香港市场迎来历史性一刻,比特币现货ETF和以太币现货ETF将闪亮登场!

此次香港证监会批准的华夏香港、博时国际及嘉实国际旗下6只虚拟资产现货货币ETF,4月29日迎来首次发行,4月30日正式在港交所上市。这6只ETF在产品费用、交易、发行、虚拟资产平台等方面表现出一定差异化。

分析人士预期,未来香港现货比特币和以太币ETF的资产管理规模有望达到10亿美元,但能否实现这一目标可能将取决于基础设施和生态系统的改善速度。

香港虚拟资产现货ETF4月29日发行

香港证监会最新公示6只虚拟资产现货ETF,于4月29日迎来首次发行,4月30日正式在港交所上市。

具体来看,这6只产品分别属于华夏(香港)、博时国际及嘉实国际,每家均是比特币现货ETF和以太币现货ETF两只产品。这些产品运作看,投资目标是紧贴比特币/以太币表现(以芝商所CF比特币指数或以太币指数(亚太收市价)表现衡量的投资结果(扣除费用及开支前)。

由于比特币、以太币是虚拟资产,为免生疑问,这些ETF基金将100%资产投资于比特币或以太币,不会进行其他类型的投资,也不会为任何目的投资金融衍生工具,及从事证券借贷、回购或反向回购等交易,也不得采用任何形式的杠杆,可能会保留少量现金用于各项费用开支或应对赎回。

其实,同为虚拟资产,比特币和以太币也有区别。比特币是首个使用区块链技术实现在线支付交易的数字货币,而以太币是基于区块链技术的允许智能合约在去中心化应用程序上运行。

