According to official sources, Blast, a Layer2 network with automatic interest generation newly launched by Pacman, the founder of Blur and a new generation "economic model guru," officially went live at 5:00 on March 1st, Beijing time. This was one of the highly anticipated events from the end of February to the beginning of March. Currently, Blast's popularity and attention have surpassed that of any other L2 network.

Let's look at the data to understand the rapid growth of Blast. In just a few days after its launch in November last year, Blast's TVL quickly exceeded $500 million. Subsequently, in about two months, it successfully attracted a total of $1.3 billion in TVL and over 100,000 users. As of February 29th, according to DeBank data, the Blast contract address currently holds assets worth approximately $2.33 billion. Among them, about $21 billion worth of ETH is deposited into the Lido protocol, $170 million of assets are deposited into the Maker protocol, and the wallet holds assets worth about $26.11 million.

Leveraging the founder's background, Blast gained curiosity and attention in the early stages of the project, successfully making its debut.

Further leveraging its greatest competitive advantage - automatic interest generation L2, it attracted users to participate. Even before the mainnet went live, it directly announced to users that depositing assets could earn corresponding ETH staking rewards and stablecoin interest. This alone was enough to attract a collective influx of crypto users, and there are expectations for future airdrops for points.

Before the mainnet went live, a testnet and the Big Bang incentive plan were launched, extending an olive branch to major projects and developers, further building and improving its network ecosystem. This not only laid the groundwork and warmed up for the mainnet's launch but also completed the most important ecological integrity and diversity.

With these excellent and successful operational strategies, the mainnet launch ensured the presence of both users and projects, seemingly indicating that an ecological flywheel is ready to go.

Warm-up of Testnet and Incentive Plan

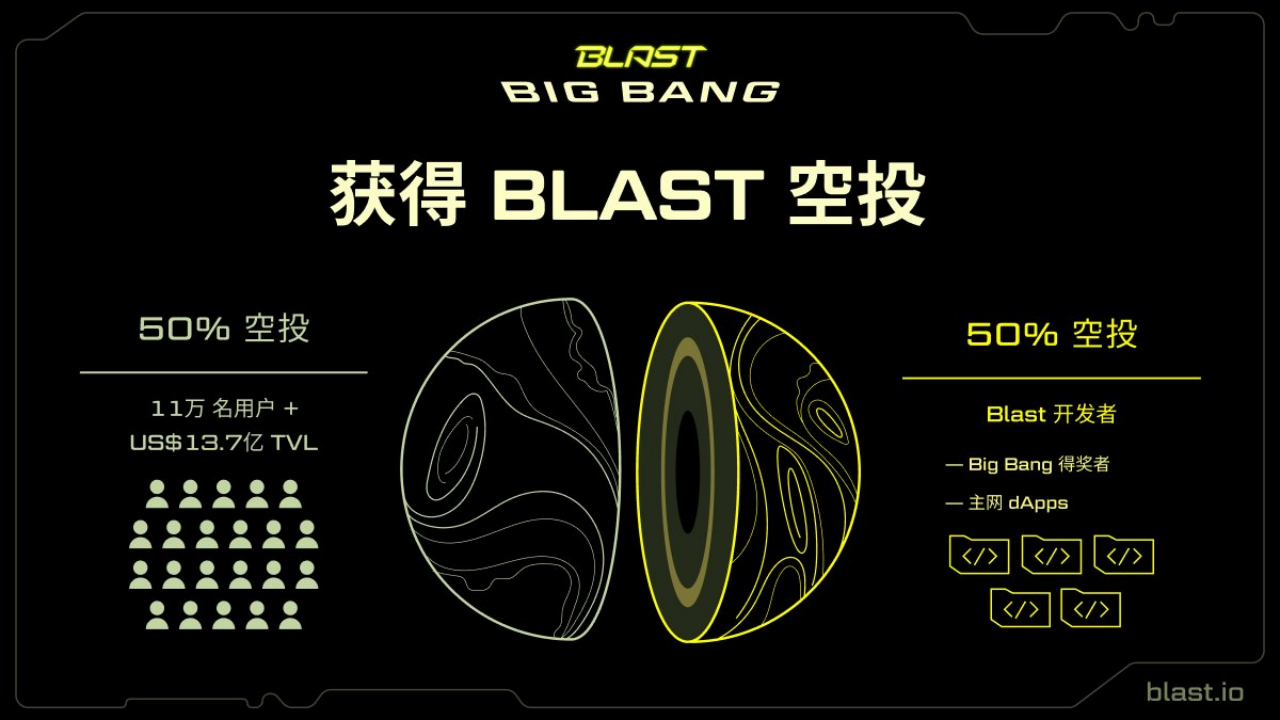

On January 17th, Blast attracted attention by launching a testnet and a one-month Big Bang incentive plan. This plan encouraged developers to actively build applications in its ecosystem and conduct competitions based on certain rules. Winning projects were promised 50% of the airdrop rewards from Blast for projects deployed on the network.

