- Title: AICoin Weekly Research Report:

Table of Contents for This Week's Research Report:

I. Preview of Key Events in Macroeconomic Data and Cryptocurrency Market This Week;

II. Review of Key News in the Cryptocurrency Industry;

III. Community Interaction and Sharing;

IV. Important Events, Data, and Interpretation;

V. Institutional Perspectives and Overseas Views;

VI. Top Gainers in the Cryptocurrency Market and Selection of Community Hot Coins Last Week;

VII. Attention to Project Token Unlocking Negative Data;

VIII. Top Gainers in Cryptocurrency Market Concept Sectors;

IX. Overview of Global Market Macroeconomic Analysis;

X. Future Market Judgment.

I. Preview of Key Events in Macroeconomic Data and Cryptocurrency Market This Week:

April 8th (Monday): Japan's February trade balance, Eurozone's April Sentix investor confidence index, and the US March New York Fed inflation expectations. The London Stock Exchange announced the acceptance of listing applications for Bitcoin and Ethereum ETNs.

April 9th (Tuesday): Minneapolis Fed President Kashkari's speech, US March small business optimism index.

April 10th (Wednesday): Bank of Japan Governor Kuroda's speech, US March CPI, core CPI, Federal Reserve Board member Bowman's speech on Basel capital requirements, Bank of Canada's interest rate decision and monetary policy report, and US February final wholesale inventory month-on-month. South Korea's general election, and the South Korean stock market will be closed for a day. Thailand will finalize the details of the digital wallet plan.

April 11th (Thursday): The Federal Reserve will release the minutes of the March monetary policy meeting, the European Central Bank will announce the interest rate decision, US initial jobless claims for the week ending April 6th, US March PPI, core PPI, and European Central Bank President Lagarde will hold a monetary policy press conference. Starknet Goerli testnet will be deprecated, and users need to migrate to Sepolia as soon as possible; Masa Network will launch its mainnet and introduce the MASA token.

April 12th (Friday): Boston Fed President Collins will speak at the New York Economic Club, Atlanta Fed President Bostic will speak, and the Reserve Bank of India will announce the interest rate decision. Richmond Fed President Barkin will speak, and the preliminary value of the University of Michigan Consumer Sentiment Index for April will be released. BlackRock will release its financial report.

April 8th to April 14th (TBD): Solana's repair team Anza is expected to start releasing repair programs this week; Jupiter's backlog issue has been resolved, and a major upgrade will be made to the backend system; Tensor Season 3 has ended, and the TNSR token economics and governance documents will be released; gm.ai will disclose an overview of the token economic model, with details to be released this week.

II. Review of Key News in the Cryptocurrency Industry (Exclusive Summary):

Data Aspect:

According to on-chain data, 1.876 million BTC were bought at prices above $60,000, indicating investors' confidence in Bitcoin. This week, large unlocks of APT, EUL, GLMR, 1INCH, and others are expected to have a certain impact on the market. Ethereum saw a record high number of new addresses in March, further demonstrating the vibrancy of the Ethereum ecosystem. In addition, net inflows into Bitcoin ETFs, the growth of Bitcoin's total market value, and Forbes' list of cryptocurrency billionaires all demonstrate the prosperity of the cryptocurrency market.

Project and Platform Aspect:

Tensor released detailed information on the TNSR token economics and announced an airdrop plan, which has attracted widespread attention in the market. Meanwhile, Coinbase will also list Tensor, further enriching the variety of digital assets on its platform. Additionally, Ripple plans to launch a US dollar stablecoin, and the BCH block reward halving has been completed, both of which are important milestones in project and platform development.

Macroeconomic Policy and Regulatory Aspect:

The US Securities and Exchange Commission (SEC) has postponed its decision on Bitwise and Grayscale Bitcoin spot ETF options trading applications, indicating a cautious attitude of regulators towards the cryptocurrency market. The decision by the Federal Reserve to maintain interest rates unchanged has also had a certain impact on the cryptocurrency market. In addition, expectations for an Ethereum ETF and rumors of Morgan Stanley possibly launching a Bitcoin ETF reflect the trend of integration between the cryptocurrency market and traditional financial markets. However, the impact of regulatory pressure on Bitcoin prices should not be underestimated. Overseas analysts have pointed out that if faced with regulatory pressure, Bitcoin prices may experience a significant decline.

