With the approval of the US SEC for a Bitcoin ETF, the price of Bitcoin has reached new highs, and the competition between cryptocurrency platforms has intensified.

Both buyers and sellers are betting on the continuously rising market, with increasing positions. The market fluctuations have affected the hearts of countless investors. Investors are trying to interpret every subtle change in the market and find a reasonable explanation for each rise and fall.

Attentive investors have already noticed that this bull market is different from previous ones. It has not led to a general rise in the market, but rather Bitcoin has led the entire market. Investors who did not buy Bitcoin mostly lag far behind the industry beta. Platform tokens have become one of the few tokens in the industry that can capture industry alpha and have certain value.

Recently, TOKEN2049 held a summit in Dubai, which experienced a once-in-a-century heavy rain. Bitget provided a shelter for participants to take a short break and held an open day for its Dubai office, inviting users to participate in face-to-face communication and directly listen to users' opinions and suggestions. Bitget is the first trading platform to open its office to the public. This move by Bitget signifies that it has become the first trading platform to open its office space to the public, demonstrating its open-mindedness as an industry leader and its deep commitment to the community.

Average return rate 138%, Gold Shovel BGB

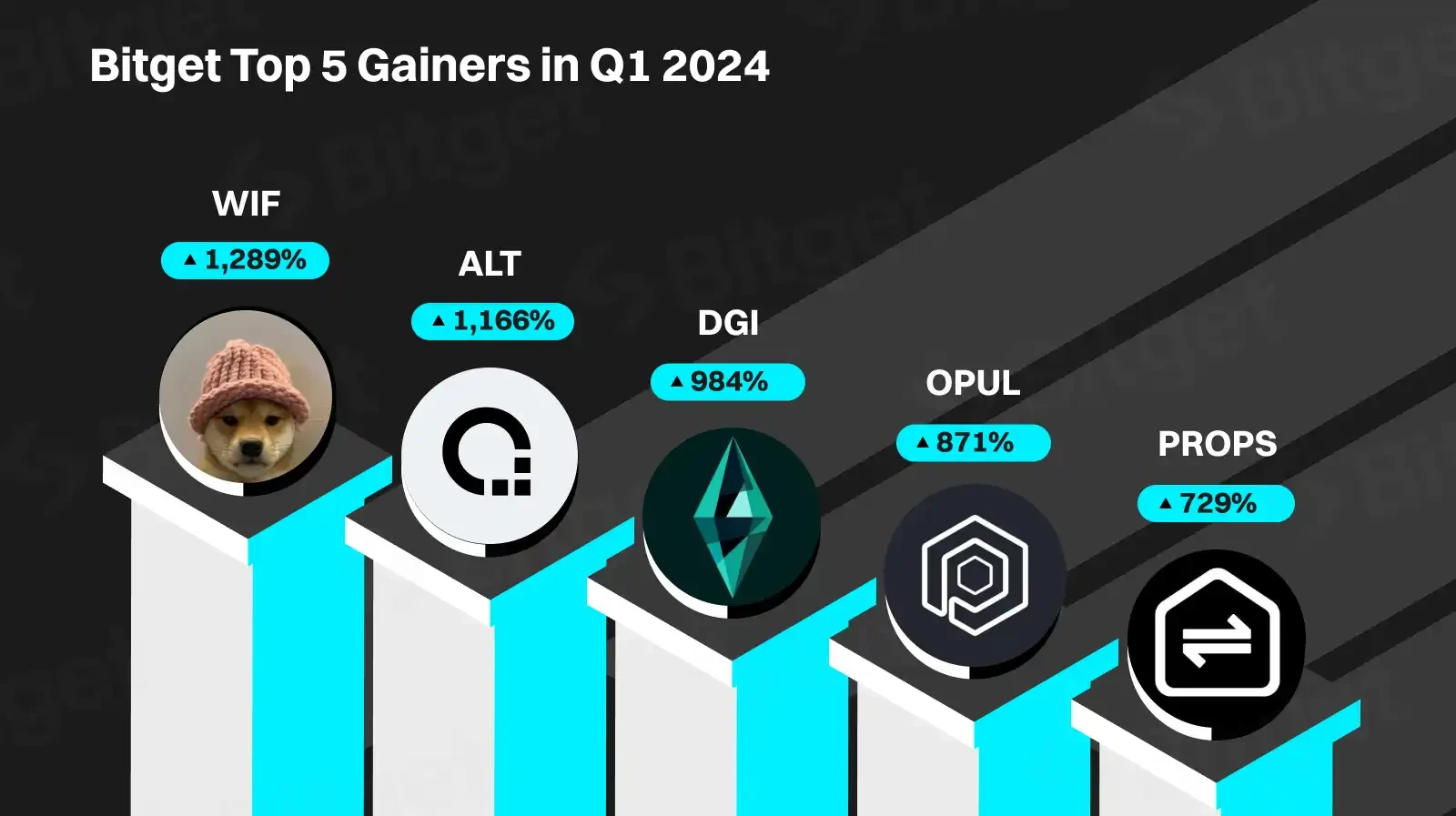

According to TokenInsight's Q1 2024 report, the platform tokens GT, BNB, and BGB have increased by 108%, 95%, and 81% respectively, all higher than BTC's increase in Q1.

