Author: NingNing

After the Ethereum Cancun upgrade, the secondary market saw a collective rise in the prices of high-performance L1 public chain tokens such as Solana, Sui, Aptos, and Sei. This has left many builders and community members in the Ethereum ecosystem feeling somewhat incredulous, finding the secondary market's reaction to the Cancun upgrade somewhat absurd and even incomprehensible.

However, if we believe in the efficient market hypothesis like Vitalik does, the secondary market prices formed in a market environment with abundant liquidity are more effective in pricing the Cancun upgrade than mathematical models and our own beliefs/prejudices.

In other words, existence is reasonable. Instead of arguing whether it should be, it is better for us to focus on understanding the underlying logic of this market phenomenon. In my personal opinion, the underlying logic can be summarized as follows:

1. In the competition of the application layer market with high-performance L1, Ethereum Rollup L2 is currently at a disadvantage

The Ethereum Cancun upgrade, also known as Proto-DankSharding, is the prototype stage of Ethereum's modular sharding solution.

In the post-Cancun upgrade era, the Ethereum mainnet will mainly carry the functions of the consensus layer, DA layer, and data settlement layer, while outsourcing the execution layer to Rollup L2 solutions such as Arbitrum, Optimism, ZkSync, Starknet, Linea, and Scroll.

Furthermore, Vitalik has proposed on the Ethereum forum a plan to increase the gas consumption of the mainnet's non-zero byte by 4 times.

As a result, Ethereum will gradually withdraw from the competition market of the application layer, leaving it to be directly competed by Ethereum L2 and Alt L1.

If we were in the March 2023 Arbitrum Season, during which Arbitrum was crazily siphoning users, funds, and developer resources from Avalanche and Polygon, the market would have a beautiful imagination of Rollup L2 flipping Alt L1.

But now, in a different time and space, the representative of high-performance L1 public chains, Solana, has started to reverse the flow and siphon resources from Rollup L2.

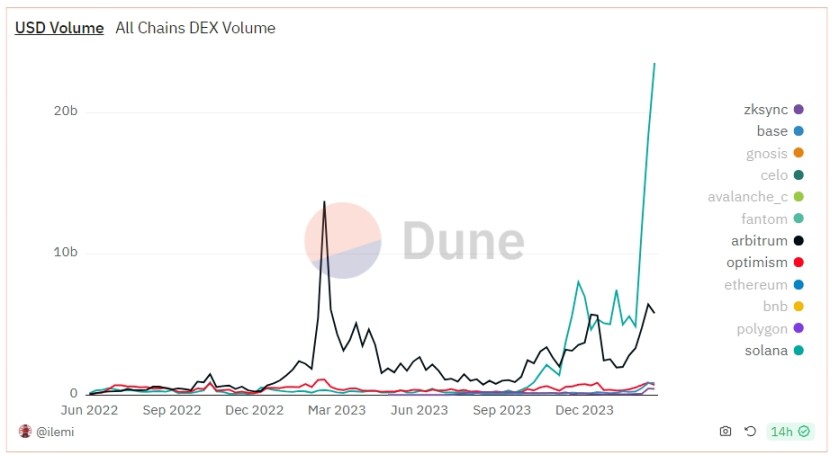

Using DEX trading volume as an indicator, in the spring market of the 24th year, apart from Arbitrum resonating with the market, the DEX trading volume on other L2 solutions is scarce, while Solana's DEX trading volume has skyrocketed.

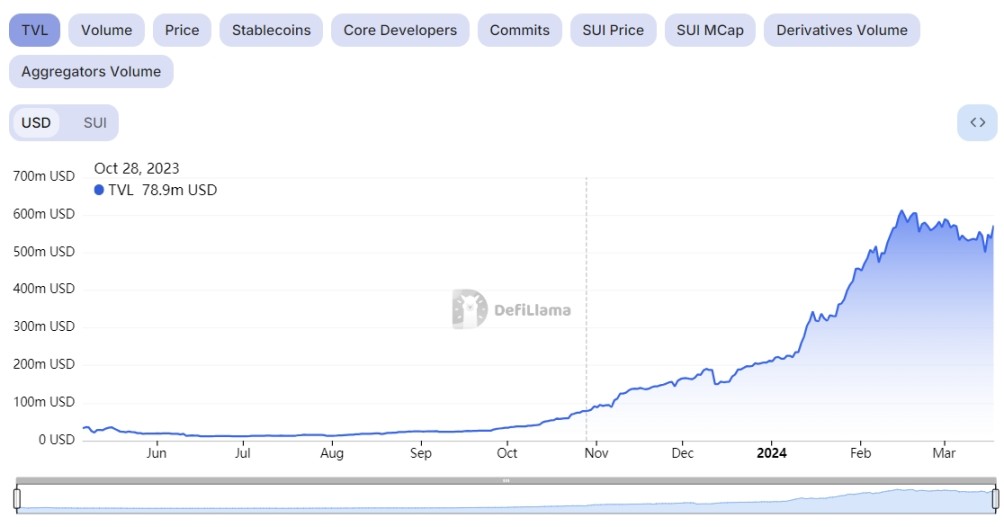

The TVL of the Sui ecosystem has quietly achieved an exponential growth of about 20 times from October 23 to the present market.

The reason for this situation is that in order to smoothly issue tokens, Rollup L2 solutions have developed an excessive reliance on the "Odyssey mission" growth strategy during the bear market. They have conspired with airdrop hunters and developers focused on obtaining grants, leading to uneconomical allocation of block space and community resources, which has harmed the user experience of real users using Rollup L2.

Real users using Rollup L2 not only have to pay additional gas fees for the behavior of airdrop hunters but also miss out on the entire bull market due to the lack of assets with wealth effects on L2.

These factors have led to the current situation where high-performance L1 public chains are overwhelming Ethereum Rollup L2.

2. Ethereum's business model is rent-economized, while high-performance L1 public chains are more like high-tech companies

The research institution @MessariCrypto, self-proclaimed as Ethereum's adversary, first proposed this viewpoint in its annual report. From the perspective of block space economics, the business model of Ethereum L2 is to resell the block space of the Ethereum mainnet to Dapps and individual end users.

In this emerging technology industry of Web3, Rollup L2 solutions are actually doing the business of the most traditional retail wholesalers. The difference is that traditional retail wholesalers earn the price difference of goods, while Rollup L2 solutions earn the gas fee difference.

The Cancun upgrade, which reduced the block space price by an order of magnitude, is a major blow to Rollup L2, whose core business model relies on earning gas fee differences. They are left with only the path of issuing assets. And now, due to the long-term tolerance of airdrop hunters, the ecosystem of L2 has become saline-alkalized, and even meme coins, the best assets to sustain, cannot survive on L2.

Compared to the Ethereum ecosystem, high-performance L1 public chains such as Solana, Sui, Aptos, and Sei are more like high-tech companies. They improve the production efficiency of block space by adopting new-generation consensus algorithms, supporting parallel computing VMs, and smart contract programming languages for accounts/objects, addressing the pain points faced by real users in Web3 such as high gas fees and long confirmation times.

Of course, the current suppression of Ethereum Rollup L2 by high-performance L1 public chains in the application layer competition may be a cyclical phenomenon that arises at the end of this bull market. Whether this situation can persist will require a longer period of verification.

But even if Ethereum Rollup L2 reverses the situation in the future, it is highly likely to be achieved by a new generation of Rollup solutions with new primitives such as RollAPP, chain abstraction, and parallel EVM execution layer, rather than the current stubborn general-purpose Rollup L2.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。