The world is bustling, all for profit; the world is in turmoil, all for profit! Hello everyone, I am your friend Lao Cui, focused on digital currency market analysis, striving to convey the most valuable cryptocurrency market information to the vast number of crypto friends. Welcome to the attention and likes of all crypto friends, and we reject any market smoke screens!

With my return to work, many friends began to hope that Lao Cui could analyze the reasons for this decline and have discussed these issues with some crypto friends; more friends hope to find the main cause to gain subsequent investment confidence. Today, Lao Cui will briefly talk about why this round of decline came earlier. Is it that Bitcoin has lost its value, or is it due to short-term artificial factors? This decline can be said to be quite complex, as foreign criticism of a certain platform has continued to this day, while the attitude of some platforms is also very ambiguous, initiating a round of compensation. An extremely extreme thought is that if certain platforms did not have malicious operations, then this round of compensation would definitely not be so easily given. Platform factors certainly exist, and the trigger that was initiated is also from the platform side. However, some uncontrollable factors were added midway, such as the coming end of the year last year, where some seized crypto assets began to be liquidated, which has nothing to do with the Americans.

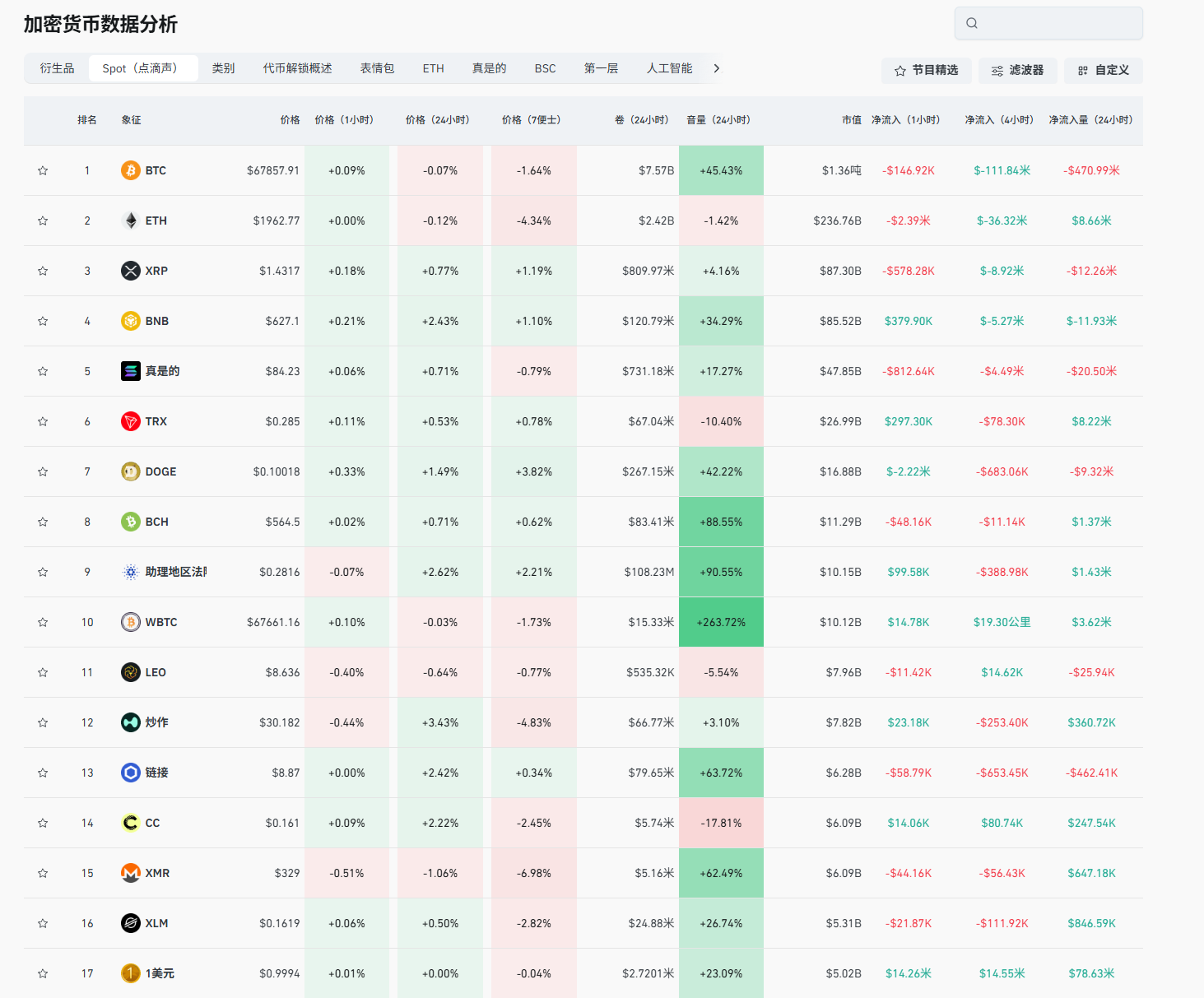

There is also collaboration from the Americans, as they want to acquire lower chips, which has been confirmed by Trump, who publicly stated that Americans should increase their Bitcoin holdings around 60K. Coincidentally, the bottom of this decline happened to be around sixty thousand, and the rebound was extremely fierce. Under the accumulation of these negative factors, the coin price has no bottom to speak of, and the ongoing decline has made most users begin to lose confidence. The flow of funds in the crypto circle is extremely difficult to fathom; if the giants do not want you to see the circulation of their wallets, they can conduct physical deliveries or even use new wallet addresses. This is where our significant misjudgment occurred earlier. Recent data has shown that more friends are worried whether the funds involved in the 1011 insider have all exited? The “1011 insider whale” has sold about 60% of the Bitcoin positions transferred to Binance. This whale previously deposited 11,318 BTC (worth $760.61 million) to Binance, and seven newly created addresses have withdrawn $464.48 million in USDT from Binance. Currently, there are still about $296 million in BTC left on a certain exchange.

