○/Title: Lao Li Mortar

I. Key Macro-Economic Data and Cryptocurrency Market Events Preview for This Week:

April 22 (Monday): Chicago Fed National Activity Index for March in the United States. ID will unlock 18.49 million tokens worth approximately 15.29 million USD, accounting for 4.29% of the circulating supply.

April 23 (Tuesday): Preliminary April Composite PMI in Japan; Preliminary April Manufacturing PMI in the Eurozone; Preliminary April Markit Manufacturing PMI in the United States; New Home Sales for March in the United States; Tesla to release financial report. SAFE Token will be transferable; Magic Eden will launch the Runes platform.

April 24 (Wednesday): Speech by ECB Executive Board Member Schnabel; Preliminary March Durable Goods Orders in the United States; Speech by ECB Executive Board Member Schnabel; Earnings reports from Meta, Qualcomm, and IBM.

April 25 (Thursday): Release of Monetary Policy Meeting Minutes by the Bank of Canada; Annualized Q1 Real GDP and Core Personal Consumption Expenditures (PCE) Price Index for March in the United States; Economic Bulletin release by the European Central Bank; Earnings reports from Google and Microsoft. Magic Eden will launch Base.

April 26 (Friday): Press conference by the Governor of the Bank of Japan, Haruhiko Kuroda, on monetary policy; PCE Price Index for March in the United States; Personal Income for March in the United States; Final value of the 1-year inflation expectation from the University of Michigan for April in the United States.

April 28 (Sunday): The first phase of the point reward program on io.net will end; Blast will announce the details of the second phase of "Gold Points" distribution, totaling 10 million "Gold Points".

II. Recap of Key News in the Cryptocurrency Industry (Exclusive Compilation):

Data Aspect: The cryptocurrency market welcomed a series of important data this week. Projects such as YGG, ID, and AGIX will undergo large unlocks, injecting new vitality into the market. Meanwhile, Bitcoin miners' income reached an astonishing 107 million USD, setting a new historical high. This data once again demonstrates Bitcoin's dominant position in the cryptocurrency market. Additionally, it is worth noting that BTC has completed its fourth halving, reducing mining rewards from 6.25 BTC to 3.125 BTC, which has garnered widespread attention in the market. Furthermore, data shows that a total of 85 billion USD in cryptocurrency is stored in Safe, while seven leading mining companies collectively hold Bitcoin worth 2.79 billion USD. These data not only reflect the prosperity of the cryptocurrency market but also reveal its enormous potential.

Project and Platform Aspect: Grayscale recently disclosed the fees for its mini version of GBTC, providing investors with more options. Additionally, the co-founder of Chainlink expressed expectations for the continuous launch of more cryptocurrency ETFs this year, injecting new momentum into the development of the cryptocurrency market. The dynamics of these projects and platforms not only drive innovation in the cryptocurrency market but also enhance its overall competitiveness.

Macro Policy and Regulatory Aspect: The U.S. Internal Revenue Service recently released a draft of the digital asset tax form, signaling the accelerated standardization of cryptocurrencies in the tax field. Additionally, the proposal of stablecoin regulations in the United States has also garnered widespread attention in the market. Meanwhile, regulatory agencies in countries such as South Korea, Japan, and Singapore are actively considering approving spot Bitcoin ETFs, which is expected to bring greater development opportunities to the cryptocurrency market. However, the formulation and implementation of regulatory policies still require caution to ensure the stability and healthy development of the market.

Institutional Research Reports and Perspectives: Numerous experts and market analysts have provided their own views on the future trends of the cryptocurrency market. The Bitcoin block reward halving is an important market event that may lead to bullish and skeptical opinions in the market. Meanwhile, an IMF report pointed out that BTC has become a necessary financial tool for preserving wealth in times of financial instability. Officials from the Federal Reserve have also given different predictions and views on future monetary policies. These perspectives and research reports provide investors with more reference information to better grasp the pulse and trends of the market.

III. Sharing of Hot Events and Interactive Communication:

The global financial markets have experienced ups and downs, with a series of major events affecting investors' sentiments. The Nasdaq's dismal performance, with a drop of over 2%, hit a new low since February, and tech giant NVIDIA suffered a heavy blow, with its stock price plummeting by 10%. This performance reflects the growing concerns in the market about the technology industry.

Meanwhile, the precious metals market has shown a different trend. COMEX gold futures closed at 2406.7 USD per ounce, indicating investors' preference for safe-haven assets. However, Brent crude oil fell by approximately 3.5% last week, indicating lingering concerns about oil demand in the market.

In the cryptocurrency market, Bitcoin completed its fourth halving, which holds milestone significance for the entire cryptocurrency market's future prospects.

