On April 24th, after the approval of the US Bitcoin spot ETF on January 10th, Huaxia Fund (Hong Kong) announced that the Huaxia Bitcoin ETF and the Huaxia Ethereum ETF had been approved by the Hong Kong Securities and Futures Commission and would be issued on April 29, 2024, and listed on the Hong Kong Stock Exchange on April 30, 2024. This also marks Hong Kong as another jurisdiction globally to approve such products after the United States, allowing retail investors to invest in digital asset-linked investments through the purchase of such ETFs.

Huaxia Fund (Hong Kong) has added digital asset management business to its traditional asset management business, marking the first approval of the Hong Kong subsidiary of a leading fund company in China. Through an interview with Zhu Haokang, the head of digital asset management and family wealth management at Huaxia Fund (Hong Kong), we will show the positive progress of Hong Kong in the field of digital assets.

PANews: First of all, congratulations on the approval of the cryptocurrency spot ETF launched by Huaxia Fund (Hong Kong). Could you please share the positive progress of Huaxia Fund (Hong Kong) in the field of digital assets?

Zhu Haokang: Since the Hong Kong government issued the "Policy Statement on the Development of Cryptographic Assets in Hong Kong" on October 31, 2022, we have witnessed a top-down drive to make Hong Kong a hub for global Web3.0. In March of this year, the Hong Kong Monetary Authority has launched three consecutive innovative sandbox projects, covering wholesale central bank digital currencies, stablecoins, and the second phase of the pilot plan for digital Hong Kong dollars. In addition, the upcoming Bitcoin and Ethereum spot ETFs in Hong Kong signify strong support from the Hong Kong government for the compliant development of the cryptographic asset ecosystem. We at Huaxia Hong Kong are keeping pace with the times, actively embracing and organizing teams to conduct in-depth research on the cryptographic asset industry, especially the securitization of real-world assets (RWA) and innovative products such as Bitcoin/Ethereum spot ETFs, and actively participating in the sandbox experiments of the Hong Kong Monetary Authority. We believe that the recognition of Web3.0 technology in financial innovation is increasing, and with the future opportunities brought by digital assets entering Web3.0, digital assets have become indispensable in the market, and Hong Kong's digital asset industry has enormous development potential.

PANews: What special regulations has the Hong Kong Securities and Futures Commission made for the cryptocurrency spot ETF launched in Hong Kong? What are the advantages and disadvantages of similar ETF products approved by the Hong Kong Securities and Futures Commission compared to those approved by the US SEC? What has caused these advantages and disadvantages?

Zhu Haokang: As you mentioned, there are significant differences and advantages in the approach taken by the regulatory authorities in Hong Kong compared to the United States. One key difference is that Hong Kong allows cash and in-kind subscriptions. Under these rules, participating traders can directly use Bitcoin or Ethereum to subscribe to or redeem shares of the ETF, while in the United States, such subscriptions and redemptions can only be made in cash. Although the current market size of the US Bitcoin spot ETF is larger than that of Hong Kong, the latter may have more advantages because Hong Kong is one of the first jurisdictions to approve spot Ethereum ETFs and allow retail participation.

These innovative measures are supported by a strict regulatory framework aimed at protecting retail investors. The Securities and Futures Commission (SFC) of Hong Kong has established a regulatory framework for cryptographic asset funds, as outlined in its announcement in December 2023. The SFC states that fund management companies must have a good regulatory record and can only invest in cryptographic assets listed on cryptographic asset trading platforms (VATPs) open to the Hong Kong public and licensed by the SFC. In addition, these funds are prohibited from having leveraged exposure at the fund level. Regarding custody, the SFC states that the fund's trustee or custodian should only entrust its cryptographic asset custody function to VATPs licensed by the SFC or institutions that meet the cryptographic asset custody standards issued by the Hong Kong Monetary Authority (HKMA), which are subject to strict regulation.

PANews: The US SEC did not approve in-kind subscriptions and redemptions for spot ETFs due to concerns about potential illegal activities such as money laundering. What institutional design has Hong Kong implemented to prevent potential illegal activities such as money laundering?

Zhu Haokang: The regulatory and licensing framework currently in place in Hong Kong emphasizes strict compliance with anti-money laundering (AML) and know your customer (KYC) and know your token (KYT) standards. These frameworks establish strict rules to protect investors, including secure asset storage, detailed KYC/KYT procedures, AML regulation, and measures to combat terrorist financing (CFT). Therefore, these regulations impose strict obligations on all market participants to prevent illegal financial activities. However, in the United States, the supervision of cryptographic asset trading platforms and custodians is not fully regulated.

PANews: Which investors can purchase Hong Kong cryptocurrency ETFs in the current market?

