The previous MANTA on Binance Launchpool is still staked, and the new project AltLayer (ALT) has arrived!

Staking Mining

Starting from 08:00 on January 19, 2024 (UTC+8), users can stake BNB and FDUSD on the Launchpad website to mine ALT and receive ALT rewards. The ALT mining will last for 6 days.

The website is expected to be updated within approximately 24 hours before the start of the mining activity.

Trading Launch

On January 25 at 18:00 (UTC+8), Binance will open the ALT/BTC, ALT/USDT, ALT/BNB, ALT/FDUSD, and ALT/TRY trading markets, following the seed label trading rules.

* How to quickly grab ALT? Welcome to use the free feature "New Listing Grab" on AICoin to get ahead!

Project Details

AltLayer (ALT), a platform that can be used to launch native and re-stake Rollups, supporting Optimistic and ZK Rollup stacks.

Official website: https://altlayer.io/

Maximum token supply: 10,000,000,000 ALT

Initial circulation: 1,100,000,000 ALT (11% of the maximum token supply)

Total mining amount: 500,000,000 ALT (5% of the maximum token supply)

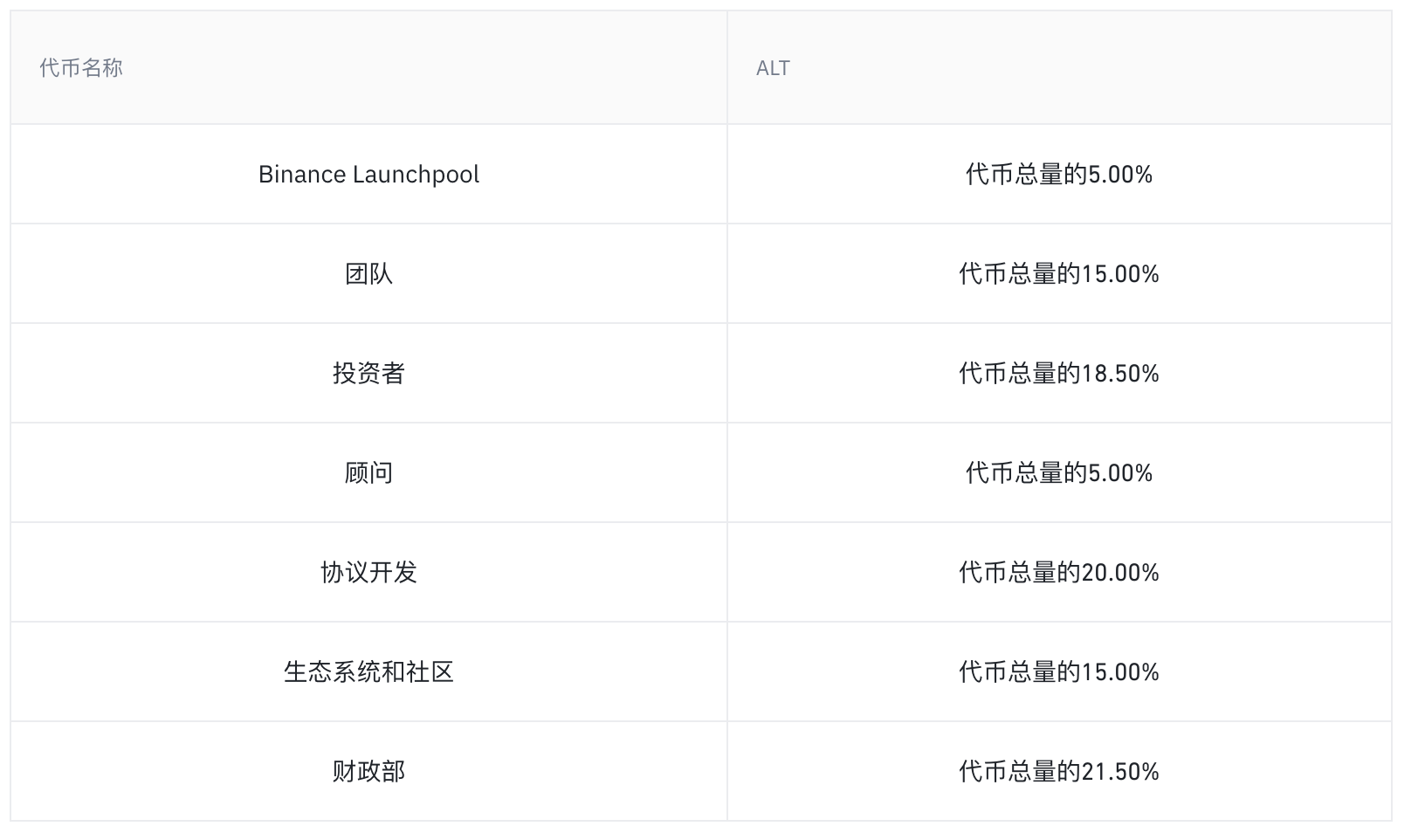

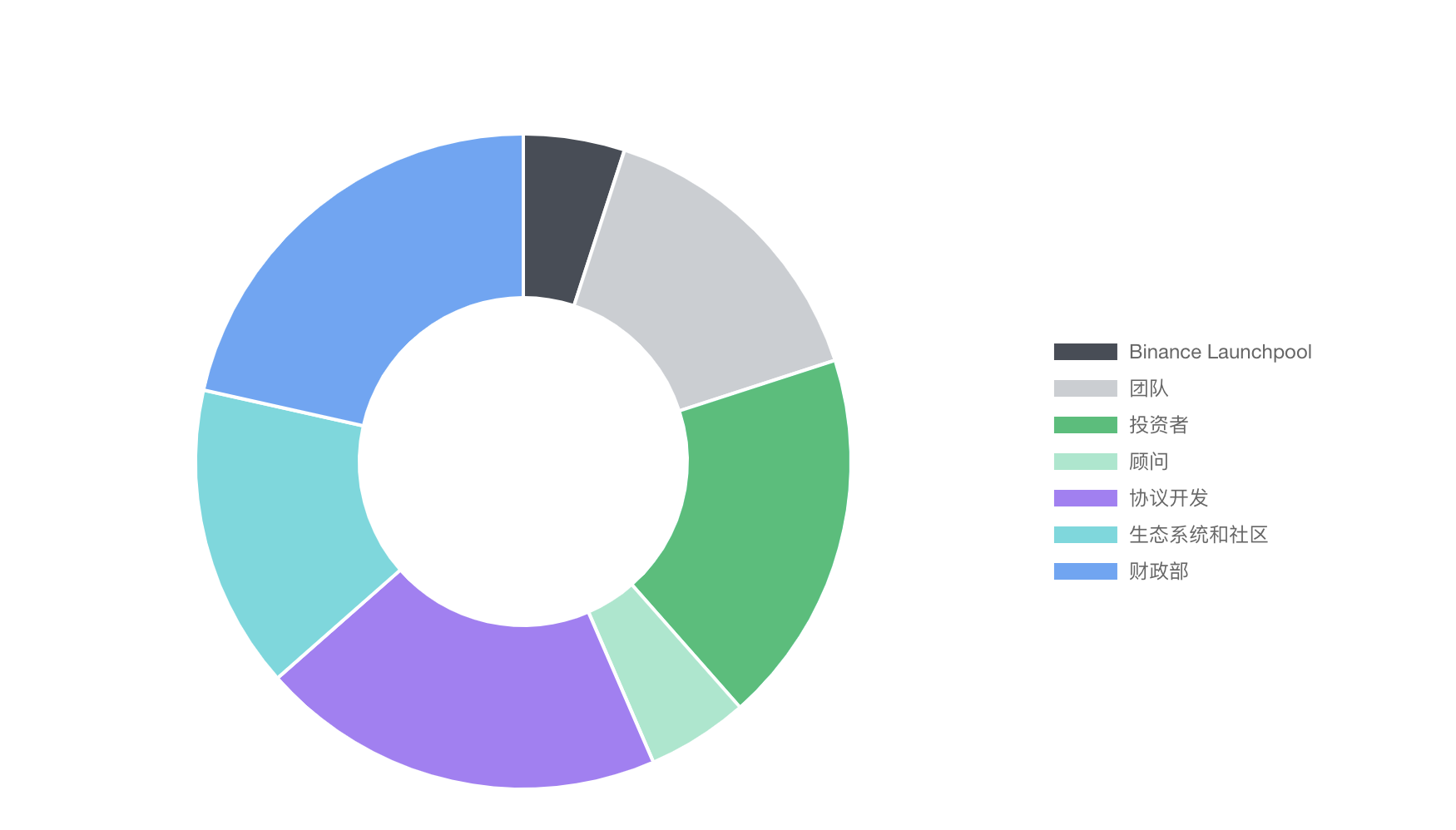

Token Allocation:

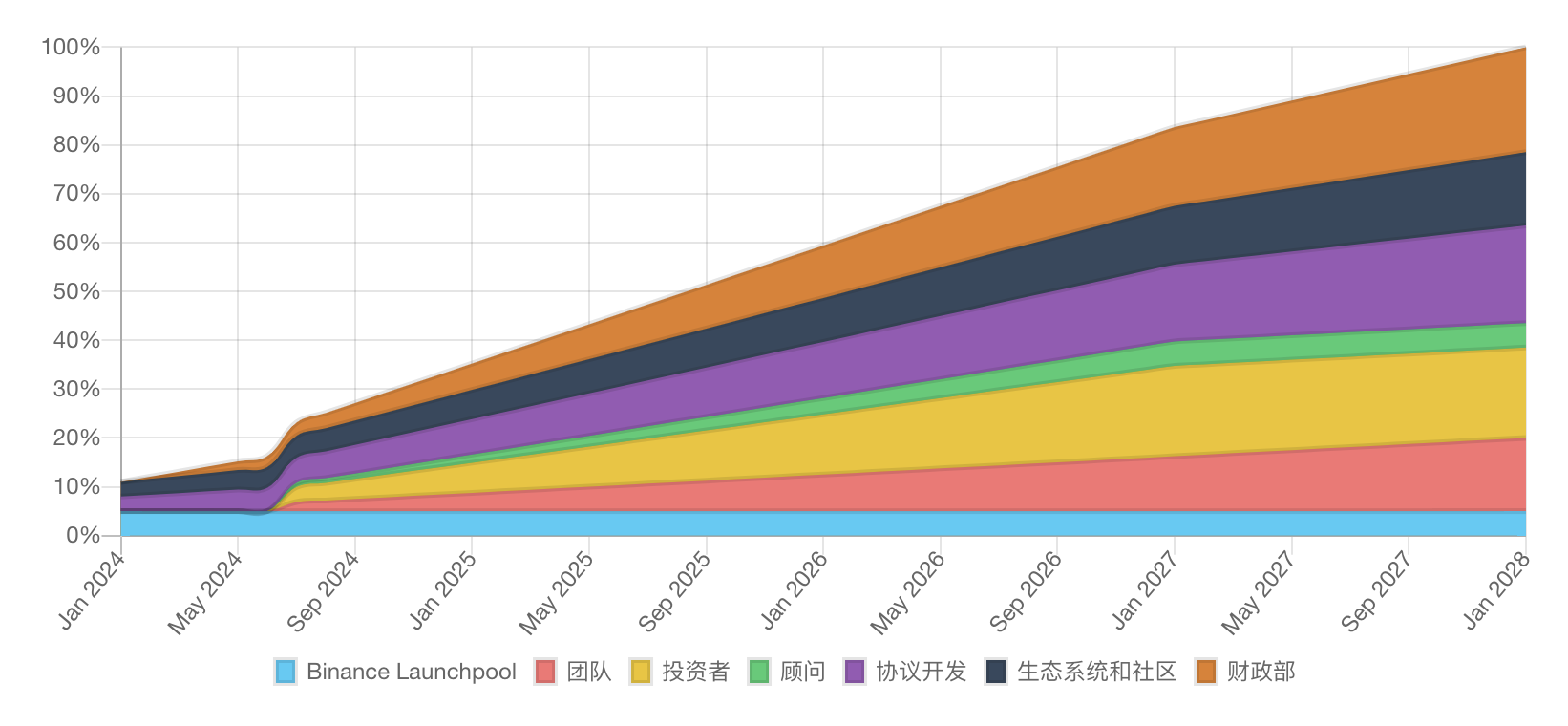

Token Issuance Schedule:

Research Report

AltLayer is an open and decentralized protocol designed for rollups. AltLayer brings a novel idea - re-staking Rollups, adopting from any rollup stack (such as OP Stack, Arbitrum Orbit, Polygon CDK, ZK Stack, etc.), and providing enhanced security, decentralization, interoperability, and rapid finality of cryptographic economics by utilizing the re-staking mechanism.

ALT is the native utility token of AltLayer, used for the following functions:

Economic bonding: ALT tokens will be used together with re-staked assets to provide economic bonding. This bonding can be slashed in case of malicious behavior.

Governance: ALT token holders can vote on governance issues.

Protocol incentives: Operators in the AltLayer ecosystem can receive ALT tokens as rewards for their services.

Protocol fees: Network participants need to pay protocol fees in ALT tokens for services within the network.

AltLayer's core product - re-staking rollups, consists of three key products:

VITAL: An Active Verification Service (AVS), where operators verify blocks submitted by rollup sequencers and their corresponding states, and present fraud proof challenges when necessary.

MACH: A protocol that provides faster rollup finality by allowing operators to re-stake Ethereum-based assets to support any claim on rollup states.

SQUAD: Provides decentralized ordering with economic support. Decentralized ordering eliminates short-term liveness issues, bad MEV, rent extraction, and other issues associated with single sequencer operation of rollups.

AltLayer raised $22.8 million through two rounds of private token sales, with 18.50% of the total ALT token supply sold at prices of $0.008/ALT and $0.018/ALT, respectively.

Investors in AltLayer include Polychain Capital, Binance Labs, Jump Crypto, Breyer Capital, DAO5, Balaji Srinivasan (former CTO of Coinbase and former global partner of a16z), Gavin Wood (co-founder of Ethereum and Parity), Sean Neville (co-founder of Circle and architect of USDC), and Ryan Selkis (founder of Messari), among others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。