Author: Mary Liu, BitpushNews

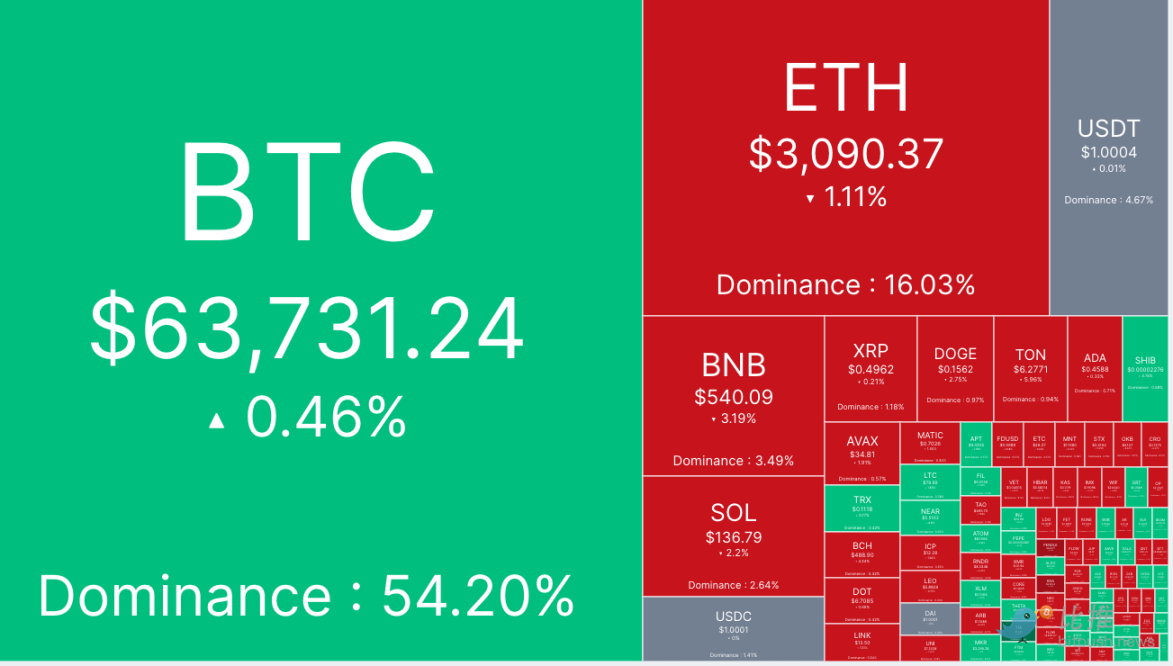

$62,000 - $63,000 seems to be the biggest resistance for Bitcoin to continue its upward trend. Data from Bitpush terminal shows that Bitcoin fell to around $61,700 three times during Tuesday's trading, then rebounded. As of the time of writing, the trading price of Bitcoin is $63,731.24, with a volatility of less than 1% in the past 24 hours.

Most of the top 100 altcoins saw a decrease in value, with Celestia (TIA) leading the gains with a 14.50% increase in the past 24 hours, followed by meme coin Pepe (PEPE) with a 6.14% increase, and Fantom (FTM) with a 4.05% increase. Pendle (PENDLE) experienced the largest decline at 10.98%, followed by Ondo (ONDO) at 10.41%, and Ethena (ENA) at 8.77%.

The total market value of cryptocurrencies is currently $2.29 trillion, with Bitcoin's dominance rate at 53.88%.

The three major U.S. stock indexes failed to gather any positive momentum. At the close, the S&P index and the Nasdaq index both fell slightly, by 0.21% and 0.12% respectively, while the Dow Jones index rose by 0.17%.

