Click to watch the video: Master Chen's 3.24 Video: Tracking the Main Force of the Market DOGE Pressure, Don't Chase After More!

So in today's video, we will track the recent movements of the whales, especially the main forces that bought at the bottom in the past two years. Recently, it seems that there are some differences, with some selling and some buying. However, most of the whales have not sold yet. So my plan remains unchanged, to continue holding the long position for profit, and to consider whether to close the position at the future top. Today, we will also share some knowledge from several charts, including Dogecoin.

First, let's take a look at the Bitcoin weekly chart. Regarding the 13th-ranked whale, some friends say that it seems to be an exchange wallet. Let's not worry about whether it is an exchange wallet or the wallet of a certain main force or manipulator. Let's look at the overall upward trend of Bitcoin over the past year.

First, let's take a look at the Bitcoin weekly chart. Regarding the 13th-ranked whale, some friends say that it seems to be an exchange wallet. Let's not worry about whether it is an exchange wallet or the wallet of a certain main force or manipulator. Let's look at the overall upward trend of Bitcoin over the past year.

This wallet has continued to buy recently. At the bottom of 15,000, it bought over 20,000 bitcoins. After the price of Bitcoin rose, it bought another 18,000 bitcoins near the low point of the consolidation zone around 25,000. Let's not worry about whether it is an exchange wallet. We will continue to track this 13th-ranked whale.

Then, I checked the rankings of other whales in the morning. For example, the 36th-ranked whale bought 22,000 bitcoins in June 2022 at a price near 20,000, or the 10th-ranked whale, which is the wallet of the Tether company, also bought around 20,000 in 2022.

I have also mentioned other whales in previous videos. The 35th-ranked whale bought 23,000 bitcoins at the bottom of 15,000 to 16,000, but then transferred them out. That is, during this period, around this month, it transferred these over 20,000 bitcoins from the high point to other wallets.

I have also mentioned before that its over 23,000 bitcoins did not move for over a year at the bottom of 15,000 to 16,000. Why did it transfer these over 23,000 bitcoins near the high point of nearly $70,000? So we need to consider whether it is selling. Of course, my view on the long term is still bullish on Bitcoin, including other whales. The 27th or 81st-ranked whale bought 10,000 bitcoins at the low point of 25,000 in August 2023 and has not sold them so far.

So we will focus on tracking the 57th-ranked whale next. Similarly, on September 7, 2023, at the low point of 25,000, it transferred over 16,000 bitcoins. It has not sold them since the first transfer, but recently, on March 22, it transferred them at the high point. Is it selling or transferring to other wallets? However, the quantity has decreased, and it currently holds only over 14,000 bitcoins.

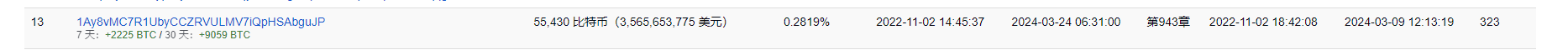

Next, let's take a look at the top 100 wallet rankings on the Bitcoin chain data. Let's focus on the 13th-ranked whale. You can click to track it. This wallet was first created in November 2022, when the price of Bitcoin was around the bottom of 15,000.

We can observe that after it transferred in over 20,000 bitcoins, it basically did not fluctuate or continue to increase. Later, the price of Bitcoin rose to the high point of around 32,000, and we can see that the gray line was falling. It fell to the low point of 25,000, and the blue line kept increasing.

Then recently, we can observe that Bitcoin has been rising from 25,000 to about $70,000, and the blue line has been increasing, indicating continuous buying. So I will continue to track this wallet in the future, as we can also see continuous buying in the recent data.

Next, let's focus on the 57th-ranked whale. We can see that it transferred over 14,000 bitcoins in the past 7 days. It was first created on March 22, 2024.

Then we go back to the Bitcoin weekly chart. So we need to consider why these major players have not moved for one to two years after buying at the bottom, but now, at the high point of $70,000, they are transferring out. We also need to suspect whether they are selling. Or the 57th-ranked whale, also bought over 16,000 at such a low position, and then did not move, but recently transferred out, or currently holds only over 14,000 bitcoins. This is also a question we need to consider for spot and medium- to long-term trading.

