On April 12th, after the public consultation on the Hong Kong OTC licensing system, the AICoin Research Institute published a column in Sing Tao Daily, sharing its research on the Hong Kong OTC market and proposing that technical supervision is the key to standardizing the development of the Hong Kong OTC and Web3 ecosystem.

Author: Jason Jiang, AICoin Research Institute

Preface:

After the public consultation on the Hong Kong OTC licensing system ended on April 12th, the AICoin Research Institute published a column in Sing Tao Daily, sharing its research on the Hong Kong OTC market and proposing that technical supervision is the key to standardizing the development of the Hong Kong OTC and Web3 ecosystem. At the same time, the AICoin Research Institute believes that as OTC regulation and the approval of virtual asset spot ETFs advance, Hong Kong is gradually transitioning from a global Web3 follower to a leader.

Column Link: https://www.stheadline.com/columnists/plus_corporate/501298745/

The following is the original column:

As the principle approval of the Hong Kong virtual asset spot ETF was obtained, over-the-counter (OTC) trading of virtual assets has also accelerated into a compliant era. According to the "Sing Tao Daily," the public consultation on the Hong Kong OTC licensing system ended on April 12th. However, as the system only covers a few currencies such as Bitcoin and Ethereum, it has raised concerns among some industry practitioners.

The AICoin Research Institute also actively participated in the consultation on the OTC licensing system and submitted consultation suggestions to the Hong Kong government in early April. Since last year, the institute has closely monitored the OTC market and conducted in-depth research on the Hong Kong OTC market through online surveys and field visits, planning to release the latest OTC research report to the global market in the near future.

1. From "Follower" to "Leader"

Hong Kong is transitioning from a "follower" to a "leader" in the field of virtual assets. After more than a year of steady development, this leadership is mainly reflected in: the focus on the inflow and outflow of virtual assets, and gradually bringing stablecoins and OTC under regulation through the imposition of new licenses, which is leading and unique globally. At the same time, actively guiding the integration of virtual assets with traditional financial markets, accelerating the adoption of Web3 innovation through financial instruments such as tokenized securities and spot ETFs.

