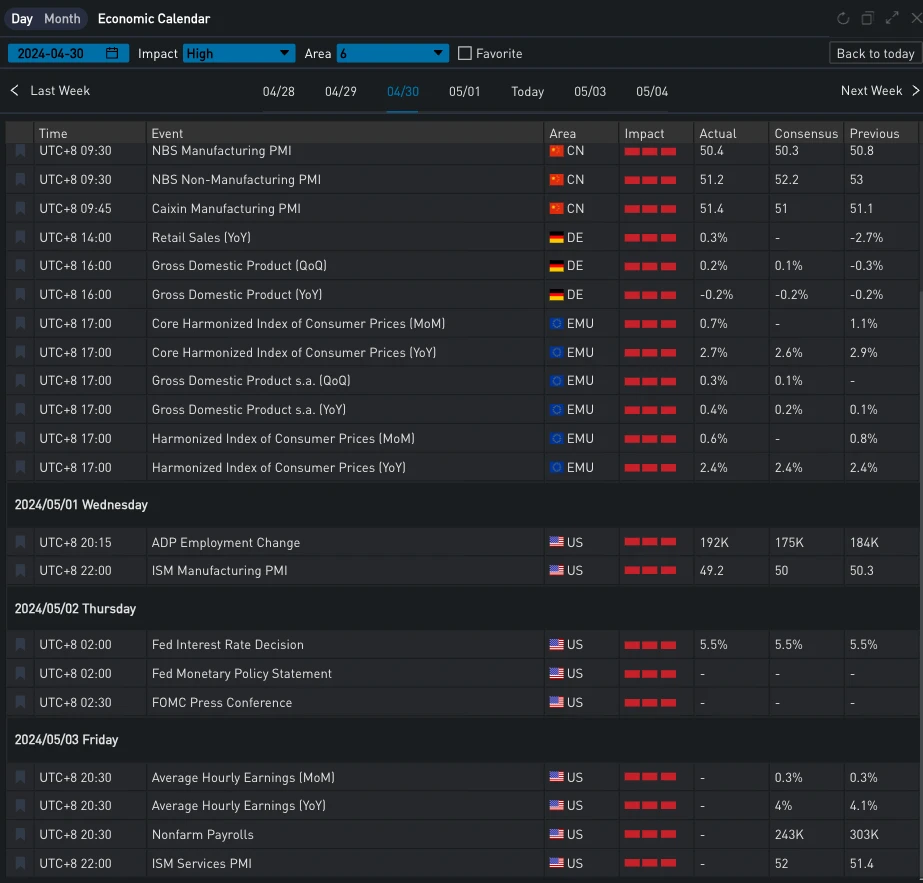

Yesterday (May 1st), the ADP employment report in the United States showed an increase of 192,000 jobs in April, exceeding the expected 175,000, marking the largest increase since July 2023. As expected, the Federal Reserve announced keeping interest rates unchanged at the FOMC meeting in the early hours, acknowledging recent inflation developments as unfavorable. However, Powell ultimately made a dovish statement, indicating that a rate hike at the next meeting is unlikely, and that delaying a rate cut at this point is appropriate.