Institutional Research Reports and Perspectives:

Major institutions and market participants hold different views on the prospects of the cryptocurrency market. The founder of BitMEX believes that the market will experience a period of weakness followed by increased liquidity, driving a bull market in cryptocurrencies. Reports indicate that Ethereum and Polygon have attracted a large number of new users, demonstrating the widespread application prospects of blockchain technology. However, some analysts have warned of the risk of Bitcoin reaching its peak, which could have a negative impact on the US stock market. In addition, institutions have delved into discussions on the demand for Bitcoin ETFs, the potential of Bitcoin as "digital gold," and the reasons for the rise in Bitcoin prices. These perspectives and research reports provide investors with diverse viewpoints and considerations.

III. Community Interaction and Sharing:

The recent consecutive record highs in the price of gold are worth exploring from two perspectives:

From a price perspective, both spot gold and COMEX gold futures have shown strong upward trends. This upward trend is not a short-term fluctuation, but a sustained rise, indicating strong market demand for gold. As a safe-haven asset, the rise in gold prices is often closely related to the escalation of geopolitical tensions. Currently, global geopolitical risks remain high, providing strong support for the rise in gold prices.

From the perspective of global central bank behavior, central banks around the world are actively increasing their gold reserves. A report released by the World Gold Council shows that global central bank purchases of gold reached the second-highest level in history in 2023. This reflects the increasing recognition and demand for gold by central banks. The increase in gold reserves by central banks not only helps stabilize the value of their domestic currencies but also enhances national financial security. The top ten countries in terms of global gold reserves (the United States, Germany, Italy, France, Russia, China, Switzerland, Japan, India, and the Netherlands) have continued to increase their gold reserves, with a total of 24,260.63 tons, an increase of 15.58 tons since February, and a continuous increase in gold reserves for 17 consecutive months, demonstrating strong confidence in gold. The increase in gold reserves helps enhance the economic strength and international status of these countries, while also providing stable support for the global gold market.

IV. Important Events, Data, and Interpretation:

Regarding on-chain data, approximately 1.876 million BTC were bought at prices above $60,000. Additionally, EMC Labs released a report in March interpreting the behavior of investors engaging in large-scale selling.

We believe that the large-scale BTC buying behavior shown in on-chain data undoubtedly provides a strong boost to market confidence. This massive buying volume, accounting for 9.5% of the total supply, demonstrates the strong confidence of large investors or institutions in Bitcoin. Their willingness to make large purchases at high levels indicates their long-term holding and positive outlook for the future value of Bitcoin. This data indicates that at this price point, a large amount of capital has entered the market and actively accumulated BTC. This large-scale buying not only increases market liquidity but also demonstrates investors' recognition and confidence in the long-term value of Bitcoin.

However, in sharp contrast to this buying behavior is the large-scale selling behavior by investors since February 26th. The selling behavior can be divided into two phases, with prices rising in the first half and falling in the second half. The fluctuation in prices is actually a result of the struggle between the long and short sides of the market. Sellers made substantial profits in the early stage and chose to secure profits in the later stage, which has had an impact on market sentiment to some extent.

Overall, the sellers have locked in nearly $63 billion in profits through the selling, which is undoubtedly a huge number. However, the report indicates that the selling pressure is weakening, which may signal the end of the first wave of large-scale selling in the bull market. In the early stages of a bull market, investor sentiment is often more exuberant, and the market is prone to excessive speculation and bubbles. As the market gradually matures and becomes more rational, investors begin to focus more on the fundamentals and value of Bitcoin, and the selling behavior gradually becomes more rational.

The recent large-scale selling before the halving is actually a deep cleansing of the market. It has cleared a large amount of profit-taking chips, making the investor structure in the market healthier. At the same time, this wave of selling has also shifted the cost center of BTC upwards, which means that in the future, the price of Bitcoin needs to reach higher levels to allow new investors to profit. This upward shift in the cost center provides strong support for the future rise in the price of Bitcoin.

For long-term investors, although this wave of selling behavior may have a certain impact on the market in the short term, it has laid the foundation for the next stage of price increase in the medium to long term. Based on caution, long-term investors should actively take a bullish stance, absorb high-quality chips on dips, and look forward to greater market development in the future.

In summary, from our perspective, although there has been a large-scale selling behavior in the Bitcoin market recently, this does not mean the end of the market. On the contrary, it may be a sign of the market's maturity and rationality. For investors, it is important to remain calm and rational, focus on the fundamentals and value of the market, and make wiser investment decisions.

