Original | Odaily Planet Daily

Author | Azuma

Last weekend, Blast officially announced the details of the distribution of the second phase of "Blast Gold" and announced that it will distribute a total of 10 million "Blast Gold" to 70 ecological projects this week.

As an evaluation index independent of the increasingly "inflated" ordinary points system, due to Blast's previous explicit statement that 50% of the airdrop share will be allocated to "Blast Gold" holders, this "Blast Gold" is also considered the most valuable on Blast.

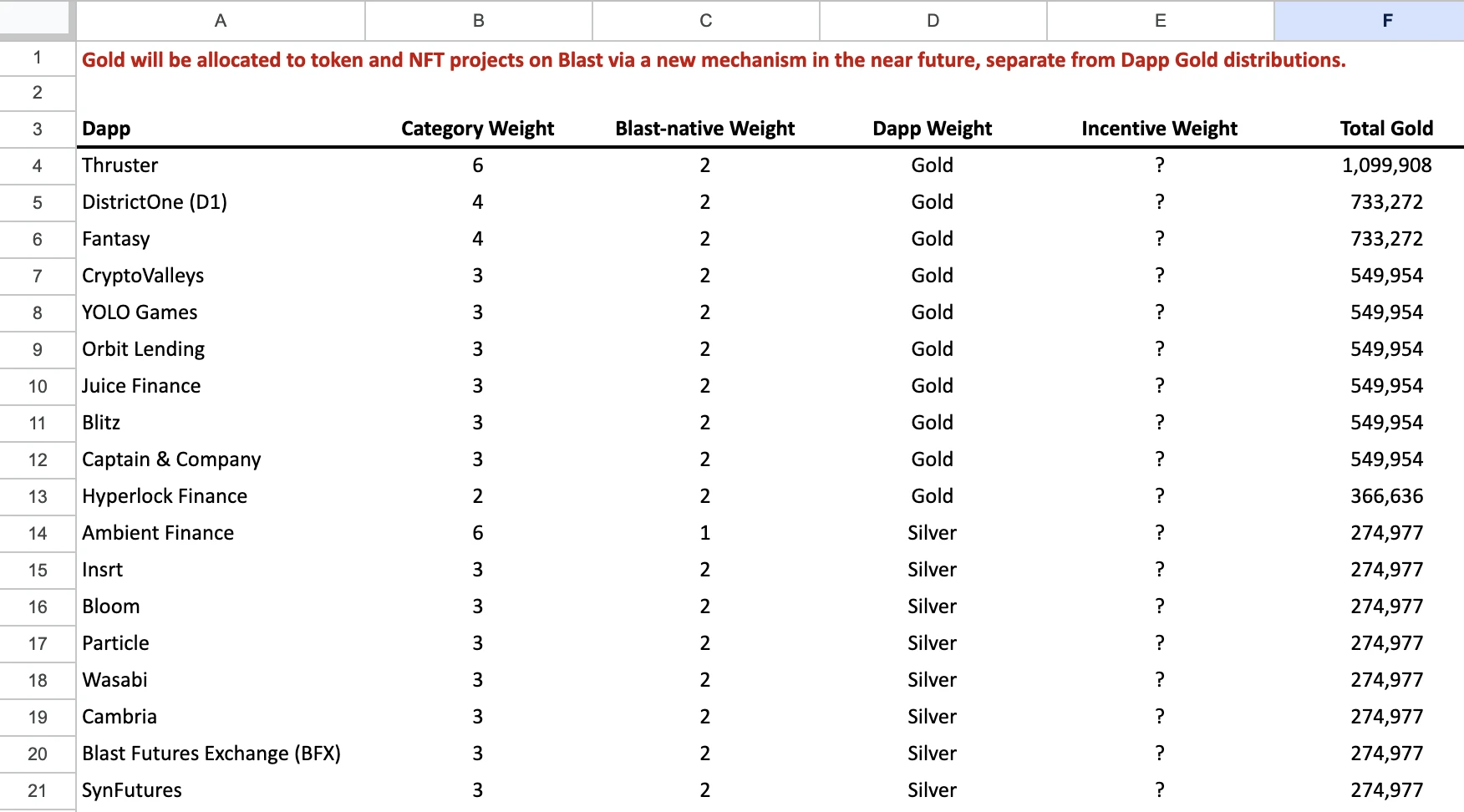

Compared to the first phase of distribution opportunities, the total amount of this phase's "Blast Gold" (10 million) has not changed, but the number of selected projects has been halved (from 140 in the first phase), and Blast has used a new algorithm in this phase's distribution — Race Track Weight (used to evaluate the importance of the track to the ecology) * Native Level Weight (used to evaluate the depth of the project's binding to Blast ecology) * Application Design Weight (used to evaluate whether the project design fits Blast's characteristics) * Incentive Effectiveness Weight (used to evaluate whether the project effectively distributed points).

Based on this algorithm, there have been significant changes in the distribution of this phase's "Blast Gold", the most obvious changes are: first, the difference in the amount of distribution between head projects and long-tail projects has been further widened; second, SocialFi projects have generally received larger amounts due to the higher "Race Track Weight"; third, some projects that have experienced security incidents such as Pac Finance and Munchables missed out on all "Blast Gold" shares in this phase due to a "Application Design Weight" score of 0.

For details on the distribution of this phase's "Blast Gold", users can refer to the official chart.

So, how can one efficiently use funds in this phase's distribution to earn more "Blast Gold"? In the author's personal experience, it can generally be achieved through three parallel strategies for earning points.

Strategy One: Stable Play with Large Funds

The first type of strategy is more suitable for large funds. Due to Blast's ecology being known for its "chaos", for the sake of fund security, it is recommended that users invest large funds in ecological head projects such as Thruster, Juice, Orbit, or projects that have received investments from well-known institutions.