In terms of macroeconomic policies, Haruhiko Kuroda, the Governor of the Bank of Japan, stated that the scale of Japanese government bond purchases will be reduced at some point in the future. This statement has sparked speculation about adjustments to Japan's monetary policy. Meanwhile, the U.S. Federal Reserve's semi-annual financial stability report highlighted that sustained inflation is seen as the top risk to financial stability. This further underscores the challenges faced by global central banks in addressing inflation issues.

In the technology industry, the U.S. House of Representatives once again passed a ban on TikTok, extending the sale deadline to one year. This move undoubtedly brings immense pressure to ByteDance. Meanwhile, Tesla reduced the prices of its Model Y, S, and X in the U.S. market, attracting widespread attention. However, the financial results released by Tesla after the market closed on Tuesday showed that its gross margin is likely far lower than that of BYD, raising concerns about Tesla's profitability.

Additionally, internal news from Tesla indicated that Musk is betting on the Robotaxi project, a decision that has raised concerns within the company. Despite Musk's enthusiasm for autonomous driving technology, the advancement of the Robotaxi project still faces numerous challenges.

In the consumer electronics sector, Apple is expected to directly release the M4 version of the Mac Mini by the end of the year, a development that has sparked high expectations among consumers and the industry. As an important part of Apple's product line, the release of the new Mac Mini will undoubtedly further solidify Apple's position in the high-end computer market.

In international politics, the U.S. House of Representatives passed a 950 billion USD aid package to provide assistance to countries such as Ukraine and Israel. This move demonstrates the proactive stance of the United States in international affairs. Meanwhile, U.S. Secretary of State Antony Blinken began his visit to China on Wednesday, which is seen as an important signal of the improvement in the relationship between the two countries.

IV. Interpretation of Important Events and Data by the Deepcoin Research Institute:

Regarding the completion of Bitcoin's fourth halving on April 20th this year and its impact on the cryptocurrency market, and whether it has already led to anticipated market trends, how will the future price of BTC evolve?

The Deepcoin Research Institute believes that the Bitcoin halving event was completed on April 20, 2024, and its impact on the cryptocurrency industry is multifaceted. Historically, Bitcoin halving is often seen as a catalyst for driving its price upward, as the reduction in the supply of new Bitcoin may increase its value. Following the halving, the mining reward on the Bitcoin network has been reduced from 6.25 BTC to 3.125 BTC, which may further impact miners' income and the supply-demand relationship in the entire cryptocurrency market.

For miners, unless the price of Bitcoin rises significantly, the halving may directly lead to a decrease in their income. This may cause the loss of some less efficient miners and may temporarily reduce the network's hash rate. From the perspective of cryptocurrency businesses or exchanges, if demand remains unchanged or increases, the reduction in the supply of new Bitcoin may increase market demand and sentiment, potentially leading to significant price fluctuations before and after the halving, tending towards an upward trend.

As for whether anticipated market trends have already occurred, this depends on various factors, including market sentiment, investor expectations, and the macroeconomic environment. Before the halving event, the market may have already anticipated the halving and made certain price adjustments in advance. However, whether anticipated market trends have already occurred specifically requires a comprehensive consideration of more market data and trend analysis.

Regarding the future evolution of BTC prices, this is also a complex and difficult-to-predict issue. Prices are influenced by numerous factors, including but not limited to market sentiment, investor participation, regulatory policies, and technological developments. Therefore, while it is possible to make certain predictions based on historical trends and current market conditions, the specific price evolution remains full of uncertainty.

Historically, there have been bull markets after halvings, but the volume, price, and time are completely different, so there is no need to be overly anxious. Some market predictions suggest that by the end of 2024, the price of Bitcoin may surpass a specific level. However, these predictions are based on current market conditions and expectations, and the actual price evolution may be influenced by many unpredictable factors. Therefore, for market participants, it is important to remain vigilant, closely monitor market dynamics, and make wise decisions based on their risk tolerance and investment objectives.

V. Institutional Perspectives + Overseas Views:

Overview: Bitcoin is currently at the top of a critical demand area, receiving strong support from a large number of addresses at relatively high average prices. After the Bitcoin halving, miners may turn to the field of artificial intelligence due to the potential for higher income. Several mining companies have already generated income or have development plans in this area. Hedge fund manager Anthony Scaramucci firmly believes that the market value of Bitcoin will eventually surpass the 16 trillion USD market value of gold and believes that regulatory approval of BTC ETFs will drive this process. Since the halving, Bitcoin's stock-to-flow ratio has exceeded that of gold. The average fee per Bitcoin transaction has decreased after the halving but remains high. Matt Hougan, Chief Investment Officer of cryptocurrency asset management company Bitwise, pointed out that the price rebound after the Bitcoin halving is a "buy on news" opportunity, especially from a long-term perspective. After the past three halvings, the price of Bitcoin rebounded within a year, demonstrating the positive impact of supply contraction on prices. The following is a detailed content:

Cryptocurrency analyst Willy Woo tweeted that according to his BTC price model, the index-type bull market for Bitcoin has not yet begun. He explained that this cycle may be a hybrid of the strong demand in 2013 and the spot-dominated market in 2017 in structure. His model is based on a combination of three different price models: the VWAP price of on-chain "investor" trading volume, realized price (cost basis), and the CVDD price of old hands selling (also known as the "bottom" model).