V. Institutional Perspectives and Overseas Views:

Summary: The US taxation and the Federal Reserve's balance sheet reduction will bring short-term weakness to the market, but after May, with improved liquidity, the cryptocurrency market is expected to enter a new bull market. Ethereum's rebound may be related to Vitalik Buterin's activities, while Bitcoin is entering a correction. The options market expectations show that the market is short-term bullish on Ethereum, but uncertain about Bitcoin's trend. Technical analysis suggests that BTC may quickly rise to new all-time highs after breaking the so-called triangle resistance. The cryptocurrency market is fiercely competitive, but coins other than Bitcoin have entered a technical bear market. Glassnode analysis indicates that long-term holders are starting to sell their tokens using new demand and liquidity, and smart investors will buy low and sell high. In the first two bull market cycles, new demand for Bitcoin was able to absorb the selling of long-term holders in approximately 6-8 months, while also driving up the price. Considering that the typical long-term holder supply has decreased by 14%, about 40% of this process has already been completed. The supply distribution of long-term holders for spot Bitcoin ETFs and GBTC during Bitcoin's ATH breakthrough is similar to the previous situation. According to calculations, GBTC accounts for about 25% of long-term holder spending, while ETF demand accounts for about 40% of net capital inflows.

In a roundtable discussion titled "Fifteen Years of Bitcoin" at the 2024 Hong Kong Web3 Carnival, Cobo co-founder and CEO Fish God stated that in recent years, many innovations have emerged from entrepreneurs of Chinese descent in the development of the Bitcoin ecosystem, with innovative advantages and resource advantages. He believes that after one or two cycles, the moment when Bitcoin applications will explode on a large scale will come, and a large number of application innovations may still come from entrepreneurs of Chinese descent. From the perspective of miners, Fish God hopes that Bitcoin will have more applications and scenarios, and will strongly support the development of the Bitcoin ecosystem. He hopes that Bitcoin will be compatible with more innovations without affecting the security of the existing mainnet. The possibility of another hard fork for Bitcoin is small, but there may be one or two versions of soft fork iterations, which innovate on existing conditions while retaining the current architecture. Regarding the price prediction for Bitcoin, Fish God stated that the prediction of "Bitcoin price reaching $1.5 million by 2030" is still conservative, and Bitcoin will usher in a large-scale application explosion after one or two cycles, with several times more space at that time. The core players involved will be large financial institutions.

Arthur Hayes, co-founder of BitMEX, predicts in his latest blog that from mid-April to early May, US taxation will drain market liquidity, coupled with the continued reduction of the Federal Reserve's balance sheet, the market may experience extreme weakness. However, starting from May 1st, with the Federal Reserve slowing down the pace of balance sheet reduction and the US Treasury using funds to stimulate the market, a new round of cryptocurrency bull market is expected to begin. Hayes pointed out that the Federal Reserve has indirectly "infused" the banking system by relaxing bank capital requirements, allowing them to hold more government bonds. The US Treasury has also been issuing short-term government bonds to absorb the tens of trillions of dollars in idle funds in the Federal Reserve's reverse repurchase tool. Both measures are conducive to improving market liquidity. However, Hayes expects the tax deadline on April 15th to drain a large amount of funds from the system. Meanwhile, the Federal Reserve is still continuing its monthly reduction of $95 billion. In addition, the expected halving of Bitcoin's block rewards on April 20th may bring short-term overselling, putting tremendous pressure on the market. Hayes advises investors to be cautious in April, but bold in their deployment after May. He revealed that he has already closed positions and made profits on tokens such as MEW, SOL, and NMT, and transferred funds to the USDe stablecoin on the Ethena platform for staking. Hayes stated that if he can avoid the risk of losses in April, he will have sufficient ammunition to establish various cryptocurrency asset positions in May and fully enjoy the benefits of the bull market.

Greeks Macro Research indicates that Ethereum has seen a significant rebound today, which may be related to Vitalik Buterin's participation in blockchain activities in Hong Kong, while Bitcoin is entering a correction. The options market expectations are consistent with the price trend. Today, Bitcoin options are mainly selling short-term, while Ethereum options are mainly buying short-term calls. Both are mainly traded in the form of spread combinations, indicating market uncertainty about future trends, with the main term IV slightly decreasing. BTC also has different signals, with 350 contracts for long-term call options expiring in March next year just traded, with a premium value of $2.5 million. Currently, whales have accumulated nearly 30,000 contracts of call options with a strike price of over $100,000 in various terms.

Technical analysis by 10x Research shows that after breaking the so-called triangle resistance, BTC may quickly rise to new all-time highs. Markus Thielen, founder of 10X Research, stated, "If the breakout is bullish, we suspect that Bitcoin may climb to over $80,000 in the next few weeks, or even earlier. Buying at $69,280 and setting a stop loss at $65,000 seems appropriate." 10x Research has become cautious a month ago after a significant bullish trend since January 25th, as from a technical perspective, the long-term returns of the market seemed unpredictable at that time. 10x Research states that cryptocurrency trading is a game of risk and return, and one should know when to go all-in and when to go light, and the past thirty days have not been a period to go all-in. But this situation will change soon, and its focus on trading signals also conveys similar information.