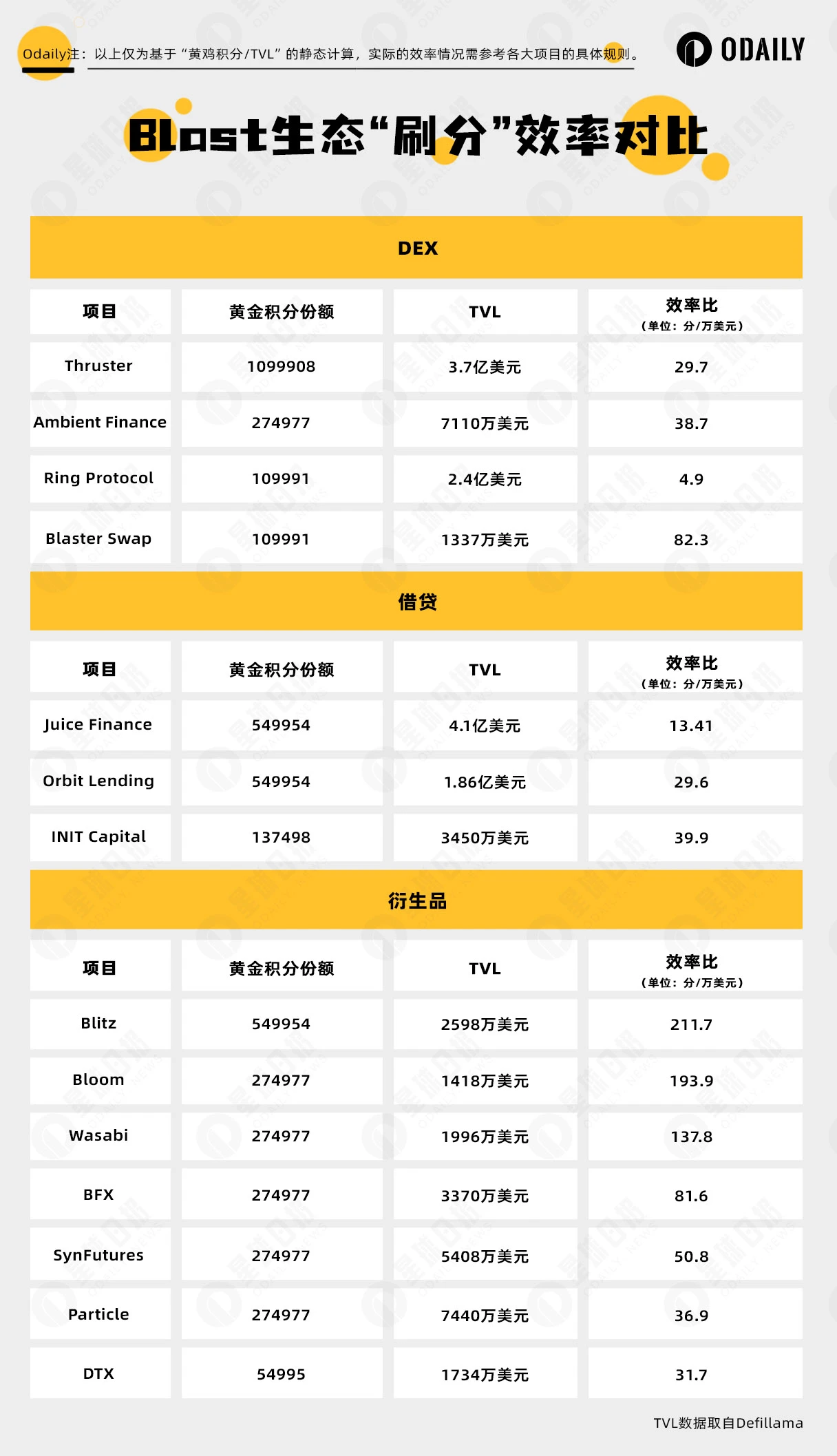

These projects are mainly common DeFi types of DEX, lending, and derivatives. We will compare the "point earning efficiency" (share/TVL) of these projects in the table below. For security reasons, we have only selected a few relatively well-known projects for each sub-category.

It should be noted that the table above is only a static calculation based on "Blast Gold/TVL", and the actual efficiency situation needs to be based on the specific rules of each major project.

Strategy Two: Leveraged Play with Small Funds

In addition to the simplest and most stable methods such as lending and providing liquidity, there are also many leveraged opportunities for "Blast Gold" within the Blast ecosystem. These opportunities offer greater profit potential, but relatively higher liquidity and liquidation risks, making them more suitable for trying out with a small proportion of funds. Here are a few examples.