It can be determined that there might still be another round of dumping; this movement of funds is apparent, but the apparent funds will not see too much inflow or outflow. All known fund flows can only be considered temporarily sealed. Currently, there are no signs that these Bitcoins have been directly sold in the secondary market. Market analysis suggests that this transfer may be used for over-the-counter (OTC) transactions or temporarily stored in an exchange's custody account. Normally, when a wallet address transfers to the platform, it is highly likely that it will be primarily for selling. Therefore, the possibility of breakthroughs in coin prices in the short term is almost nonexistent, especially with the recent ruling from the Americans, which declared tariffs illegal, once again putting Trump in the spotlight by announcing a temporary 10% tariff increase on all global goods. Lao Cui has previously mentioned that the start of a tariff war is a significant positive for the cryptocurrency circle because the crypto circle has the ability to bypass, but the short-term tariff increases will cause investment outflows from the crypto circle.

So why did the previous tariff initiation lead to a decline in the crypto circle? The main factor is that all tariff initiations typically end within a short period and do not last long. Also, even though the ruling declared Trump's tariffs illegal, do not be overly optimistic. Lao Cui has found that many friends have some misunderstanding of finance and politics; even if the ruling is illegal, the benefits of the previous tariff increases will not be refunded to other countries. Part of these tariff revenues has already been used for wage payments, and the additional 10% tariff issue is simply a substitute for the previous tariffs. In this situation, it reflects the already stringent fiscal issues of the Americans. Reviewing last year's fluctuations in the crypto circle, one can clearly see that Trump's push for the crypto economy has failed, whether in terms of coin prices, market value, or so-called stablecoins, none have reached the expected projections. Will Trump's view of the crypto circle change?