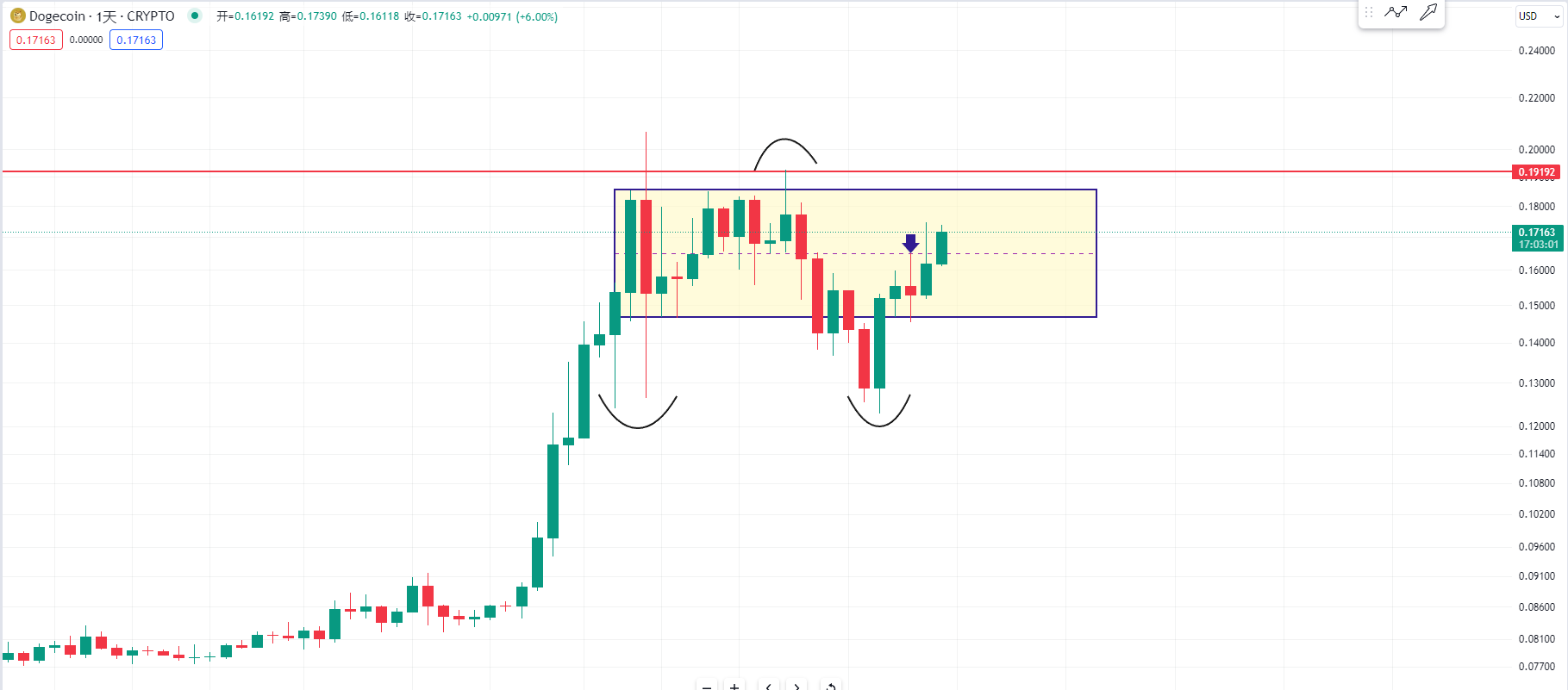

Then let's take a look at the daily chart of Dogecoin. Let's observe the range as much as possible. You can divide it into the upper half and the lower half, or in these two days, pay attention to approximately the position of the upper half of the range. It has been two days, and the upper shadow line has not broken through.

Including yesterday's upper shadow line, it also did not break through. So Dogecoin is currently very strong. If Bitcoin does not experience a major drop, then if Dogecoin can effectively stay above 0.165 at the daily closing, it may consolidate in the upper half of this range. The next resistance level is between 0.19 and 0.2, which is also an important pressure area for Dogecoin.

In previous video updates, I also mentioned not to chase after Dogecoin at the high point of 0.2 in 2021, as there is still pressure on Dogecoin at that level.

For more strategies, you can join the live trading.

Candlesticks are king, trends are emperor. I am Master Chen, focusing on BTC, ETH spot and contract trading for many years. There is no 100% method, only 100% following the trend. I update macro analysis articles and technical analysis review videos daily on the entire network.

Warm reminder: This article is only written by Master Chen on the official account (shown in the image above). Other advertisements at the end of the article and in the comments section are not related to the author. Please carefully distinguish between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。