不仅如此,这些产品费用、发行、交易、平台等方面略有不同。

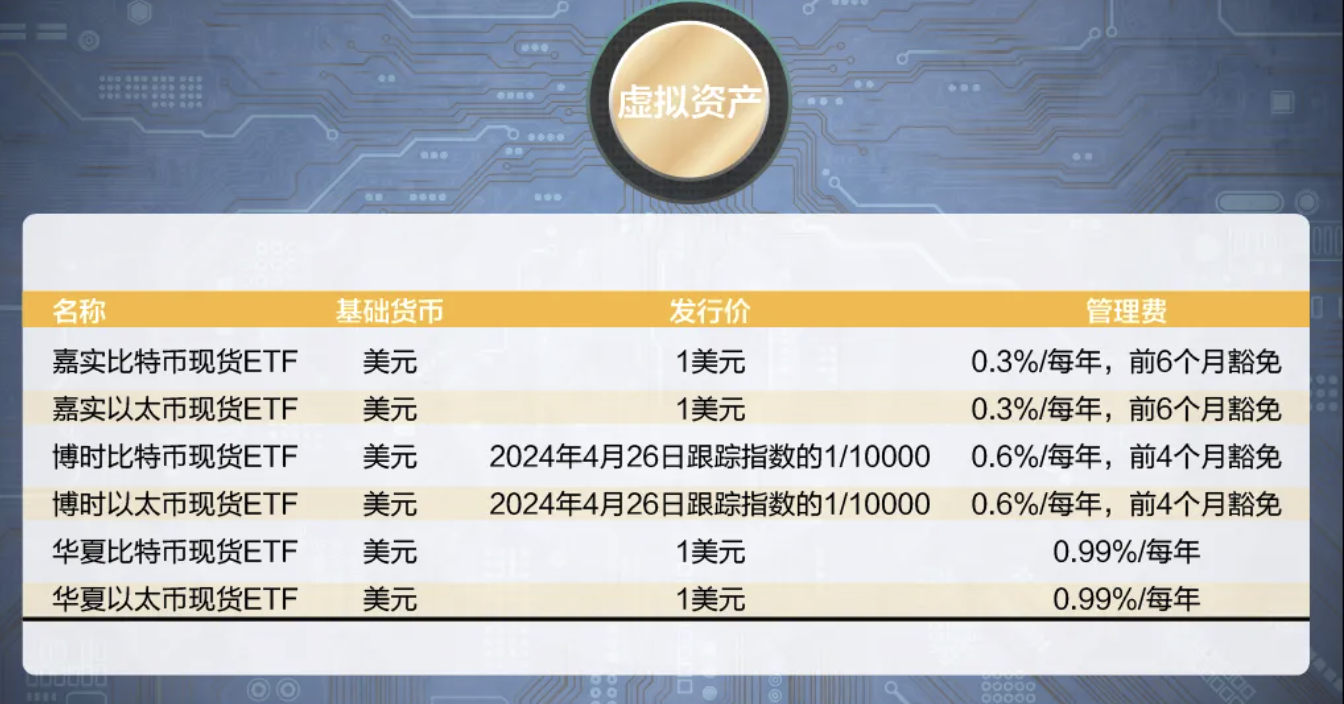

首先,管理费用方面,嘉实比特币和以太币现货ETF每年管理费为资产净值的0.3%,但自上市日起前6个月获豁免,博时比特币和以太币现货ETF每年管理费为资产净值的0.6%,自4月30日上市日起至2024年8月暂时减免费用。这可能是香港近年来首次豁免ETF费用。而华夏比特币和以太币现货ETF每年管理费为0.99%。

发行价方面,嘉实国际、华夏(香港)旗下产品发行价每股1美元,博时比特币ETF和以太币ETF的初始发行价分别与2024年4月26日跟踪指数的1/10000和1/1000基本一致,即折算后的基金份额净值对应约0.0001枚比特币价格和0.001枚以太币价格,意味着持有10000股约等于1个比特币,1000股约等于1个以太币。

从交易单位来看,嘉实国际旗下比特币/以太币现货ETF一级市场申请是最少10万股份(或其倍数),二级市场最小买卖单位是100股;博时比特币现货ETF一级市场申请是5万股份(或其倍数),二级市场最小买卖单位是10股,以太币ETF是一级市场申请是10万股份(或其倍数),二级市场最小买卖单位也是10股。

此外,与嘉实国际和博时国际的产品相比,华夏(香港)旗下比特币现货ETF和以太币ETF还设置了人民币柜台。

专业分析人士认为,除了费用、发行、交易等方面的安排可能有所不同,每个ETF的做市商和虚拟资产平台也有所不同。因此投资者需要注意每只ETF的总拥有成本。

香港加密货币现货ETF资产管理规模有望达到10亿美元

经历十年的探讨,美国证监会终于在2024年1月11日批准了全球首批现货比特币ETF的发行,令比特币等加密资产正式进军传统主流市场。

据彭博数据显示,上市仅3个月左右,美国现货比特币ETF持续录得巨量流入,规模接近589亿美元。

华夏(香港)认为,新经济时代,Web3.0所造就的数字经济是未来最具前景的投资机遇之一。加密货币则是Web3.0中最重要、最受关注、投资者最为广泛的资产。其中,比特币和以太币以各自的技术优势和投资者的追捧,成为加密货币中的“顶流”。

“继美国发行现货比特币ETF后,香港市场即将成为亚洲首个发行现货比特币、以太币ETF的市场,加密货币ETF未来有望被越来越多的市场认可。当越来越多的投资者广泛地参与到加密货币的投资中,比特币、以太币等加密货币晋身新经济时代主流资产或指日可待。”华夏(香港)称。

彭博行业研究ETF亚太首席分析师冼素君表示,香港现货比特币和以太币ETF的资产管理规模有望达到10亿美元,但能否实现这一目标可能将取决于基础设施和生态系统的改善速度。

冼素君还表示,香港散户和机构的ETF需求强劲,这两类投资者均对虚拟资产表现出兴趣。不过,这类产品的创新性意味着虚拟资产ETF的基础设施需要时间才能发展成熟,而HashKey和OSL是仅有的两家已在香港获批的此类交易平台。一旦ETF生态系统发展起来,市场竞争料将更趋激烈,资金流动或将随之增加,定价更加准确,利差收窄,流动性增强,费率也将走低。

内地投资者尚不可参与买卖

香港现货加密货币ETF的发行和上市,意味着投资者可通过传统证券投资账户持有虚拟资产,无需额外设立虚拟资产钱包和交易账户。

据了解,香港现货加密货币ETF对香港专业和零售投资者开放。对香港投资者而言,在基本KYC(实名认证)的基础上,只要通过加密货币知识测试即可购买香港的现货比特币和以太币ETF,香港投资者购买美国相应的ETF必须是专业投资者,有高额的投资门槛限制。

中国内地投资者目前尚不可参与买卖。香港证监会与香港金管局在2023年12月22日发出的有关中介人的虚拟资产相关活动的联合通函显示,无论是目前香港市场上已有的虚拟资产期货ETF,还是未来将发行的虚拟资产现货ETF,均不可向中国内地等禁止销售虚拟资产相关产品的零售投资者发售。

中国基金报记者 方丽 孙晓辉

编辑:舰长

审核:陈墨

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。