上周六 Runes 协议上线的当天,就刷到了很多 FUD 符文的帖子。其实 FUD 也没什么,说明符文的热度实在太高了,自然吸引了大量眼球。只是大部分 FUD 的维度实在有点无厘头,所以还是想做下说明。

整体来说,FUD 符文的内容主要可以分为两类:

1️⃣对于 Runes 协议设定的 FUD;

2️⃣对于符文资产价值的 FUD。

作者:Portal_Kay

X/推:@portal_kay

对于 Runes 协议设定的 FUD

1、符文是不是让资产发行越来越中心化了?

4月20号上午协议上线后,被讨论的最多的就是前 10 号符文。但是当大家看完一遍之后,才发现好像无从下手啊,这不是项目方100%预挖,就是项目方预留很大一部分老鼠仓。这不是又退回到中心化发行的时代吗?

而我对这个问题的看法是:【不是更中心化了,而是选择更丰富了】。

前 10 号符文只有 Casey 自己硬编码的 0号 是完全公平发射无预留的,其他都有不同程度的预留。这并不是 Runes 协议的问题,而是部署者们自己的选择。

在 BTC 生态经历了 BRC-20 和各种 BRC-XXX 协议之后,Casey 其实是吸取了各家协议的经验教训(尤其是 BRC-20),才逐步把 Runes 协议优化到了最终上线的样子。Runes 最初就规划了 Fixed Cap 和 Fair Launch 两种发行方式,在后来的一次升级中,又增加了部署者可以在 Fair Launch 基础上保留 Premine 额度的设定。

因此,Runes 协议能够支持更加多元的资产发行场景:

1️⃣发行 Meme 币,100% Fair Mint,全看社区共识;

2️⃣项目方发行项目治理代币,按照代币经济学的规划分配给投资方、生态等各种利益方;

3️⃣某个项目的奖励代币,100% 预挖后空投给社区用户;

4️⃣项目方和社区共建类项目,项目方预留一部分作为运营需要,剩余部分由社区 Fair Mint

5️⃣……

事实上,我觉得由项目方驱动的资产发行会是一个生态发展的必然趋势。真正意义上的无主代币要能够持续运行,其实是一件非常低概率的事。完全依靠社区天然凝聚起共识的代币又能举出几个呢?更常规的情况,难道不是有一个项目方在踏踏实实做建设,最终才让项目有持续性的叙事、资产的价值也逐步攀升吗?

2、 符文代币的其他一些 FUD

字符那么长,谁记得住?

在最早开始了解 Runes 协议的时候,我也觉得这个设定并不好。但是一方面名字长不是本质问题,稍微熟悉下就适应了;另一方面,长字符也能有自己独特的玩法,不信你看看这个连Leonidas 都发推的 ORDINALS•ARE•DEAD。

符文居然必须一张一张卖,那跟 NFT 有什么区别?

其实 Runes 协议本身支持对资产进行非常便捷的操作,只是协议才刚出来,各家交易平台没来得及进行研发支持而已。Casey 也专门发推解释过符文交易跟 BRC-20 代币交易的一些区别。从推文里可以看出,符文是可以支持任意数量的转移交易的,而并不一定要一整张去挂单。

Casey 推文:符文交易跟 BRC-20 代币交易的区别

https://twitter.com/rodarmor/status/1781984102713028783

对于符文资产价值的 FUD

1、顶着 2000 gas 打的符文,这下亏惨了吧?

