Original author: Donovan Choy, former analyst at Bankless

Translation: Azuma, Odaily Planet Daily

Editor's note: Earlier this month, USDe developer Ethena Labs announced the launch of the second season event Sats, which will be accompanied by Ethena using BTC as the supporting asset, expected to last until September 2 (5 months), or until the supply of USDe reaches 5 billion US dollars, whichever comes first.

As the most watched stablecoin project in the current market, Ethena Labs' popularity has peaked with the TGE of ENA. Currently, ENA's fully diluted valuation (FDV) exceeds 13 billion US dollars. For users interested in participating in the project, the most efficient way to earn subsequent ENA rewards in addition to directly purchasing ENA on the secondary market is through the second season event Sats.

In this article, former Bankless analyst Donovan Choy provides a detailed analysis of the low, medium, and high mining strategies in the Stas event and their potential returns, translated by Odaily Planet Daily.

Ethena's first season event Shards lasted for six weeks, and top miners such as Defi Maestro reaped profits in the high eight figures through the first season event.

If you missed the first season event, it's not too late to participate in the second season event Sats. Although the pool quota (Pendle) is gradually approaching full capacity, you still have the opportunity to participate.

In the following, we will analyze three different Ethena mining strategies and their potential returns.

Before we start the data analysis, let's briefly understand several basic concepts involved in the above strategies.

First, Ethena is the issuance protocol for USDe, a synthetic dollar stablecoin. When you purchase USDe during the second season event, your address will automatically accumulate points (sats), which will determine the ENA rewards you will receive during the second season event. ENA is the governance token of Ethena, and its FDV was as high as 14.3 billion US dollars at the time of writing this article.

Second, Pendle is a yield-splitting protocol that can split a token with self-generated income (such as USDe) into "principal tokens" (PT) and "yield tokens" (YT). PT allows users to hold independent principal exposure, while YT allows users to hold independent yield exposure. Since YT does not include principal, the value of YT will gradually tend towards zero at maturity. For the strategies mentioned in this article, we will focus on YT.

In the case of this article, since the current annualized yield of USDe is 17%, when you purchase USDe YT tokens on Pendle, the YT tokens only carry 17% of the yield value and the point rewards provided by the underlying protocol (Ethena).

Third, Mantle and Arbitrum are both Layer2 networks, and Pendle has been deployed on these networks in addition to Ethereum.

After understanding these basic concepts, let's take a look at the three mainstream mining strategies in the second season event:

Low risk: Hold USDe on Ethereum (earn 5 times sats per day), or lock it for at least 7 days (earn 20 times sats per day);

Medium risk: Purchase USDe YT on Pendle;

High risk: Lock ENA to earn additional income, and purchase USDe YT on Pendle with an equivalent fund ratio.

