原创|Odaily星球日报

作者| Golem

什么是RBF

RBF全称为Replace By Fee,即替代付费,是比特币加速交易的一种方式。它允许用户将一笔未确认的交易替换成一笔新的更高手续费的交易,以达成加速交易的目的。只要新的代替交易附带足够高的手续费,矿工就有动力打包代替交易入块。

不过使用RBF的要求是,创建的代替交易必须使用与原交易一个或多个相同的UTXO作为交易输入。

为什么能够使用RBF 狙击比特币交易

根据上述所说的使用RBF的要求,一般来讲我们不能替换别人的交易,因为无法获取别人的签名授权,使用不了别人交易中的UTXO。

但因为目前基本所有比特币交易市场使用的签名都是PSBT(部分签名的比特币交易),使我们有了狙击其他比特币交易的可能。简单来讲,卖家会在上架资产时将签名私下授权给市场,签名内容可通俗理解为“当收到xxx BTC时同意将资产卖出”,当有买家愿意交易时,市场将买卖双方这两部分签名组合成一个完整的签名交易广播到内存池。

而进入内存池后,因为比特币网络的透明性,卖家的签名就不再只有市场知道,而是暴露在所有人眼下。因此我们就可以拿到卖家的签名授权,使用RBF功能重构一笔高手续费的代替交易完成狙击,使原买家的交易作废,竹篮打水一场空。

如何使用RBF狙击比特币交易

RBF本身在技术上具有一定的复杂性,一般的交易者要想熟练使用它具有一定门槛。好在市场上已经有人开发出了相关狙击工具,即使小白也能使用,下面我们就拿Magisat提供的狙击工具做教程。

