研究员:E2MResearch,Steven

疑惑

跨链未来的形态会是什么样的?

CM:中心化是主流方案!!安全性问题没有想象的那么严重。

链变多对于跨链的需求会变多么?

某种意义上与加密货币都与美元挂钩,是否意味着美元挂钩的稳定币有能力控制流动性?

当下跨链的解决方案基本上都是:

流动性互换,预备流动性池

(源链)锁定+(目标链)包装/映射资产

而销毁/铸造u本质上打破了这两者存在的局限性。

研究初衷

无论是稍微早一点的Op stack、Arbitrum Nova等全栈服务,还是近期的Celestia、Dymension、Cosmos等模块化区块链,都大幅度降低了创造一条新链的门槛,并且可以预见的未来应用链的数量相比现在只增不减。这种趋势带来了一个问题,就是流动性的进一步分散,通过更高效、便宜、安全的跨链将链之间的数据孤岛链接起来。

资金跨链的本质

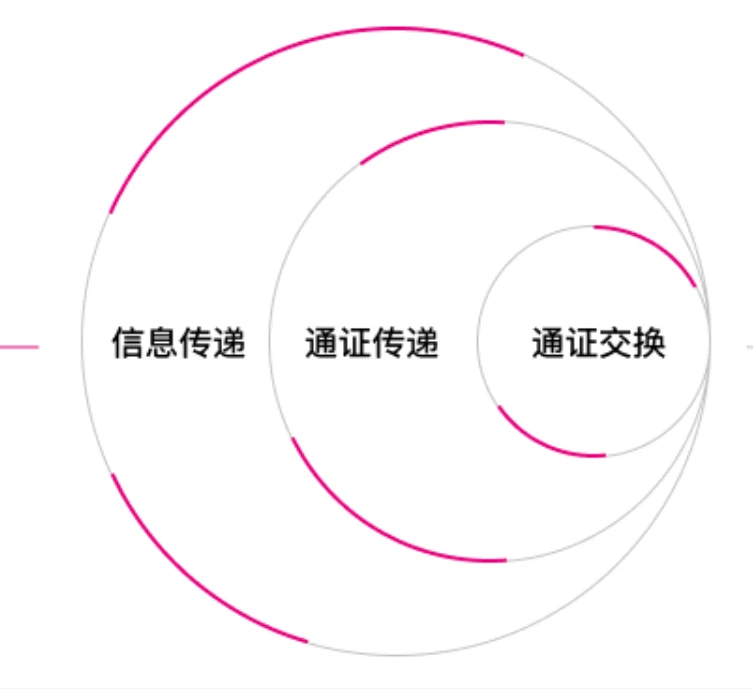

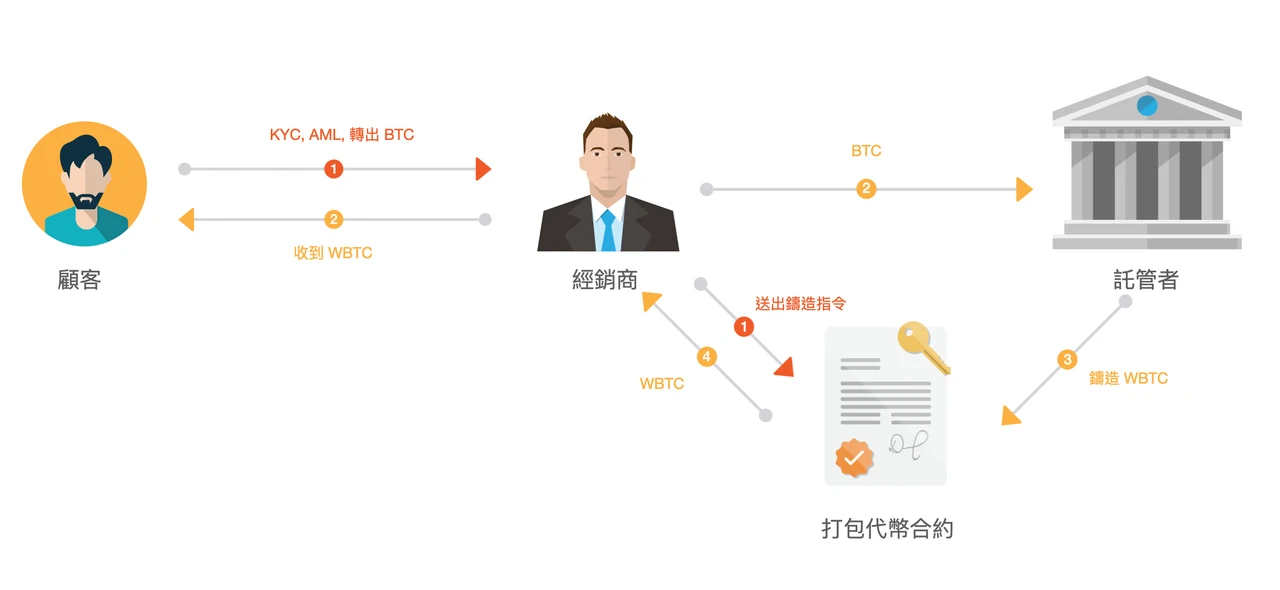

通证交换:最简单的跨链是不同链上Token之间的交换。例如,A和B达成了协议,A用在BTC上的1个BTC,换B在ETH上的10个ETH,为了保证双方均守约,通过“哈希时间锁”的跨链技术让双方同时交易。WBTC是最典型的例子。

通证传递:一条链上的原生资产,流通到另外的链上。例如,现链A上的资产参与链B上的DeFi应用(Aave V4的Portal、Compound V3),构建一个更普惠的开放金融,也可以将通证从一个昂贵的链,转移到一个经济链,节省交易费用,或者从一个缓慢的链转移到快速的链,实现扩容,亦或者,从一个非隐私链,转移到一个隐私链,实现交易隐私。

信息传递:一条链上的原生资产,流通到另外链上的同时,同时可以执行智能合约,也就偏向LayerZero、Zetachain等项目的链抽象概念。

三者之间是包含的关系,但是根据实际情况也不一定所有的Dapp都需要做的大而全。

1. 跨链分类对比

1.1 常见的跨链桥资金转移方案

目前市场中常见的跨链桥资金转移方案主要有两种:“锁定/销毁 + 铸造”和“流动性互换”。