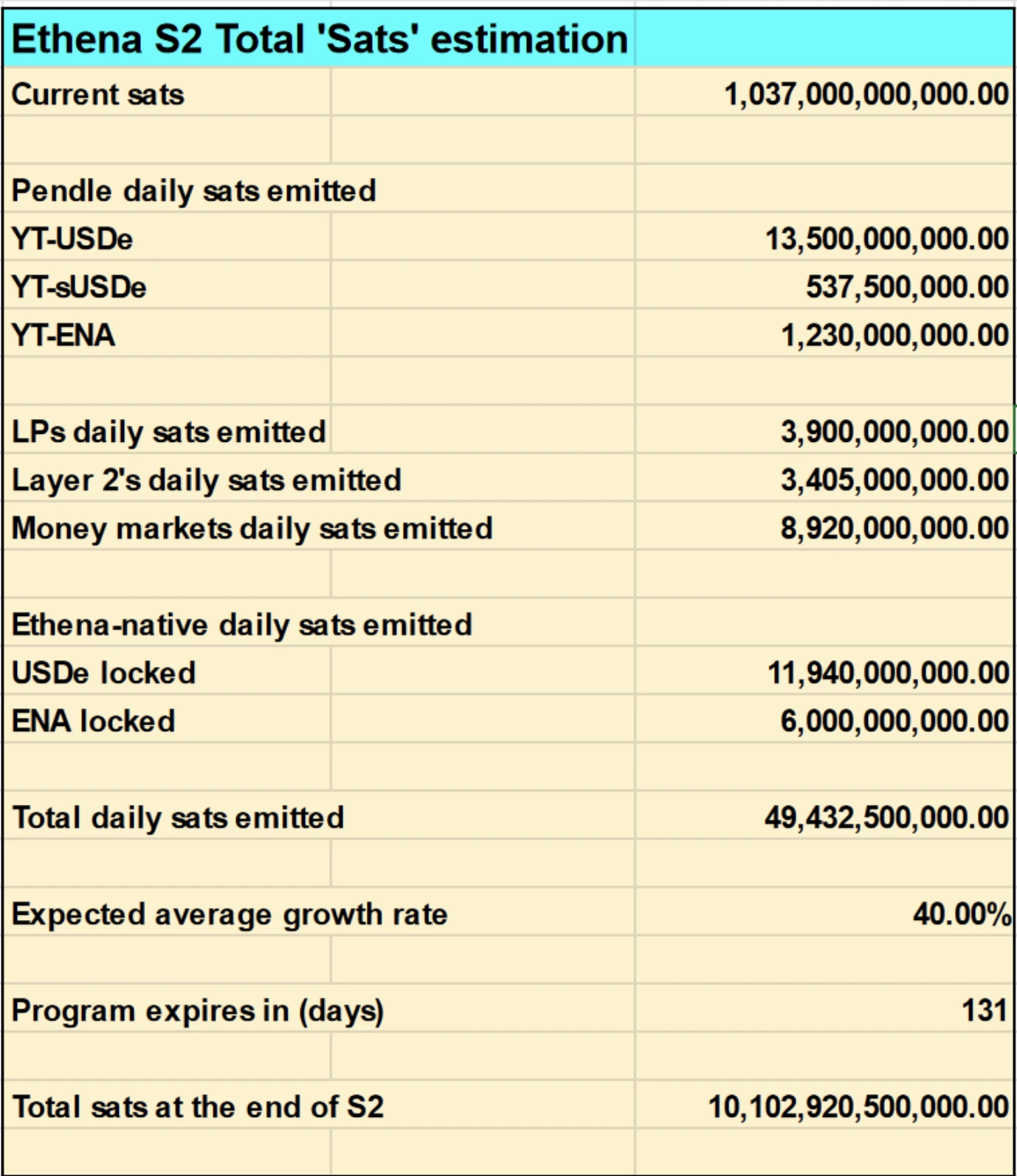

Estimated total amount of second season event stas

To calculate the specific potential returns, we first need to answer a key question—how many sats will be distributed by the end of the second season event? Based on this crucial answer, we can quantify the airdrop returns and determine which strategies can achieve the best returns at the corresponding risk level.

Note: We did not calculate the points distributed to CEX wallets for USDe and ENA.

