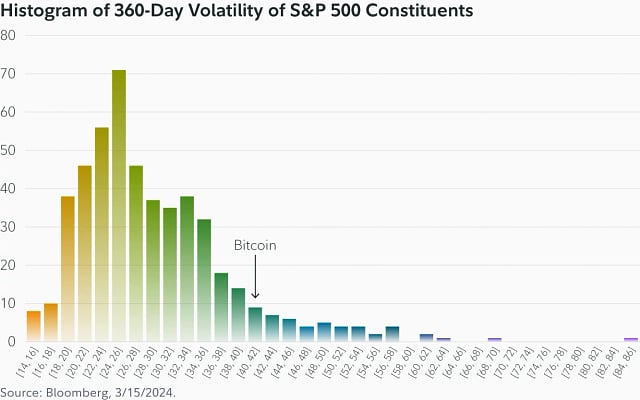

According to the study conducted by Zack Wainwright at Fidelity Digital Assets, bitcoin (BTC) is exhibiting signs of decreased volatility as it evolves. Historically known for its sharp price fluctuations, BTC’s volatility levels have notably declined in recent years. Wainwright’s analysis points out that bitcoin’s volatility was lower than that of 33 S&P 500 stocks as of early 2024, challenging the traditional view of bitcoin as an exceedingly unstable asset.

Image source: Fidelity Digital Assets study called “A Closer Look at Bitcoin’s Volatility.”

The Fidelity Digital Assets study also compares bitcoin’s volatility to that of popular mega-cap stocks, revealing surprising findings. For instance, over the last two years, bitcoin showed less price fluctuation than Netflix (NFLX) shares. The data suggests that while bitcoin remains volatile, its relative stability is increasing compared to some widely held traditional stocks, offering a new perspective to risk-averse investors looking to the leading crypto asset.

Wainwright’s research draws parallels between bitcoin and other historically volatile assets, such as gold, that stabilized over time. “There is a historical precedent for an emerging store of value asset class that had to undergo a similar price discovery process and, therefore, exhibited a similar surge in volatility before declining: gold,” the Fidelity report details.

Wainwright adds:

Shortly after the U.S. dollar was de-pegged from gold and then as private U.S. citizens were allowed to own it again, gold’s price rapidly increased alongside inflation while volatility spiked to over 80—almost double bitcoin’s volatility in April 2024.

The decrease in volatility is not only a sign of maturity but also an attractive factor for investors who previously may have been cautious about entering the bitcoin market. With lower volatility levels, bitcoin could appeal to a broader base of investors, including those in traditional markets who are seeking to diversify their portfolios without encountering extreme volatility.

Furthermore, the report points out that investors have habitually overestimated bitcoin’s volatility. “Bitcoin’s forward-looking implied volatility as measured by traders’ pricing of derivatives, has consistently been higher than what is then actually realized,” states the Fidelity Digital Assets study. The researchers propose that this discrepancy may signal a general misunderstanding of bitcoin’s volatility, indicating that it is still in a phase of discovery.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。