When most analysts on Wall Street fall into a cautious wait-and-see mindset, Fundstrat's Tom Lee, with his unique interpretation of macro signals, draws a distinctly different treasure map for investors in the market.

In an environment where most analysts hold a cautious or even pessimistic view of the market, Tom Lee—Chairman of BitMine and Co-founder of Fundstrat—once again attracts market attention with his contrarian bullish perspective. As one of Wall Street's most outspoken bulls, Lee has accurately predicted a market rebound from 2023 to 2025.

In a recent in-depth interview, he systematically elaborated on his unique insights into the current macro cycle, the AI super cycle, and the trends in crypto assets, pointing out that investors are missing historic opportunities due to misjudgments of key signals.

1. Contrarian Thinking: Why Are 90% of Analysts Wrong?

In the face of pervasive pessimism in the market, Tom Lee incisively identifies the core issue: 80% of trading essentially depends on the macro environment, and over the past three years, investors have almost all considered themselves "macro traders," but have made two critical mistakes.

● “An inverted yield curve does not necessarily signal an economic recession,” Lee explained, “This inversion is caused by inflation expectations—short-term inflation is high, so short-term nominal rates should be higher, but in the long run, they will decline, which is the real reason for the curve inversion.”

● Lee believes that our generation has never truly experienced inflation, so everyone uses the 1970s "stagflation" as a template, without realizing that today lacks the persistent inflationary conditions that were present then.

The "tariff crisis" in April is a typical case. When most economists declared a recession was coming, institutional investors traded based on that, effectively preparing for a massive bear market. “This incorrect positioning cannot be adjusted in just six months,” Lee pointed out, “yet the market has made a strong rebound supported by corporate earnings.”

2. The Engine of the Super Cycle: Overlooked Structural Forces

Tom Lee repeatedly emphasizes that the most misunderstood concept in the current market is the "super cycle." He identified two future drivers of super cycles back in 2018, which are now coming into play.

● Millennials entering their prime working age: This demographic is at the peak of their income and consumption capacity, creating a 20-year economic tailwind.

● Global labor shortage in the golden age: This seemingly mundane factor is actually laying a solid foundation for the AI boom.

Lee compares the current AI-driven boom to similar historical periods: “From 1991 to 1999, there was a labor shortage, and tech stocks thrived; from 1948 to 1967, there was also a labor shortage, and tech stocks experienced a boom. Today's AI wave is replaying this pattern.”

3. The Explosive Potential of U.S. Stocks and Crypto Assets

Despite the market having experienced a strong rise, Tom Lee remains optimistic about the year-end outlook. He predicts that the S&P 500 index could reach 7000 or even 7500 points by the end of the year and highlights three major potential opportunities.

● AI trading will make a strong comeback: Although there has been some recent volatility, the long-term outlook for AI remains unaffected, and companies are expected to make significant announcements as they look towards 2026.

● Financial stocks and small-cap stocks: If the Federal Reserve cuts interest rates in December, confirming its entry into a loosening cycle, this will be extremely beneficial for financial and small-cap stocks.

● Cryptocurrency: Cryptocurrencies are highly correlated with tech stocks, financial stocks, and small-cap stocks, and thus will see a massive rebound.

Lee particularly emphasizes: “The market has performed strongly over the past six weeks, but people's positions have deviated significantly, indicating that there is huge potential demand for stocks. 80% of institutional fund managers have underperformed the benchmark index, which is the worst performance in 30 years. They have only 10 weeks left to catch up, which means they will have to buy stocks.”