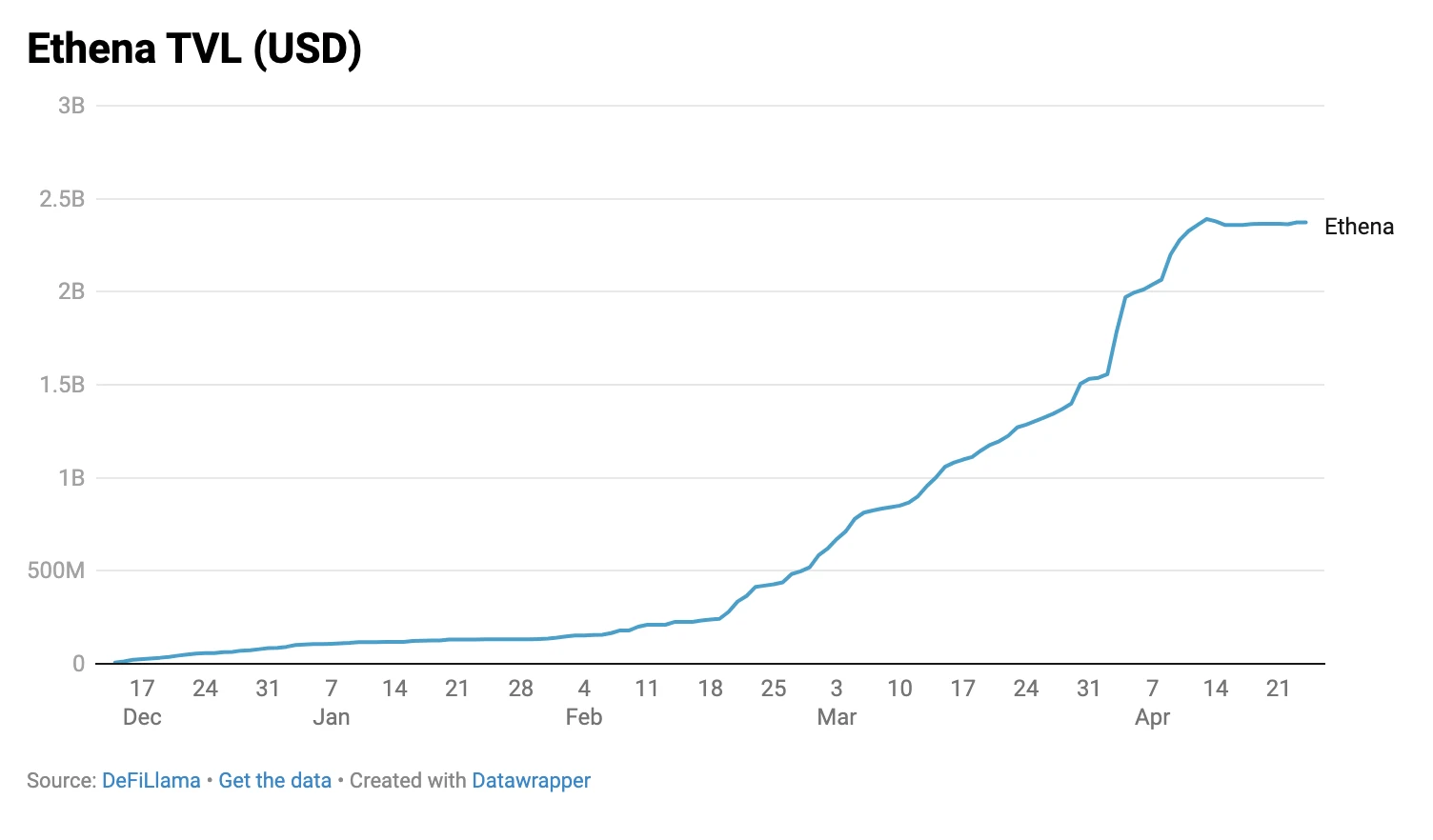

We conservatively estimate the overall growth rate of sats to be 40%, which means that by the end of the second season event (September 2, 2024), a total of 10.1 trillion sats will be distributed. It is worth mentioning that if the supply of USDe reaches 5 billion US dollars before the end of the second season event, the event will also end. However, we believe that based on the current supply of 2.4 billion US dollars and the growth rate, this is unlikely to happen.

Note: Data is from DeFiLlama.

