Author of the original article: Jake Pahor

Original article translated by: Frank, Foresight News

As a Rollup-as-a-Service platform that provides low-threshold Rollup launch solutions to DApp teams, AltLayer, which has been continuously expanding its ecological footprint, saw its token ALT reach a historical high of 0.66997 USDT (Binance spot data) today.

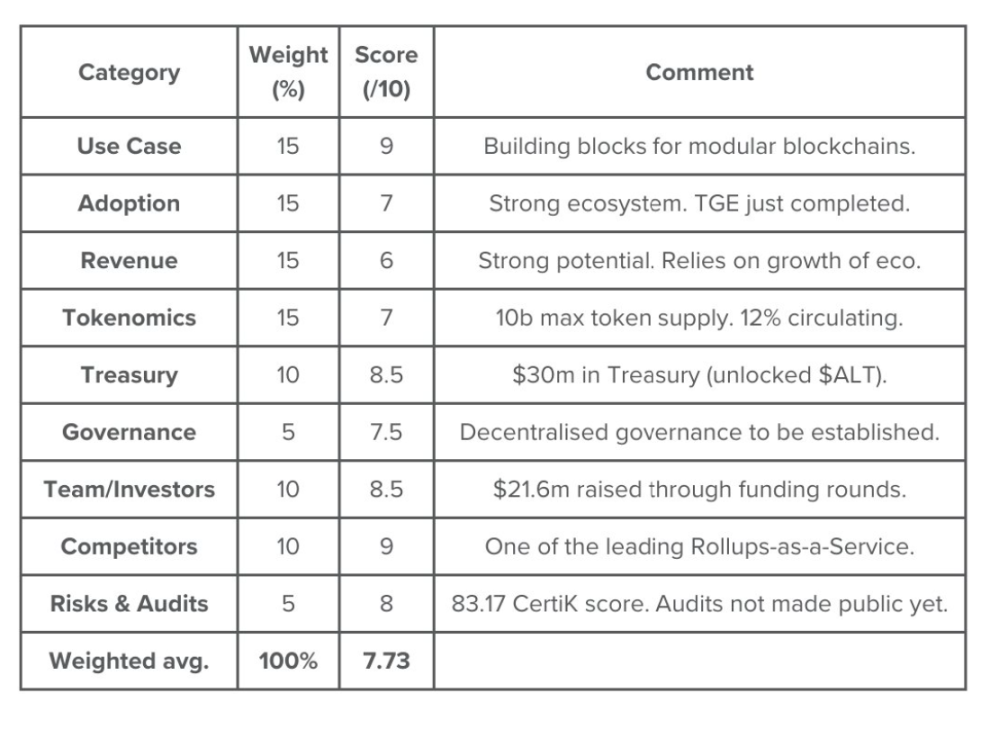

This article is a brief report on ALT by crypto researcher Jake Pahor, who conducted a detailed study of AltLayer, covering various aspects such as use cases, mass adoption, project revenue, and token economics. Foresight News has compiled the entire article.

1. Overview

AltLayer is a decentralized protocol for launching native and restaked Rollups using the Optimistic and ZK Rollup stack, with its main products being:

Restaked Rollups;

Rollups-as-a-Service;

The goal of these two products is to help projects save time and money while promoting innovation.

