In the 30 days following the crash on October 11, the cryptocurrency market has experienced a severe adjustment from its historical highs, with over $1.5 billion in funds withdrawn from crypto funds. The competition among a group of market whales has added a legendary aspect to this turmoil.

Over the past month, the cryptocurrency market has undergone a profound adjustment under the dual pressures of macro policies and internal market structure. Bitcoin plummeted from its historical high of $126,000, briefly falling below the psychological threshold of $100,000.

Ethereum has erased all gains made this year. Market panic has spread, with the total liquidation amount across the network hitting new highs, and the large-scale withdrawal of institutional funds has cast a shadow over the market.

1. Institutional Selling and Position Adjustment

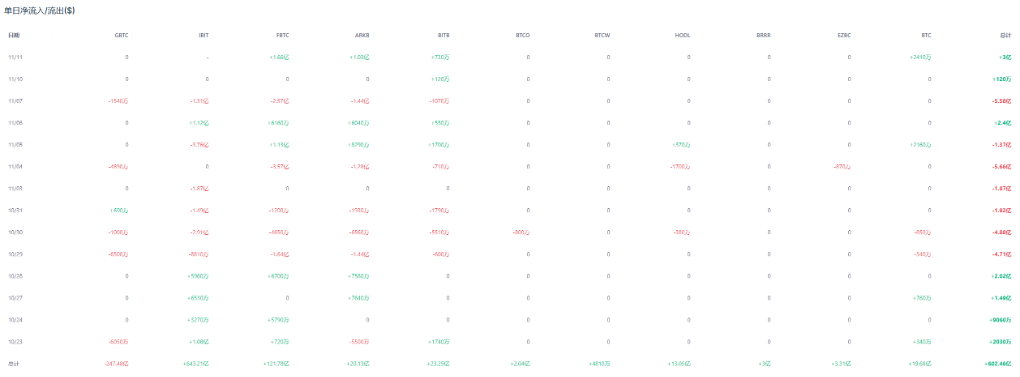

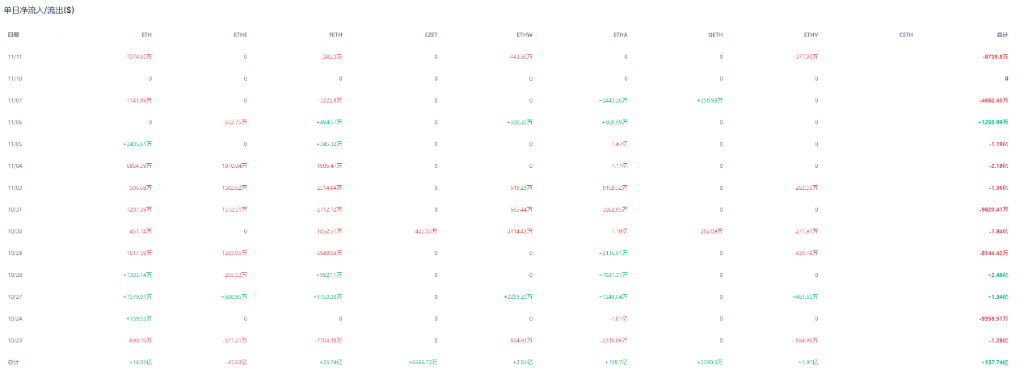

In the past month, the cryptocurrency market has experienced continuous capital outflow since the crash on October 11.

● Cryptocurrency investment products have seen massive net outflows for two consecutive weeks, totaling as much as $1.5 billion. This phenomenon marks a significant shift in market sentiment.

● Bitcoin has become the hardest-hit area for capital outflows. Last week, Bitcoin ETP saw a net outflow of $932 million, slightly lower than the previous week's $946 million. Meanwhile, short Bitcoin products have gained favor, recording an inflow of $11.8 million last week, the highest single-week inflow since May 2025.

● Ethereum has not been spared either. After recording an inflow of $57 million the previous week, last week saw an outflow of $438 million. This indicates that institutional investors are not only reducing their Bitcoin holdings but also adjusting their entire crypto asset portfolios.

This chart shows the capital changes of BTC holding addresses of different sizes. Overall, the recent market has shown significant differentiation:

● Addresses holding 1–10 BTC and 10–100 BTC have seen a continuous decline in holdings, indicating that small and medium investors have chosen to reduce their positions or exit during recent price fluctuations;

● Addresses holding 100–1000 BTC significantly increased in the previous phase, but have also seen a decline in recent days, showing that some medium-sized institutions or whales are starting to take profits;

● Addresses holding over 1000 BTC have shown signs of rebound after a long period of decline, indicating a potential return of main capital.

2. Market Selling Pressure Under Multiple Resonating Factors

The continuous decline in the cryptocurrency market is caused by both macro policies and internal market factors.

Macroeconomic Policy Pressure

● The erratic U.S. tariff policy and the ongoing federal government "shutdown" have become major factors suppressing market sentiment. On the tenth day of the government shutdown, the director of the White House Office of Management and Budget announced that federal layoffs had begun, further exacerbating market concerns.

● The Federal Reserve's monetary policy signals have also impacted the market. St. Louis Fed President Bullard stated in October that while he supports interest rate cuts, he emphasized that "monetary policy still needs to remain cautious."

This conditional statement on interest rate cuts has cooled investors' expectations for liquidity improvement.