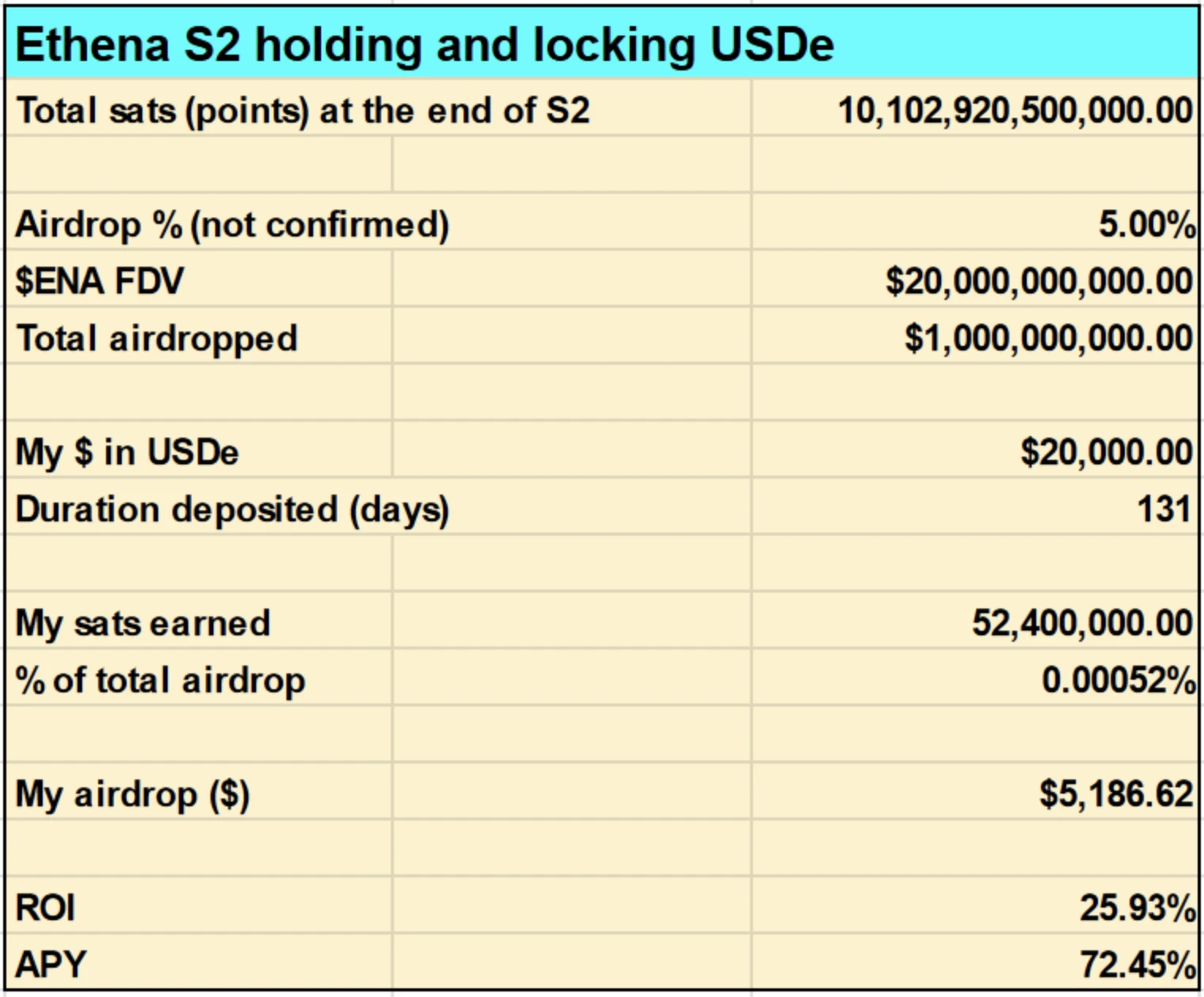

Low risk strategy: Hold and lock USDe

Now let's calculate the potential return of only holding and locking USDe, which is the lowest risk strategy in this article. Here are our two assumptions: the second season will distribute 5% of the total supply of ENA (assuming it is the same as the first season); the FDV of ENA at the time of the second season airdrop is 20 billion US dollars, while the data at the time of writing this article is 14.4 billion US dollars.

As shown in the table below, if you lock 20,000 USDe at 20 times efficiency today (with 130 days remaining in the second season), you will earn a profit of 5,186 US dollars. This means a 25.93% return on investment (ROI), equivalent to an annualized yield (APY) of 72.45%.

Unlike the subsequent strategies, this strategy does not involve Pendle, and you can retain all of your principal.