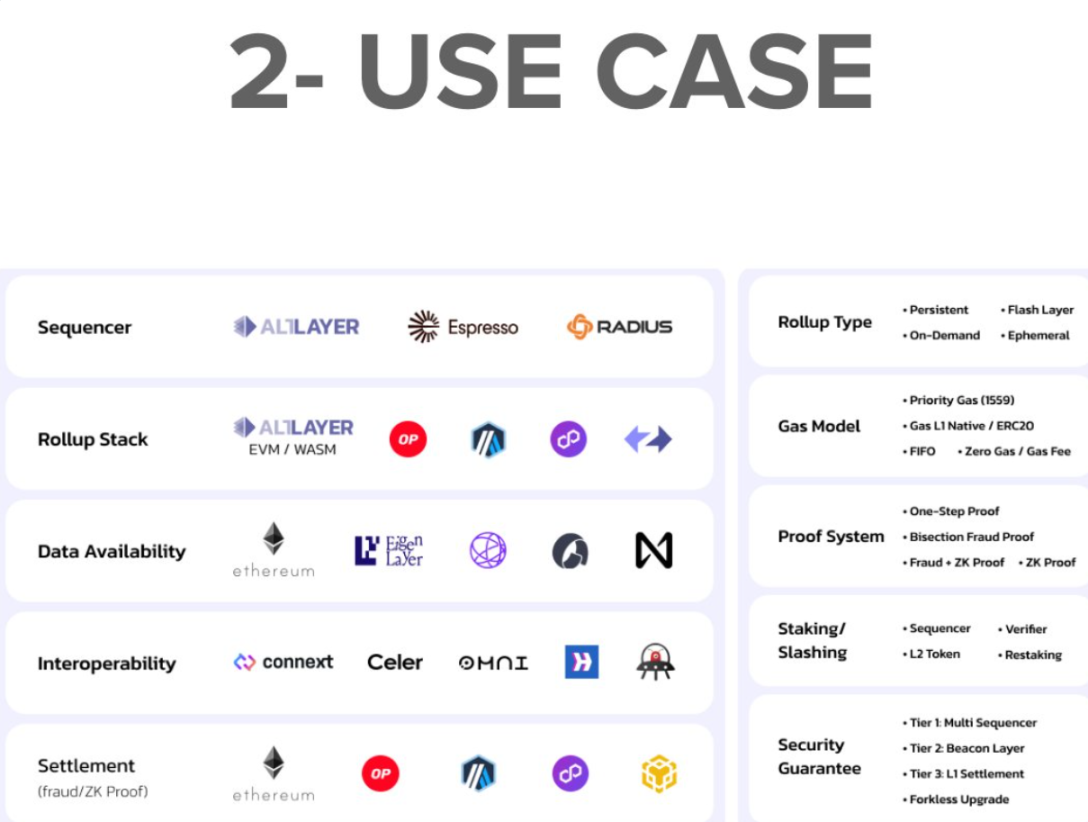

2. Use Cases

Restaked Rollups combine existing Rollup solutions (OP Stack, Arbitrum Orbit, ZK Stack, etc.) with enhanced security, decentralization, interoperability, and fast finality, and integrate the existing Rollup stack with EigenLayer's restaking mechanism to leverage its advantages.

AltLayer envisions a world with thousands of Rollups, including general and application-specific Rollups, making it as easy to create these Rollups as using LEGO bricks.

For example:

AltLayer = Sorter;

OP = Stack;

Celestia = DA;

Ethereum = Settlement;