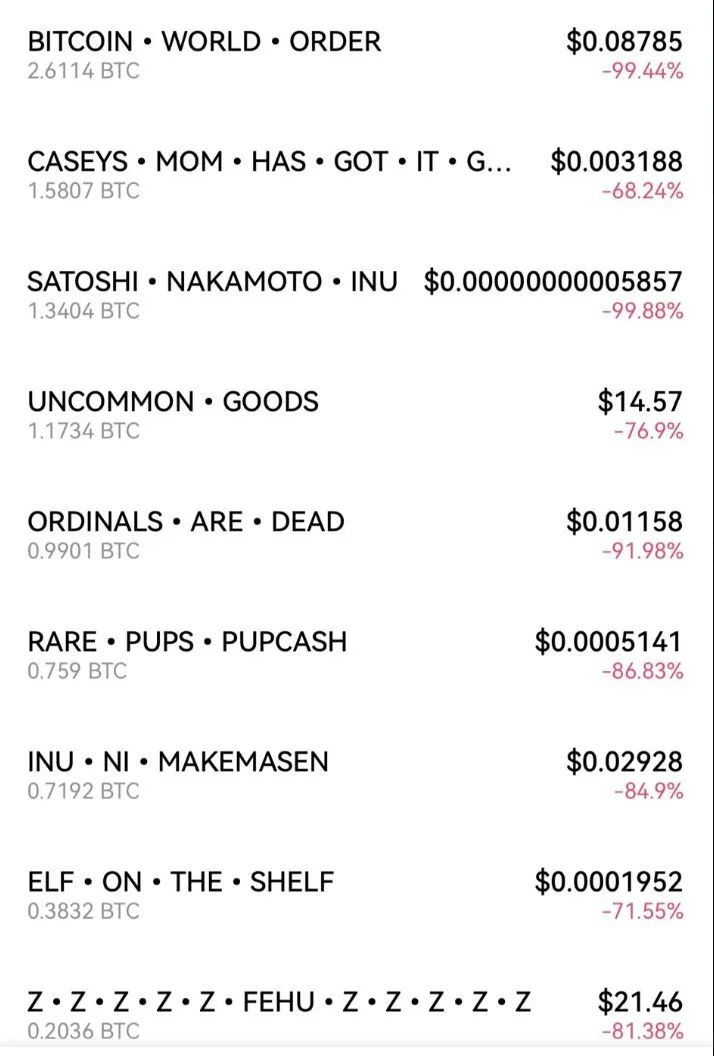

在协议上线第一天,有一张被争相转发的 OKX 符文市场截图。然后发推的 KOL 还会配上一两句类似“这就是你们要的符文?”“2000 gas 你就打个这?”之类的嘲讽话术。然而,这张截图的统计方式其实是错误的。OK 应该是弄错了这些刚上架符文的价格起点,所以导致涨跌幅度计算出错。

那么 4 月 20 号 参与符文的打新的是不是都在亏钱呢?下面整理了几个第一天就部署上线,且收益还不错的标的(注:“Unisat 成交价”就是选取了一个比较折中的价格)。当然,这并不是说所有符文项目发布之后盲打就能赚钱,最终还是需要做扎实的投研才能找出好标的的。

其实这类 FUD主要是出于两个原因:

1️⃣ 发帖人主力持仓了 BRC-20 或者 EVM 生态资产,看到符文热点起来之后,大量的流量和资金被吸引过去,就本能地开始排斥。这类属于屁股决定脑袋,因为本身重仓其他资产,自然而然会担心符文虹吸其他板块的资金。这种 FUD 基本可以无视,因为他的利益在那儿,这就不是讲道理可以解决的了。

2️⃣ 人性天然排斥新鲜事物。Runes 协议对于很多人来说都是个新事物,如果之前没有去看过一些资料,大家对它必然是陌生的。人对于陌生事物天然会有排斥,这个无可厚非。但是作为加密玩家,对新事物的排斥很多时候就意味着对赚钱机会的错失。

大家到底在 FUD 什么?

整理完上面这些 FUD 内容之后,我突然觉得这些可能都只是表面而已。那么本质上,大家到底在 FUD 什么?我猜,大家真正在 FUD 的可能是【毫无新鲜叙事的资产滥发】!

其实经历了过去这一年由 BRC-20 带动的 BTC 资产浪潮之后,大家已经不太愿意再为毫无新意的资产发行而 fomo。毕竟一大堆的 Ordinals 小图片归零了,各种当时吹得天花乱坠的 BRC-20 铭文也悄无声息,还有五花八门的 BRC-XXX 协议资产都没几个能让人记住。大家最终明白了,空气还是空气在,最终基本都会归零。

而目前 BTC 生态就是处在这样一个尴尬的时段,有较强共识的资产协议已经出来了,但是落地的应用却还没有诞生。资产协议最终只是一个价值承载的媒介而已,只有当资产在 DeFi 、GameFi 等落地应用当中流动起来时,才算有了一定的实用价值。

但种种迹象表明,这个尴尬的时段应该很快就要结束了。各种应用也都处于诞生的前期,现在就好像是 BTC 生态爆发的黎明破晓前……请大家多给 BTC 生态一点点耐心。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。