1、复制待狙击交易的交易id

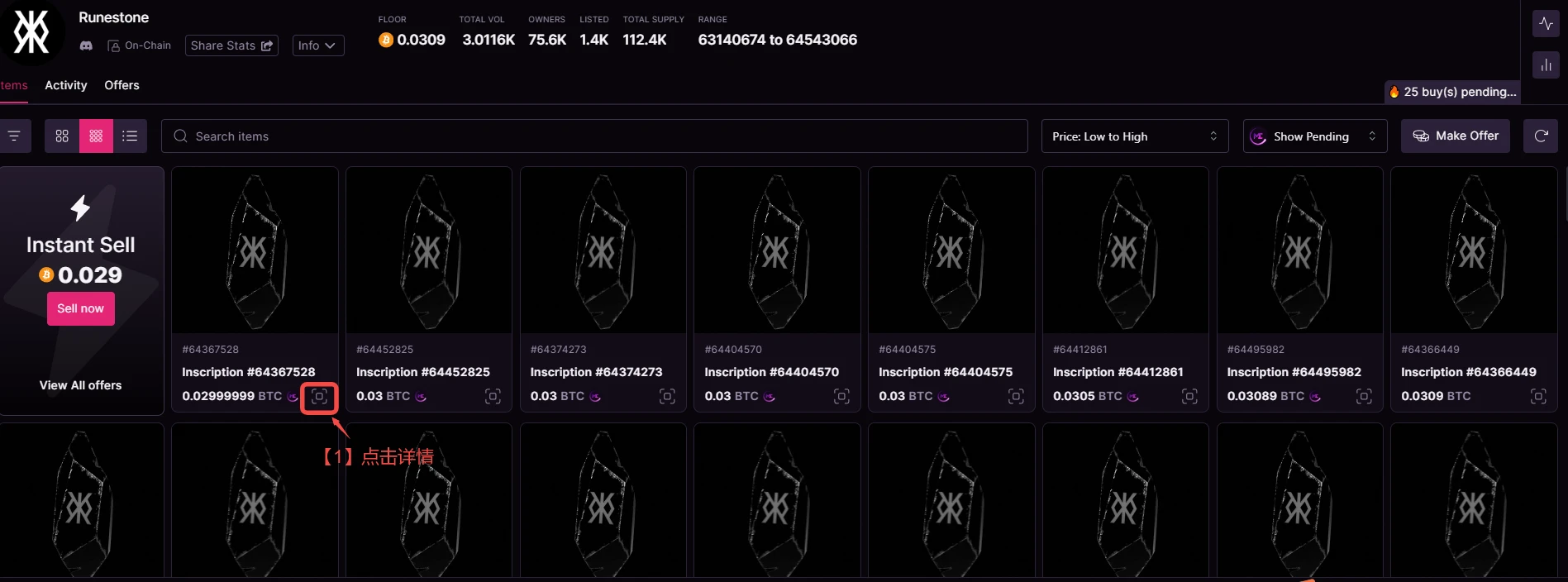

以Magic Eden为例,如果我们现在想要狙击Runestone的交易,首先打开Runestone的交易界面,点击详情

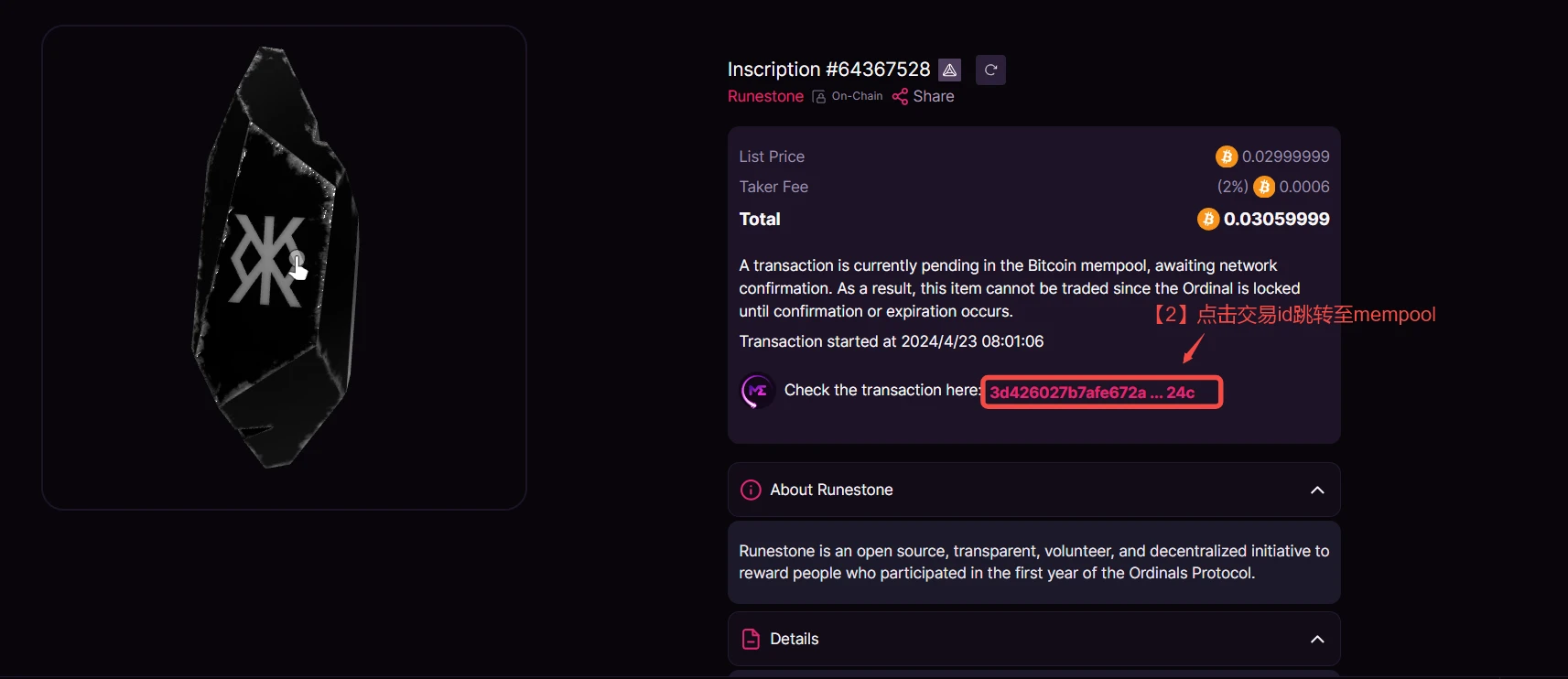

然后在下面的交易详情页点击交易id跳转至mempool

最后在mempool中,复制这笔交易id,同时记住这笔交易的费率,因为待会狙击时费率一定要比原交易高才行。

2、使用Magisat平台工具完成交易狙击

Magisat是一个比特币NFT交易平台,该平台同时上线了即时狙击的工具。点击下面链接进入工具:

https://magisat.io/instant-snipe

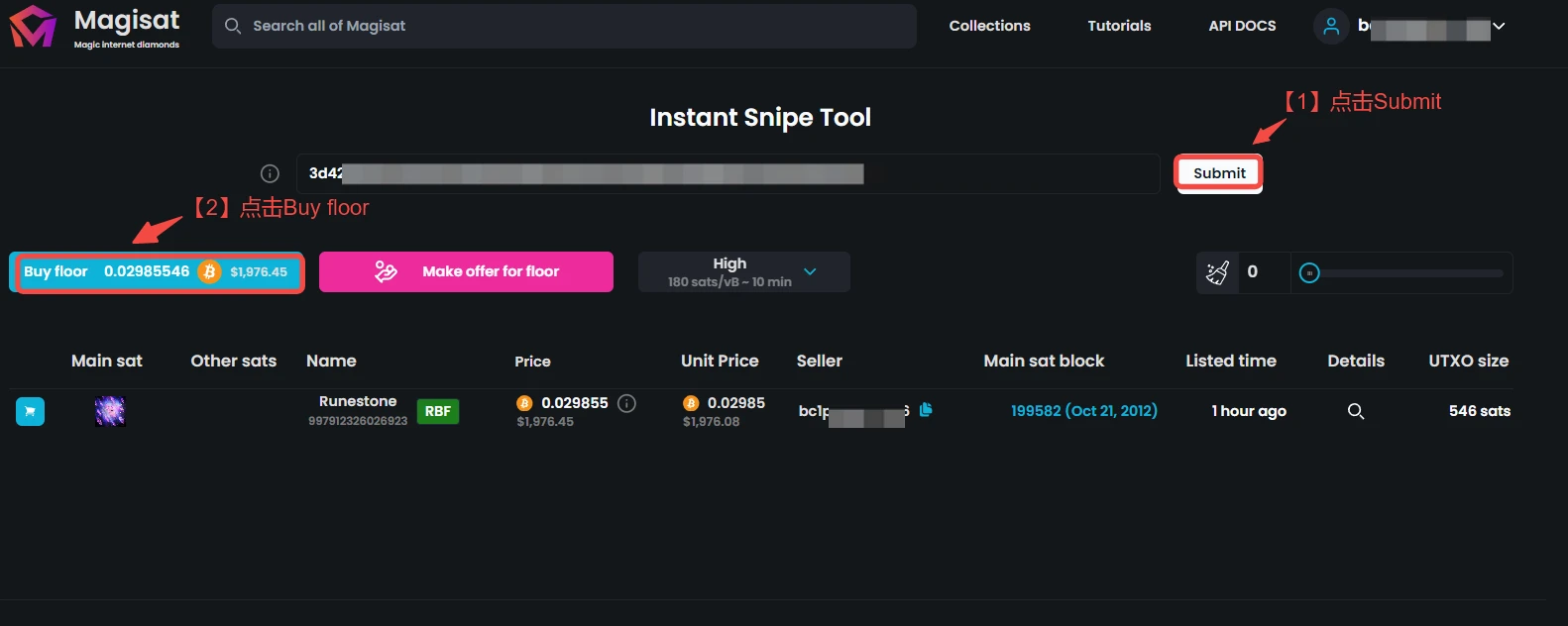

然后将刚刚复制的交易id粘贴到搜索框,先点击“Submit”,可以看见下方已经出现了该笔交易的详细信息,然后我们再点击“Buy floor”