As shown in the image, Blast's airdrop reward this time is straightforward - all Blast airdrops are split, with half going to the winning projects and developers of mainnet applications, and the other half going to users who provide liquidity on Blast. This direct and clear incentive method is highly attractive to both developers and users. For project teams, participating in the competition has low costs and relatively low barriers, and Blast's network already has a certain user base. It's a new L2 network launch, and they can also receive the most important airdrop rewards (financial support). In addition, the types of projects supported in this Big Bang competition are very diverse, and major project teams have all joined the Blast track.

Through this competition, the projects on the Blast network were quickly enriched and completed before the mainnet went live, injecting a powerful booster for the vigorous development of the network ecosystem. The greater significance of this activity lies in shaping Blast itself into an L2 with a Launchpad attribute, which will have a very profound impact in the future.

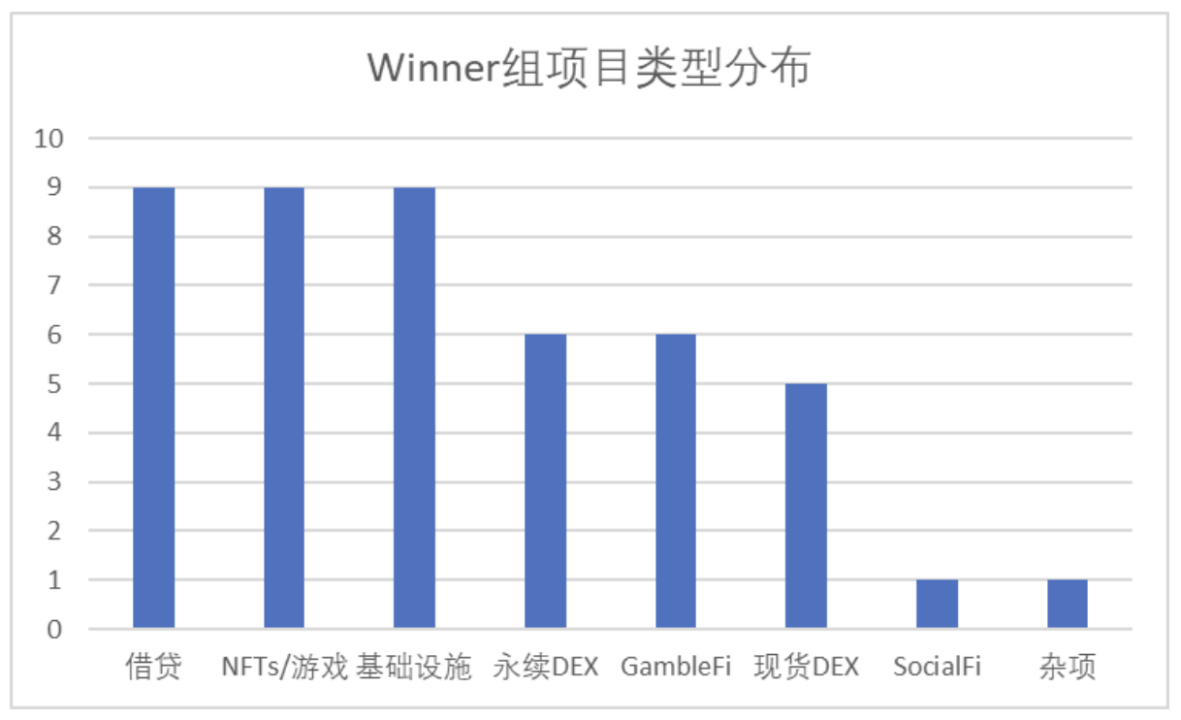

According to the competition results, a total of 118 potential projects were selected in this round of BIGBANG, including 47 Winners projects, 31 Runner-Ups projects, and 40 Honorables projects, covering project types such as DeFi/NFT/social/gaming/infrastructure, etc.