The cryptocurrency market is still fiercely competitive at $70,000, but coins other than BTC have entered a technical bear market. Bitcoin has rebounded significantly in the past week, with the main term IV rebounding to a new high for the year after a slight decrease, and Dvol remains high. VRP has risen significantly this week, and there is significant downward pressure on the IV of main term options, mainly IV of short to medium term options. The Bitfinex green leaf interest rate market has become active again, with the weighted interest rate continuing to rise, with the 120-day interest rate reaching over 20%. Idle funds can start to increase lending in the green leaf market.

Glassnode analysis indicates that the situation of Bitcoin breaking its all-time high price is almost the same as before. Long-term holders are starting to sell their tokens using new incoming demand and liquidity, and smart investors will buy low and sell high. In the first two bull market cycles, new demand for Bitcoin was able to absorb the selling of long-term holders in approximately 6-8 months, while also driving up the price. Considering that the typical long-term holder supply has decreased by 14%, about 40% of this process has already been completed. The supply distribution of long-term holders for spot Bitcoin ETFs and GBTC during Bitcoin's ATH breakthrough is similar to the previous situation. According to calculations, GBTC accounts for about 25% of long-term holder spending, while ETF demand accounts for about 40% of net capital inflows.

The latest report from Flipside shows that Ethereum and its Layer 2 scaling solution Polygon have attracted the most new users in the first quarter of 2024, and it is also the chain with the most cumulative new users observed so far this year in the EVM chain. As of March 27th, Polygon has 12.3 million new users, and Ethereum has 13.4 million new users, accounting for about 70% of all new on-chain users observed this year.

EMC Labs released a report in March stating that investors began large-scale selling on February 26, leading to a decline in the price of Bitcoin. The selling can be divided into two stages, with the first half seeing the price rise from $51,730.96 to $71,475.93, and the second half seeing the price drop to $60,771.74. Overall, the sellers have locked in nearly $63 billion in profits. The report suggests that the selling pressure is weakening, indicating that the first wave of large-scale selling in the bull market is coming to an end, laying the foundation for the next stage of price increase. This wave of large-scale selling before the halving has cleared a large amount of profit-taking chips, shifted the cost center of BTC upwards, and is helpful for the next stage of price increase. For long-term investors, it is advisable to take a bullish stance based on caution.

VI. Last Week's Cryptocurrency Market Performance Ranking and Community Hotspot Coin Selection:

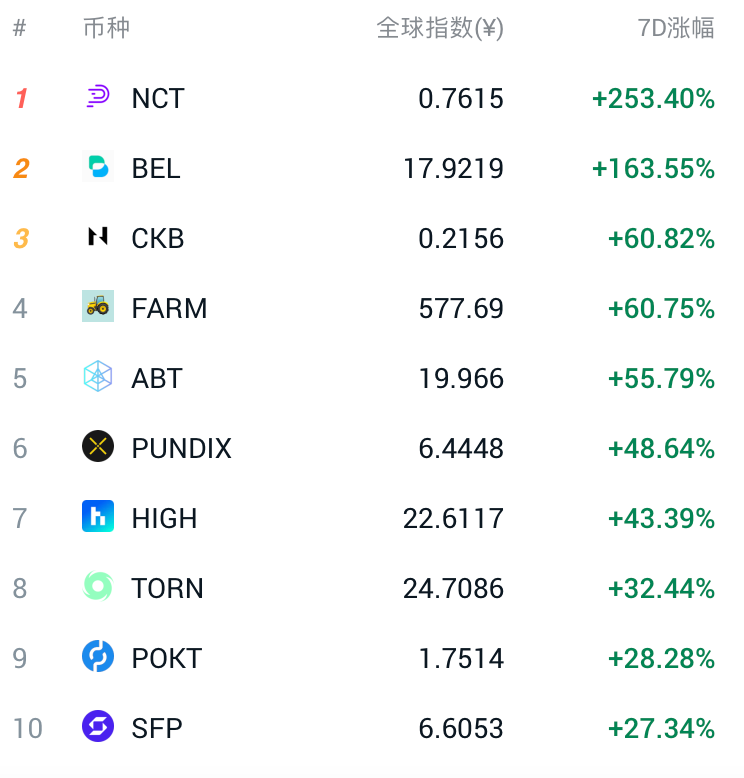

In the past week, the performance ranking of altcoins is as shown above. NCT has risen significantly, nearly doubling in value; BEL has risen by about 160%, while CKB, FARM, and ABT have risen by about 55%-60%. Other coins are also at the forefront of the rise. Potential trading opportunities can continue to be monitored this week, and attention should be paid to seizing the market hotspots.

