On the morning of January 8th, Eastern Time (8 p.m. Beijing Time on January 8th), was the deadline for the submission of the spot Bitcoin ETF application files set by the U.S. Securities and Exchange Commission (SEC). Except for Hashdex, the other 10 major applicants have submitted the final versions of the S-1 documents (Grayscale's is S-3), which is an important information disclosure process in the ETF application process.

The decision whether to approve or not is pending the final response from the SEC. Although this highly anticipated ETF has not yet been finalized, several applicants have already started a fee war.

According to the updated documents, BlackRock's "flexible policy" caught its competitors off guard. Its iShares Bitcoin Trust has a fee of "0.20% for the first 12 months or first $5 billion, and 0.30% thereafter," giving it a competitive advantage with its flexibility after listing. After the fee was disclosed, ARK quickly adjusted its fee from 0.80% to 0.25%.

Another battleground is the price of Bitcoin. Influenced by various ETF news, BTC has experienced fluctuations in the past week. It broke through $45,800 on January 2nd, dropped to $42,200 the next day, and then fluctuated between $42,000 and $43,000 over the following days. In the early morning of January 9th, Bitcoin broke through $46,000 and tested up to $47,000.

Within the frequent 10% fluctuations, the market sentiment of crypto assets has been repeatedly impacted by the news of the ETF, and the entire market is waiting for this key point on January 10th. According to the previous application schedule, the SEC needs to make the final round of responses to the applications from ARK and 21Shares on this day.

Previously, analysts predicted that if the SEC approves, these spot Bitcoin ETFs are likely to be approved all at once. Whether the prediction is accurate or not, the SEC will reveal the answer on January 10th, Eastern Time.

Market sentiment repeatedly impacted by news friction

If we go by Eastern Time, it's less than 48 hours until the deadline for the SEC's response to the spot Bitcoin ETF applicant ARK.

In the past week, the cryptocurrency market led by Bitcoin has repeatedly impacted investors' nerves due to price fluctuations. BTC dropped from above $45,800 to $40,000 within 7 days, and then continued to fluctuate in between.

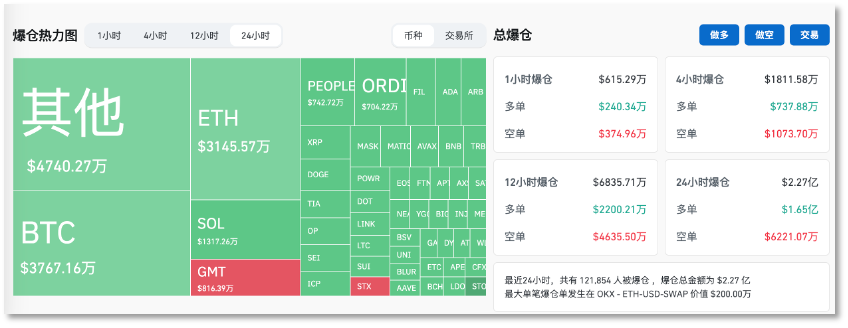

The high volatility also led to liquidation in the futures contract market.

Data on liquidation in the cryptocurrency futures market in the early morning of January 9th, Beijing Time

Data on liquidation in the cryptocurrency futures market in the early morning of January 9th, Beijing Time

According to Coinglass data, in the early morning of January 9th, the total liquidation amount of futures contracts in the market reached $227 million within 24 hours, with the BTC market liquidation amount at $37.6716 million, the ETH market at $31.4557 million, and the liquidation amount in other altcoin markets even more terrifying, at $47.4022 million.

The most significant factor affecting market sentiment is the news of the spot Bitcoin ETF.

Since the beginning of the new year, various insiders predicting whether the SEC will "approve" or "reject" have continuously appeared in the news market, while the "approval camp" has been playing with the dates, sometimes targeting the past weekend, and other times targeting the weekdays of this week, with some news even spreading without aligning the dates and days of the week; the "detractors" simply say "none will be approved."

The change in market sentiment has already caught the attention of the SEC. On January 6th, the SEC's Office of Investor Education and Advocacy issued an article "Reject FOMO," reminding retail investors to pay attention to the risks of cryptocurrency assets, including meme coins, cryptocurrencies, and NFTs. Subsequently, there were interpretations of this article, with the tone still being about predicting whether it will be approved or not.

Rather than listening to the news, it's better to closely follow the timelines and prescribed actions of all parties under U.S. law.

According to the previous application schedule, the deadline for the SEC's final response to the application from ARK and 21Shares is January 10th, which is why the cryptocurrency market is waiting for this day. The remaining 7 applicants, including BlackRock, have their final response period in March this year; Global X is in April, and the latest are Hashdex and Franklin, all in May.

Final response time from the SEC to the applicants

Final response time from the SEC to the applicants

According to the application process, before the spot Bitcoin ETF starts trading, two technical requirements must be met.

First, the SEC must sign the 19b-4 document submitted by the ETF listing exchange, which is a proposal for changes to the rules of the securities exchange, and the document is used by regulated exchanges and other self-regulatory organizations (SROs) to record rule changes to the SEC. When submitting the document, these exchanges must prove to the SEC the reasonableness of the new rules, including supporting fair trading markets, providing investor protection, and necessary supervision procedures.