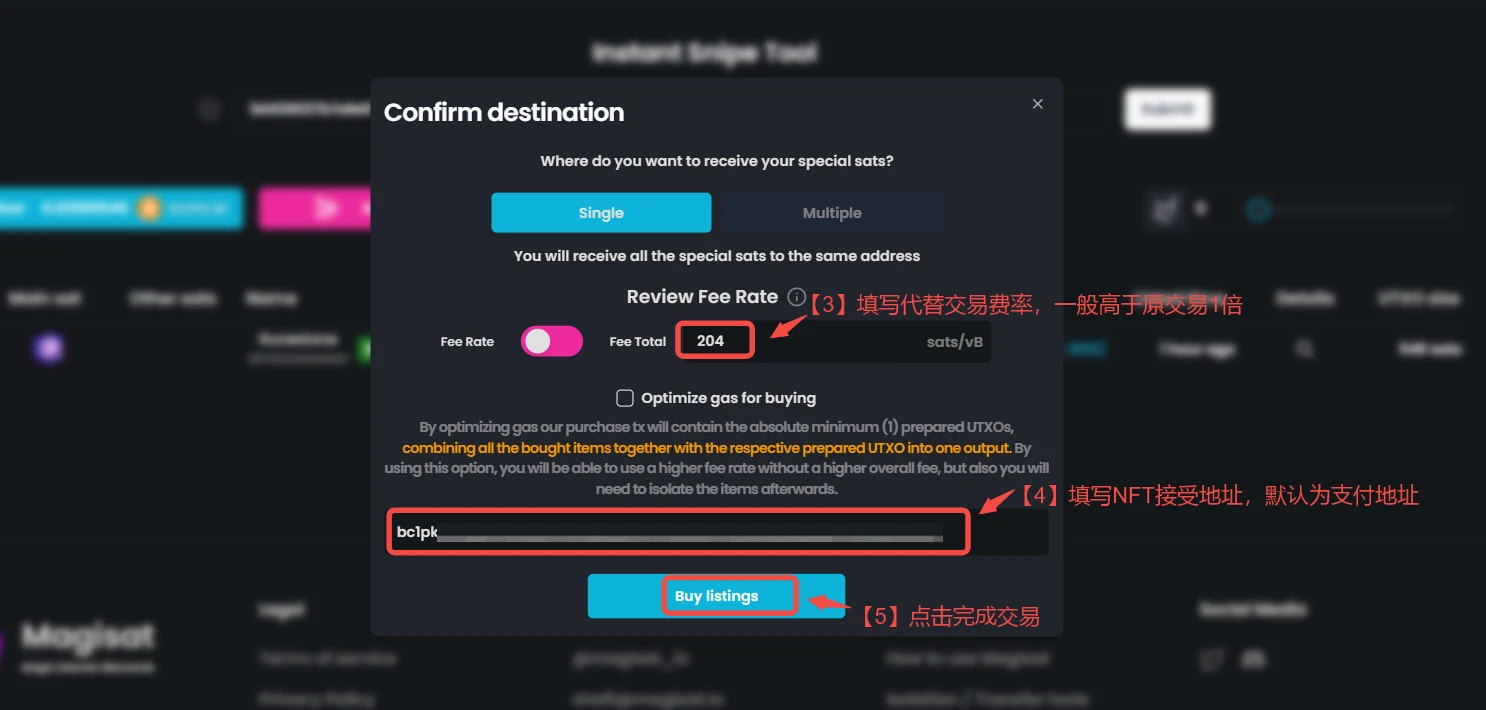

到了创建交易的页面,如下图首先设置费率,为狙击成功一般要高于原交易的一倍;然后填写runestone接收地址;最后点击Buy listings弹出钱包签名确认交易即可。

此时如果返回mempool中查看原交易,如下图,会显示该交易已经被代替为新交易,并且下方还展示了代替交易的历史。

提示:以上教程所选例子只是作为演示,并没有狙击例子中的交易

目前使用这种方式可以狙击比特币NFT和BRC20的交易,Runes资产估计也将在不久后支持。同时需要注意的是并不是所有狙击都能成功,这跟矿工/矿池有很大的关系,如果打包下一个区块的矿工/矿池不支持RBF功能,那么尽管你已经代替了交易,它们依然会打包原交易进块。不过从利益角度来说,为得到更高手续费收入,矿工支持RBF似乎是个必然事件。

如何防止被人狙击

换位思考,如果我们自己是买家当然不希望自己的交易被别人狙击,那么有什么办法能够防止自己的交易不被狙击呢?

可能有读者会觉得既然狙击交易本质上是使用的RBF功能,那么只要在签名时禁用RBF就可以避免了。但这样实际也不能完全避免,这样的禁用最多是禁用自己不能使用RBF功能,矿工照样可以将替换过后高手续费的交易打包进块。

所以现在唯一可靠的办法就是在购买资产时拉高gas尽快过块,避免交易被卡给狙击者足够的时间操作。当然,如果实在运气不好遇到半小时不出快的情况而被狙击,也可以根据上述教程进行反狙击。

总结

区块链是个名副其实的黑暗森林,所有人都是躲在暗处的猎手,一边担心暴露自己一边伺机而动捕猎别人。在比特币上使用RBF狙击交易实际和以太坊中的“夹子机器人”类似,只不过随着信息差缩小和工具的出现,狙击比特币交易的门槛已经变低,达到人人可用的地步。

即使你不想作为猎手狙击别人的交易,但也应该掌握方法以在关键时刻进行反狙击。毕竟最好的防守就是进攻。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。