Author: Patryk Krasnicki, Messari

Translation: 1912212.eth, Foresight News

Key Points

- Sei positions itself as a high-speed L1 network, compatible with the CosmWasm and Cosmos IBC protocols.

- The Twin-Turbo consensus mechanism reduces transaction latency and increases transaction execution and network consensus speed through intelligent zone block propagation and Optimistic zone block processing.

- Parallelization increases throughput, as transactions are independently executed in parallel.

- The upcoming Sei V2 upgrade will introduce multiple technological upgrades, including full backward compatibility of EVM smart contracts and tokens, Optimistic transaction parallelization, and a re-architecture of the network storage interface.

- According to the 7-day moving average data as of April 9, 2024, Sei has an average of 8,300 daily active addresses, a daily transaction volume of 394,000, and a DeFi TVL of 38.7 million USD.

Introduction

The previous bull market exposed the limitations of blockchain, with the network experiencing high gas fees and slow transaction speeds. However, in the recent bear market, new L1 solutions have emerged, with technological innovations aimed at addressing these limitations. Sei Labs is an L1 network aiming to become the fastest network for exchanging digital assets. Sei's built-in technologies such as Twin-Turbo consensus and transaction parallelization can reduce transaction latency and increase transaction throughput. Sei competes with other alternative Layer-1 networks, such as emerging non-EVM Layer-1 networks (such as Sui and Aptos), existing networks (such as Solana), and the upcoming parallel EVM public chain Monad. As the network continues to mature, Sei Labs plans to upgrade to Sei V2 and subsequent technological upgrades in the first half of 2024, further distinguishing Sei and achieving growth.

Background

Sei was announced in May 2022 and was founded by Jayendra Jog and Jeff Feng. The two founders previously worked as software engineers at Robinhood and as venture capitalists at Coatue Management. Sei Labs raised 35 million USD through two rounds of financing and conducted two incentive testnets. The Seinami incentive testnet (also known as Atlantic-1) went live in July 2022. In March 2023, the upgraded Atlantic-2 testnet went live.

In August 2023, Sei launched the Pacific-1 mainnet and SEI, the native token airdropped to eligible users. Since the mainnet launch, network activity has continued to grow, and the on-chain ecosystem has expanded with the support of the Sei Foundation. Sei Labs is working on significant technical upgrades to the public Devnet in preparation for the upcoming launch of Sei V2 in the first half of 2024.

Technology

Sei is an integrated general-purpose Layer-1 network. As an integrated zone blockchain, Sei combines execution, settlement, consensus, and data availability into one network. The zone blockchain is compatible with the Inter-Blockchain Communication (IBC) protocol of Cosmos and is built through a modification fork of the Cosmos SDK and Tendermint Core protocol. Sei's application layer supports CosmWasm smart contracts written in Rust. While Sei is built using Cosmos technology, it has sovereignty in architecture and governance.

The network's built-in features enhance transaction efficiency and throughput to support Sei in becoming the fastest digital asset exchange network. These features include the Twin-Turbo consensus mechanism to reduce transaction latency and transaction parallelization to increase transaction throughput. Additionally, the on-chain Central Limit Order Book (CLOB) supports liquidity across the entire network, although it has been deprecated. Sei's initial technical feature set will be expanded in the upcoming Sei V2 upgrade.

Consensus

Sei relies on a Proof of Stake (PoS) protocol based on Tendermint Core, a Byzantine Fault Tolerance (BFT) algorithm for consensus. Sei validators process transactions on the network and settle state changes (account balances, smart contracts, etc.). Validators are selected to produce zone blocks based on their total stake (self-staked plus delegated SEI tokens). Anyone meeting the hardware requirements can operate a validator node to secure the network.

Currently, only the top 39 validators by total stake can participate in consensus and earn network transaction fees and staking rewards. If active validators behave improperly, their total stake may be slashed or burned. SEI token holders can delegate SEI to existing validators, allowing delegates to help secure the network and share relevant validator rewards, minus the commission rate chosen by the validator. Both validators and delegates must wait for a 21-day unlocking period before fully unlocking staked SEI. It is worth noting that non-native tokens can be staked to secure the network.