4. Ethereum's Explosive Potential Far Exceeds Bitcoin's

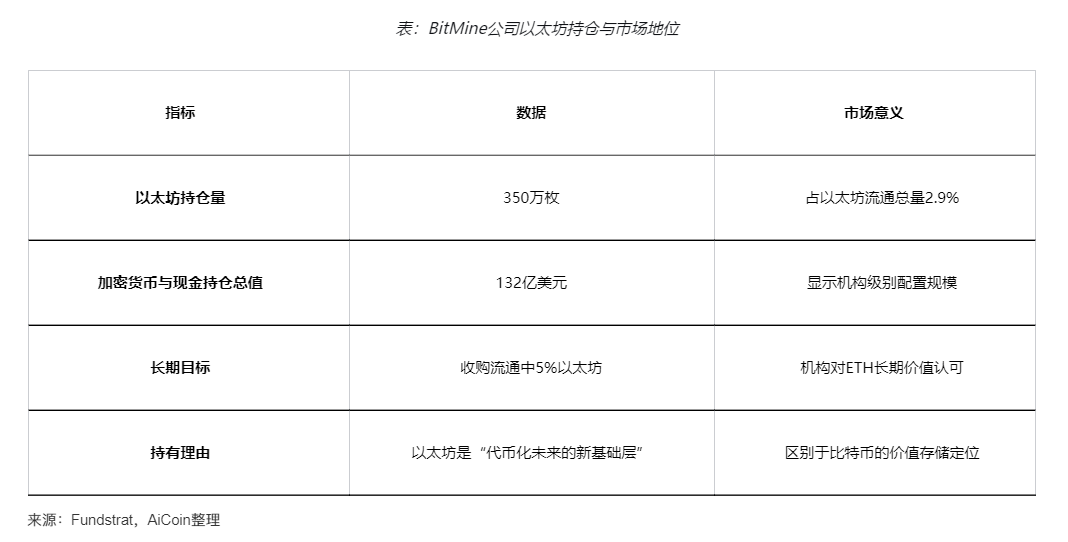

In the cryptocurrency space, Tom Lee presents a perspective that differs from traditional views. He believes Bitcoin has the potential to reach over $100,000 by the end of the year, possibly even $200,000.

● But he states: “To me, it is more evident that Ethereum may see significant gains before the end of the year.”

● Lee analyzes that stablecoins and tokenized gold are eating into Bitcoin's demand, and these operate on smart contract blockchains like Ethereum. Additionally, Wall Street is actively positioning itself, with BlackRock's CEO Larry Fink hoping to tokenize everything on the blockchain.

● “Fundstrat's Head of Technical Strategy, Mark Newton, believes that by January next year, Ethereum's price could reach $9,000 to $12,000. I think this prediction is reasonable, which means Ethereum's price could more than double from now until the end of the year or January next year.”

5. Overrated Inflation and Geopolitical Shocks

Among the many market risks, Tom Lee believes that “the return of inflation” is the most overrated.

● “Too many people think that monetary easing or GDP growth will create inflation, but inflation is a very mysterious thing,” Lee analyzed, “We have experienced years of loose monetary policy without inflation. Now, the labor market is cooling, and the housing market is weakening, and none of the three main drivers of inflation—housing, labor costs, and commodities—are rising.”

● Regarding geopolitical risks, Lee also believes their impact is overstated. He gives an example: “This summer, the U.S. bombed Iran's nuclear facilities, and at that time, some predicted this would cause oil prices to soar to $200, but in reality, oil prices hardly moved.”

● “Geopolitics can destroy unstable economies. But in the U.S., the key question is: Will corporate earnings collapse due to geopolitical tensions? If not, then we should not use geopolitics as a primary reason to predict a bear market.”

6. How to Seize Opportunities Amid Volatility

In light of the current market environment, Tom Lee offers practical advice for investors.

● He emphasizes that when investors sell stocks, they actually need to make two decisions: first, to sell, and second, when to re-enter the market at a better price. If one cannot ensure a tactical re-entry, then panic selling may lead to missing out on long-term compounding returns.

● For investors who have already missed market opportunities, Lee suggests gradually returning to the market through “dollar-cost averaging” rather than investing a lump sum. Spread the investment over 12 months or longer, investing a fixed percentage each month, so that even if the market declines, one can achieve a better cost advantage through phased buying.

● Lee particularly warns investors to avoid falling into the “waiting for a correction” trap: “Peter Lynch said, ‘Waiting to recover lost money costs more than the loss itself.’ This emotional stubbornness often stems from a lack of firm belief rather than rational judgment.”

Tom Lee's market views sharply contrast with the general caution on Wall Street. In his view, when everyone thinks a top is near, a top cannot form. “The top of the internet bubble formed because no one thought stocks would fall.”

For the market in the next 12 months, his advice is concise and powerful: “Buckle up.” Over the past six years, the market has risen significantly but has experienced four bear markets. “In 2025, we dropped 20% at one point, but ultimately could rise 20% for the year. So remember, this situation is likely to happen again.”

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。