According to IntoTheBlock monitoring, Bitcoin is currently at the top of a critical demand area, with 1.66 million addresses purchasing Bitcoin at an average price of 64,800 USD. If the market faces further downward pressure, this price point may become a strong support level.

CoinShares (CS) stated in a recent report that after the Bitcoin halving, cryptocurrency miners may turn to artificial intelligence in energy-secure areas. Coinshares pointed out that mining companies such as BitDigital (BTBT), Hive (HIVE), and Hut 8 (HUT) have already generated income from artificial intelligence. Meanwhile, TeraWulf (WULF) and Core Scientific (CORZ) have either business or plans for development in this field.

Hedge fund manager Anthony Scaramucci believes that the market value of Bitcoin will eventually surpass the 16 trillion USD market value of gold. In an interview with CNBC, the SkyBridge Capital founder stated that Bitcoin is a high-quality asset that has never been seen in the 5,000-year history of humanity. Scaramucci believes that Bitcoin still has a long way to go to reach the 16 trillion USD market value of gold, but he thinks that with regulatory approval of BTC ETFs, the gap will narrow over time.

According to Bitcoin News, the stock-to-flow ratio of Bitcoin has exceeded that of gold since the halving on Friday.

YCharts data shows that the average fee per Bitcoin transaction reached a historical high of 128.45 USD on the day of the halving, dropping to 34.8 USD on April 21. The total Bitcoin transaction fees on Sunday decreased from 81 million USD the previous day to 22.37 million USD.

Matt Hougan, Chief Investment Officer of cryptocurrency asset management company Bitwise, stated in an interview with CNBC Squawk Box that the price of Bitcoin has rebounded significantly after the halving, making it a "buy on news" event, especially from a long-term perspective. Hougan also mentioned that after the past three halvings, the price of Bitcoin rebounded within a year, demonstrating the positive impact of supply contraction on prices.

VI. Top Gainers in the Cryptocurrency Market Last Week and Selection of Hot Community Coins:

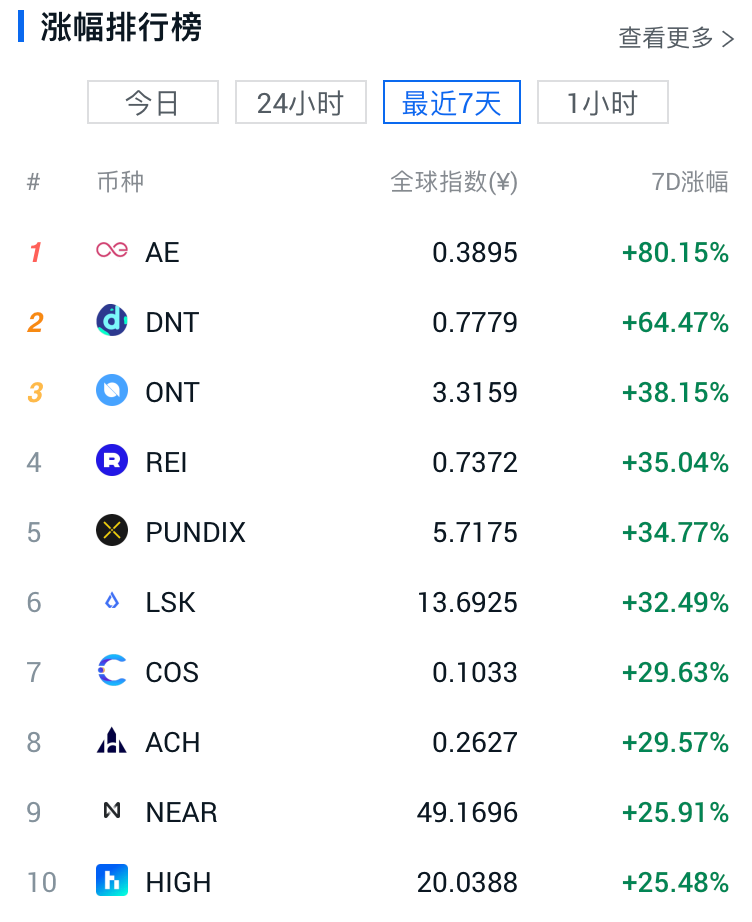

In this week's cryptocurrency market, the performance of altcoins is noteworthy. According to the latest data, the AE coin leads the market with an astonishing 80% increase, demonstrating its strong market potential. Following closely is DNT, with a stable increase of around 65%, indicating investors' confidence and approval of this coin. Additionally, coins such as ONT, REI, and PUNDIX also performed well, with increases ranging from 35% to 40%. The excellent performance of these coins not only demonstrates the vitality of the cryptocurrency market but also provides investors with abundant trading opportunities.