Image Source: TechFlow

To help everyone further understand the rapidly developing Blast ecosystem and select more valuable investment targets from the massive Blast ecosystem projects, TrendX will introduce and analyze the Winners group projects based on the above list of winners, including project positioning, funding history, airdrop allocation mechanism, and other factors.

Blast Ecosystem Project Sharing

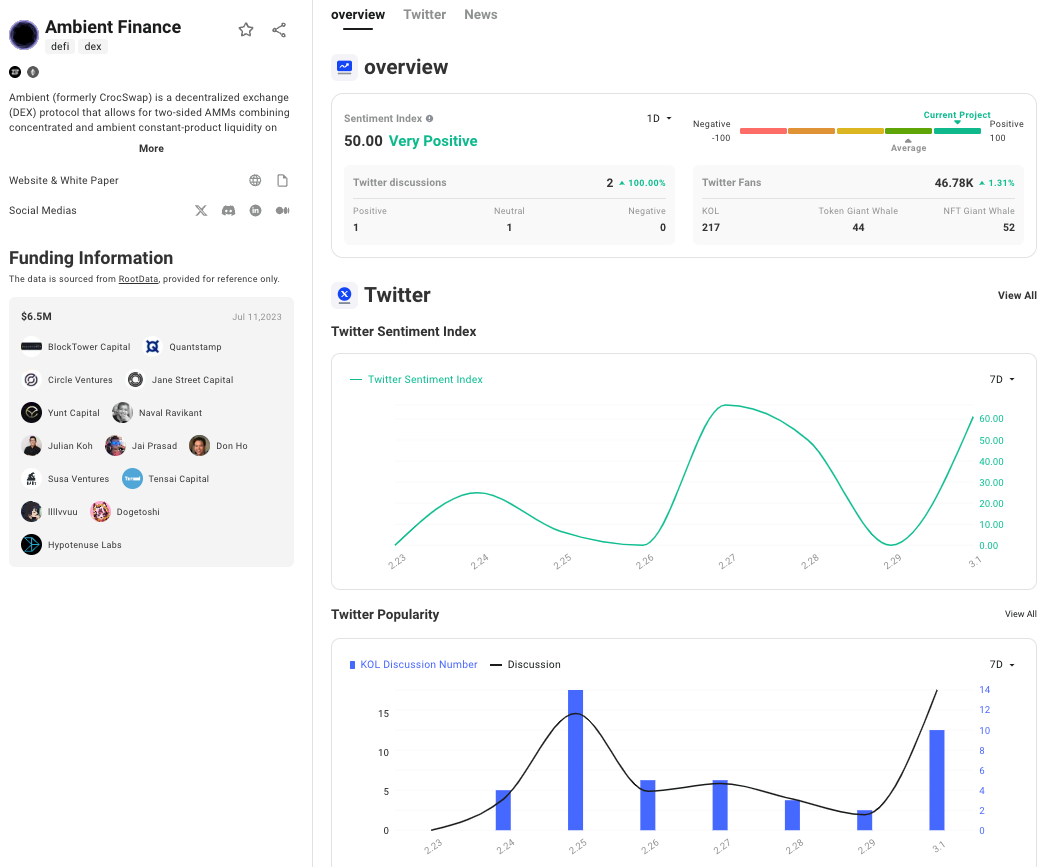

1. Ambient Finance

Funding History: In July 2023, Ambient Finance completed a $6.5 million seed round of financing, led by BlockTower Capital. Before the seed round, it received funding support from PostiveSum and Motivate in the Pre-Seed round, with the specific amount undisclosed.

Developer Airdrop Allocation Mechanism: Not disclosed yet

Introduction: Ambient Finance, formerly known as CrocSwap, is an improved AMM protocol that can support centralized liquidity provision, full-range liquidity provision, and on-chain limit orders within a single liquidity pool. Ambient is a singleton contract that supports hooks, dynamic fees, automatic compounding, and gas fee savings.