Source: Economic Calendar

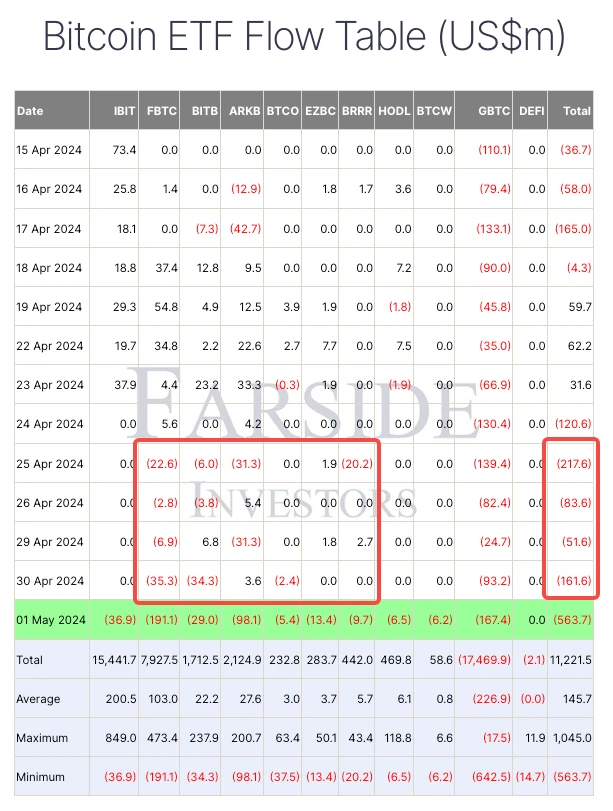

In the cryptocurrency market, the recent pressure from the "higher for longer" interest rate environment in the United States has generated a certain level of risk aversion, leading to a significant outflow of funds from ETFs and substantial selling pressure from whales in the spot market. These factors have collectively contributed to the sharp decline in Bitcoin prices over the past two days. Some analysts suggest that this round of price selling may be profit-taking under macro pressure, including from investors who entered the ETF market early and holders who bought BTC during the past two years of downturn.