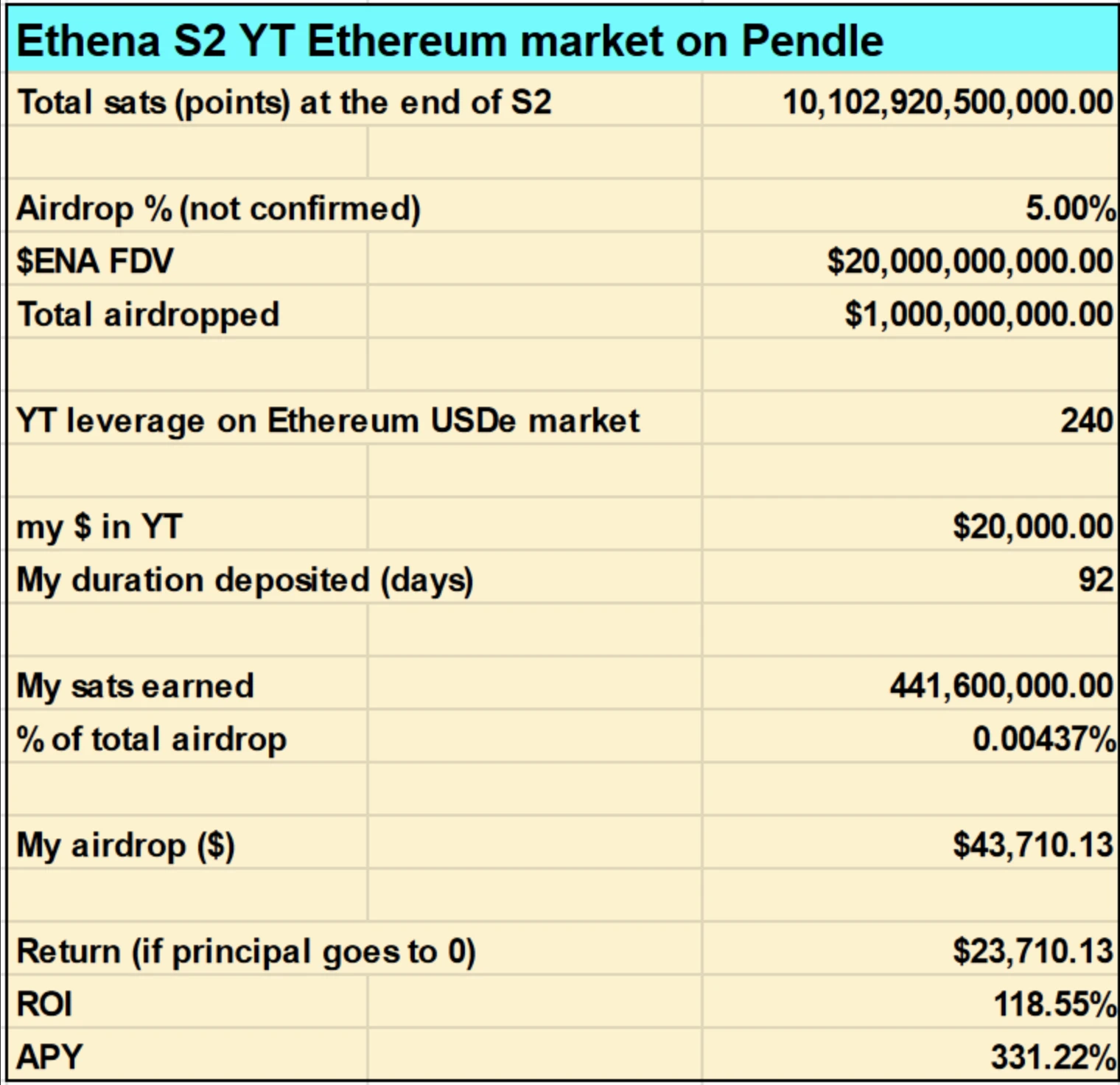

Medium risk strategy: Pendle YT

Now let's take a look at the medium-risk strategy, which involves using Pendle's USDe YT on the Ethereum mainnet to earn sats.

With the same 20,000 US dollars (but with a term of 92 days because the Pendle pool will expire), the expected ENA income is about 43,710 US dollars, resulting in a net income of approximately 23,710 US dollars after deducting the principal (the value of YT will tend towards zero at maturity, so you will lose the 20,000 US dollars in principal), about 4 times that of the first strategy.

Under this strategy, the expected ROI is 118.55%, and the expected APY is 331.22%.

It is important to note that the calculations in the table below are based on the current leverage ratio in the Pendle market, and the real-time leverage ratio of YT will be affected by market demand and the maturity date.