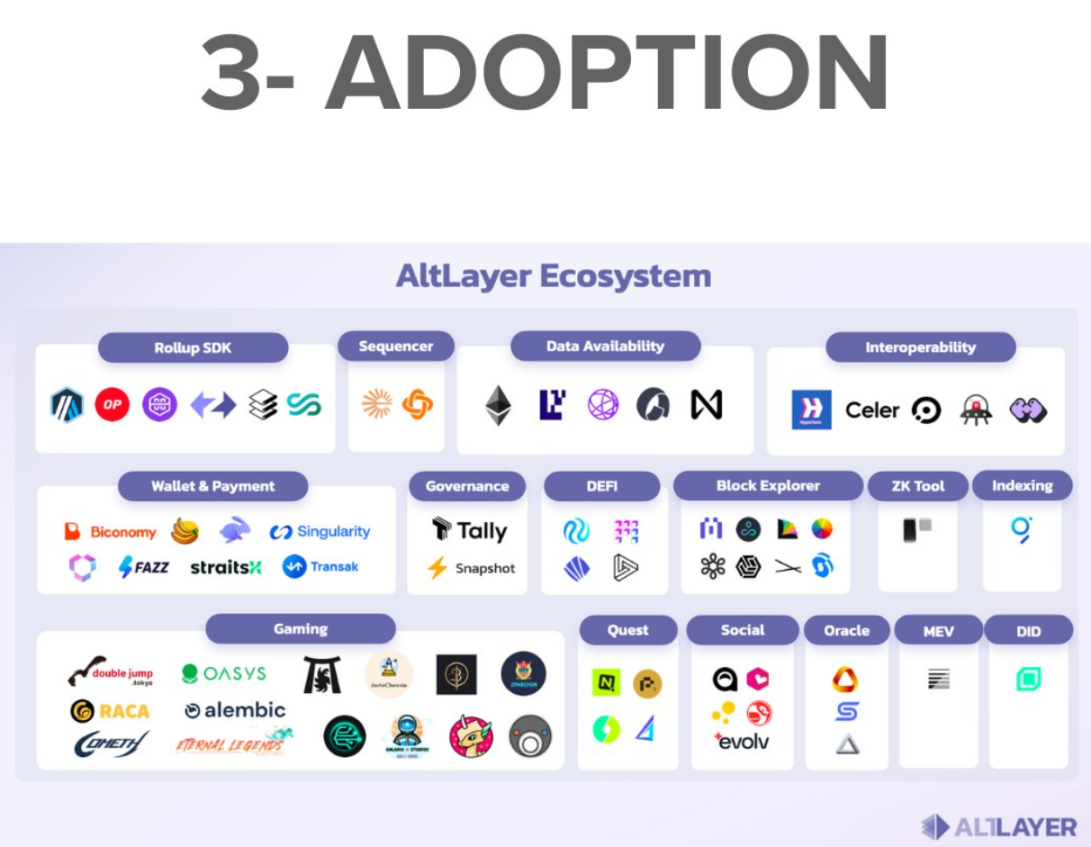

3. Mass Adoption

The AltLayer ecosystem is rapidly growing and currently includes some noteworthy partners: Arbitrum, Optimism, Polygon, EigenLayer, Celestia, Espresso, Hyperlane, Injective, Rabby.

So far, they have launched 4 public testnets and collaborated with over 20 well-known clients.

4. Revenue

ALT demand is driven by 3 main mechanisms:

Collateral: ALT tokens are used as collateral alongside restaked assets;

Incentives: Operators in the AltLayer ecosystem can receive ALT tokens as rewards for their services;

Transaction fees: Paying network service fees in ALT;