Weak Internal Market Structure

● The decoupling of stablecoins USDX and USDE has further amplified market volatility. In early November, the USDX stablecoin briefly plummeted to $0.113, triggering a series of chain reactions. Several lending platforms were forced to liquidate urgently, and borrowing rates soared to an astonishing 800%.

● The high leverage in the derivatives market has also exacerbated market volatility. AiCoin data shows that within just 24 hours from October 10 to 11, the total liquidation amount across the cryptocurrency network exceeded $19 billion, with the number of liquidated individuals reaching 1.62 million.

3. Whale Operations: The Birth and Demise of Myths

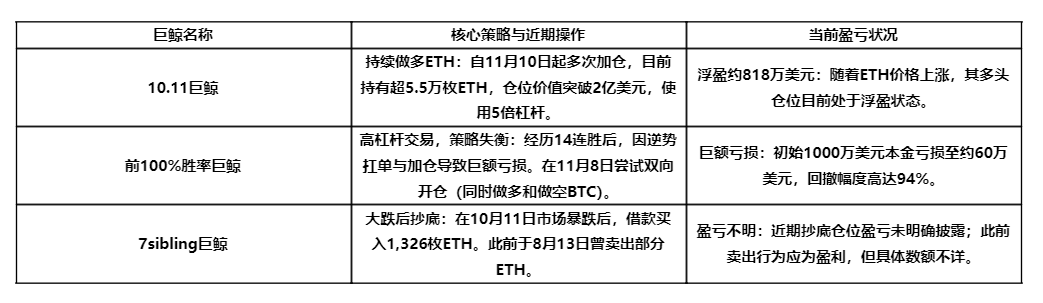

In the past month, the performance of well-known market whales has shown a polarization, with the most notable being the legendary story of the "100% win rate whale."

October 11 Whale: The "Insider Player" Firmly Going Long

This whale was known for accurately shorting the market before the crash on October 11 and making substantial profits, but their recent operational direction has changed significantly.

● Continuously increasing long positions: Since November 10, this whale has repeatedly increased their Ethereum (ETH) holdings, pushing the total value of their ETH long positions above $200 million on November 11.

● Holdings and Leverage: As of now, their holdings exceed 55,000 ETH, using 5x leverage, with an average opening price of approximately $3,467.

● Current Floating Profit: Based on their latest opening price and the current market price, this whale's ETH long position has a floating profit of over $8.18 million.

The 100% Win Rate Whale: The Myth's Demise and Strategy Shift

The experience of this whale has been tumultuous, serving as a typical cautionary tale of a high-risk trading strategy.

● Glory and Collapse: They began trading on October 14, achieving a 14-game winning streak through high leverage and switching between long and short positions, with peak floating profits reaching $25.34 million. However, starting at the end of October, due to a strategy error of "running when profitable, holding when losing," they increased positions against the trend in coins like SOL, leading to a sharp increase in losses. Ultimately, on November 5, their position was close to liquidation, with total losses reaching $44.67 million (including principal and previous profits), leaving only about $600,000 from an initial $10 million principal, a drawdown of 94%.

● Recent Operations: After experiencing massive losses, this whale attempted a new strategy on November 8: dual-direction operations. They simultaneously opened 40x leverage long and short positions in BTC, with the short position (90.63 BTC) significantly larger than the long position (20 BTC), which may indicate they are trying to find new opportunities amid market volatility, but overall still lean towards bearish.

7sibling Whale: A Long-Term Player Buying on Dips

This is a typical long-term Ethereum holder, skilled at bottom-fishing during market declines.

● Recent Bottom-Fishing: During the market crash on October 11, this whale borrowed $40 million USDC from the Aave protocol and quickly used $5 million USDC to purchase 1,326 ETH, with an average purchase price of approximately $3,771.

● Historical Operations: According to historical records, this entity successfully bottom-fished during the market crash last August. The most recent record shows that on August 13 of this year, they sold 19,957 ETH at a price of $4,532, and currently still hold about 280,000 ETH, valued at approximately $1.3 billion.

4. Market Summary: Short-Term Pain and Long-Term Reconstruction

In the past month, the cryptocurrency market has undergone a difficult adjustment period. Bitcoin recorded its first October decline since 2018, with a drop of nearly 5%.

From the perspectives of capital flow, market sentiment, and investor structure, the market is undergoing profound changes.

● In terms of capital flow, institutional funds have significantly flowed out of Bitcoin products, partially flowing into short Bitcoin products and certain altcoins. The Solana ETP continued to receive $118 million in inflows last week.

● In terms of market sentiment, the fear and greed index has fallen from extreme greed back into the fear range.

● In terms of investor structure, short-term holders have faced immense pressure. CryptoQuant analysts point out that since prices have failed to maintain above the average cost price of $110,000, this group of investors has intensified their selling efforts, leading to massive losses, marking one of the most intense sell-offs since 2025.

Looking at the market changes over the past month, Glassnode's analysis suggests that "Bitcoin seems to be at a critical turning point." The range between $100,000 and $108,000 may constitute a mid-term support level, but the overall downward trend in profitability continues to suppress market sentiment.

Market participants remain hesitant, as they digest this historically largest liquidation event. And that "100% win rate whale," after the liquidation, has engaged in aggressive operations with 40x leverage in both long and short positions, seemingly reminding us that the legends and tragedies of the crypto world are always alternating.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。