“锁定/销毁 + 铸造”会锁定或销毁源链上的原生资产,同时在目标链上铸造等量的包装资产以实现资金跨链传递。但这种解决方案并没有实现真正的资金跨链。用户在目标链上的包装资产仅代表用户在源链上资金的证明,原生资产并没有被转移。

目前,使用“锁定/销毁+铸造”方案的跨链桥包括 WBTC、Multichain、Wormhole。

“流动性互换”方案依靠智能合约实现。跨链桥首先需要在源链和目标链上各建立一个流动性资金池。在资产转移时,用户的资金会被存入源链上的流动性池,然后从目标链的资金池中取出等值资产。这种解决方案真正实现了资金跨链,但它不支持非智能合约平台(Bitcoin)和目标链内不可用的资产(XRP 在以太坊网络中不可用)。

目前,使用“流动性互换”方案的跨链桥包括 Synapse Protocol、Stargate Finance、Hop Protocol 。

1.2 按照跨链范围分类

资产特定跨链桥(Asset-specific):这类桥主要用于特定资产的跨链转移,例如将比特币(BTC)封装到以太坊(ETH)上的各种x比特币资产。封装过程通常涉及将资产在源链上锁定,并在目标链上创建等价的封装资产。由于这类资产的流动性较好,且操作相对简单,因此它们在市场上比较容易部署。

每个目的地链上都需要重新实现封装逻辑,这限制了它们的功能扩展性。

WBTC等

链特定跨链桥(Chain-specific):这类桥专注于两条特定区块链之间的资产转移。用户可以将代币锁定在源链上,并在目的链上铸造出封装资产。链特定跨链桥由于其结构相对简单,通常可以较快地推向市场。

它们的扩展性较差,通常只能服务于有限的区块链生态系统。例如,Polygon的PoS桥允许用户在以太坊与Polygon之间转移资产。

应用特定跨链桥(Application-specific):这种跨链桥服务于特定的去中心化应用(DApp),允许用户在多个区块链之间使用该应用。应用特定跨链桥通常具有较小的代码库,并且在各个区块链上部署轻量级的适配器,而不是完整的应用。这使得不同区块链上的用户可以共享同一应用的服务,形成网络效应。