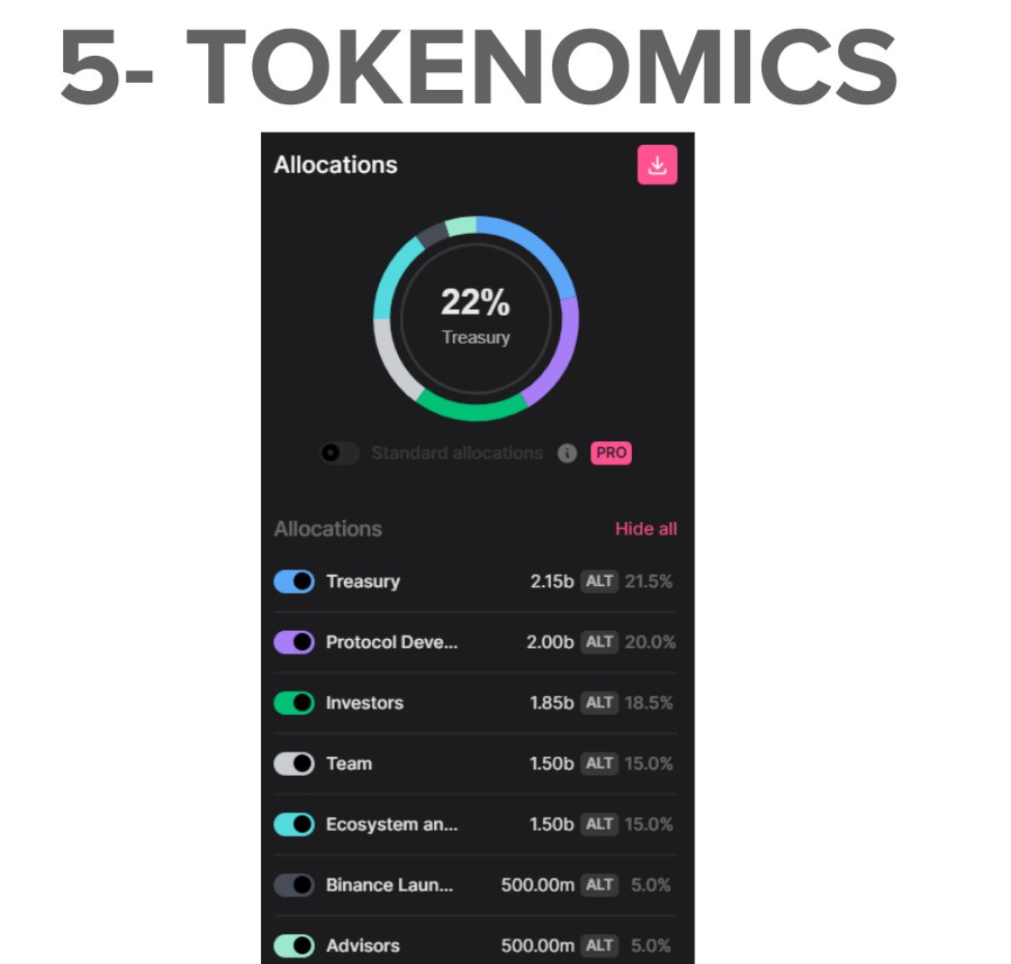

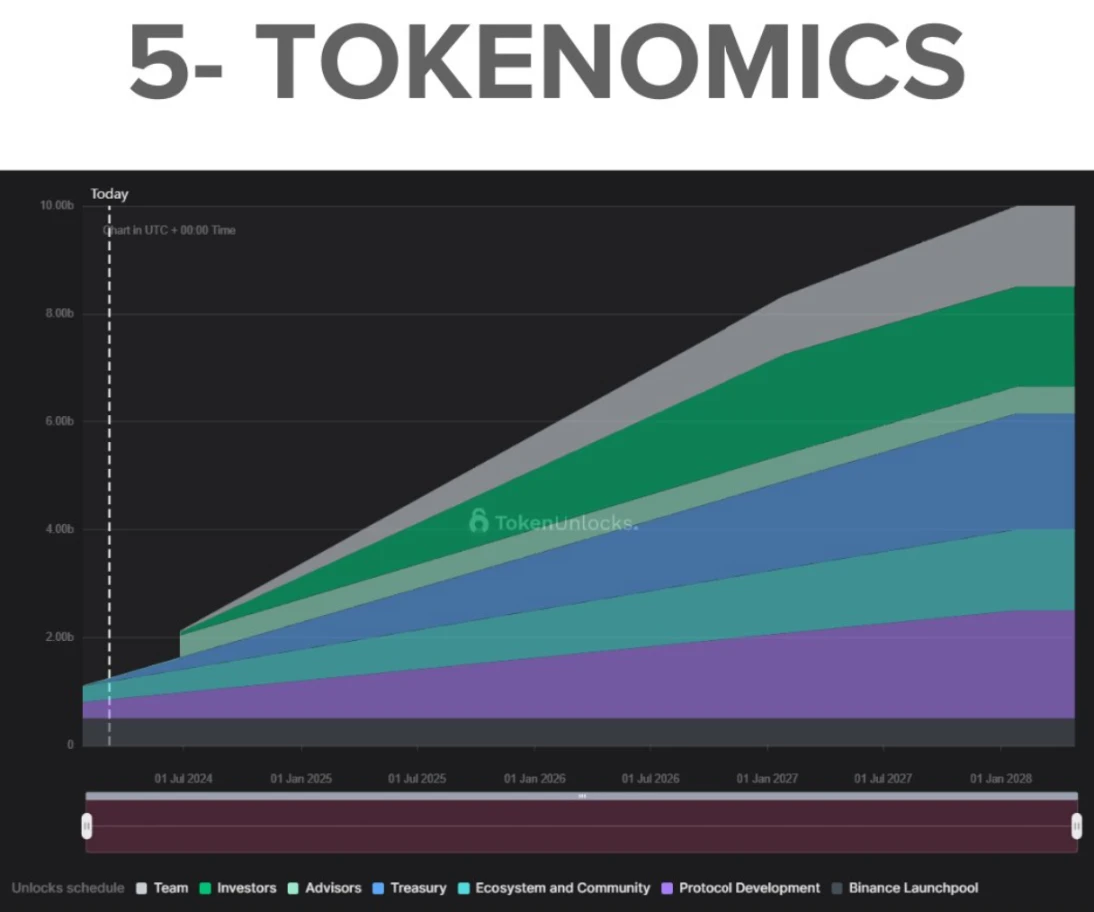

5. Token Economics

ALT is the native utility token of AltLayer, used for collateral, governance, protocol incentives, protocol fees, and other scenarios.

Initially, AltLayer airdropped 3% of the token supply (300 million ALT) to NFT holders, Altitude event participants, EigenLayer restakers, and Celestia stakers.

The Celestia staker airdrop claim window has now closed, and overall, it was not a large airdrop for most people, typically requiring staking 35 TIA to be eligible for claiming.

Current token supply statistics:

Circulating supply: 11 billion tokens;

Maximum supply: 100 billion tokens;

Market cap: $5.45 billion;

FDV: $50 billion;

Market cap / FDV: 11%;

