我们用合约做多,牛市币价上行时,往往没有爆仓风险。

而在下行区间呢?经济系统内的资金不断被杠杆吸纳,也终究会有枯竭的一天,此时就会进入下行区间。下行区间物价会下降,那么抵押的房子就不值100万美元了,你抵押的房产就会被清算。从整个经济体系来看,大家的资产都面临清算,原本靠杠杆加持而来的资金流通量突然缩水,经济体系会快速衰退。我们仍用合约举例,如果不开合约只玩现货,熊市时币价下跌,资产只会缩水;而开合约爆仓,就不只是资产缩水,而是直接归零。所以在下行区间,有杠杆一定会比无杠杆时崩溃得更快。

从宏观来看,即使最终会破裂,杠杆的出现也是必然的;其次杠杆并不完全是好的,也不完全是坏的,要看它处于哪一个周期内。回到Restaking的宏观影响,ETH生态内的杠杆对撬动牛熊周期有着非常重要的作用,其出现也是必然的,在每一个周期中,杠杆都一定会以某种形式出现在市场上,上个周期中的所谓DeFi Summer,本质正是LP Token的二池挖矿,极大程度助长了2021年的牛市,而这一轮的牛市催化剂可能变成了Restaking,虽然看起来机制不一样,但经济本质完全相同,都是为了消化市场上涌入的大量资金、满足货币流通量需求而出现的杠杆。

根据上文对杠杆与周期相互作用的阐述,Restaking这种多层杠杆可能会促使本轮牛市阶段上升速度更快,顶部更高,同时也会促使本轮周期的熊市下跌更猛,出现的连锁反应更广泛,影响更大。

总结

Restaking是PoS机制的二次衍生物。技术上,Eigenlayer 是借用 restaking 的价值来维护 AVS 的经济安全性,利用质押和罚没的机制实现“有借有还,再借不难”。赎回质押款的窗口期不仅留足了时间可供检查 Operator 行为的可靠性,还避免了短时间大量资金撤出导致市场和系统的崩溃;

而在对市场的影响上,要从宏观和微观两个角度来分析:从微观角度看,Restaking在给以太坊生态提供流动性和收益的同时,也带来了一些风险,这些风险可以通过调整参数、变通规则等手段来缓解;从宏观角度看,Restaking本质上是一种多层杠杆,加剧了周期内加密货币整体的经济演进,产生了较大的泡沫,使加密货币上行和下行均变得更加急速和剧烈,且有极大可能成为这轮周期杠杆破裂,转入熊市的重要原因,并且这种宏观经济影响是顺应底层经济规律,无法更改,只能顺应的。

我们要理清Restaking对整个加密领域造成的影响,并在上行区间内利用其带来的红利,在下行周期内做好杠杆破裂,市场转衰的心理准备。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。