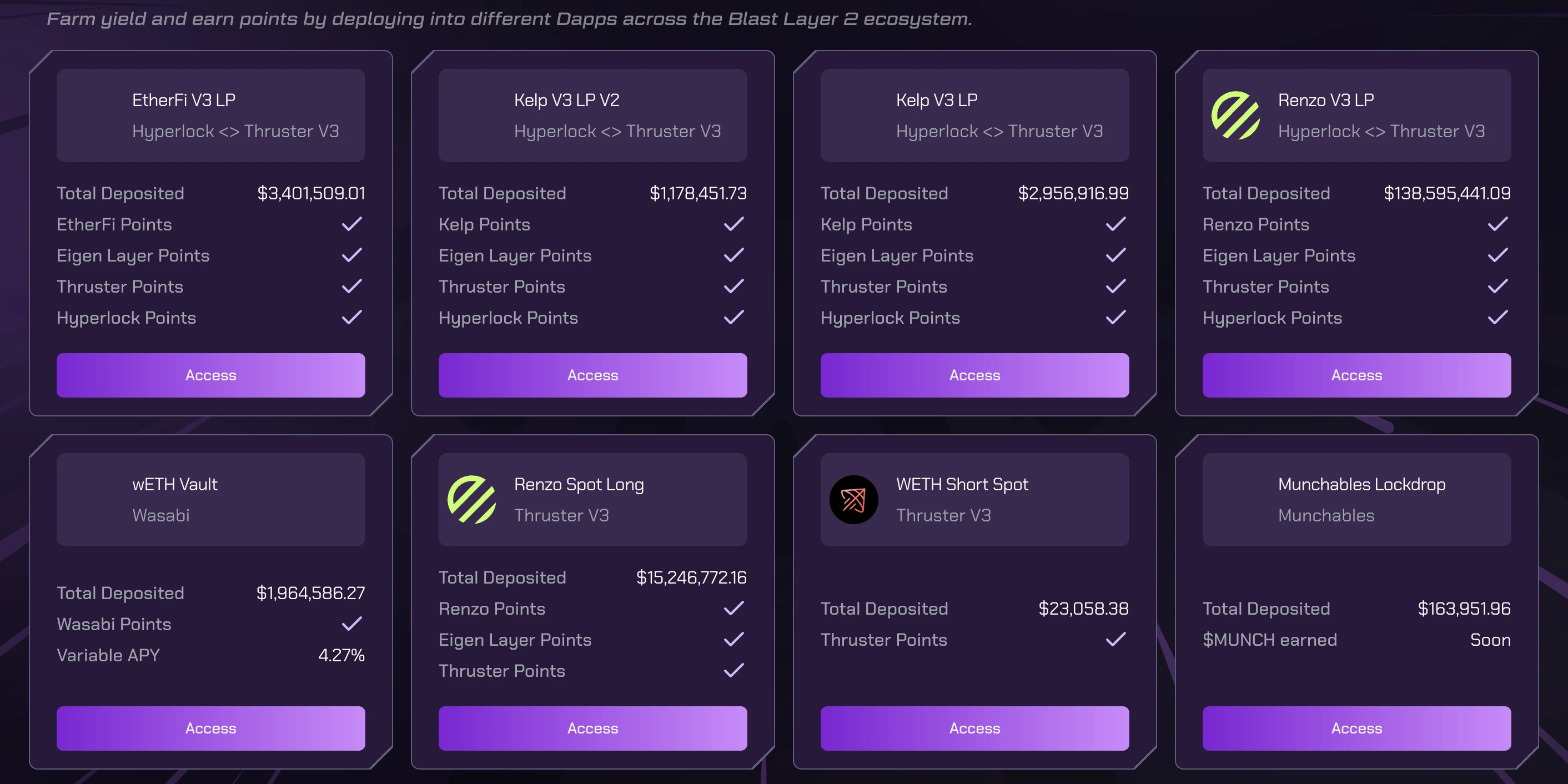

For example, between lending protocols Thruster, Juice, and yield optimization protocol HyperLock, there are multiple combination income strategies for USDB and WETH. Taking the Renzo V3 LP strategy in the following figure as an example, users can simultaneously earn Renzo points, Eigenlayer points, Thruster points, Juice points, HyperLock points, Blast points, and Blast "Blast Gold" by "leveraging lending in Juice, providing liquidity in Thruster, and optimizing collateral in HyperLock".