Sei also utilizes its innovative Twin-Turbo consensus mechanism to reduce transaction latency through two main components:

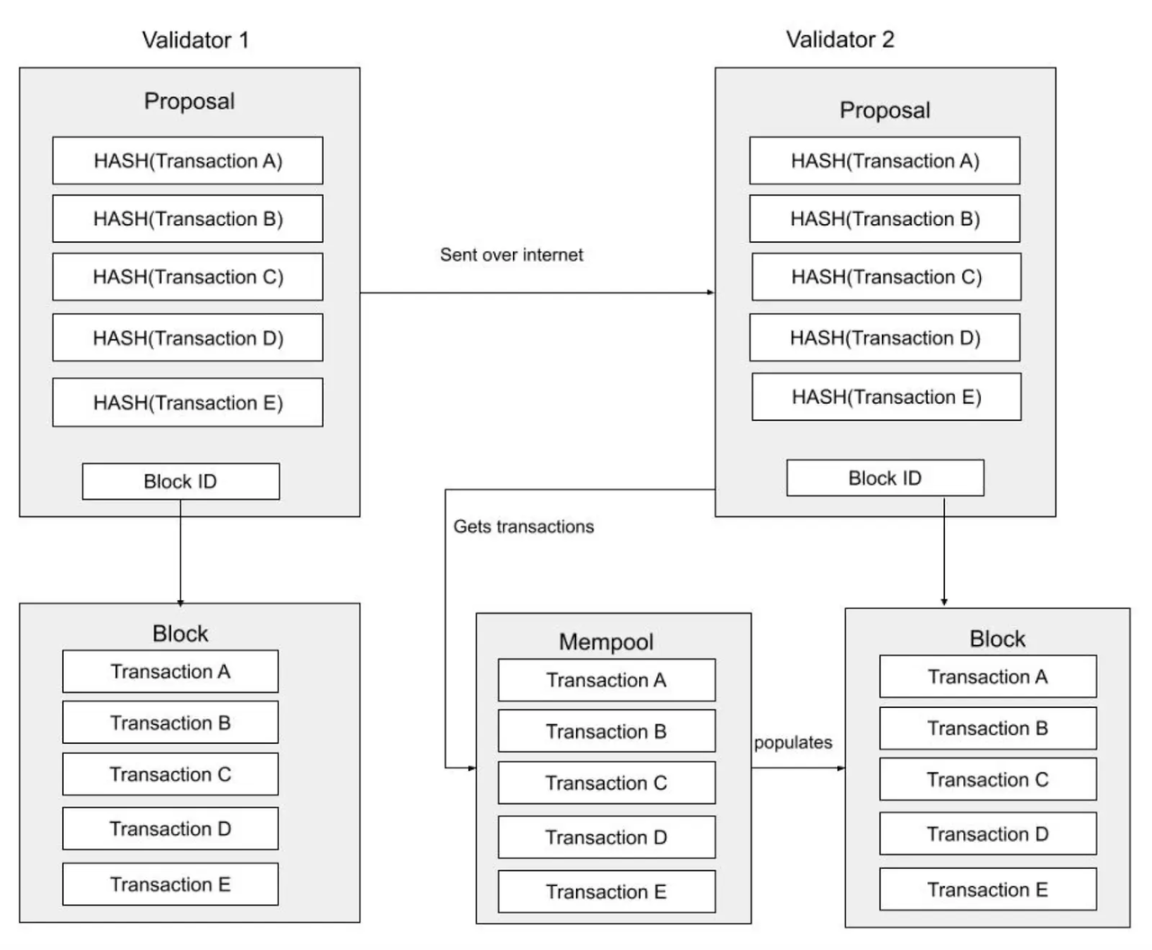

Intelligent zone block propagation: Zone block proposers create a zone block distributed among the validator set. These blocks are compressed to include the hash value of each transaction contained in the block. Typically, validators need to wait for the full content of the proposed block to arrive before reaching consensus. However, Sei's design allows validators to receive individual transactions from the proposed block, enabling them to utilize various transactions already in their memory pool. If all necessary transactions are stored in the memory pool, validators can reconstruct the proposed block locally without waiting for the full content of the proposed block. This reduces the time validators have to wait to reconstruct the proposed block, thereby reducing transaction latency.