The following are the selected hot coins for community discussion, for reference only and not as a basis for trading decisions:

According to Coingecko data, the market value of TON broke through $20 billion yesterday, reaching a new all-time high. TON broke through $7, currently trading at $6.898, with an intraday increase of 25.37%.

VII. Project Token Unlocking Negative Data Focus:

According to TokenUnlocks data, this week Aptos will see a large one-time token unlocking, including:

- 1inch will unlock 214,000 1INCH tokens on April 11 at 8:00, worth about $117,000, accounting for 0.02% of the circulating supply.

- Moonbeam will unlock 214,000 GLMR tokens on April 11 at 8:00, worth about $1.35 million, accounting for 0.36% of the circulating supply.

- Euler will unlock 76,200 EUL tokens on April 11 at 9:27, worth about $432,600, accounting for 0.41% of the circulating supply.

- Aptos will unlock 24.84 million APT tokens on April 12 at 15:59, worth about $330 million, accounting for 6.23% of the circulating supply.

This week, attention should be paid to the negative effects of these token unlocks, avoiding spot trading, and seeking short opportunities in contracts. Among them, APT's unlocking magnitude is relatively large, so it should be closely monitored.

VIII. Last Week's Cryptocurrency Market Concept Sector Performance Ranking:

In the past week, the performance of concept sectors is as shown above. Based on the degree of rise and fall, the leading sectors in the past seven days are liquidity mining, DeFi, Alameda Research (SBF) investments, Coinbase Pro comprehensive, and sports competition. Attention should be paid to the rotational speculative market of the above-mentioned sectors with significant increases.

IX. Global Market Macro Analysis Overview:

In the A-share market, all three major indices achieved weekly gains, indicating a generally positive market sentiment. The strong performance of cyclical sectors such as non-ferrous metals, oil and gas exploration and services, and coal may be related to the rise in international commodity prices and the gradual economic recovery in China. Conversely, the decline in sectors such as Sora concepts, short dramas, and media may reflect short-term concerns or uncertainties in these emerging areas.

In the Hong Kong stock market, the Hang Seng Index saw an increase, but the Hang Seng Tech Index experienced a decline, indicating market differentiation. The rise in sectors such as forestry, home appliances, and non-ferrous metals may be related to expectations of global economic recovery and the revaluation of the Hong Kong stock market. The decline in sectors such as pharmaceuticals and lithium batteries may be related to policy adjustments or market competition pressure in the relevant industries.

In the US stock market, all three major indices fell, indicating volatility and uncertainty. The mixed performance of large-cap tech stocks reflects different market expectations and views on these companies. The rise of Google, Meta, and Amazon may be related to their performance or business development, while the decline of Apple, Tesla, and Nvidia may be related to market competition, policy adjustments, or investor sentiment. Most popular Chinese concept stocks fell, possibly due to uncertainty in Sino-US economic and trade relations and adjustments in the domestic market.

Key events this week include US Treasury Secretary Yellen's visit to China, which may have a significant impact on global capital markets. Further discussions on Sino-US economic and trade relations will be an important signal for global capital markets. In addition, important releases from the Bank of Canada, Reserve Bank of New Zealand, and Bank of Japan will have an impact on financial markets. The release of the Federal Reserve meeting minutes and speeches by officials will also provide important clues about the future direction of monetary policy.

X. Future Market Judgment:

BTC broke through the upper resistance of the converging triangle since $73,777 on Monday, rising to near $72,800, and is currently experiencing a pullback. It is currently testing the extension position of the original downtrend line, and it is not yet clear whether it is an effective breakthrough or a false one.

Considering the halving is about ten days away, there is no clear direction due to the struggle between long and short positions. The market has been oscillating at this level for over twenty days, and there may be a lot of disorderly fluctuations before that. The frequent opening and closing of positions by short-term speculative funds may also lead to poor market sustainability. The support levels to consider are near $66,600, $63,800, and $59,000, while the resistance levels are near $73,777 and the all-time high. Only when a confirmed candle closing price is established outside the technical price range can the recent wide-ranging oscillation pattern be broken.

Follow us: Lao Li Mortar

April 8, 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。