Related Link: https://app.trendx.tech/project/d908a23e02da0a206a3fc9544a6b3ced4f07b38a635b1633ac5df86e0a3d2be4

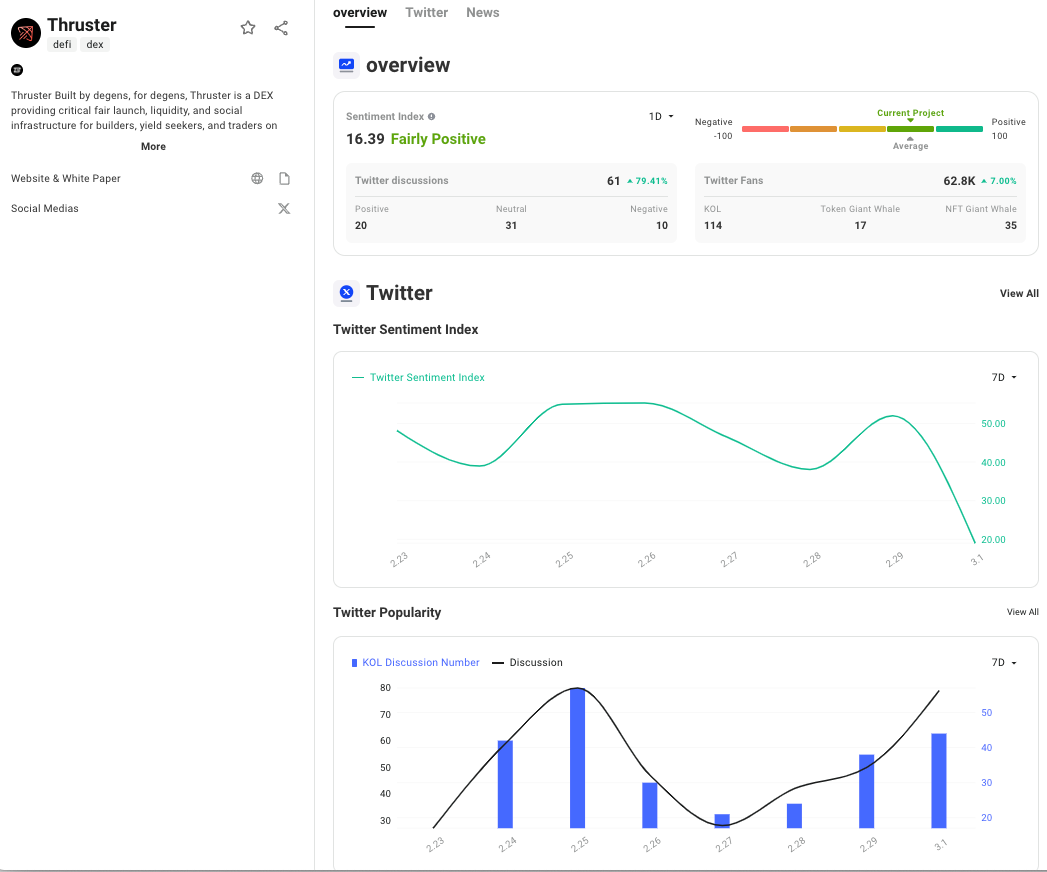

2. Thruster

Funding History: The official statement expressed gratitude to investors including DCFGod, PopcornKirby, B1lurr, CBB0FE, Casey Caruso, 0x Lawliette, Loomdart, and others, with the remaining information undisclosed.

Developer Airdrop Allocation Mechanism: Once receiving the developer airdrop from Blast, the project will use a unique mechanism to direct the airdrop incentives from the pool to some key partnership pools to promote Thruster's liquidity fitness and attract more users.

Introduction: Thruster is a DEX built for Blast by decentralized finance enthusiasts, providing developers with a fair launch mechanism and liquidity tools, and offering users the best LP yield opportunities, built-in analysis tools, and a simple trading experience. Thruster also supports various AMM market-making types, including centralized liquidity provision, full-range liquidity provision, and stablecoin market-making.

Related Link: https://app.trendx.tech/project/d6875de08e4edfa3d553ae9fdc20b100ac749311480304aa6bb65b7688855ba0