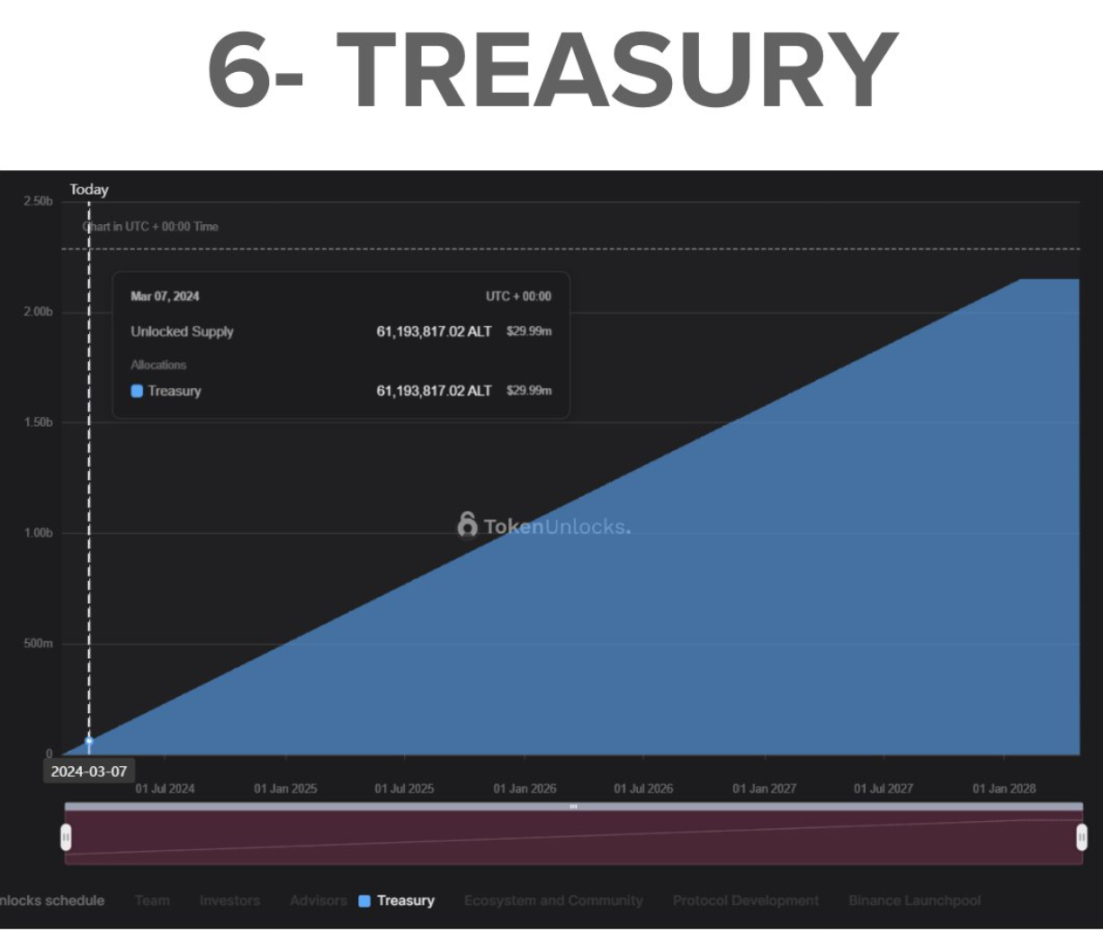

6. Treasury

Based on the current valuation, the AltLayer treasury holds:

61 million ALT = $40 million

These tokens have been unlocked, and the remaining allocations will be linearly unlocked over the next 4 years. Once fully vested, their value will exceed $1 billion at the current token price.