Zhu Haokang: Qualified investors, institutional investors, retail investors, and internationally qualified investors in Hong Kong can all invest in cryptocurrency ETFs. Currently, investors from mainland China cannot invest in Hong Kong cryptocurrency ETFs. For specific investor qualifications, you can consult securities firms and sales channels and continue to pay attention to whether there will be corresponding regulatory adjustments or specific regulatory frameworks in the future.

PANews: Bitcoin has recorded its seventh consecutive month of gains. How should investors currently view digital asset investments?

Zhu Haokang: Research and decision-making for any investment are complex, especially in the emerging field of digital assets. I have created a 3D theory of digital assets for investment, which includes Defensive, Diversification, and Decision, to help everyone analyze digital asset investments from the perspectives of risk defense, portfolio diversification, and decision-making. Taking Bitcoin as an example, Bitcoin was born against the backdrop of the global financial crisis in 2008. Since then, the global financial market has experienced events such as the European sovereign debt crisis, special liquidity measures by global central banks in response to COVID-19, and the collapse of major regional banks in the United States. Investors' awareness of asset risk defense has significantly increased. Bitcoin is the first digital, independent, global, rule-based currency system in history. In theory, its decentralization should help mitigate systemic risks in traditional financial systems, and the price volatility of Bitcoin decreases over time. Although it has only a 15-year history, Bitcoin has performed well during periods of risk aversion. For example, during the recent crisis of the collapse of a major regional bank in the United States, Bitcoin's price rose by over 40%, highlighting its role in hedging counterparty risk. Although Bitcoin has experienced declines in the past, its setbacks have been industry-specific. For example, the recent significant drop in Bitcoin was due to the collapse of the FTX exchange due to fraud in 2022. In every previous cyclical decline, Bitcoin has demonstrated its anti-fragility and set new highs.

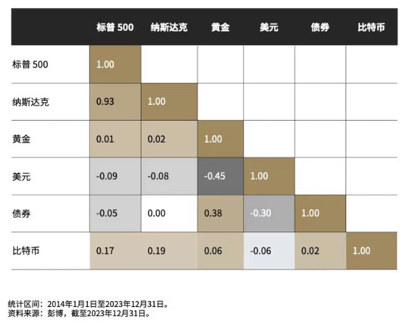

The unique characteristics of Bitcoin make it significantly different from other traditional assets: scarcity, liquidity, divisibility, portability, transferability, substitutability, auditability, and transparency. Looking at a 5-year period from 2018 to 2023, the average correlation of Bitcoin returns with traditional asset categories is only 0.27. Importantly, the correlation of Bitcoin returns with the returns of gold and bonds, two traditional safe-haven assets, is 0.2 and 0.26, respectively. The correlation between bonds and gold is as high as 0.46. Looking at a 10-year period from 2014 to 2023, the highest correlation with Bitcoin is only 0.19, with the Nasdaq 100 index, and the correlation with the returns of gold and bonds, two traditional safe-haven assets, is even lower at 0.06 and 0.02, respectively. Therefore, as an investment portfolio, Bitcoin has a low correlation with the returns of other asset categories, which allows for effective portfolio diversification.

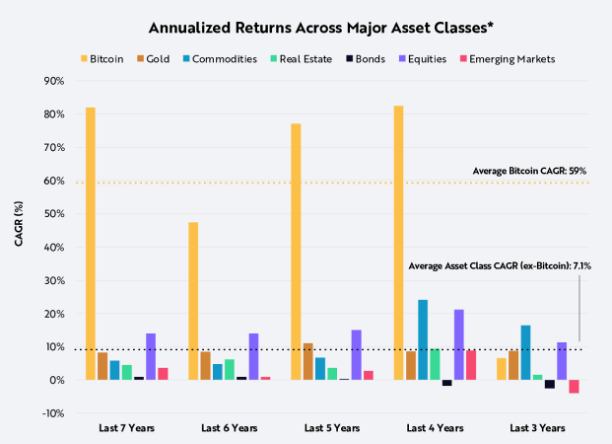

As a revolutionary technology and emerging asset, the speculative nature and short-term volatility of Bitcoin make investment decisions complex and variable. Currently, Bitcoin's market value has exceeded $1 trillion, maintaining its independence while increasing its purchasing power. Investment decisions mainly revolve around timing and pricing, and both short-term and long-term performance of Bitcoin outperform all other major asset classes. According to data and calculations from ARK Investment Management LLC based on PortfolioVisualizer.com, as of March 31, 2024, the annualized return on investment in Bitcoin over the past 7 years is close to 60%, while the average return on other major assets is only 7%. Based on the classic modern 60/40 investment portfolio (i.e., 60% stocks + 40% bonds), the portfolio with the largest allocation to Bitcoin investment has performed the best over the past 5 years.