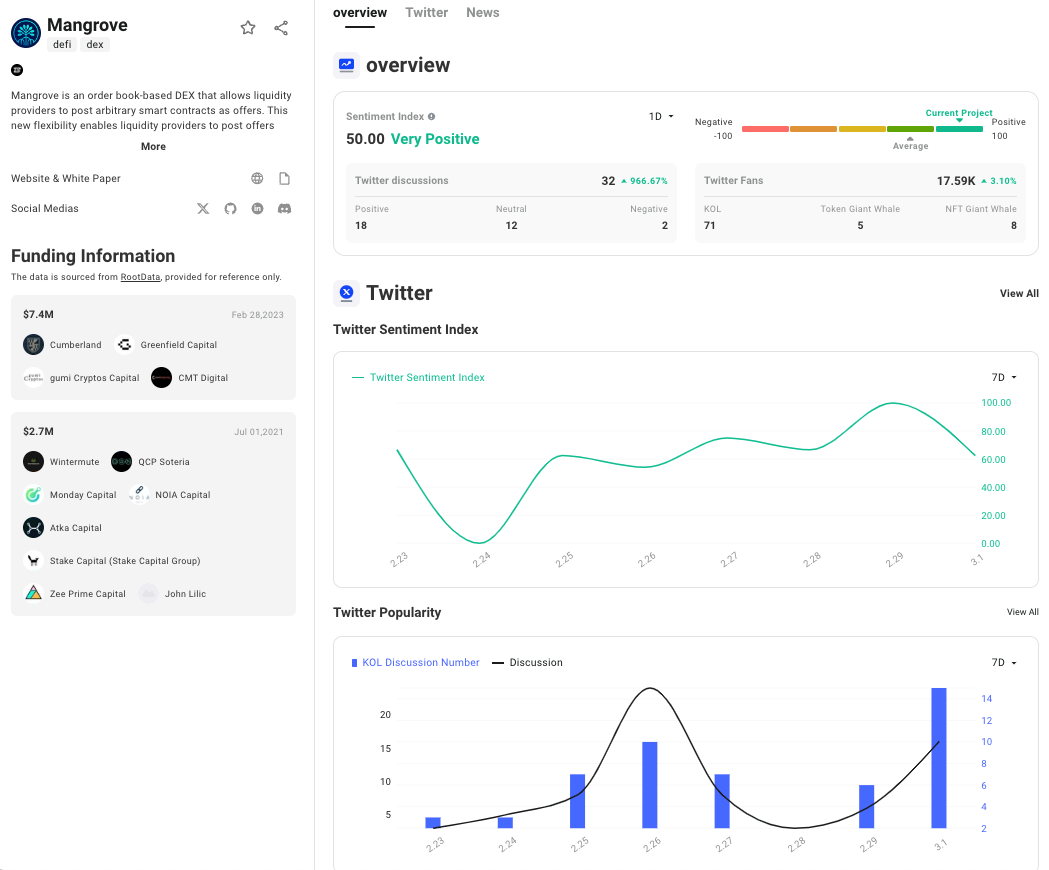

3. Mangrove

Funding History: In 2021, Mangrove completed a $2.7 million seed round of financing. In February 2023, Mangrove completed a $7.4 million Series A financing, led by Cumberland and Greenfield Capital.

Developer Airdrop Allocation Mechanism: 100% will be returned to Mangrove users.

Introduction: Mangrove is an order book DEX, with its main feature being the "re-staking" mechanism, allowing liquidity providers to redeploy liquidity deployed on other protocols to Mangrove's order book, thereby expanding potential earning opportunities. However, Mangrove does not lock this liquidity but only posts it, allowing users to operate their liquidity normally within other protocols, and it will only be utilized when the quote is accepted. On Mangrove, code can be attached to quotes published on the order book, achieving the aggregation of all liquidity within the Blast ecosystem and doubling the earnings.

Related Link: https://app.trendx.tech/project/41250c0020385b5b256d961092b369b5c42a2029e7f5fb8420e39bbe58cf120b

