Original | Odaily Planet Daily

Author | Azuma

There are only a few days left until the fourth halving of Bitcoin, but the top "big gods" have presented completely different predictions for the future market.

The bulls generally believe that the darkest moment has passed; the unexpected CPI and the postponement of interest rate cuts have not been able to interrupt the upward trend of Bitcoin; the main reason for the recent adjustment in the past few days is that liquidity was temporarily drawn away due to the arrival of the tax reporting day; while the bears believe that unexpected and sustained inflation has put risk assets on the edge of a significant adjustment…

In the following text, we will take stock of the seed players of both the bulls and bears and their main statements, hoping to help everyone make the right moves in the future market.

Four Bull Kings: GCR, Arthur Hayes, Chris Burniske, Matt Hougan

GCR: Hold on to spot, don't surrender!

After the sharp drop in the early morning of April 14, the legendary trader GCR (who had previously shorted DOGE, SHIBA, LUNA at the top) who had not posted trading statements on social media for a long time publicly went long. The post has now received nearly 9 million reads on X, and the number of likes has also reached 55,000.

GCR said: "If your position is not enough, this will be a good opportunity for you to expand your positions in tokens with strong consensus. If you have already gone all in, then stick to it, hold on to your spot positions, don't surrender. Someone once said, the essence of liquidation is to forcibly transfer wealth from leveraged traders to wealthy spot holders. I have retired from social media, but I don't want to see my brothers still being eliminated in the future under such bright circumstances."

Arthur Hayes: The bottom is here, charge!

BitMEX co-founder Arthur Hayes has long been one of the most influential "big gods" in the market. Earlier this month, Arthur predicted that from April 15 to May 1, the annual U.S. tax filing (April 15 is the tax deadline) would drain market liquidity, coupled with the continued reduction of the Fed's balance sheet, and the upcoming halving of Bitcoin on April 20 may bring about a short-term oversold condition, and the market may become extremely weak. However, starting from May 1, with the Fed slowing the pace of balance sheet reduction and the U.S. Treasury using funds to stimulate the market, a new round of crypto bull market is expected to begin.

And with the consecutive days of sharp decline, Arthur also changed his stance and started to go long.

On April 15, Arthur posted on X, saying: "The bottom is here, charge!"

On April 16, Arthur once again stated: "Until this weekend before the April 15 U.S. tax filing deadline, the trends of Bitcoin and gold have remained in sync. Also on this weekend, the situation between Israel and Iran escalated, causing a sharp drop in the price of Bitcoin, while gold happened to be on holiday. On Monday, gold did not fluctuate after the opening, while Bitcoin fell again. The big trend of Bitcoin remains unchanged (still works), people just need to pay taxes."

Chris Burniske: How dare you liquidate before the halving???

Former ARK Invest crypto head, now Placeholder VC partner Chris Burniske had accurately predicted a significant pullback in the market after the approval of ETFs.

After this round of decline, Burniske also spoke out bullish several times.

This morning, Burniske posted: "There is significant panic in the market, and the price has stabilized within a reasonable range, excessive volatility has been eliminated, which will be the basis for the eventual price increase."

Later, Burniske also retweeted a post about "you actually liquidated 4 days before the halving" and accompanied it with a picture of a whale swallowing, possibly implying that the whales are eating up the chips of panic selling by retail investors at low prices.

Matt Hougan: Mere interest rates, nothing to worry about!

Bitwise Chief Investment Officer Matt Hougan (the one on the left in the picture) has always been an active representative of the Bitcoin "perma-bulls" in the social media field.

When Bitcoin fell last week due to the higher-than-expected CPI and the delayed rate cut expectations, Hougan said, "I don't think the higher-than-expected CPI will interrupt the upward trend of Bitcoin, whether the Fed cuts rates in June is not a long-term driver of Bitcoin prices, but only a marginal factor. The flow of ETFs and the growing deficit issue are more important, and these data are all bullish for Bitcoin."