这种桥的功能通常难以跨应用扩展。COMP Chain和Thorchain是此类桥梁的例子,分别针对借贷和交易市场。

通常性跨链桥(Generalized):这类桥旨在支持多个区块链之间的广泛通信。它们通常采用高效的协议设计,如O(1)复杂度,从而能够处理大量的跨链消息传输。这种设计带来了强大的互联网效应,即单个项目的集成可以让其访问整个跨链生态系统。

为了实现这种扩展性,通常需要在安全性和去中心化之间做出权衡,这可能会引发一些不可预见的复杂后果。互联互通协议(IBC)是这类桥梁的典型例子,它用于在具有最终确认性保证的异构链之间发送消息

例如:Zetachian、IBC

2. 什么是CCTP

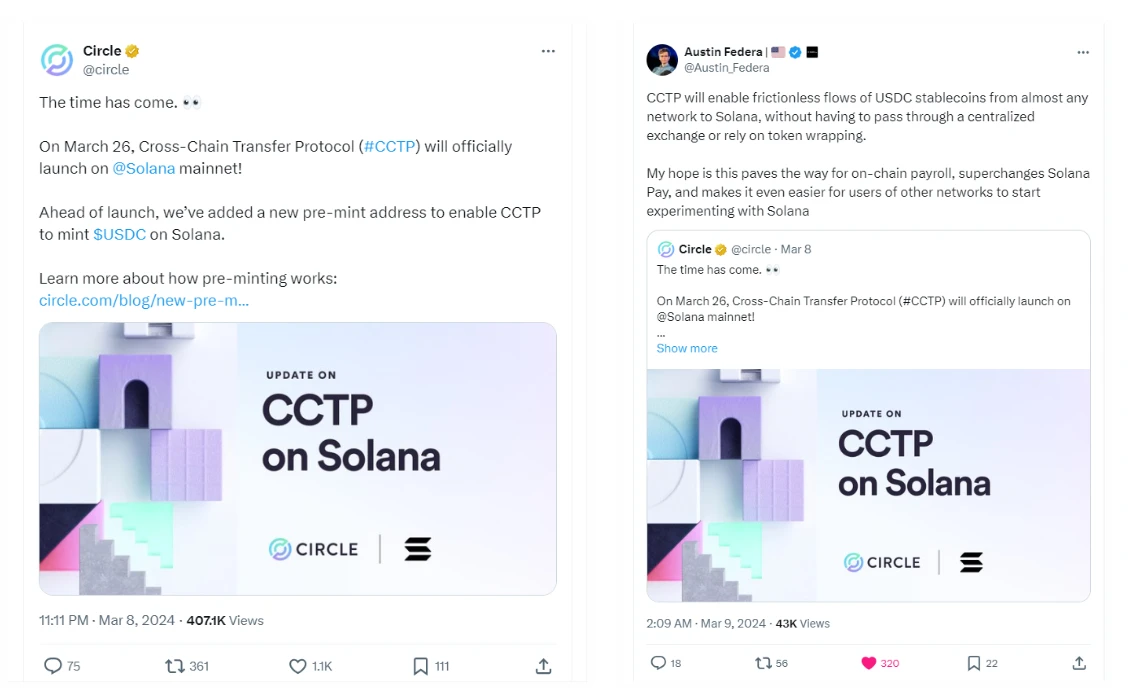

2024年3月8日,CCTP宣布于3月26日将CCTP正式于Solana主网上线;Solana的战略主管Austin Federa发推文说道:“CCTP 将实现 USDC 稳定币从几乎任何网络到 Solana 的无摩擦流动,而无需通过中心化交易所或依赖代币包装。”

图片来源:https://twitter.com/circle/status/1766119655347745231?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1766164252820152602%7Ctwgr%5Ee18525ffb1b0d647ff560ab7fbfdabf0d1589886%7Ctwcon%5Es3