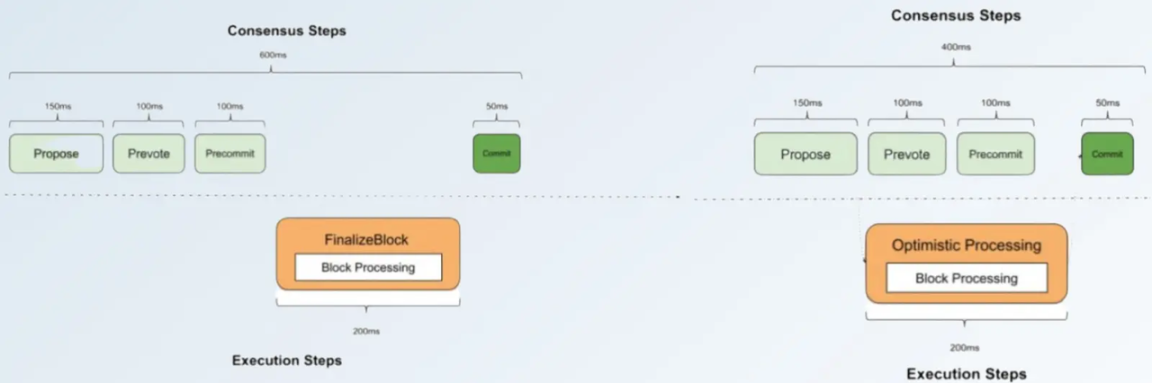

Optimistic zone block processing: Typically, validators go through pre-vote and pre-commit steps before reaching consensus on the proposed block and submitting it to the blockchain. However, on Sei, once validators have reconstructed the content of the proposed block, they optimistically assume its validity. This processing occurs simultaneously with the pre-vote and pre-commit steps. Validators immediately start processing the first block proposal they receive, even before the block has been confirmed by consensus. This process helps reduce transaction latency.

If the validator set fails to reach consensus on the optimistic acceptance of the proposed block, the network will reject the block, and the future rounds of that block height will not use optimistic block processing. It is worth noting that intelligent zone block propagation and optimistic zone block processing come with trade-offs in terms of increased secondary communication complexity. In other words, the number of messages sent between the validator set grows exponentially, making it difficult to increase the maximum validator set size due to increased bandwidth and processing requirements.

Execution

Many chains have a sequential transaction engine, where transactions are executed one by one in order. In order to speed up execution, transactions on Sei can be executed in parallel, allowing smart contracts to run without interfering with each other. This reduces network congestion and increases transaction throughput. Currently, parallelization on Sei is optional and pessimistic. In order to utilize Sei's parallelization feature, developers must define the state (account balances, smart contracts, etc.) used by the smart contracts. If not defined, transactions will be processed sequentially. If dependency mappings are defined, the network will be maintained to know which transactions can be parallelized and which cannot, as they depend on each other. These dependency mappings are created through a Directed Acyclic Graph (DAG). If dependencies between transactions are found (i.e., they read/write to the same location in the Sei state), they will be processed sequentially, causing transactions on Sei to proceed synchronously.

Roadmap

In November 2023, Sei announced the Sei V2 plan, which will involve three major upgrades to the network. In February 2024, Sei launched a public Devnet to test the Sei V2 features. The upgrade is expected to be deployed to the mainnet in the first half of 2024. Finally, once Sei V2 is live, the team plans to launch the parallel stack for Sei, which will expand the Layer-2 network to Sei.

EVM Integration

Sei V2 plan introduces compatibility with EVM smart contracts written in Solidity, including the ERC-20 and ERC-721 token standards. EVM smart contracts will also be backward compatible, meaning smart contracts from Ethereum and its Layer-2 networks can be seamlessly redeployed on Sei.

Sei will support two execution environments simultaneously. Additionally, each user's EVM and Wasm addresses will be linked and share the same underlying account. By using pointer contracts and pre-compiled contracts, EVM smart contracts and tokens will interoperate with existing CosmWasm smart contracts, and vice versa.

These contracts will allow tokens to be accessible in both environments without the need for wrapped versions of the tokens. Essentially, pointer contracts act as converters between the two execution environments. With the introduction of EVM compatibility, Sei will become a suitable hub for deploying cross-chain EVM protocols.

Many leading protocols on Ethereum also exist on other EVM-compatible networks. This upgrade may lead to the deployment of EVM infrastructure and DeFi protocols on Sei, thereby fostering a robust EVM ecosystem on the network. This upgrade will also enable EVM developers to build on the network.

According to Electric Capital's 2023 Developer Report, 87% of multi-chain developers work on at least one EVM chain. This previously inaccessible developer ecosystem will be able to leverage Sei's enhanced transaction efficiency and throughput to create novel EVM applications native to Sei. Evidence of this can already be seen through the development of EVM applications on Sei's public Devnet.