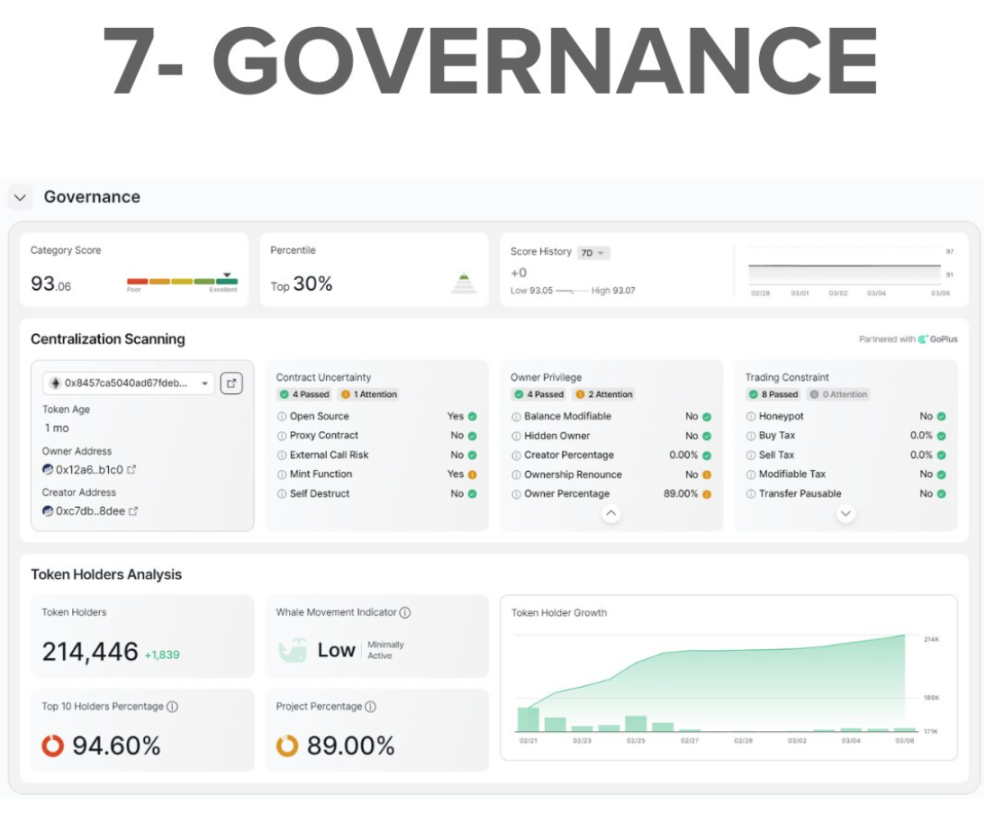

7. Governance

ALT token holders will have the opportunity to vote on governance decisions, but a formal governance structure has not yet been established.

According to CertiK, AltLayer has shown strong performance in the governance category, demonstrating a relatively high level of decentralization.

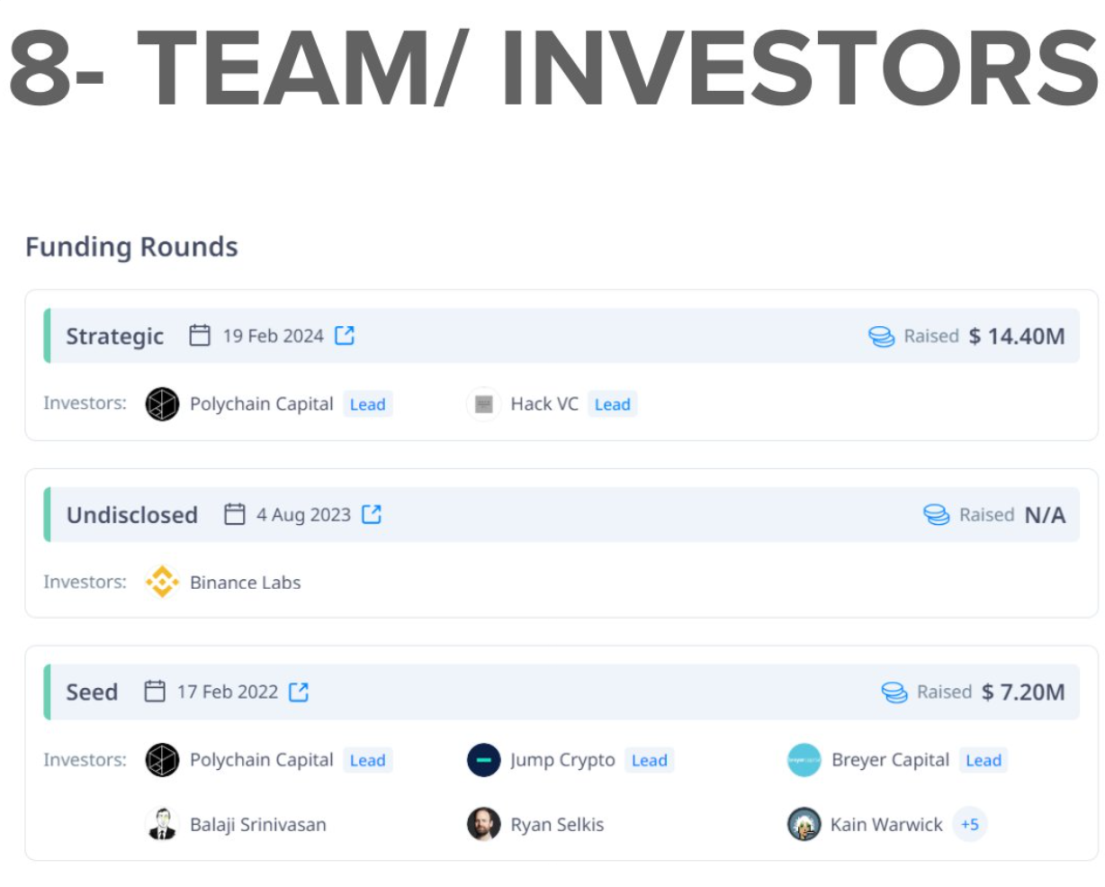

8. Team and Investors

AltLayer was founded by Jia Yaoqi in 2021 and has raised over $21.6 million in funding over the past few years. Investors include Polychain Capital, Jump Crypto, Breyer Capital, Binance Labs, Hack VC, Balaji, Ryan Selkis, and Gavin Wood.