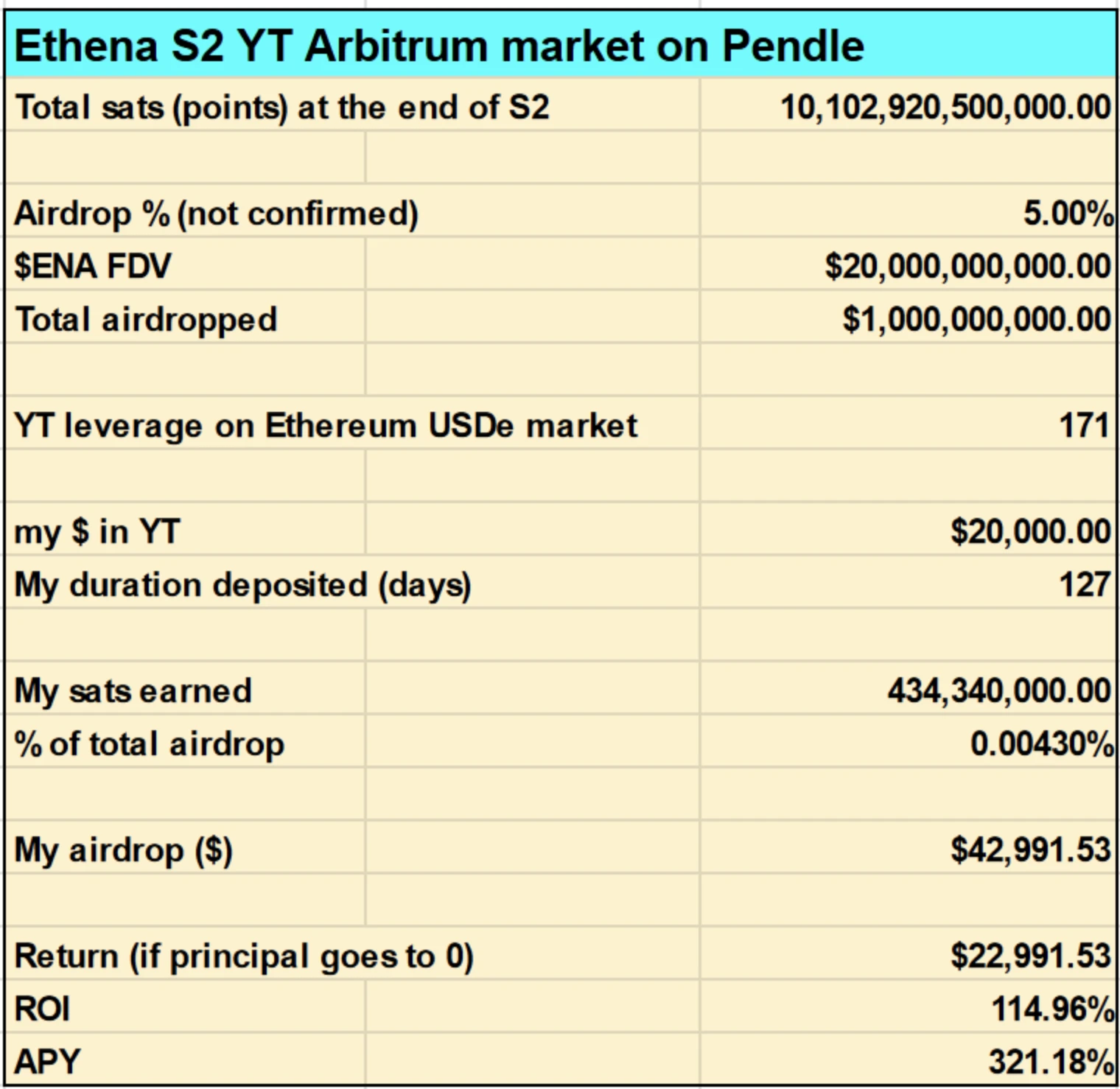

If you choose to operate on the Pendle pool on Arbitrum instead of the Ethereum mainnet, the expected ROI and APY will be slightly lower, decreasing to 114.96% and 321.18% respectively. The reason for this difference is actually due to the difference in real-time leverage ratios of YT on the Ethereum mainnet and Arbitrum.

You can also perform similar operations in the Pendle pool on Mantle or Zircuit, but the expected data will also vary.