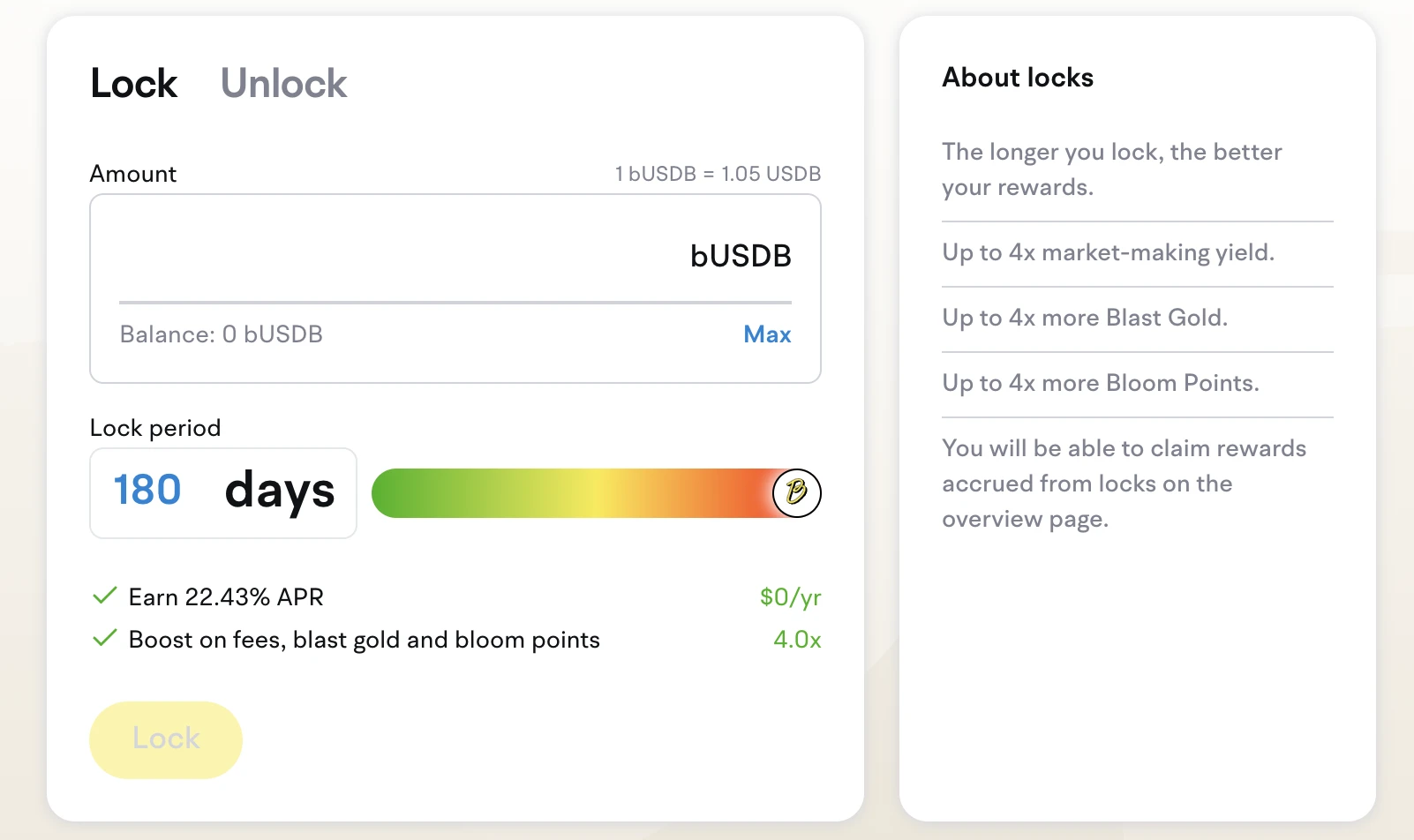

In addition, some protocols also provide different incentives to different users through conditions such as lock-up. For example, the derivative project Bloom mentioned in the previous table, users can selectively lock up for 30 to 180 days (or choose not to lock) when providing liquidity on the platform, in order to gain 1.2 to 4 times the points (including "Blast Gold") compared to regular users. However, this method is only suitable for users with low liquidity requirements and is not recommended for large funds.

Strategy Three: Accelerated Play in Niche Tracks

From the beginning of its creation, Blast has mentioned that its positioning is a Layer2 primarily serving DeFi. This positioning also means that the Blast ecosystem has many DeFi projects and a large capital scale. Based on this background, instead of competing with whales in the DeFi track, it is better to choose some relatively niche tracks to accelerate point earning. Here are a few simple examples.

In the distribution of the second phase of "Blast Gold", the two major SocialFi projects, DistrictOne and Fantasy, both received over 730,000 "Blast Gold" shares, ranking second in shares. Fantasy as a new project about to launch on the mainnet has a great expectation for point earnings. Currently, the early airdrop activity for Fantasy is still ongoing, and users can prepare for the upcoming "Blast Gold" distribution by connecting their X account, verifying their wallet, and then completing the airdrop tasks provided by Fantasy's smart contract account.

In addition, the battle-type blockchain game project Captain & Company also received nearly 550,000 "Blast Gold" shares in this phase, and players who like sea battle themes can earn points while playing.