Source: Farside Investors; TradingView

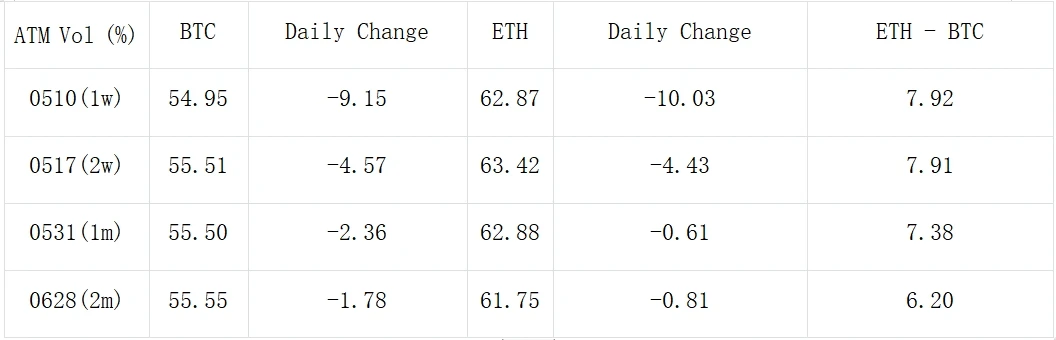

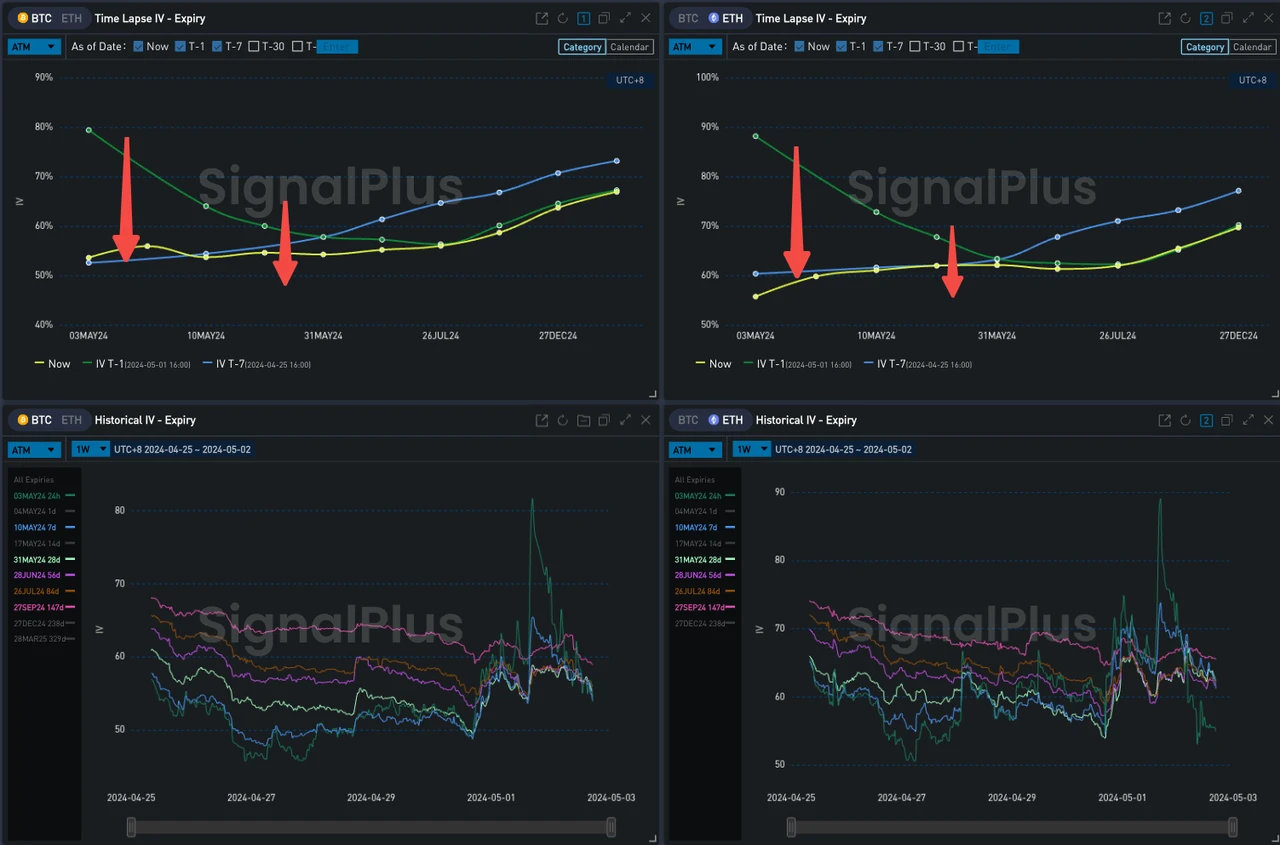

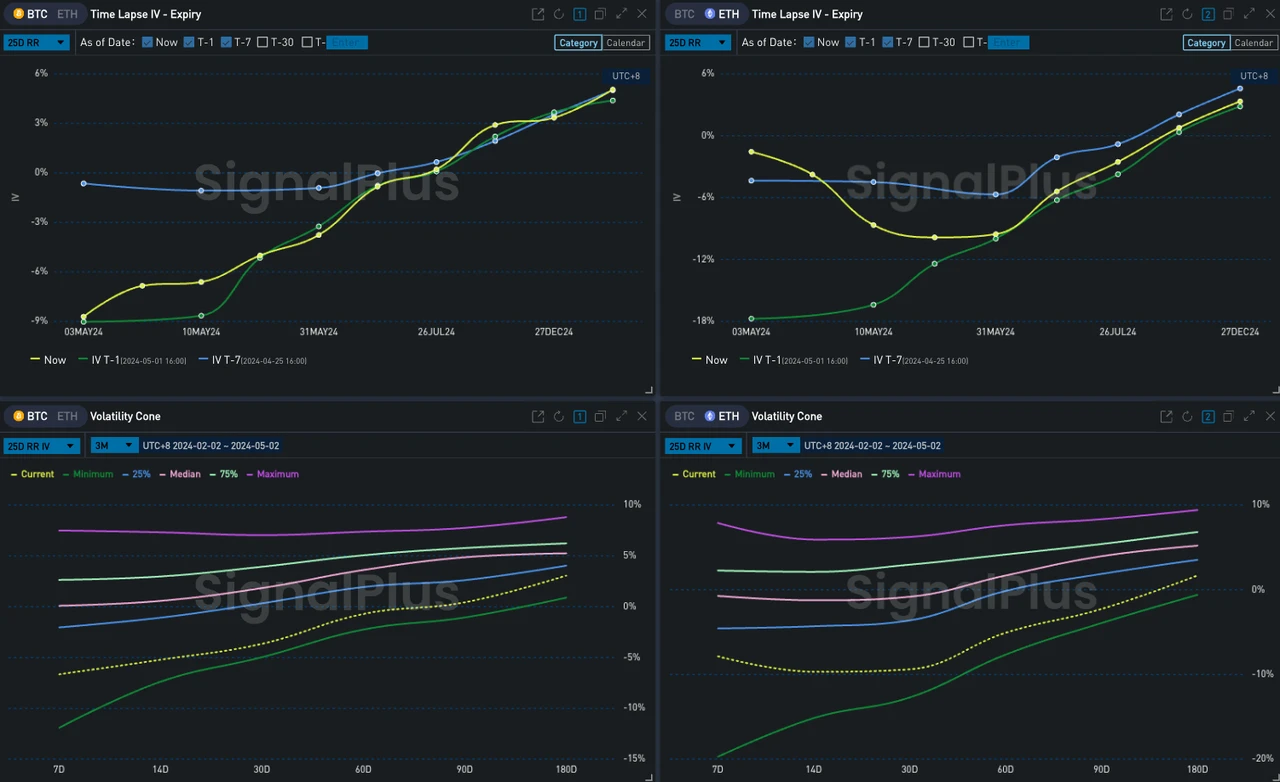

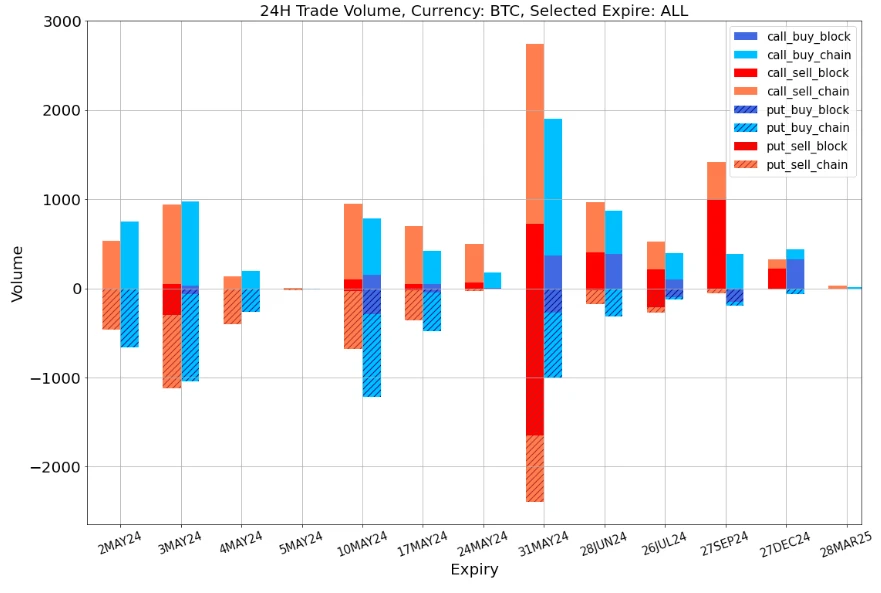

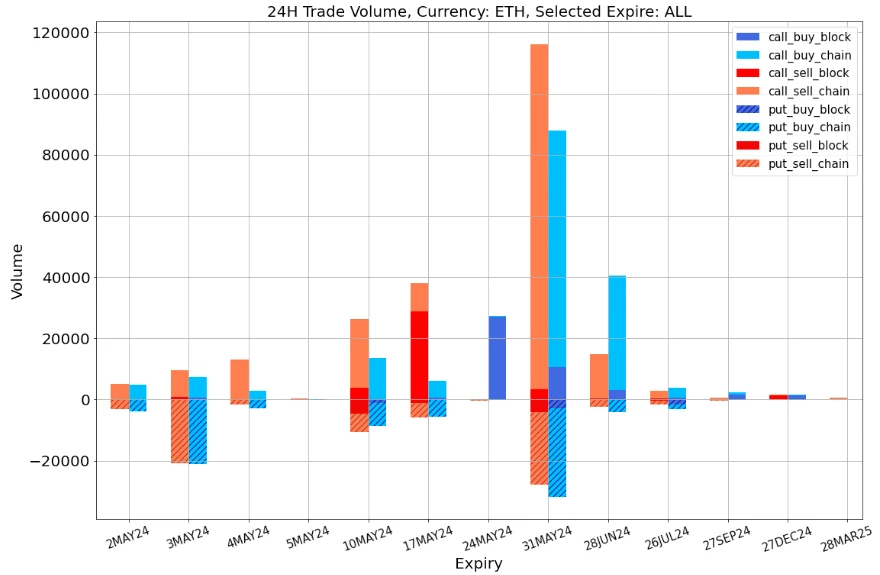

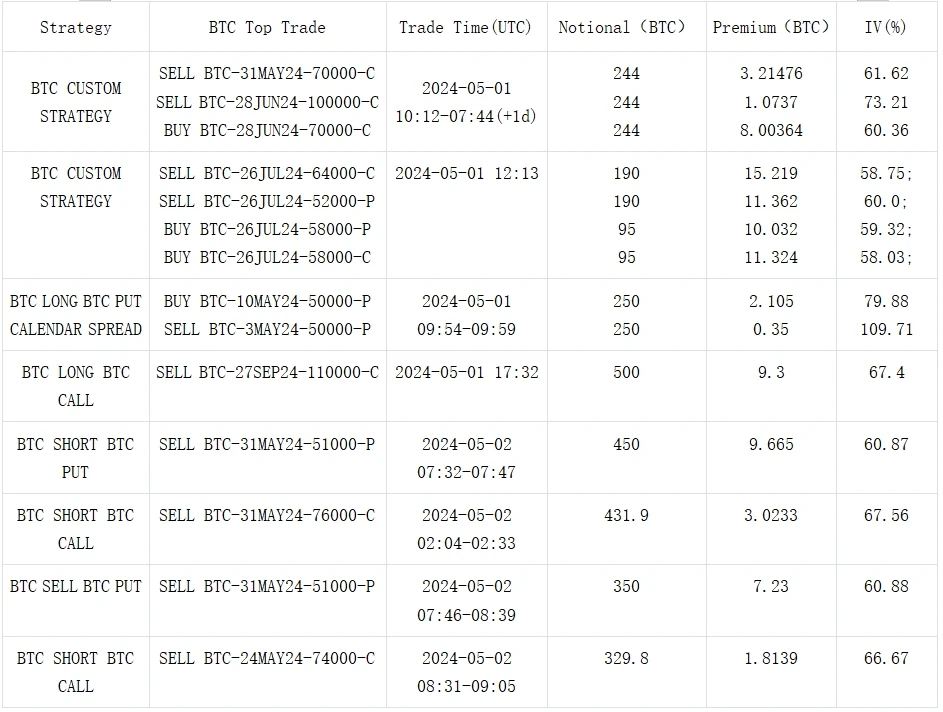

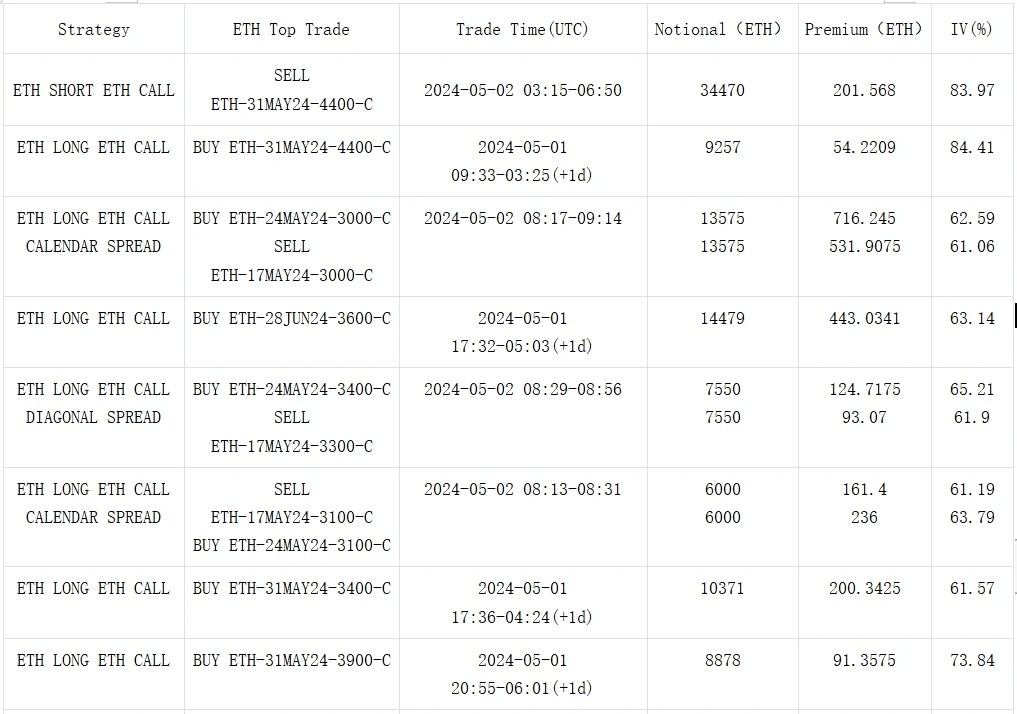