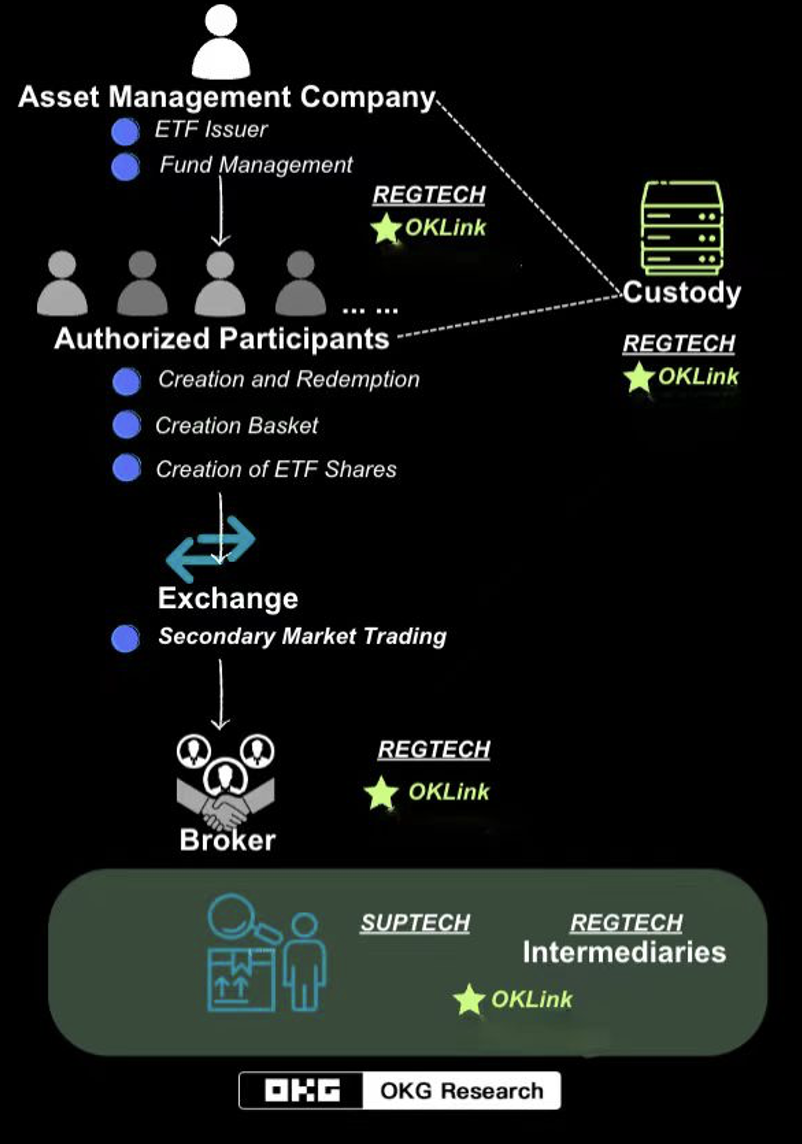

In this process, technical supervision is playing an increasingly important role. Ren Yunan, Executive Director, Chairman of the Board, and CEO of AICoin Holdings (01499.HK), stated in a media interview last year that the licensing system is only the starting point for the compliant development of virtual assets in Hong Kong, and technical supervision is the key to standardizing the Web3 market in the future. The recent approval of the issuance of virtual asset spot ETFs in physical delivery mode in Hong Kong is largely due to the confidence of regulatory authorities and relevant institutions in using KYT, KYA, and other technical means and compliance tools to address various risks that may be involved in the custody and delivery of virtual assets. In the process of OTC regulation, we also believe that Web3 regulatory technology centered on on-chain data will become an indispensable part.

Figure: The value of RegTech in the issuance process of virtual asset spot ETFs

Source: AICoin Research Institute's "Learning from the US to Explore the Future Development of Bitcoin Spot ETF in Hong Kong"

In the public consultation responses, the AICoin Research Institute also suggested that the Hong Kong government consider using more Web3 regulatory technology and encourage OTC license applicants to equip themselves with blockchain analysis tools and other compliance products to enhance regulatory transparency and reduce compliance costs.

2. Why Suggest Adopting More Web3 Compliance Technology?

Despite the prevalence of virtual asset trading fraud in recent years, making the public more vigilant about virtual asset activities and gradually exposing the previously overlooked OTC risks, overall, all parties in Hong Kong are positive and optimistic about the upcoming OTC regulation.