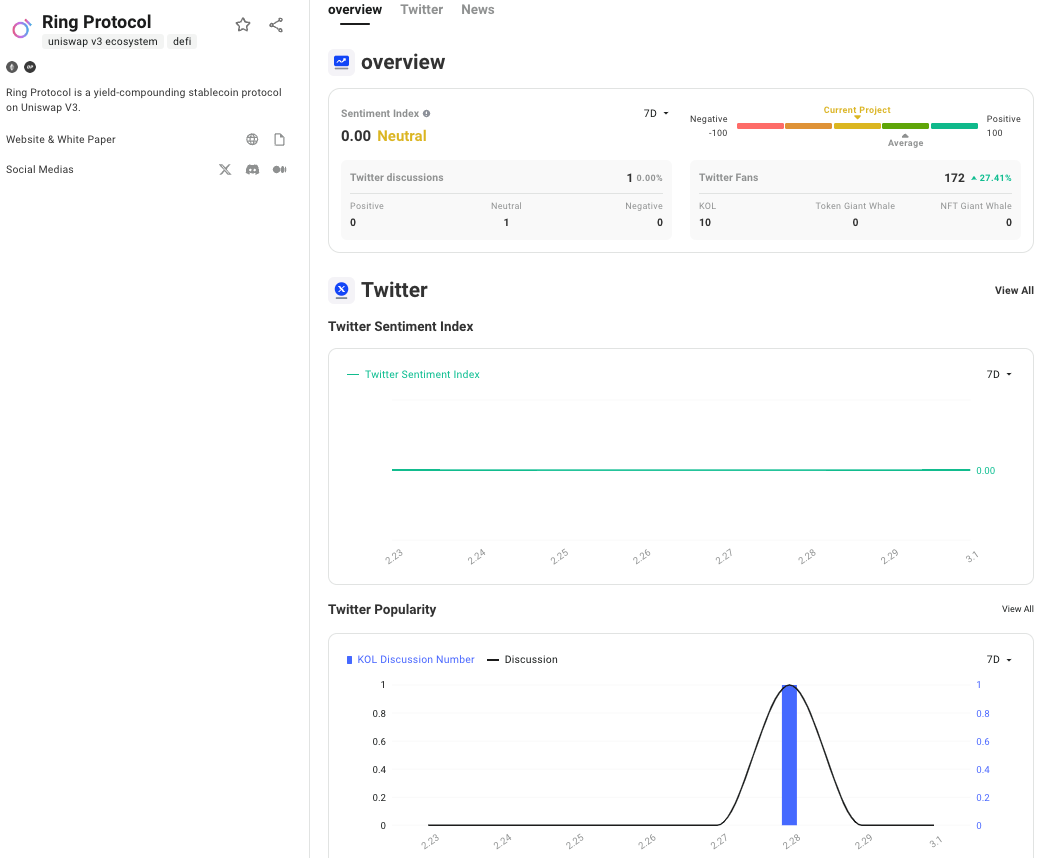

4.Ring Protocol

Funding History: Not available

Developer Airdrop Allocation Mechanism: Not disclosed yet

Introduction: From the testnet UI, Ring Protocol appears to be a classic AMM model DEX, and will launch a Launchpad service in the future. According to the introduction, Ring Protocol allows liquidity providers to earn rewards by staking underlying assets and RWA assets. Ring Protocol heralds a new era of decentralized exchanges on Blast, maximizing asset utilization.

Related Link: https://app.trendx.tech/project/9fd11510d28b9b6e2180f1f04f3720436f9f8229046f9e2a62f4d6c31125a931