Currently, the 11 spot Bitcoin ETF applicants and the exchanges they are set to land on have completed this work.

Second, the SEC must approve the relevant S-1 document, which is the registration statement of the potential issuer, containing basic business and financial information, with a deadline of 8 a.m. Eastern Time on January 8th.

At the end of last year, the applicants and the SEC held over 20 meetings on the S-1, and the majority of the applicants completed the perfection of the S-1 form in December. One important item is to replace the physical redemption model with a cash redemption model, in order to make the spot Bitcoin ETF more compliant with regulatory requirements.

Currently, 10 major applicants have submitted updated versions of the S-1 document. Surprisingly, Hashdex seems to have missed the deadline, and the approval may be delayed, while Grayscale needs to submit the S-3 document due to product changes.

Next, the 19b-4 document and the S-1 document will be reviewed by two different departments of the SEC, with the corporate finance department responsible for reviewing the S-1, and the SEC's trading and markets department responsible for reviewing the 19b-4. If both documents are approved, according to past practice, the formal trading of the ETF will begin on the next working day after approval.

Applicants engage in a fee war

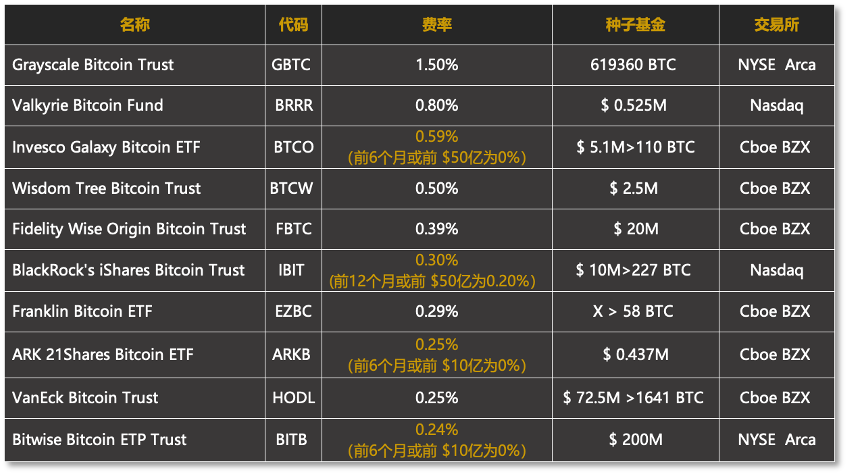

With the termination of the submission of the S-1 documents, the trading fees and seed fund information of each applicant's ETF products have also come to light, and the trading fee has become a battleground for issuers.

According to the latest S-1 documents, BlackRock has adopted a flexible fee structure, "0.20% for the first 12 months or first $5 billion, and 0.30% thereafter," which not only is lower than analysts' previous predictions, but also directly hits its market competitors.

In addition to BlackRock, Invesco, ARK, and Bitwise have currently designed low fees within a certain period or a certain total trading volume, while ARK/21Shares previously had a fee of 0.80%, but after seeing the competitive advantage of its competitors, it announced an adjustment to 0.25%, and offered a 0% fee for the "first 6 months or first $1 billion" in trading.

Comparison of fees for various Bitcoin spot ETF products

According to Eric Balchunas, a senior analyst at Bloomberg, the differences in fees between Bitcoin ETF products will not have a significant impact on the competitiveness and market size of each issuer. "Investment advisors are more concerned about regular fees because they are long-term investors. Given that all of these ETFs are doing the same thing, perhaps fees will have an impact under other equal conditions."

Looking at the seed funds, the initial scale attracted by each applicant is also different. The seed fund is the initial investment that allows the ETF to start and begin trading. It is the issuance unit that constitutes the foundation of the ETF, making it convenient for ETF shares to be traded by investors on the open market.

Currently, apart from Grayscale, an early institutional hoarder of Bitcoin, Bitwise is the known applicant with the largest seed fund scale. On December 29th, the company disclosed that there are buyers planning to purchase $200 million in shares as a seed fund, which is higher than VanEck's $72.5 million.

The latest news shows that the U.S. cryptocurrency hedge fund Pantera Capital plans to invest $200 million in the potential Bitwise Bitcoin ETP Trust, and this hedge fund company is very likely the buyer hinted at by Bitwise earlier.

In terms of the scale of the seed fund, apart from established players like Grayscale, the initial capital for Bitcoin spot ETFs is only around $300 million, which is still less than the daily trading volume of mainstream cryptocurrency exchanges. As for how much new capital this market can attract, analysts compare it to the gold ETF. As of now, the total assets of gold ETFs in the U.S. market amount to $114.7 billion.

The approval of spot Bitcoin ETFs in the U.S. still has certain variables, but as more and more information from the S-1 documents is transmitted to the market, the price of BTC has once again surged. In the early morning of January 9th, Binance exchange data showed that BTC briefly soared to $47,248, breaking the previous high and reaching a new high for the year.

(Disclaimer: Readers are strictly advised to comply with local laws and regulations. This article does not represent any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。