High risk strategy: Lock ENA and Purchase YT Again

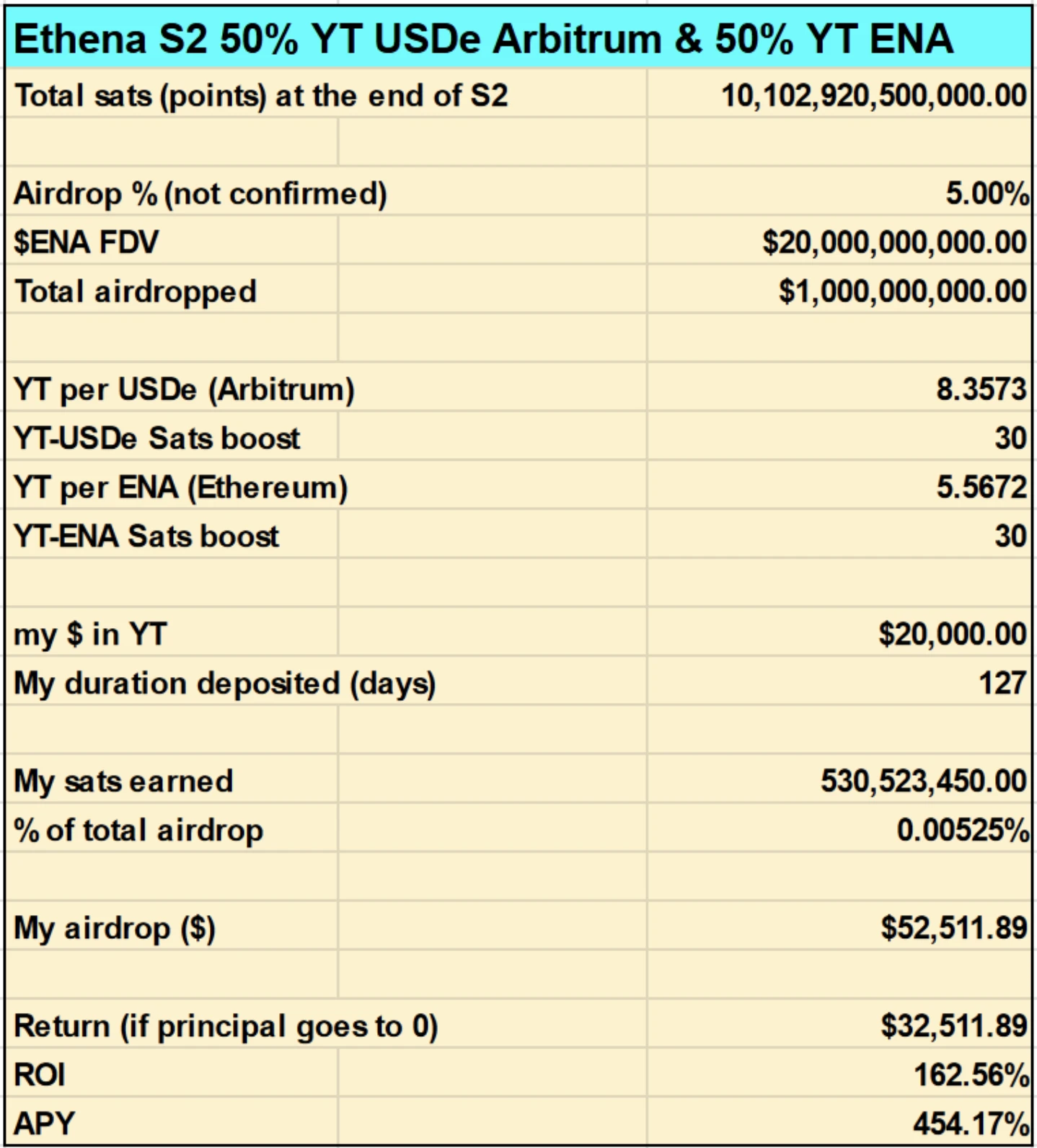

Finally, let's take a look at the highest risk and highest potential return strategy, which will split the principal in a 50:50 ratio, with half used to lock ENA and the other half used to purchase Pendle's USDe YT.

Why such complexity? This is because Ethena will provide additional income incentives to users who "lock 50% of their USDe holdings in ENA", and by holding YT-ENA and YT-USDe in the same wallet, this will increase your total rewards in these two pools by 50%.

This may also be the strategy adopted by the most savvy YT traders, who may have fully utilized the airdrop rewards they received in the first season to achieve higher sats accumulation efficiency in the second season.

As shown in the table below, this strategy (deployed on Arbitrum) can achieve the highest returns—expected ROI of 162.56% and expected APY of 454.17%, but in turn, it will also carry higher risk due to locking ENA.

Note: The USDe pool is on Arbitrum, and the ENA pool is on the Ethereum mainnet.

It is important to note that if you choose to use the Pendle YT strategy, you need to pay attention to the real-time leverage ratio. When the market is selling YT (more likely near the maturity date), the leverage ratio will increase, and vice versa. Although the real-time leverage ratio will continue to change based on the YT market conditions, once you buy YT, the leverage ratio for your own position will not change and will remain constant throughout the entire holding period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。