Preface: Investment involves risks, please proceed with caution.

Article review takes time, and there may be delays in publication. The article is for reference only, and your readership is welcome!

Time of writing: 12:39, April 24th, Beijing time

Market Information

Tesla did not sell its $711 million worth of Bitcoin holdings in Q1 2024, marking the seventh consecutive quarter without selling Bitcoin.

Arthur Hayes: Currency printing is accelerating, and investors should boldly increase their holdings of cryptocurrency assets.

Co-founder of Kinto: BlackRock realizes that risk-weighted assets are a "tens of trillions of dollars opportunity."

Tesla did not sell Bitcoin in the first quarter and continues to hold the asset. (COINOTAG)

The US SEC delays the decision on Grayscale's application to convert Ethereum Trust into an ETF.

Market Review

Due to some delays recently, there has been a hiatus for a period of time, and I seek everyone's understanding! Despite the hiatus, the market has followed my predicted direction. Interested friends can refer to my previous article, where I mentioned that there would be a rebound in the market, followed by a decline. The highest point of the rebound for Bitcoin was at 72,797, breaking below 71,888, and then starting to decline. The lowest point of the decline was at 59,600, slightly deviating from my predicted point of 61,700. However, as long as the direction is correct, making money should not be a problem. Due to the lack of timely updates during this period, I couldn't provide firsthand strategies to everyone. I hope that everyone has made good profits from this rebound and decline.

The trend of Ethereum has also been largely as expected. The highest point of the rebound was at 3,735, followed by a decline, which was quite strong, directly dropping to 3,791, breaking through the 3,000 mark. The trend is similar to Bitcoin, with a generally correct direction but some deviation in points. Due to the lack of timely updates, I hope everyone has made profits in the recent market conditions.

Market Analysis

BTC:

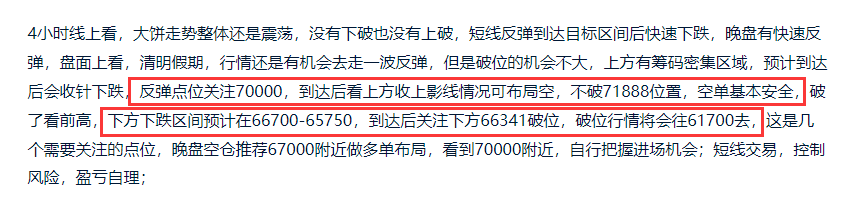

Looking at the 4-hour chart, Bitcoin has been oscillating at high levels, and the decline has reached the previous short-term low point, followed by a rebound from the short-term support level. Currently, there is not a strong resistance level for Bitcoin at its current position. The pressure zone for upward movement is between 67,800 and 70,000, which is a concentrated area of chips. There will be relatively strong resistance after reaching this position following the rebound. Short-term trading-wise, there is still room for a rebound in Bitcoin. After reaching the 67,800-70,000 range, short positions can be established once a long upper shadow appears. In white-plate trading, Bitcoin's support near 66,200 can be used for layout. It should not be a problem to capture a small short-term opportunity near the upper pressure zone and then open a short position once a long upper shadow appears. The best position is near 70,000. Manage risk in short-term trading, and take care of profits and losses.

ETH:

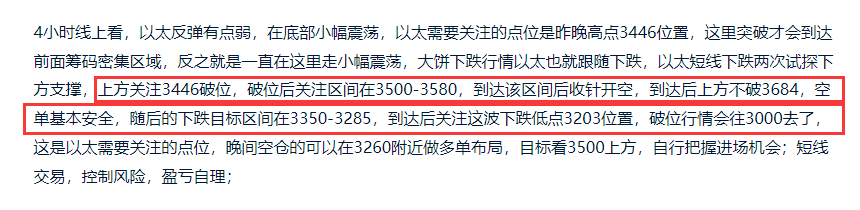

Looking at the 4-hour chart, Ethereum's overall trend is relatively weaker compared to Bitcoin. The rebound to 4,093 was relatively weak, and the subsequent decline directly broke through the short-term low point of 3,056 to reach 2,852. The rebound of Ethereum is not as strong as Bitcoin's. Reaching 3,395 in this rebound would be good, and it is expected to be difficult to reach the 3,540 level. There should be another low point in the subsequent decline. In white-plate trading, pay attention to Ethereum's situation near 3,395. The pressure for Ethereum in the white-plate is near 3,260. After reaching this level last night, there was a slight oscillation and decline in the short term. There will be another opportunity to challenge the pressure level in the short term, aiming for 3,395. In white-plate trading, layout near the support of 3,190, and do not enter if there is no opportunity, as the upper pressure is already being tested. After rebounding to around 3,395, pay attention to the closing situation of Bitcoin in the upper pressure zone, and establish a short position once a long upper shadow appears. Manage risk in short-term trading, and take care of profits and losses.

In summary:

The short-term rebound of Bitcoin and Ethereum has not yet reached its peak. Pay attention to the closing situation after reaching the pressure zone before considering opening a short position.

This article is time-sensitive. Pay attention to the risks. The above is only personal advice and is for reference only!

Follow the public account "加密老赵" to explore the market together.

What you think you hear is an opinion, but in reality, it is often just noise. In the market, opinions are even cheaper than cabbages in the market, and are not worth anything. You need to have the ability to distinguish between opinions and facts. At any time, when anyone expresses something, try asking yourself: Is he stating a fact or an opinion?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。