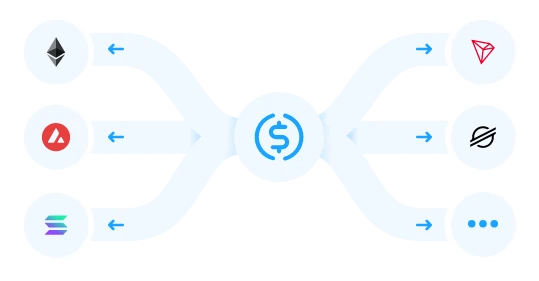

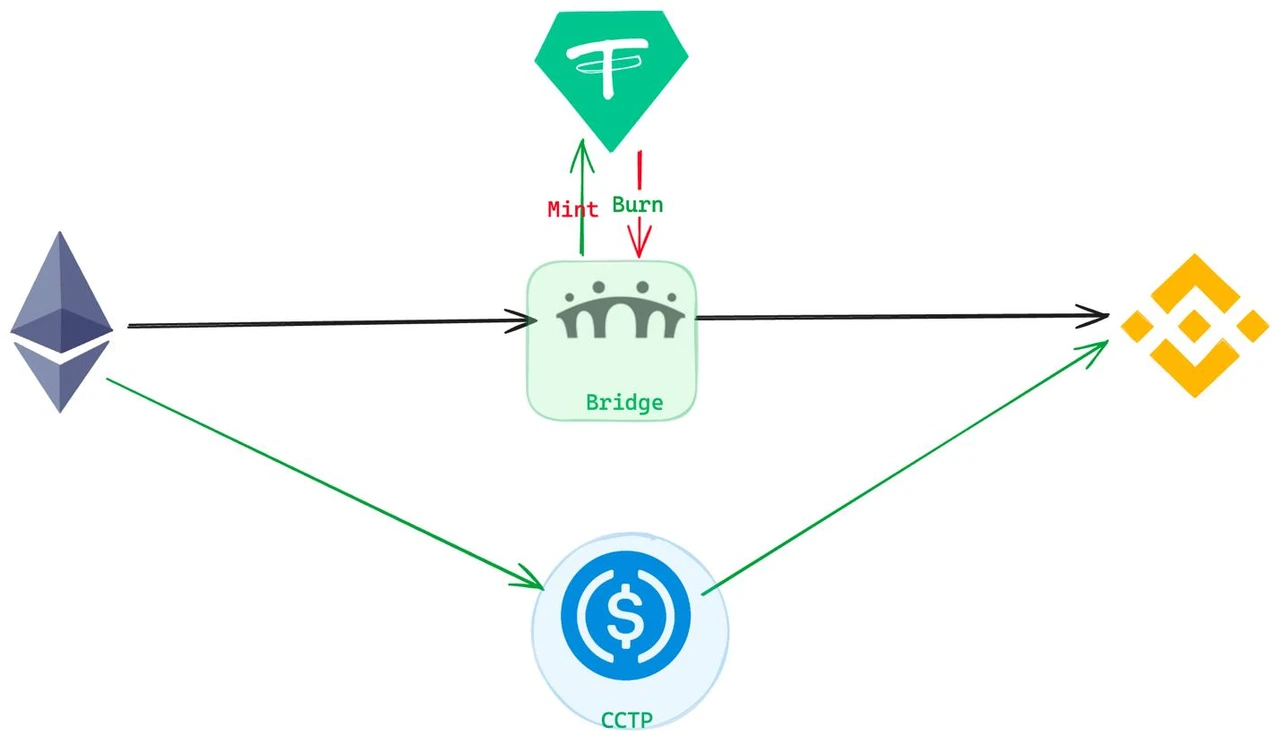

CCTP(跨链传输协议)是 Circle 的一种无需许可的链上工具,可促进不同区块链之间的 USDC 传输。Circle 不需要目标链上的流动性,而是在源链上销毁 USDC 后简单地铸造原生 USDC。

工作原理

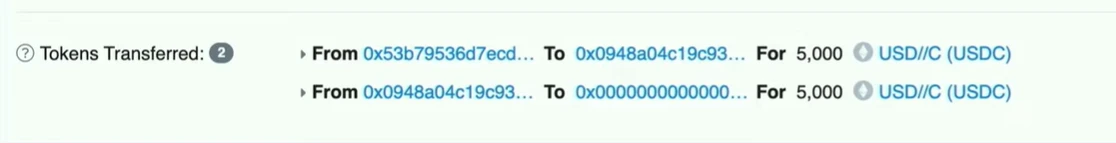

首先,用户通过源链上的任何集成门户发起 USDC 转账。用户还可以指定目标链上的钱包地址。从那里,门户/钱包/桥(dApp)在源链上销毁 USDC。

Circle 然后在源链上证明销毁事件。然后,dApp 向 Circle 请求证明,后者提供在目标链上铸造已烧毁数量的 USDC 的授权

最后,dApp 使用该证明在目标链上铸造 USDC 并将其发送给接收者。截至目前,Metamask、5 Bridges 以及 Layer Zero 和 Wormhole 等 10 个不同的合作伙伴 SDK 已与 CCTP 集成。