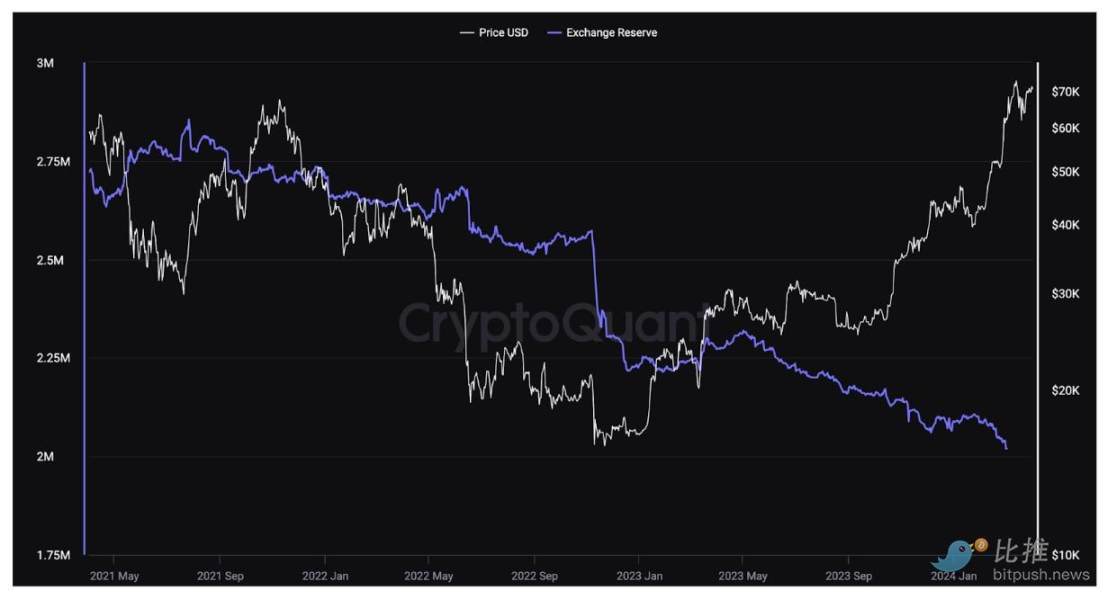

Bitcoin Reserves on Exchanges May Deplete by January Next Year

According to a new report from the cryptocurrency exchange Bybit, the recent addition of a U.S. spot Bitcoin ETF has made this week's halving unique and unprecedented, with the potential result being the depletion of Bitcoin reserves on exchanges by January 2025.

Bybit stated, "Bitcoin began to recover in early October last year (2023), with about six months remaining until the halving in April 2024. However, it was also in October that major traditional financial giants began applying to operate Bitcoin spot ETFs."

Since the start of ETF trading, the rate of Bitcoin reserve depletion on all centralized exchanges has been faster than any other period, as TradFi strengthens its sales force and promotes funds to capital-rich retirees and other investors, with this new demand expected to continue.

Analysts wrote, "CEX's Bitcoin reserves are down to only 2 million coins. If we assume that $500 million flows into Bitcoin spot ETFs every day, approximately 7,142 bitcoins will flow out of exchange reserves daily, meaning that it will only take 9 months to deplete all remaining reserves."

Bybit analysts also pointed out that data shows miners are selling reserves at a much faster rate than before the halving in 2020. This could exacerbate post-halving supply shortages and potentially lead to a rapid depletion of CEX reserves. They stated, "At the same time, the promotion of Web 2.0 will focus on Bitcoin halving, leading to FOMO-driven behavior from new investors."

Based on their analysis, Bybit has come up with some recommendations.

They wrote, "It is wise to take profits by the end of 2024, six months after the halving. Past cycles have shown a twelve-month window after halving. However, we have observed more profit-taking before halving, which has limited the upside potential after halving."

Investors Await Easing of Geopolitical Tensions

In a report, CryptoQuant analysts stated that "investors have reduced their investments in BTC this week ahead of the Bitcoin halving (expected on April 20) and may be waiting off-chain for the easing of tensions in the Middle East."

According to data from the market intelligence platform IntoTheBlock, 1 million addresses bought over 530,000 BTC at an average price of $64,300, which could serve as an important support level. However, if this support level is broken, the next major support level is around $56,000. IntoTheBlock stated, "While this does not mean that Bitcoin must fall this low, it is best to keep this range in mind when exploring recent lows."

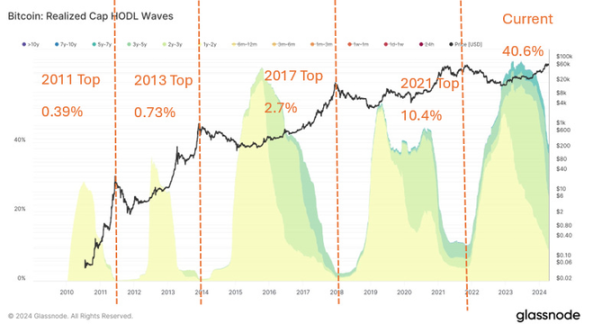

Tom Dunleavy, a cryptocurrency analyst and partner at MV Capital, pointed out that the percentage of realized value by long-term holders exceeds 40%, far higher than the 10% historically defined as the top of BTC. The analyst stated, "With many ongoing catalysts (halving, further ETF flows, BTC L2), we see no reason to doubt a continued pullback in the near term, followed by a full-speed move towards $150,000 by early 2025."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。