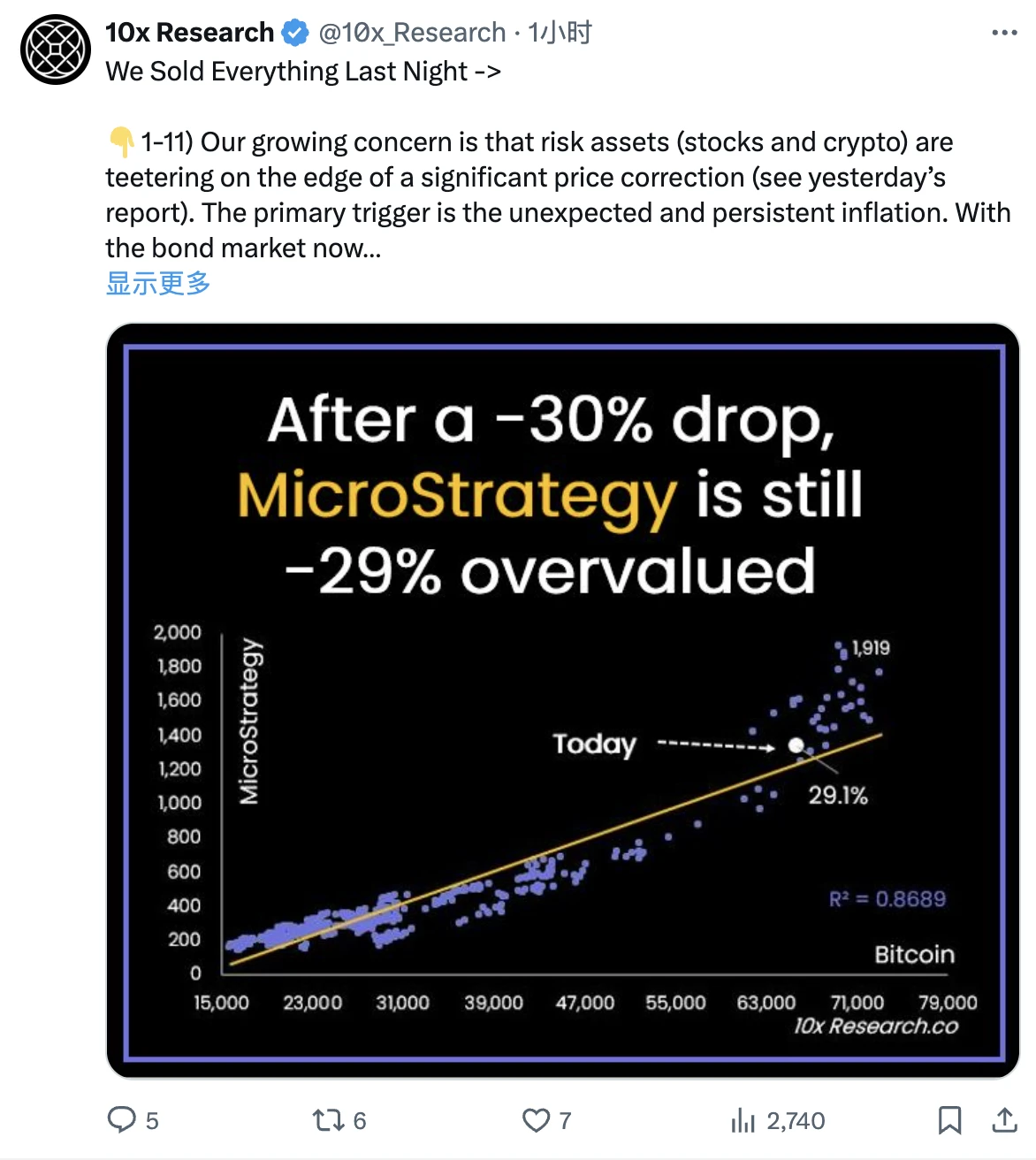

Reversing the bearish singer: 10x Research

Compared to the bulls, there are relatively few well-known players in the bear camp. Arthur, who was originally bearish in April, would have been the best representative, but with Arthur turning bullish, the bear camp urgently needs a new banner.

This morning, the well-known institution 10x Research, which was still calling for a target of 80,000 last week, suddenly stated "has liquidated all positions last night", which has also sparked widespread discussion on social media.

In explaining the logic of the liquidation, 10xResearch stated that the main reasons were:

We are increasingly concerned that risk assets (stocks and cryptocurrencies) are both at a critical point and may experience a significant price correction. The main triggering factor is the unexpected sustained inflation, the current bond market forecasts show that the number of rate cuts will be less than three times, and the yield on the 10-year U.S. Treasury bond has exceeded 4.50%, and we may have reached an important turning point for risk assets.

It must be understood that trading is a game that is continuous and full of opportunities. The key to trading is to continuously analyze the market and find opportunities at favorable times, sometimes we advocate strategies to increase risk (to gain more returns), and at other times, preserving capital is the top priority, which allows you to seize opportunities at lower risk levels.

… (10xResearch's report does have a third point, but to read the third point and more complete content, the minimum membership fee required is $340 a year, I choose to use this $340 to buy the dip.)

Risk Warning

Finally, it needs to be emphasized that the above content is only a summary of the market predictions of some KOLs who are currently receiving high attention in the market. The predictions and reasons of the major KOLs in the article are their personal opinions and do not represent the views of Odaily Planet Daily.

Investment is extremely risky, please do not easily believe in others' calls, be sure to DYOR before making any moves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。