Optimistic Parallelization

Parallelization on Sei is currently optional. In order to utilize Sei's parallelization feature, smart contract developers must define the state (account balances, smart contracts, etc.) used by the smart contracts. The Sei V2 plan aims to change pessimistic parallelization by introducing Optimistic parallelization, which will optimistically assume that all transactions meet the conditions for parallel processing. Similar to Sei's optimistic block processing fallback, if there are dependencies between transactions (transactions that interact with the same part of the Sei state), they will be reprocessed sequentially. The change to Optimistic parallelization will not require the definition of dependency mappings, thus improving the developer experience.

SeiDB

The Sei V2 plan involves a re-architecture of the network's storage interface. SeiDB will introduce a new storage layer on Sei, decoupling the State Commitment (SC) layer and the State Storage (SS) layer. This is expected to:

- Improve state read/write performance, thereby reducing state sync time and decreasing commit time, resulting in faster finality.

- Reduce state bloat by reducing the metadata that needs to be stored.

- Lower hardware requirements for node operators.

Parallel Stack

Modularized blockchains separate one or more tasks of execution, settlement, consensus, and data availability. With the launch of Layer-2 networks specialized as execution layers on Ethereum in 2022, modularized zone blockchains emerged. In 2023, networks specialized as DA layers began to launch. Sei plans to join the modularized blockchain space with the launch of Sei V2 and Sei's compatibility with EVM. Specifically, the upcoming open-source parallel stack for Sei will enable developers to launch modular Layer-2 zone blockchains as parallel EVM execution layers on Sei. These Layer-2 networks can utilize Sei's validator set for ordering services and customize their settlement and DA layers.

SEI Token

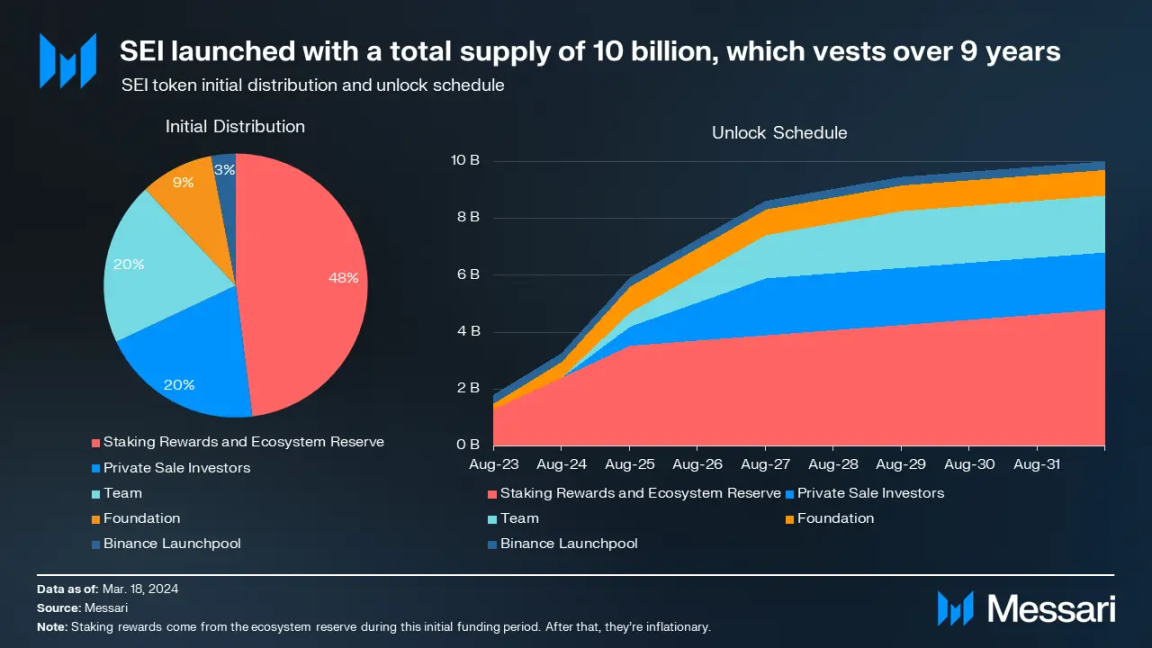

SEI is the native token of Sei, launched on the Pacific-1 mainnet on August 16, 2023. The current maximum token supply of SEI is 10 billion. As of April 9, 2024, the total token supply of SEI is approximately 8.7 billion, with approximately 65.18% staked (about 5.67 billion) and approximately 31.72% in circulation (about 2.76 billion). The remaining approximately 1.3 billion SEI is planned to be minted over 10 years as inflationary token rewards distributed to Sei's active validator set. The SEI token provides various functions for Sei, including:

- Settling network transaction fees

- Staking by validators and delegates

- Rewarding validators

- Participating in governance

Token Economics

Distribution of SEI Tokens into Five Areas

Ecosystem Reserve (48% of total supply): 4.8 billion tokens are allocated to the ecosystem reserve controlled by the Sei Foundation. The reserve is intended to provide funding for staking rewards, ecosystem initiatives, airdrops, and incentive programs. Of this, 27% is available at TGE, while the remaining 73% has a variable vesting period of nine years.

- 300 million SEI (3% of total supply) is allocated for airdrops from the ecosystem reserve distribution. Eligible users include those who participated in the Sei incentivized Atlantic Testnet. The project team did not specify the eligibility criteria, but official mission activities during the testnet included Dawn NFT, Dusk NFT, and Sunken Treasure NFT. Additionally, active users bridging assets to Sei from Solana, Ethereum, Arbitrum, Polygon, Binance Smart Chain, and Osmosis are also eligible.

- 1.5 billion SEI (15% of total supply) is allocated to be minted over 10 years as inflationary token rewards distributed to Sei's active validators.

- The Sei Foundation has not disclosed how much of the remaining 3 billion SEI (30% of total supply) is allocated to each ecosystem protection area.

Private Investors (20% of total supply): 2 billion tokens are allocated to private investors. There is a one-year lock-up period, followed by a linear unlock over three years. Sei Labs raised $35 million through two rounds of funding.

- In August 2022, they raised $5 million in a seed round led by Multicoin Capital, with participation from Coinbase Ventures, Hudson River Trading, and others.

- In April 2023, they raised $30 million in two strategic rounds with participation from Jump Crypto, Distributed Global, Flow Traders, and others.

- In November 2023, Circle Ventures completed a strategic investment in Sei.

However, the project team did not disclose whether equity and/or tokens were sold in these rounds.

- Team (20% of total supply): 2 billion tokens are allocated to the team, subject to a one-year lock-up, followed by a variable vesting period of five years. Specifically, 76% of the tokens are linearly unlocked over the first three years, with the remaining 24% linearly unlocked over the following two years.

- Foundation (9% of total supply): 900 million tokens are allocated to the foundation. 22% is available at TGE, while the remaining 78% has a linear unlock over two years.

- Binance Launchpool (3% of total supply): 300 million tokens are allocated through the Binance-driven Launchpool. Users can stake BNB, TUSD, and FDUSD for 30 days to receive a proportionate share of SEI tokens.

It is worth noting that non-vested tokens (e.g., tokens allocated to the team, foundation, and private investors) can be staked. These staked tokens can earn liquid SEI token rewards and have governance and network protection capabilities.

Governance

Sei uses an on-chain governance process where proposals can impact network parameters, including parameters related to SEI's minting schedule or increasing the maximum number of active validators. Sei's governance does not have an official voting frontend, but can be interacted with through supported wallets such as Fin Wallet and Compass Wallet. The governance process is as follows:

- Create Proposal: Proposals can be created to initiate a two-day deposit period during which SEI can be deposited to support the pending proposal. Once the minimum deposit threshold of 3,500 SEI (equivalent to $2,400 as of April 9, 2024) is met, the proposal will proceed to on-chain voting. The use of the is-expedited flag can expedite the proposal, halving the deposit period to one day but doubling the minimum deposit threshold to 7,000 SEI (equivalent to $4,800 as of April 9, 2024).

- Deposit Period: SEI can be deposited to support pending proposals. If the minimum deposit threshold is met, the proposal will proceed to on-chain voting. If the minimum deposit threshold is not reached before the end of the deposit period, the proposal will be canceled, and all deposits will be destroyed.

- Vote on Proposal: Users staking SEI can vote on valid proposals, with voting power equivalent to their respective token holdings. The voting period is five days, with a quorum of 33% of the staked token supply. A simple majority of at least 50% of the total voting power used for the proposal must vote in favor for the proposal to be approved. If over 33% of the total voting power is used to select "nowithveto," the proposal will fail regardless of other vote counts.