Source: TokenInsight

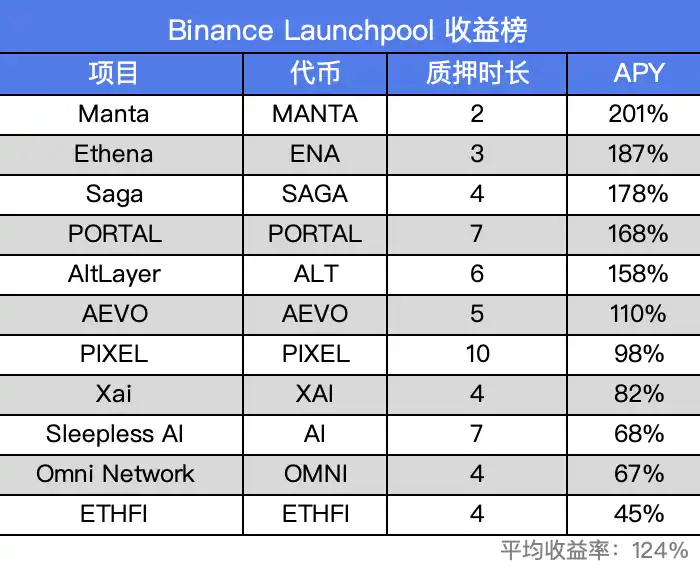

According to public information, Binance has conducted a total of 11 Launchpools in 2024, with an average annualized return rate of 124%.

Meanwhile, Bitget's overall average annualized return rate is higher than Binance's, at 138%. Since 2024, Bitget has launched seven Launchpool projects, including popular projects such as ZKFair ($ZKF), ZetaChain ($ZETA), and Ethena ($ENA).

Interestingly, BGB is the first platform token in this round of market to reach a new all-time high price. Currently, BGB's market value has exceeded $1.7 billion, ranking 57th among all cryptocurrencies and is the fifth largest platform token. If BGB's price is adjusted to a monthly candlestick chart, it can be observed that BGB almost reaches a new all-time high every 1-2 months.

In reality, many platforms are not unwilling to conduct IEOs, but high-quality projects in the market have been largely taken by Binance and Bitget. Since 2024, OKX has only conducted one Jumpstart, and this project, Polyhedra Network, was even conducted in collaboration with Bitget.

Thanks to continuous high returns and price surges, BGB has gradually gained the nickname "Gold Shovel" in the community.

Through Launchpool, Bitget has added new use cases for BGB, driving demand growth and to some extent locking in liquidity, making tradable BGB scarce in the market, which is beneficial for the long-term development of the coin's price. In addition to Launchpool, Bitget has recently launched a new mining platform, PoolX, which is positioned as a more lightweight Launchpool with higher frequency of new listings and a faster pace, maintaining a yield of 20% - 30% for BGB and USDT, which is considered a good return regardless of market conditions.

Moreover, holding BGB on Bitget also entitles users to various benefits, such as an 80% discount on spot trading fees and fee-free withdrawals for staking BGB. According to the BGB whitepaper, there are plans to introduce a buyback and burn mechanism in the future, further enhancing the value and scarcity of BGB.

Exploring high-quality assets, deepening spot layout

In this round of market, many platforms have chosen to list a large number of projects, regardless of the quality of the projects.

Of course, data shows that Bitget has also listed many projects, with a total of 186 new assets listed in 2024 Q1, ranking third among all platforms. However, after communicating with Bitget's listing team, it was revealed that Bitget's listing strategy is not simply about quantity.

Source: Bitget

Bitget has clear quantitative standards for evaluating new assets and does not primarily rely on business and channel recommendations for projects, but rather conducts research-driven exploration of high-quality assets from top to bottom. In an interview, Bitget's research institute revealed three key principles for listing: value-driven, efficiency-oriented, and comprehensive radiation. Bringing wealth effects to platform users and putting user interests at the center is the starting point for Bitget's development.

