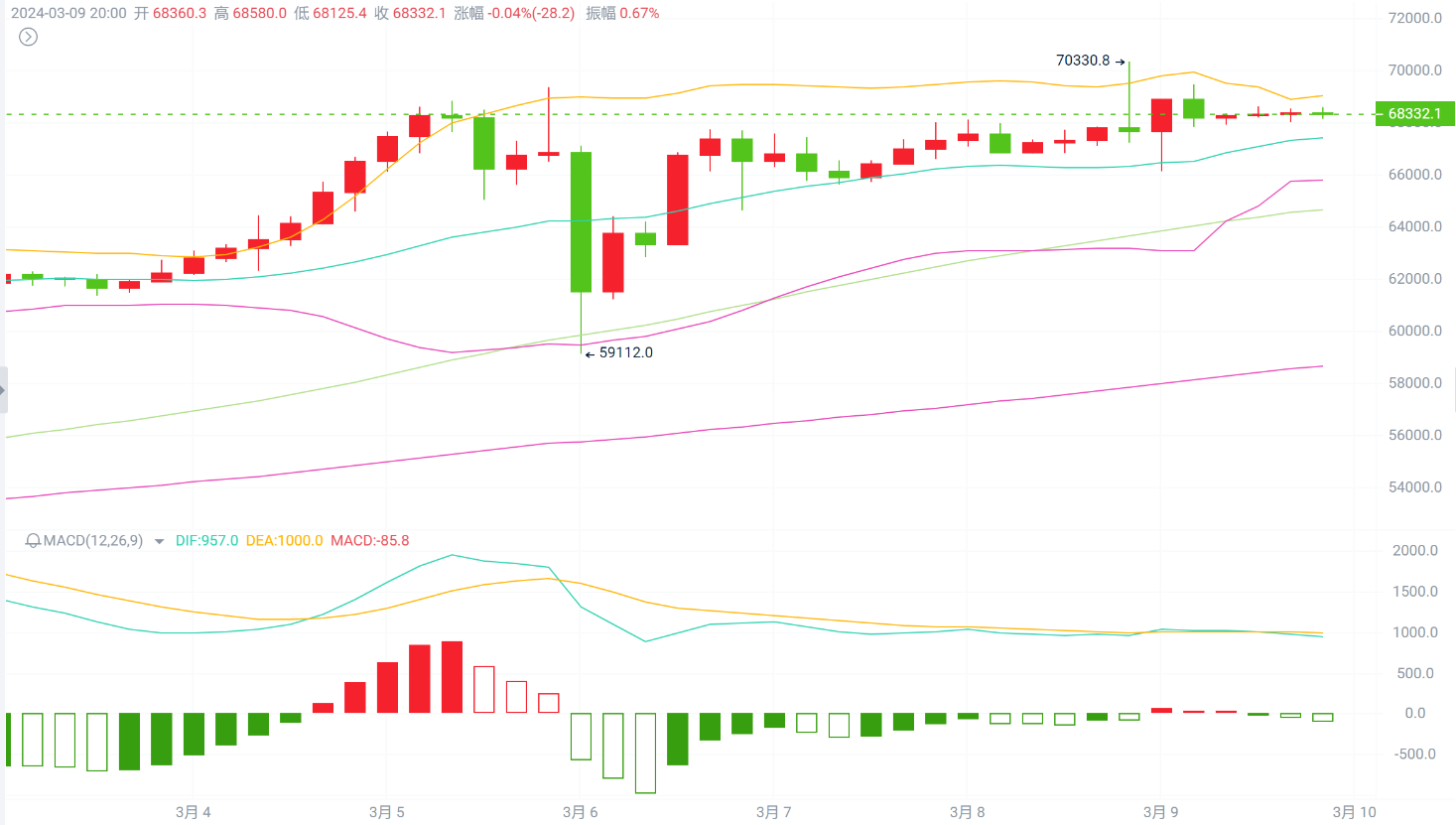

Bitcoin/Ethereum daily level, the current BOLL upper rail continues to open and rise. Here, MACD and KDJ have experienced technical changes of shrinking volume and retracement several times, but in the face of absolute capital, the indicators can also conform to the market. The main chart shows that the three-day MA moving averages are still in a bullish upward trend, which means that the possibility of a significant decline today is not too high. Considering that it is the weekend, the short-term trend still tends to be oscillating and upward. Looking at the 4-hour level, the short-term MACD shows a bearish volume stage with a dead cross, and the short-term KDJ shows a oscillating downward trend. However, the three-line indicators have already shown a slight upward turn, and the current BOLL continues to rise at the middle and lower rails, indicating that there is still strong buying support at the bottom. However, with the upper rail showing downward pressure, the overall intraday volatility is not expected to be too strong. In the case of the mid-rail not being effectively broken in the short term, the intraday trend sentiment still tends to be oscillating and upward. The future operation suggestion is to continue to focus on retracement for long positions. Specific positions can be referred to as follows:

btc: Long at 68000-67500, target 69300

eth: Long near 3900-3870, target 3990

The above suggestions are for reference only. For specific operations, please refer to real-time guidance in the actual trading. "Public Number: Mu Feng Looks at Trends" welcomes learning and communication together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。