ETF bullish expectations stimulate the strength of ETH, corresponding to the weekend rise of BTC. CME once again has a small gap, with the lower gap position at $51,300.

Since BTC has been through the ETF, the institutional effect has become more and more obvious. There has been no movement over the weekends. The term "gap market" refers to the fact that when the Americans are resting over the weekend, regardless of whether BTC rises or falls, the price can return to fill the price gap over the weekend. The most obvious example is the New Year's Day on January 1st. During those two days, the bulls took advantage of the Americans' rest and caused a surge in the bears. However, within two days, the price fell back to its original point. Currently, the upward gap for BTC is at $51,300, which means that BTC is likely to fill this position.

UNI's new proposal for holding coins and splitting transaction fees has led to a straight surge in price. The "Old Wolf" has mentioned many times before that coins are not just for speculation; otherwise, BTC would have gone to zero long ago. The value of coins lies in their use and in solving users' problems. Therefore, the value indicator for DeFi is TVL, and the value indicator for public chains is on-chain activity. The more people use it, the more it will form a network effect, continuously increasing its value.

BTC:

The position holding volume has surged, indicating that significant fluctuations are imminent. BTC is holding steady along the 5-day moving average, with a decrease in the peak of the hourly line. The upper resistance at $51,695 was formed on February 25th. Only with a significant breakthrough above $51,695 can it quickly rise and enter a short squeeze market. With the weakening of bullish volume, BTC needs to test support. Next, BTC will test the bottom at $51,302.

Resistance levels: $51,695, $52,078, $52,426

Support levels: $51,302, $51,023, $49,656

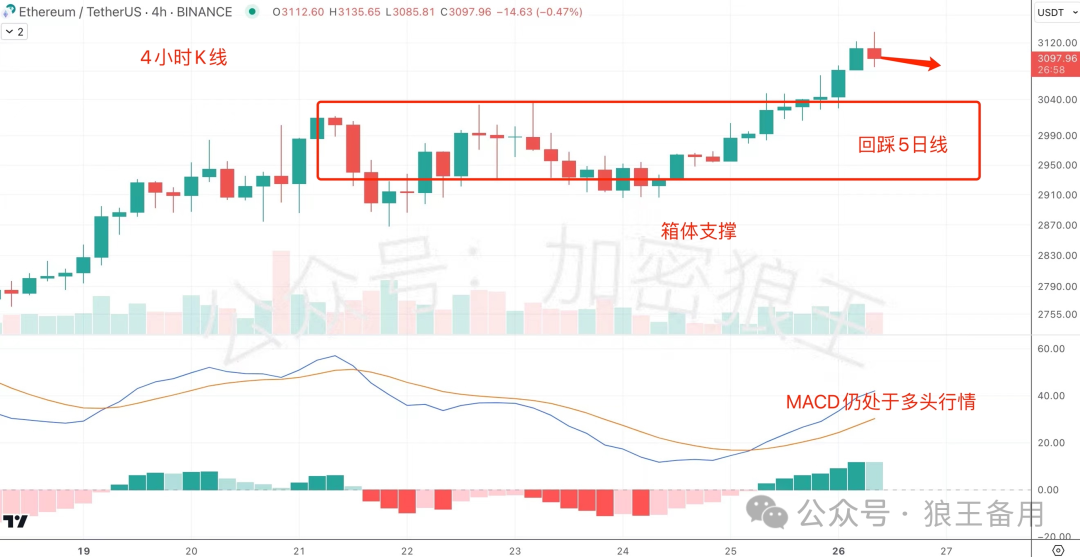

ETH:

The Constantinople upgrade and bullish expectations for ETFs have driven the strength of ETH. ETH is rising along the 5-day moving average, with continuously higher minor lows, indicating the presence of bullish support. The lower support level is at $3,052, which is also a key point for the 5-day moving average. Only by stabilizing at $3,052 can it resume its rise and strengthen. Next, ETH will retest the support at $3,052.

Resistance levels: $3,147, $3,222, $3,296

Support levels: $3,052, $2,958, $2,877

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。