Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of digital currency market trends, striving to convey the most valuable market information to the majority of currency friends. Welcome the attention and likes of the majority of currency friends, and refuse any market smokescreens!

After talking about exchange rates for so long, I found that everyone's understanding of exchange rates is still insufficient. Often, when everyone reads Lao Cui's articles, they will do as he writes. Especially when it comes to why USDT is falling, including the fact that the US dollar has not lowered interest rates but has been declining all along, a series of underlying logic, the questions that everyone has raised for Lao Cui are almost the same. This time, I will analyze the underlying logic of interest rate cuts and make predictions for the future trend of the currency circle.

First of all, everyone needs to understand that the previous choices made by the United States to get through the crisis were all processes of reaping through interest rate hikes and balance sheet reduction. However, the effect of this round of interest rate hikes and reaping is not obvious. He has indeed reaped a part of the third world countries under such a large interest rate pressure, with Europe and Japan being the most significant two regions. But the effect of this round is obviously not as intense as the previous gains. Here, I want to remind everyone that the most important point is that the purpose of raising interest rates is to bring back funds. After a large amount of dollars are brought back, he also needs to release these funds back into the market. This time, the dollars released into the market are highly likely to return to the domestic market (this is relatively easy to predict, especially since the reduction in corporate taxes is to attract everyone to invest).

At this point, everyone will think of the way it was in 2008. Shouldn't the consistent style of the United States be to flow into third world countries after raising interest rates and then reap their assets? This brings us to our way, which can be said that this time, due to our growth, it has prompted a change in the United States' strategy. Because this time, we played a role in supporting the market, MF's debt will not be a problem, and the US dollar debt will not be a problem. The US dollar reserves of third world countries are all supported by us. They are basically all replaced with RMB debt, so after these dollars are brought back, they have not flowed into third world countries. Based on the recent policy judgment of the United States, it is highly likely that they will do the same as us, resume industrial production, and once again make a large investment in domestic infrastructure (we are also doing the same).

At this point, everyone needs to understand that Lao Cui is not pessimistic about the exchange rate of the US dollar. Many friends will definitely think, after hearing these words, whether the US dollar will collapse. You can rest assured about this. If he wants to collapse, we will not allow this situation to happen. Overall, the result is that the collapse of the US dollar is more harmful than beneficial to us, so we will not promote this to happen. This is also why, before the normal interest rate cut has not been implemented, the exchange rate has been slowly declining. The peak has reached a rate of 7.45, and the temperature has almost declined now, with the lowest point also reaching 7.37.