Looking ahead to this week, these strong-performing altcoins are still worth investors' attention. However, market hotspots can change at any time, so investors need to remain vigilant, closely monitor market dynamics, and be prepared to trade at the right time. It is also recommended that investors conduct thorough market analysis and risk assessment before making decisions to ensure the scientific and effective nature of their investment decisions.

In summary, the cryptocurrency market is full of infinite possibilities and opportunities. Investors need to maintain keen insight and flexible trading strategies to cope with market changes and challenges.

The following are the hotspots, selected as follows, for reference only and do not constitute trading advice:

Bitcoin halving completed, pre-market gains in the U.S. cryptocurrency sector, with Riot Platform up nearly 6%, Marathon Digital (MARA.O) up nearly 5%, Hut 8 up nearly 4%, and Coinbase (COIN.O) up 3%.

Market data shows that due to the news of Unibot's launch of three growth plans including recommendation systems, token repurchases, and rewards, UNIBOT briefly broke through 16.5 USD, currently trading at 16.37 USD, with an intraday increase of 12.06%. Market fluctuations are significant, so risk control is essential.

VII. Attention to Negative Data from Project Token Unlocks:

According to TokenUnlocks data, this week YGG, ID, and AGIX will undergo large one-time token unlocks, releasing a total value of over 44 million USD.

Specifically: Yield Guild Games (YGG) will unlock 16.69 million tokens on April 27 at 22:00, worth approximately 15.71 million USD, accounting for 5.33% of the circulating supply.

SPACE ID (ID) will unlock 18.49 million tokens on April 22 at 8:00, worth approximately 15.29 million USD, accounting for 4.29% of the circulating supply.

SingularityNET (AGIX) will unlock 8.84 million tokens on April 28 at 8:00, worth approximately 8.78 million USD, accounting for 0.69% of the circulating supply.

Cartesi (CTSI) will unlock 21.43 million tokens on April 23 at 12:00, worth approximately 4.66 million USD, accounting for 2.73% of the circulating supply.

This week, pay attention to the negative effects of these token unlocks, avoid spot trading, and seek short opportunities in contracts. In particular, keep a close eye on the large unlocks of YGG and ID.

VIII. Top Gainers in Concept Sectors of the Cryptocurrency Market Last Week:

Nine, Global Market Macro Analysis Overview:

In the performance of concept sectors in the past week, we observed a significant differentiation in gains and losses. Based on the division of the degree of increase and decrease, concept sectors such as ST, Dapp, Hong Kong concept, super computing power, and Coinbase investment have shown a significant upward trend in the past seven days, leading the market compared to other sectors. This phenomenon requires in-depth research and analysis. Firstly, the rise of these sectors may be influenced by multiple factors such as market hotspots, favorable policies, and technological advancements. For example, the rise of the ST concept may be related to the improvement in performance or expectations of restructuring of certain companies; the rise of the Dapp sector may benefit from the innovation and application expansion of blockchain technology; the Hong Kong concept may be driven by economic cooperation between mainland China and Hong Kong; the rise of the super computing power sector may be due to the rapid development in cloud computing and big data fields; and the rise of the Coinbase investment sector may be closely related to the institution's investment strategy and performance. In addition, attention should also be paid to the rotational speculation market of these coins with larger increases in their respective sectors. In the cryptocurrency market, sector rotation is quite common, and investors need to closely monitor market dynamics to seize investment opportunities in a timely manner. At the same time, it is also important to be cautious of the risks of market speculation and avoid blindly following the trend, which could lead to investment losses.

Ten, Future Market Judgment:

BTC fell from around $72,800 after the last major triangle breakdown, all the way to a recent low near $59,600, benefiting from the Israeli-Iran conflict. This overall trend aligns with the key technical position we analyzed half a month ago. Of course, market trends are not based on a single logic. Before the Bitcoin halving on April 20, there was a significant fluctuation, which was also compounded by the decline in the U.S. stock market and the hawkish stance of the Federal Reserve's policymakers on future interest rate policies, indicating a reduced probability and frequency of rate cuts, and a possible delay.

At present, BTC has been oscillating in a range of approximately $59,000 to $73,777 for nearly 50 days. In the future, only by breaking through this range will there be an opportunity to choose a new direction. In the short term, it is still possible to maintain the strategy of operating within a wide range. The price axis is around the average of the two, approximately $66,388 to $66,688, which is near the current price. This can be seen as the midpoint of the distribution of long and short positions.

Follow us: Lao Li Mortar

April 22, 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。