Source: ARK Investment Management LLC, 2024, data and calculations based on PortfolioVisualizer.com, Bitcoin price data from Glassnode, as of March 31, 2024.

All investments carry risks, and digital assets are no exception. Risks associated with digital asset ETFs include concentration risk, industry risk, speculative risk, unforeseen risk, extreme price volatility risk, concentrated ownership risk, regulatory risk, fraud, market manipulation, security vulnerabilities, network security risk, potential manipulation of the Bitcoin network, fork risk, illegal use risk, and trading time difference risk. When investing in digital assets or related products such as ETFs, investors should consider their investment objectives, risk tolerance, and market volatility. The high volatility of the cryptocurrency market means that high risk and high returns coexist.

PANews: What is the management capability of the Huaxia Fund (Hong Kong) cryptocurrency ETF and the potential initial scale of fund inflows for the Hong Kong cryptocurrency ETF?

Zhu Haokang: Huaxia Fund has 26 years of asset management experience and is the largest ETF issuer in China, as well as a pioneer in the Chinese fund industry. It is also the first fund management company established in China and has issued the first ETF in China. As of the end of March 2024, its assets under management exceed 2.15 trillion RMB (approximately $300 billion), maintaining the top position in China for 18 consecutive years, with a market share of over 22% in the mainland ETF market[1]. In addition to its absolute leadership position in China, the brand influence of Huaxia Fund has expanded to the global market. According to a report by the globally renowned financial consulting firm ETFGI at the end of 2023, Huaxia Fund was rated as one of the top 19 ETF issuers globally, being the only Chinese ETF issuer to enter the top 20.

Huaxia Fund (Hong Kong) is a wholly-owned subsidiary of Huaxia Fund, established in Hong Kong for 16 years, and has won over 90 industry awards. It is a strong and trusted top-tier Chinese fund company in Hong Kong. In the overall ETF market in Hong Kong, it manages several of the largest or Hong Kong's largest ETFs:

- The world's largest offshore CSI 300 ETF

- The world's largest Hang Seng ESG ETF

- Hong Kong's largest NASDAQ 100 ETF

- Hong Kong's largest Japanese stock ETF

- Hong Kong's largest European stock ETF

- Hong Kong's largest Hong Kong biotech ETF

- Hong Kong's largest MSCI A50 ETF

From investment managers, capital markets, operations, trading, sales, compliance, and other departments, our team has experience working in globally renowned asset management companies, ensuring smooth and efficient operations and management. Our team is very stable and works together seamlessly. The rich resources in custody, trading, market making, and other areas accumulated over the past 16 years are incomparable to other companies. Our experience over the past decade has also demonstrated that Huaxia Fund Hong Kong has significant advantages in managing the core factors affecting ETFs, including 1) liquidity, 2) tracking error, 3) premium/discount, and 4) bid/ask spread. Especially for complex and innovative products such as spot Bitcoin and Ethereum ETFs, the management and operational capabilities of ETF issuers will be greatly tested. We are confident in ourselves, and we believe that the strong team strength, 16 years of management experience, and the brand influence we have accumulated in the Hong Kong market will not disappoint the market's expectations.

We have observed that the largest asset management company in the United States managed a Bitcoin spot ETF with a scale of only $10.45 million when it was first launched on January 10th this year. By April 25th, the scale of the ETF had soared to $17.2 billion, an increase of about 1,700 times in just three months. This comparison not only shows the enormous market potential for traditional investors to enter the digital asset market but also highlights Hong Kong's competitive advantage in the global digital asset field. As one of the largest public asset management companies in China, the largest ETF issuer in China, and a top-tier Chinese fund company in Hong Kong, we at Huaxia Fund (Hong Kong) are full of confidence in the future of digital asset innovation and Web3.0 development in Hong Kong.

Unless otherwise specified, the data is from Huaxia Fund (Hong Kong), Bloomberg, Wind, as of April 29, 2024.

Investment involves risks. The unit price of the fund may rise or fall, and past performance does not guarantee future fund returns. You may also lose the capital you invested. This data does not constitute an invitation to buy or sell any securities or funds or any investment advice. This document is for your reference only, and you should not rely on it to make any investment decisions. Some of the data or information in this document is obtained from non-affiliated third parties, and we reasonably believe that such data or information is accurate, complete, and up to date as of the date shown; Huaxia Fund (Hong Kong) Limited ensures the accurate reproduction of such data or information, but does not guarantee the accuracy and completeness of the data or information provided by non-affiliated third parties. You should carefully read the fund sales documents, including the risk factors. If necessary, seek independent professional advice. The issuer of this data is Huaxia Fund (Hong Kong) Limited. This data has not been reviewed by the Securities and Futures Commission of Hong Kong.

[1] Note: The footnote reference is not included in the translation as it does not contain any specific content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。