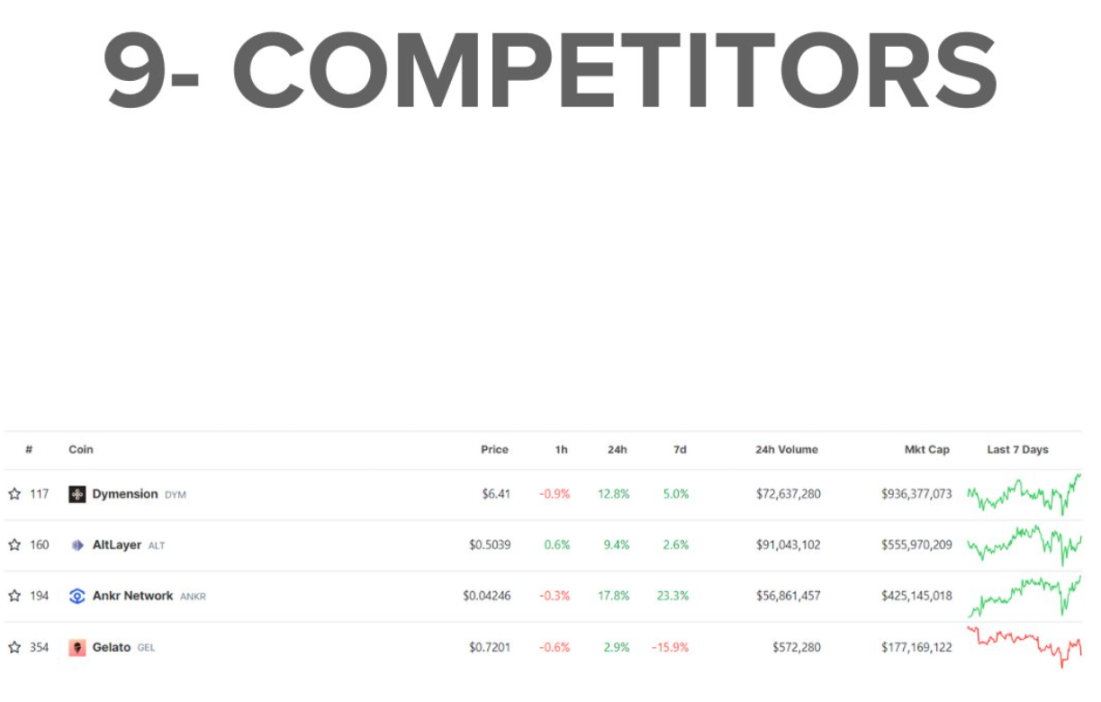

9. Competitors

AltLayer is at the forefront of the new wave of modular blockchain applications, with some referring to this category as "Rollups-as-a-Service".

Its main competitor, Dymension (DYM), recently completed an airdrop and token issuance as well.

10. Risks and Audits

CertiK Security Score: 83.17, project ranking in the top 10%, and 21st among newly released projects.

AltLayer stands out for its market performance, governance practices, and community engagement, but as of now, no public code audit has been found.

11. Conclusion

Overall, I am very optimistic about the modular blockchain theory, and I believe that AltLayer is well positioned to take full advantage of this narrative development.

Upcoming catalysts:

Modular narrative growth;

Further airdrops;

Continued integrations;

Overall weighted score = 7.73

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。