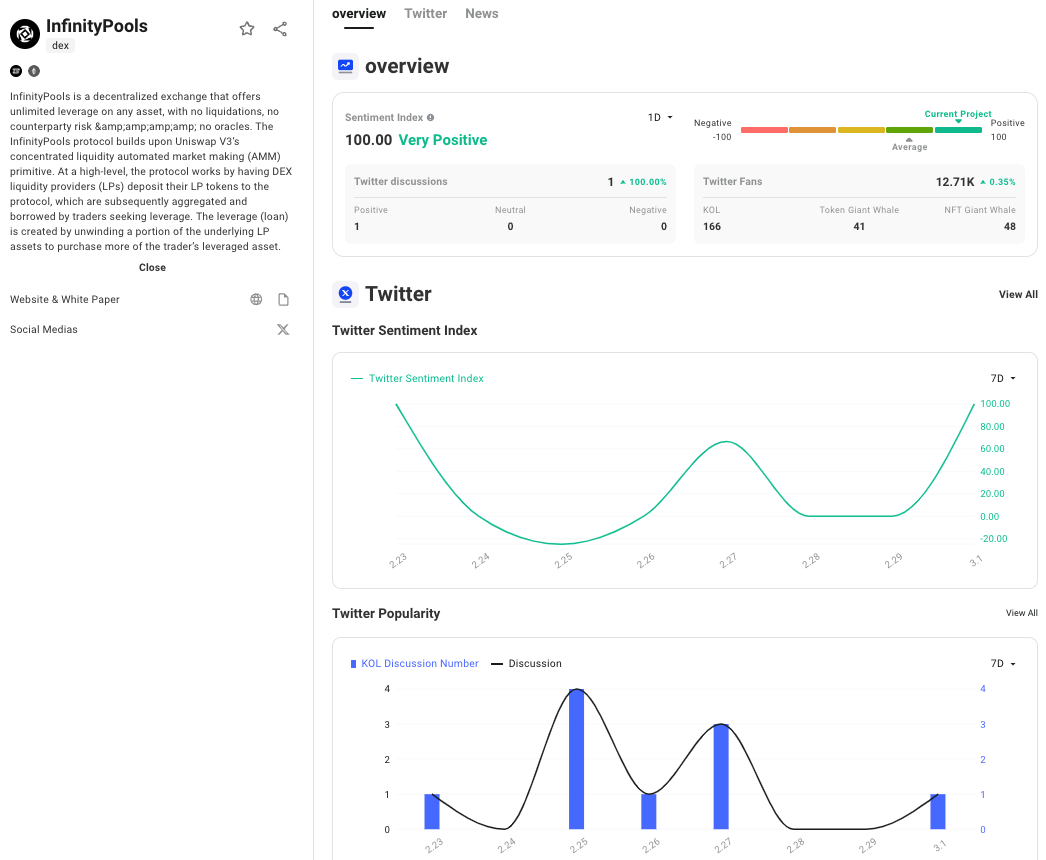

5.InfinityPools.finance

Funding History: The development team Lemma Labs completed a seed round of financing in December 2021, with participation from Standard Crypto, Dragonfly, Nascent, Multicoin, Robot Ventures, Coinbase, Uniswap, Wintermute, GSR, Kronos, and Folius.

Developer Airdrop Allocation Mechanism: Not disclosed

Introduction: InfinityPools is a self-custodial decentralized derivatives exchange that claims to provide infinite leverage for any asset (officially up to 10,000 times, but initially subject to the volatility of the underlying asset), without liquidation, counterparty risk, or the need for oracles.

Related Link: https://app.trendx.tech/project/5b1a21070e66c7847c97ed42177267536b2030593de76e636e9e4068584a48ab

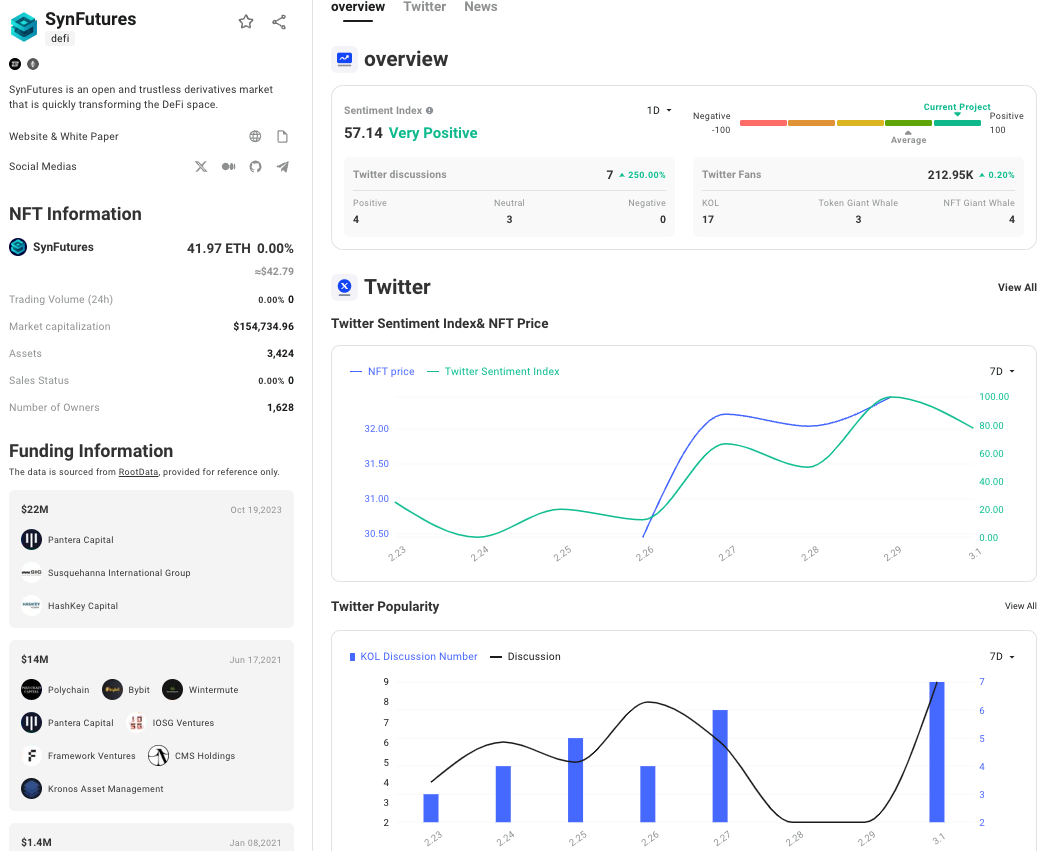

6.SynFutures

Funding History: In 2021, SynFutures completed a $14 million Series A financing, led by Polychain Capital. In October 2023, it completed a $22 million Series B financing, led by Pantera Capital, with participation from SIG DT Investments and HashKey Capital.