To create more opportunities for profit, the assets listed on Bitget either have short-term growth expectations or are of high quality with long-term growth prospects. Examples include ORDI, a leading asset in the BRC20 track, TIA, a modular blockchain leader, and GAS, the fuel token for the public chain Neo. Thanks to early listings, Bitget has become the dominant market for these tokens, second only to Binance and OKX.

For early popular tokens, Bitget strives to list them as soon as possible to help users capture valuable time windows. For projects that surge again due to major positive news, Bitget has an interesting strategy. They may not immediately list the token, as it could lead to short-term losses for users chasing highs. Instead, Bitget will choose the right time to list the token. A community user, Alice, mentioned that Bitget did not initially have the GAS token, but shortly after a major positive news for GAS in October last year, Alice noticed Bitget's announcement of listing GAS. Initially, she did not pay much attention, but GAS subsequently surged 10 times in the following two weeks, bringing substantial gains to users who got in at that time.

For a trading platform, finding a balance between the quantity and quality of listed projects is a difficult challenge.

Bitget COO Vugar Usi stated in an AMA that spot trading will be the focus of Bitget's strategic direction in 2024, continuously enriching the variety of tokens, actively seeking potential projects, and introducing different spot trading zones. As of now, Bitget has listed over 750 available tokens and over 820 spot trading pairs.

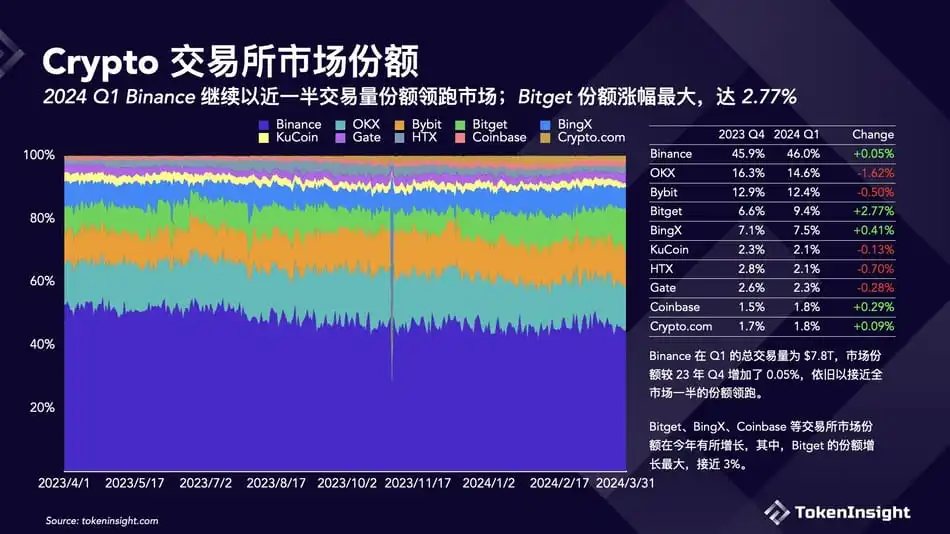

Based on the data, Bitget's spot strategy has achieved good results, successfully striking a balance between the two. TokenInsight data shows that in Q1 2024, Bitget's market share saw the largest increase, approaching 3%. According to the "2023 CEX Market Report" recently released by 0xScope, Bitget's comprehensive market share has risen to fourth place and its spot trading has grown rapidly. Additionally, the growth of spot trading has also contributed to Bitget's performance in the traditional advantage battlefield of futures contracts. Coinglass data shows that Bitget's BTC and ETH futures contract positions have continued to rise, ranking second and third among futures trading platforms.

Source: TokenInsight

User-centric, shaping a top-tier platform

In just six years, Bitget's growth to become the fourth-largest trading platform is not accidental. Among Bitget's four corporate values, the first is "user-centric," indicating that its business decisions are based on user needs rather than the actions of friendly competitors.