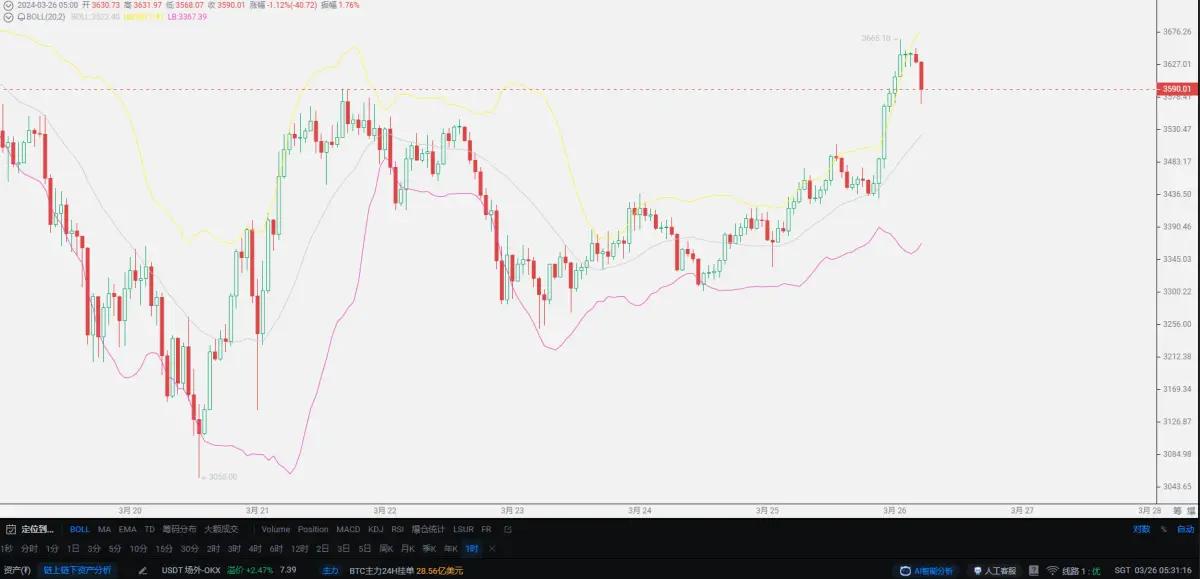

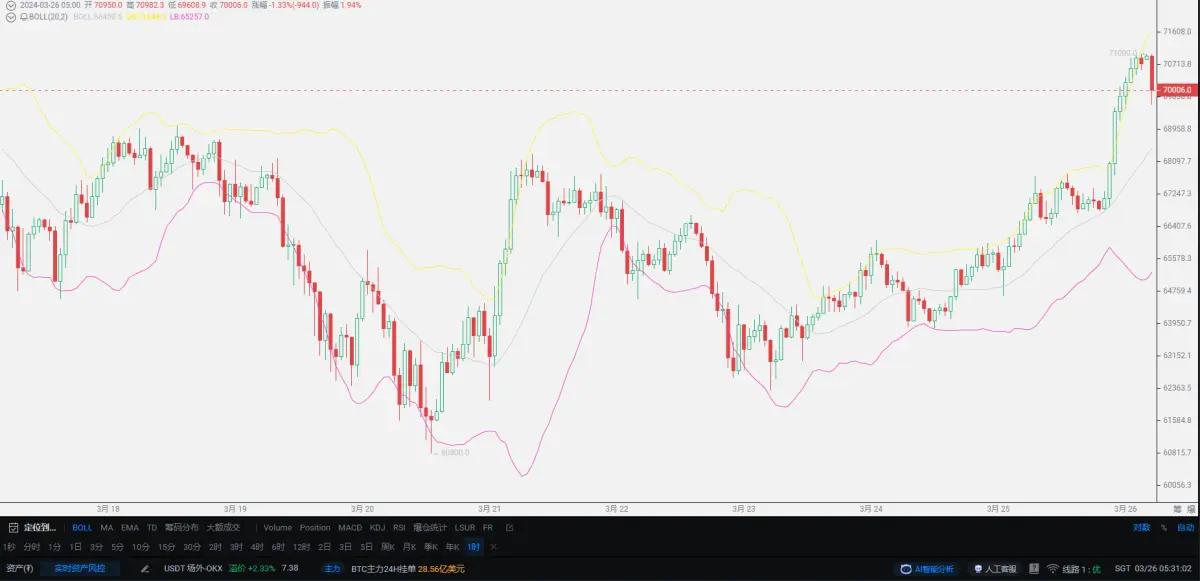

Do not underestimate this 0.08 exchange rate, which is definitely good news for the currency circle. The decrease in the price of USDT will also cause an increase in the currency circle, especially since the United States has confirmed that it will cut interest rates this year. Under this trend, USDT will also cool down, as it is pegged to the US dollar. Everyone should not think that USDT is a type of currency for investment in the currency circle, it has an underlying asset. Almost every day now, we will encounter a decrease in the exchange rate by 0.01, as long as the decline continues, the currency circle will return to a bullish state. But it will take time for the new high to cool down (under the condition of unchanged exchange rate). As long as the exchange rate continues to decline, new highs will not be a problem. But for the medium term, we cannot blindly be bullish, because the normal implementation of interest rate cuts has not actually landed. This is also why, even if there is an upward trend in the near future, the depth of the retracement is almost higher than our previous one-way market.

This is also why Lao Cui has always been bullish on the long-term level. The United States' interest rate hike strategy has now failed, and the interest rate cut is definitely a good thing for us. Especially as Bitcoin gradually becomes compliant, at least moving in this direction, the overall market environment is improving, naturally attracting more investment from major players. Especially the giants of traditional industries, almost all of them are entering the market in batches. The long-term bullish trend cannot be changed, which is why in yesterday's article, Lao Cui gave advice on spot trading, which is to provide everyone with opportunities to enter the market during the retracement. Do not think that the current price is high, the new high will definitely appear, and it will be much higher than the target that most people expected (most people do not represent the crowd that blindly goes long).

Especially the concept before listing and the current market concept are completely different. Everyone should not think that a new high will definitely be accompanied by a deep retracement. The retracement depth itself is within our predicted range, there will not be too deep a situation, and there will not be a doubling of growth before it is clearly implemented. Do not use the current Bitcoin to measure the situation when it first appeared in 2008. Many friends will be scared by the new high, and even be afraid to enter the market, which is the situation that Lao Cui has encountered with users in the past two days. Lao Cui's advice is to let everyone enter the market in batches. After the market goes up, most people are still in a wait-and-see situation. There will definitely be retracements in the medium term, but as long as the exchange rate continues to decline, the overall depth will not be too deep. Contract users can go short, but they must ensure that there is a profitable situation to exit, as the overall trend will not give everyone too many opportunities to exit. It is basically in a range trend and is still running in a market with oscillations.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The masters consider the overall situation, plan for the general trend, do not focus on every move, and aim to win the game in the end, while the lower ones fight for every inch, frequently switch between long and short positions, and only fight for short-term gains, often getting trapped in the end.

Original article created by public account: Lao Cui Shuobi. If there is any infringement, please contact the author to delete.

This material is for learning and reference only, and does not constitute buying or selling advice. Buying or selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。