3. CCTP合作伙伴

4. 优势对比

CCTP除了打通USDC的流通以外,更宏大的一个前景是成为一个通用性跨链桥,有很多优势

不需要包装,像各种xBTC、XETH,很大程度上降低中心化程度和提高安全风险

不需要预备流通性池,消除流动性需求,实时销毁实时铸造,很大程度提升资本效率

跨链成本低,仅用消耗销毁、铸造的Gas fee,基本无滑点

本身已经兼容55条条公链,同时具有可编程性,为用户体验更好的全链Dapp提供更多可能性

本身USDC的稳定性+共识,壁垒极高,复制门槛大

局限性

中心化程度高,但Circle这种体量已经属于相对比较放心的机构了

散户无法参与,是个2b业务

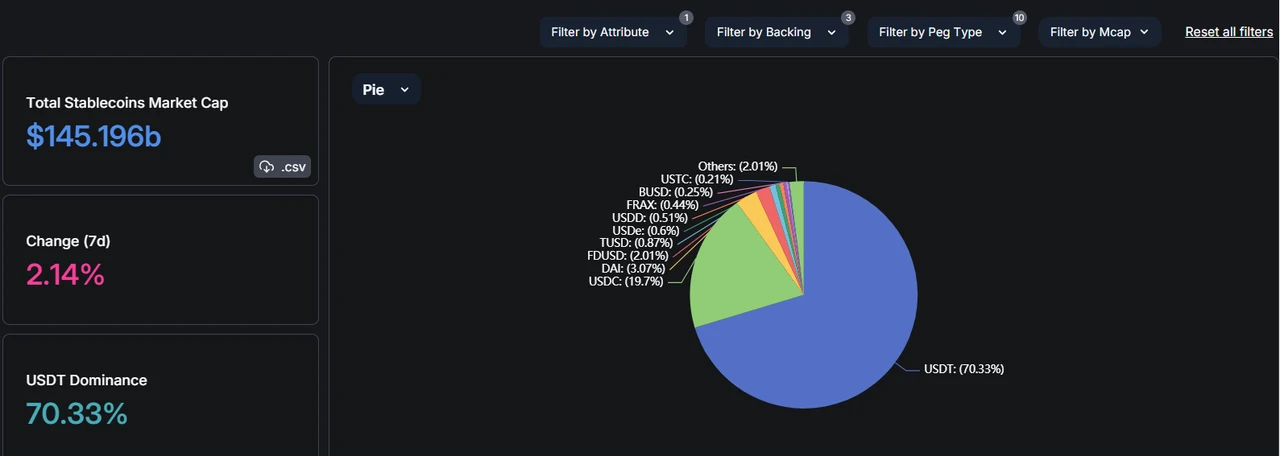

5. 稳定币市场份额

数据来源:https://defillama.com/stablecoins

附录

https://foresightnews.pro/article/detail/52378

https://www.odaily.news/post/5192646

https://mp.weixin.qq.com/s/k7hsTHPgTJG2uhxh0ry_ZQ

https://www.chaincatcher.com/article/2111830

https://weird3d.com/new/6668.html

深入項目》Omnichain全鏈創新者 ZetaChain:原生DVT的新型Layer1公鏈

兩萬字深度解析》 ZetaChain:打破區塊鏈碎片化橋樑,實現全鏈dApp互操作

Paka Labs万字报告(1/4)| 将孤岛连成大陆:跨链技术及应用形态全景图

Paka Labs 万字报告(2/4)| 将孤岛连成大陆:BTC锚定资产与以太坊跨层快速通道

Paka Labs 跨链研报(3/4)| 将孤岛连成大陆:解读20座跨链桥及4种跨链技术范式

关于E2M Research

From the Earth to the Moon

E2M Research 聚焦投资和数字货币领域的研究与学习。

文章合集 :https://mirror.xyz/0x80894DE3D9110De7fd55885C83DeB3622503D13B

关注推特 :https://twitter.com/E2mResearch️

音频播客:https://e2m-research.castos.com/

小宇宙链接:https://www.xiaoyuzhoufm.com/podcast/6499969a932f350aae20ec6d

DC链接:https://discord.gg/WSQBFmP772

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。