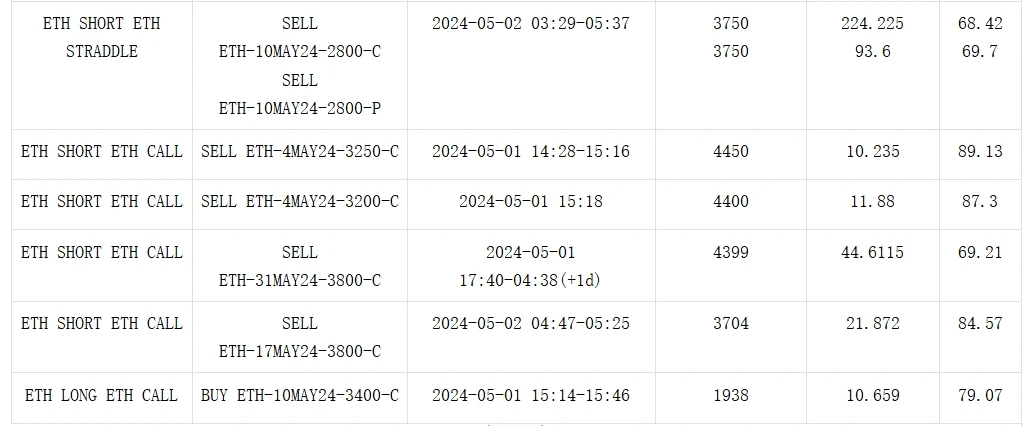

Following the Federal Reserve meeting, the IV at the front end of the options market rapidly decreased intraday, and the term structure of volatility remained relatively flat. The near-term Skew remains low, revealing short-term market panic and risk aversion sentiment. In terms of trading, the implied volatility level of BTC for May 31st decreased under the dual pressure of Puts and Calls, while ETH's main trading is more concentrated on that expiration date. From the bulk records, in addition to the selling of Outright Calls, there were also transactions involving selling the short-term 17th May and buying the 31st May, representing a triangular price spread strategy.

Source: Deribit (as of May 2nd 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

Data Source: Deribit, BTC/ETH overall trading distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and engage with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。