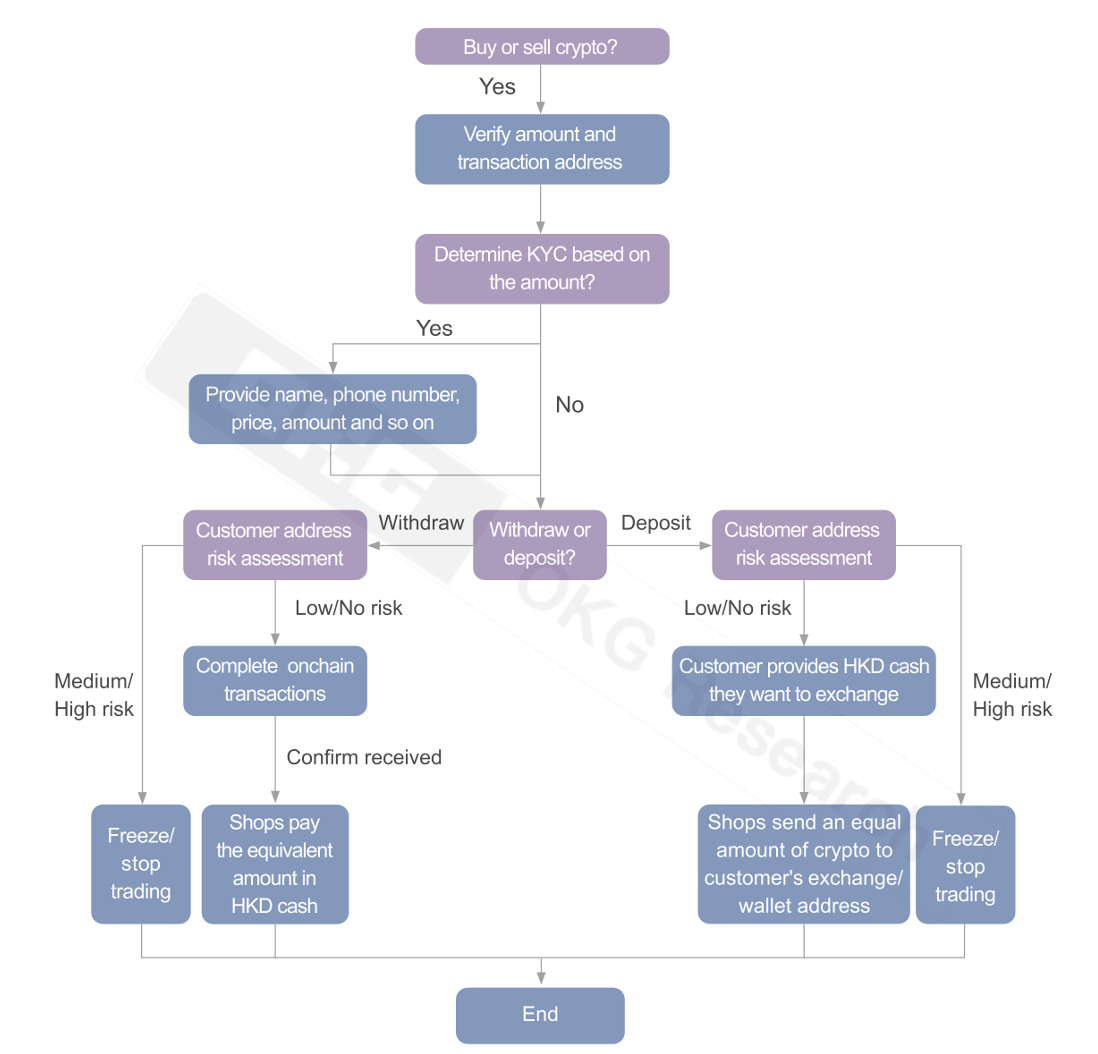

However, we have found that although the services provided by OTC merchants are similar to traditional currency exchange services, there are significant differences in business processes and risk situations. OTC businesses in Hong Kong are more of a complex off-chain + on-chain hybrid model, where the currency side is transferred off-chain through cash, but the asset side requires on-chain transactions through the blockchain network. This hybrid model is more complex than traditional currency exchange services, and it also means that OTC risks may originate not only from the fiat currency system but also from the more innovative and complex on-chain processes. In order to match this hybrid model, static risk identification and control technologies centered on KYC are not sufficient. The market needs more flexible and targeted Web3 compliance solutions.

Figure: Common trading process of physical OTC stores in Hong Kong

Source: AICoin Research Institute OTC Research Report (to be released soon)

Therefore, we suggest that OTC merchants intending to apply for licenses in Hong Kong consider integrating technologies such as KYA and KYT into the existing KYC process, deeply explore the on-chain characteristics of OTC, actively identify and timely respond to various malicious or fraudulent transactions through wallet address risk screening and real-time transaction monitoring, thereby changing the passive situation of dealing with on-chain risks and enhancing the proactiveness in preventing and combating OTC money laundering activities.

At the same time, the use of blockchain analysis tools can also help regulators more effectively monitor the OTC market and improve regulatory efficiency through visual interfaces. According to the findings of the Cambridge RegTech Lab's survey in February this year, regulatory technology mainly focuses on banking business and investor protection, with only 21% of institutions prioritizing virtual asset regulation. While the Hong Kong government vigorously promotes Web3, actively adopting blockchain analysis tools will set an example for global regulation.

No industry can develop healthily by hiding in the dark forever. Only by letting the sunlight in can there be hope.

About AICoin Research Institute

The AICoin Research Institute is a strategic research institution under the AICoin Group, with the mission of helping global business, public, and social sectors to gain a deeper understanding of the evolution of financial technology and the blockchain economy. It outputs in-depth analysis and professional content covering topics such as technological applications and innovation, technological and social evolution, and challenges in financial technology, and is committed to promoting the application and sustainable development of cutting-edge technologies such as blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。