Since the launch of the Sei mainnet, as of April 9, 2024, 48 out of 53 active proposals have been approved. These include minor increases in the maximum number of active validators, updates to governance deposit parameters, updates to the minimum network transaction fee, and upgrades to network software. It is worth noting that non-vested tokens can participate in governance through staking.

Current State of the SEI Ecosystem

Since the launch of Sei's mainnet in August 2023, various vertical protocols have been launched and have contributed to the ecosystem:

- DeFi: As of April 9, 2024, Sei's TVL is approximately $38.7 million, lagging behind Solana, Sui, and Aptos. Sei's decentralized exchange Astroport has the highest TVL, at approximately $38.3 million. Traders can use decentralized perpetual contract exchanges such as Levana Finance (with a cumulative trading volume of approximately $36.6 million), while lending protocols like Hoyu and Kawa Finance operate on Sei's public Devnet.

- Liquidity Staking: Protocols like Silo and Kryptonite enable users to stake SEI tokens through their respective iSEI and stSEI tokens. As of April 9, 2024, Silo and Kryptonite have staked approximately $11.6 million and $4.4 million worth of SEI tokens, respectively.

- Wallets: As of April 9, 2024, Sei has an average of approximately 8,300 daily active addresses and approximately 394,000 daily transactions. Wallet space includes Sei native wallets in Fin Wallet and Compass Wallet. SPACE ID provides .sei name services, where over 20,300 human-readable NFTs representing Sei addresses have been minted.

- NFTs: The NFT ecosystem on Sei is one of the most active parts of the network, with a historical total trading volume exceeding $20 million. Sei's native NFT market includes Pallet Exchange, MRKT, Quik, and Dagora. NFT projects include (1) Seiyans, building on MRKT, (2) The Colony, building on AntSwap, and (3) WeBump, which offers a toolkit called Lighthouse, used to mint over 500,000 NFTs.

- Gaming: Collaboration with Pixel Realm aims to bring their risk fund, game market, and game studio to Sei.

- DePIN: Nimble Network was first launched on Sei, aiming to decentralize the training of AI models.

Other officially announced partnerships or integrations include Seijin (LaunchPad project), Kado (cryptocurrency on/off ramp), Tenderly (EVM development toolkit), and Space and Time (data indexing), among others. Once Sei's V2 upgrade goes live and Sei becomes EVM compatible, a variety of EVM applications are expected to be launched, including protocols like Algebra DEX. Additionally, the ecosystem's development is being stimulated by several projects:

- Ecosystem Fund: In September 2022, Sei announced the establishment of an ecosystem and liquidity fund to help early founders and teams acquire users and scale. The fund was launched with $50 million in funding from companies such as Multicoin Capital, Flow Traders, and Hudson River Trading. In January 2023, MEXC Global secured $20 million in funding. In April 2023, Foresight Ventures secured $50 million in funding.

- Creator Fund: In April 2024, Sei announced the establishment of a creator fund, focusing on new and existing NFT and social projects. The fund is in partnership with Gitcoin, a well-known leader in the field of community-funded ecosystems.

- Sei Launchpad Program: Managed by the Sei Foundation, the program aims to support founders in building on Sei through guidance and investment. Interested parties can apply here.

- Ecosystem Reserve: A portion of Sei's ecosystem reserve is used to fund ecosystem initiatives, airdrops, and incentive programs. Since the birth of the SEI token, no additional ecosystem initiatives, airdrops, or incentive programs have been initiated. However, the Sei Foundation continues to hold these tokens, which can be used to stimulate future growth of the network and its ecosystem.

Sei is a Layer 1 blockchain designed to be the fastest digital asset exchange network. It features novel technical capabilities built into the blockchain, namely the Twin-Turbo consensus and transaction parallelization, which enhance transaction efficiency and throughput. Since the launch of the mainnet in August 2023, Sei has witnessed the launch of native project ecosystems and the emergence of a community.

To maintain momentum, Sei must successfully deploy the features of the Sei V2 upgrade plan. EVM compatibility can unlock new opportunities by expanding Sei's developer ecosystem and supporting the deployment of established EVM protocols on Sei. Optimistic transaction parallelization will improve the developer experience, while SeiDB will comprehensively enhance the network's performance.

After V2, Sei will set its sights on parallel stacks. With developers launching Layer 2 EVM Rollups seeking to improve user experience and novel design space, this stack can further facilitate the growth of the Sei ecosystem and validator usage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。