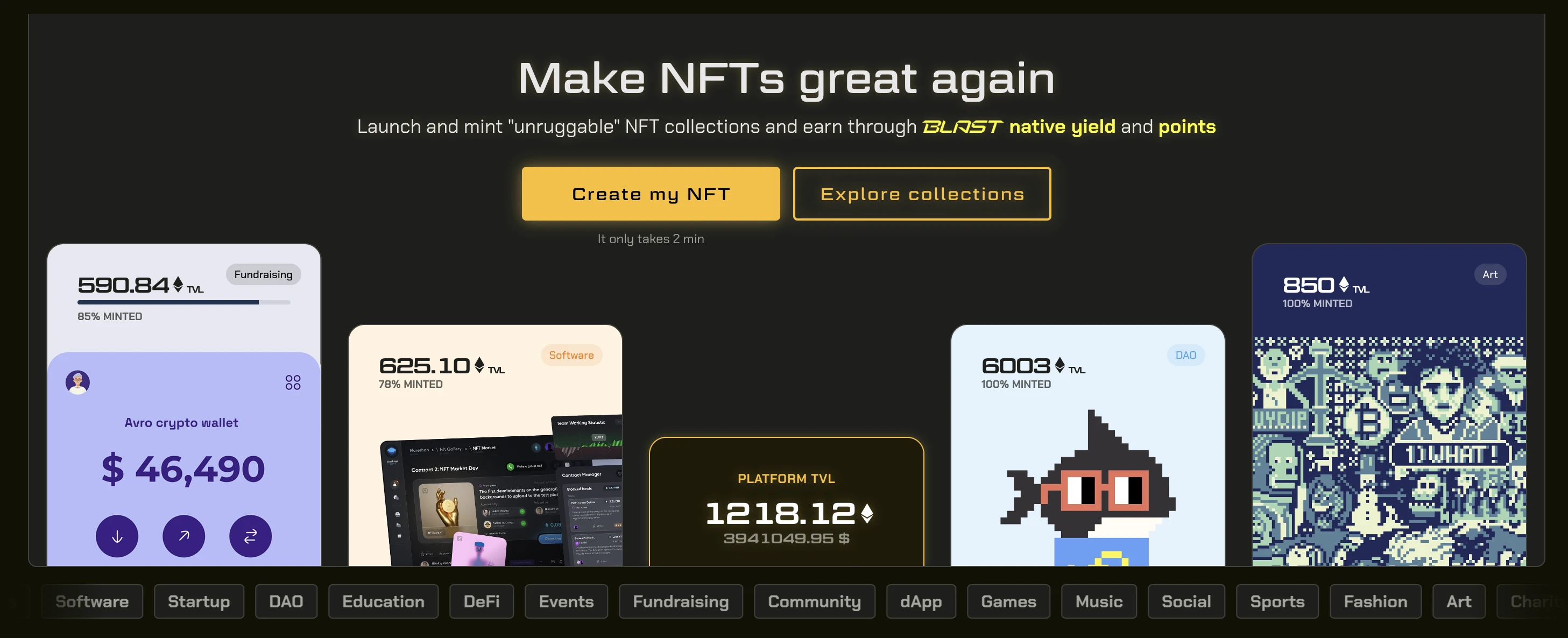

For example, in this phase, the NFT project BLASTR, which has received 90,000 "Blast Gold" but only has a TVL of a few million dollars, provides a refundable NFT minting mechanism and promises to distribute 100% of the "Blast Gold" to the community, with 50% being distributed to the creators of the NFT. However, it requires the NFT series to have at least 100 holders, and the funds (refundable) in the minting contract must exceed 5 ETH. For ordinary users who cannot meet the creator threshold, they can also choose NFT series that promise to distribute "Blast Gold" to the minter to team up for earning points.

There are countless paths, but safety comes first.

In conclusion, due to the official incentives of Blast, the number and variety of projects in the ecosystem are quite rich, allowing users to have countless strategies to earn "Blast Gold" in the ecosystem. The above content is only a brief summary based on the author's personal interaction experience over the past period, and does not represent the most efficient point-earning strategy, but it is enough to help many users who are not familiar with the Blast ecosystem to avoid some detours.

It is important to note that the Blast ecosystem is known for being "wild", so it is essential to personally conduct due diligence before interacting with various projects, including but not limited to checking financing history and audit materials. I personally recommend that ordinary users try to interact with head projects with higher TVL and point shares, as safety is the premise of everything.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。