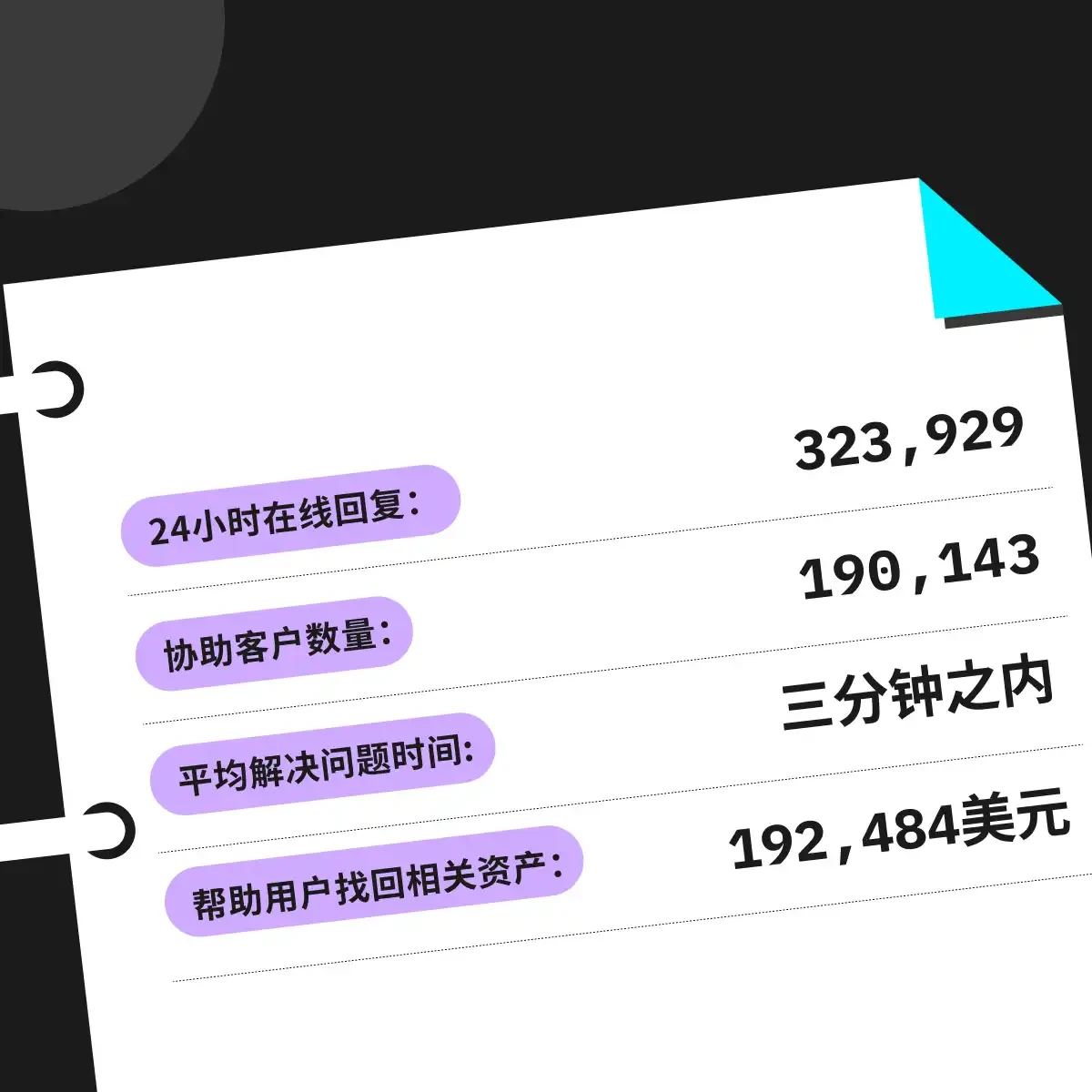

Bitget's quarterly report shows that it has collaborated with over 190,000 clients and provided support with an average response time of less than 3 minutes. In addition, it has helped clients recover over $190,000.

Source: Public information compilation

When asked how Bitget became a top-tier global platform, Vugar Usi believes that as the cryptocurrency industry matures, the competition among trading platforms will not be limited to just the platform or trading itself, but will encompass the entire cryptocurrency ecosystem.

In fact, Bitget has already built a diversified cryptocurrency ecosystem through industry-wide layout. It has acquired the decentralized wallet Bitget Wallet, supported VC firms like Foresight Ventures, invested in emerging public chains like Morph, covering multiple upstream and downstream segments of the cryptocurrency industry chain.

Another reflection of Bitget's current position is its exclusive partnership with football superstar Lionel Messi. Shortly after Binance announced the signing of "King of the Champions League" Cristiano Ronaldo before the 2022 World Cup, Bitget reached a partnership with another football GOAT, Messi. As two of the most influential football stars globally, Ronaldo and Messi have competed on the World Cup stage, and signing Messi alongside Ronaldo reflects Bitget's determination to challenge the industry leader.

In addition to leveraging Messi's unparalleled global influence to promote the cryptocurrency industry, Bitget's ability to partner with Messi also stems from the parallel development of its journey and Messi's growth experience, a "coincidence" from being once overlooked and underestimated, quietly working hard in the shadows where the spotlight couldn't reach, to eventually gaining the attention of the world and the industry.

Source: Bitget

Bitget's six-year development journey has also witnessed the rise and fall of many cryptocurrency platforms. Bitget adheres to the concept of "long-termism," bringing substantial returns to users and making significant contributions to the development of the cryptocurrency industry. This is Bitget's story, as well as a microcosm of growth for every "serious" cryptocurrency enterprise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。