Some market conditions are said to be ignored, but you can't help but pay attention. Some trades are said to not go against the trend, but you can't help but touch the forbidden zone. It's not being cold-blooded, it's not being slow to warm up, it's just fear, the sadness brought by blind heavy betting. Don't be arrogant, don't be reckless. Without me, you just lose your reliance. You are at a loss in a one-sided market, occasionally encountering irrelevant fluctuations, clearly agreeing not to hold a position, but always unable to let go, always realizing that it's no longer a one-sided market before being able to understand, no market will always stay in place waiting.

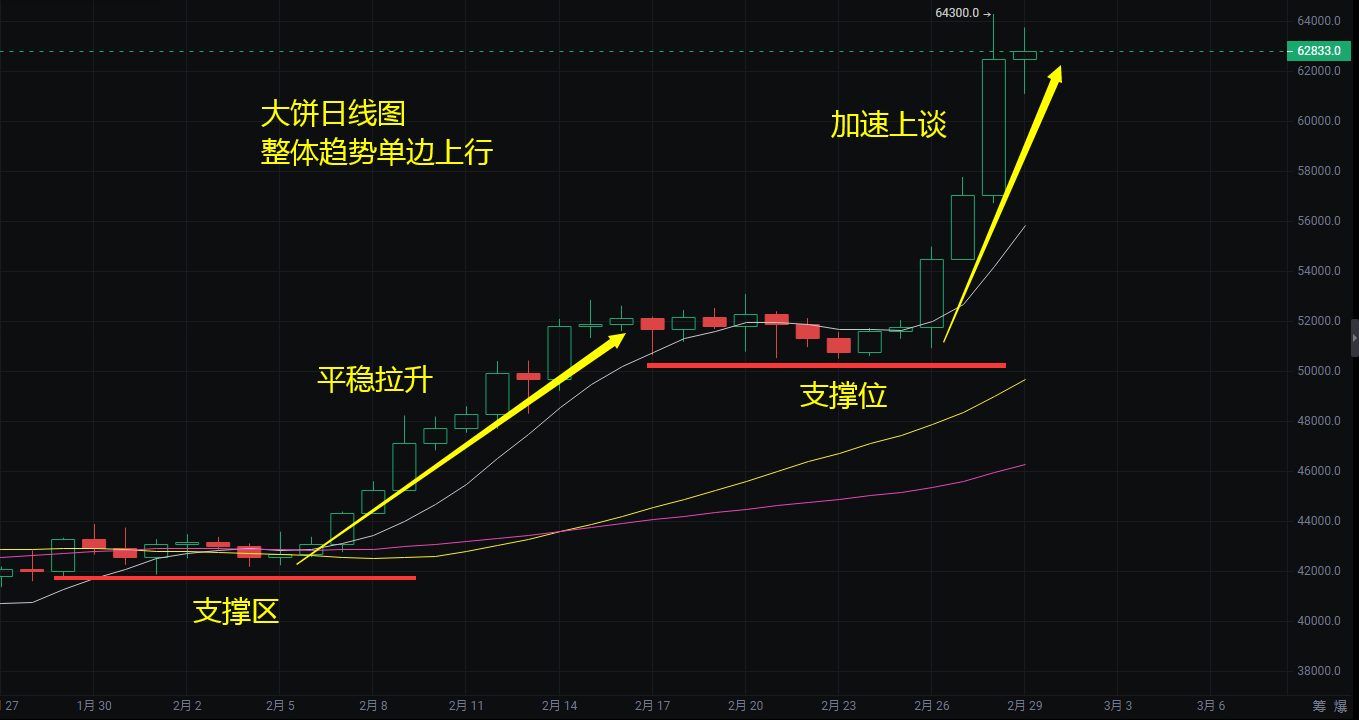

Today, February is over. Let's review this month's market. At the beginning of the month, it was still in a high-level fluctuation. From the eve of the Spring Festival, the trend began to rotate. During the continuous ten-day rise, the trend became smoother, also giving the bears time to breathe. From last Saturday, the bull market once again erupted, hitting the hot search multiple times, experiencing a 10,000-point market for two days, and today it has stopped again. From the 42,000 mark at the beginning of the month to the current 64,000 mark, a 50% increase in a month, we almost always advised everyone to go long, and the achievements we have made are countless.

Market analysis:

This month, due to the large market, the directions given were accurate. In this month, we accumulated 33,569 points of space for Bitcoin and 2,046 points of space for Ethereum. It has been almost a one-sided rise this month, and even the pullbacks were not very significant.

Standing at the forefront of the times, you can feel the surging and urgent waves; standing high, you can see far, you can see the vastness of the clouds and the height of the sky.

For more information, follow Mingjie's public account

Mingjie likes to study economic news and analyze market trends. Proficient in short-term and medium-to-long-term layout, maintaining an accuracy rate of over 80% in the long term. What we need to do is to use professional knowledge to help you. Professionalism achieves quality, and strength builds reputation. If you feel at a loss about the current situation, or if your operations are not ideal, you can talk to us. Good opportunities may exist every day, it depends on whether you can seize them. What I can do is to help you start with risk aversion and maximize returns with the smallest risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。