Developer Airdrop Allocation Mechanism: 100% returned to the community

Introduction: A veteran derivatives exchange, previously deployed in multiple ecosystems including Polygon, with a cumulative trading volume of $23 billion. It offers perpetual DEX with up to 100x leverage and native yield, powered by Blast. Oyster AMM model = CLMM + on-chain limit orders.

Related Link: https://app.trendx.tech/project/4e2cb4a16569bd30e81791262a2d3b2bb342d48a9f75380c7e363e94473860cf

7.100x Finance

Funding History: Not disclosed

Developer Airdrop Allocation Mechanism: 100% returned to users, partners, and the community

Introduction: 100x Finance is a self-custodial decentralized derivatives exchange that supports full-margin trading, providing perpetual contracts, MOVE contracts, and spot trading services with a CEX-like trading experience. 100x Finance uses a full-margin model, allowing users to increase capital utilization efficiency and continuously accumulate earnings using Blast's automatic interest generation mechanism.

Related Link: https://app.trendx.tech/project/ca8be6aea8bd042ad41c04dfb275cc60c25a6577a281c012c3a6ef806b8175ba

8.Blast Futures Exchange (BFX)

Funding History: Not disclosed

Developer Airdrop Allocation Mechanism: 100% returned to the community

Introduction: Blast Futures Exchange (BFX) is an automatic interest-generating perpetual contract exchange built on Blast, providing easy-to-use trading services while allowing users to earn an additional 5% interest on their balances.

Related Link: https://app.trendx.tech/project/af5bd18dd7dbdfbced28a9238f505e98b58d5826dbfcbd2feae54fcabf87c161

9.Blitz

Funding History: Not disclosed

Developer Airdrop Allocation Mechanism: 100% returned to the community

Introduction:

Blitz is a branch of the perpetual contract exchange Vertex on Arbitrum, built on Blast, supporting spot and perpetual contract trading services. Blitz adopts a full-margin model and will bridge cross-chain liquidity with Vertex on Arbitrum, providing users with better trading depth.

Related Link: https://app.trendx.tech/project/416c57810ba203d36f9d81b9732bde1eb71e3395e82b8cde383b56f7e0098b09

10.Bloom

Funding History: Not disclosed. The list of investors displayed on the official website includes Pantera Capital, Ankr, Founders Fund, Pyth, Galaxy, and Biconomy.

Developer Airdrop Allocation Mechanism: 100% returned to long-term users and liquidity providers.

Introduction: Bloom is a decentralized derivatives exchange that supports 50x leverage, gas-free transactions, and automatic interest generation. The Bloom contract has been audited by the third-party security company Zellic, and the report will be disclosed after the audit is completed.

Related Link: https://app.trendx.tech/project/e09eb49dd386ac4fac7ee00d6d804833a95840edd88f79e00497f9ad77aea574

Conclusion

According to the official announcement, Blast has stated that a significant portion of the airdrop will be given to the 47 Winners champion projects, after the scheduled mainnet launch in May. However, the mainnet has already launched in March, indicating that the one-month testnet competition has indeed achieved better-than-expected results, and the mainnet launch has capitalized on this momentum. In this context, it is evident that the Blast team is confident, and the scheduled airdrop distribution should also arrive quickly with the mainnet launch, maintaining the ecosystem's momentum. As small investors, in the diverse Blast ecosystem, prioritizing participation in Winners projects should be the most effective way to receive airdrops. After selecting projects and understanding the rules, it is important to focus on multiple benefits and try different project experiences. Blast's mainnet and the team's support for the entire ecosystem will continue for some time, and if there are any airdrop benefits in the future, TrendX will continue to monitor and provide updates.

Follow Us on TrendX

TrendX is a leading AI-driven Web3 trend tracking and intelligent trading platform globally, aiming to be the preferred platform for the next billion users entering the Web3 space. By combining multi-dimensional trend tracking and intelligent trading, TrendX provides a comprehensive experience of project discovery, trend analysis, primary investment, and secondary trading.

Website: https://app.trendx.tech/

Twitter: https://twitter.com/TrendX_tech

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。