Since Trump promoted stablecoins, Lao Cui has also explained why he holds them in such high regard. I wonder if you still have some impression: promoting stablecoins is nothing more than allowing the gray capital from around the world to legally flow into the Americans, while also increasing the purchase volume of US debt and even stabilizing the position of the dollar. To date, the market value of stablecoins is only a few hundred billion, far from the concept of using the crypto circle to pay off US debt. The American regime is also very interesting; whether the next president will continue what Trump could not accomplish is a big question. Historically, most wouldn’t continue. From the author's perspective, this round of dumping is more about Trump's disappointment, leading to an unclear definition of the future of the crypto circle, meaning the narrative capability cannot be sustained. Thus, mid-level funding has led to a wave of earnings. Although there is some disappointment, it does not mean the future of the crypto circle has come to an end.

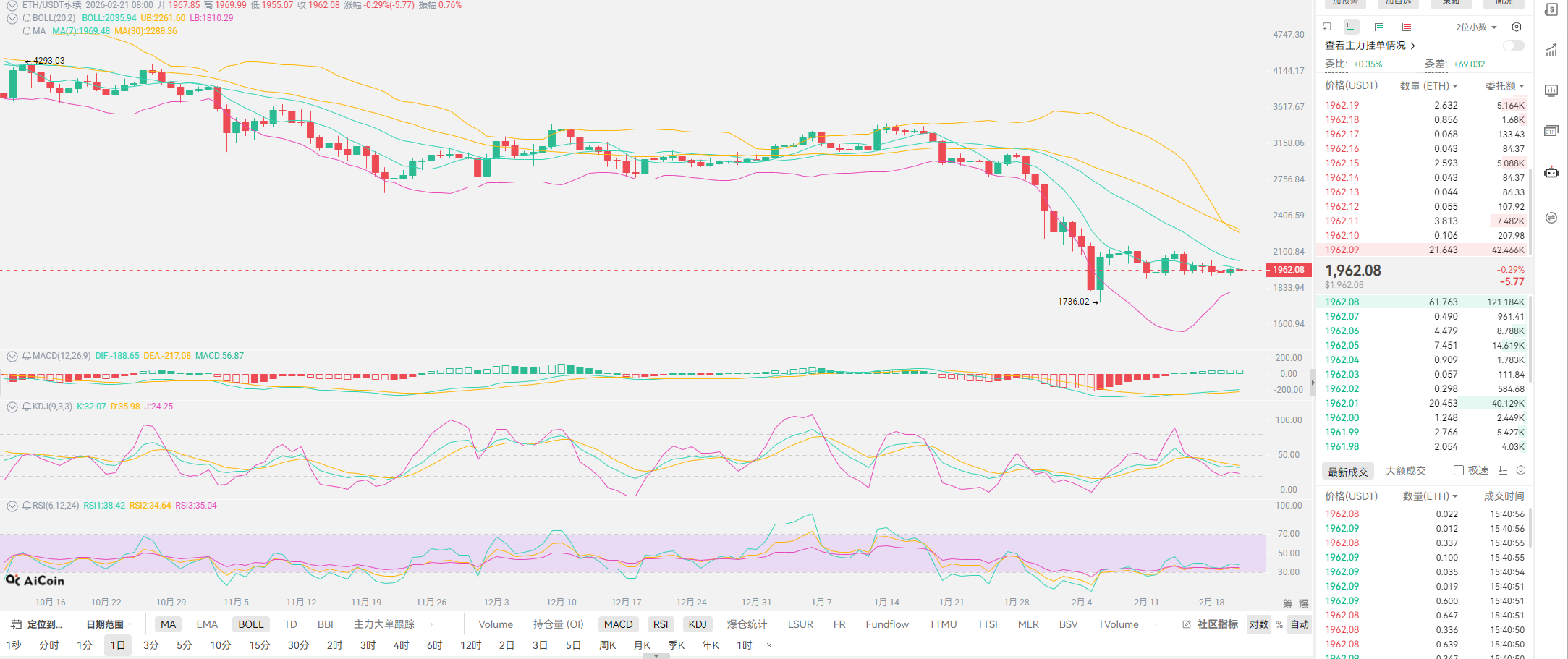

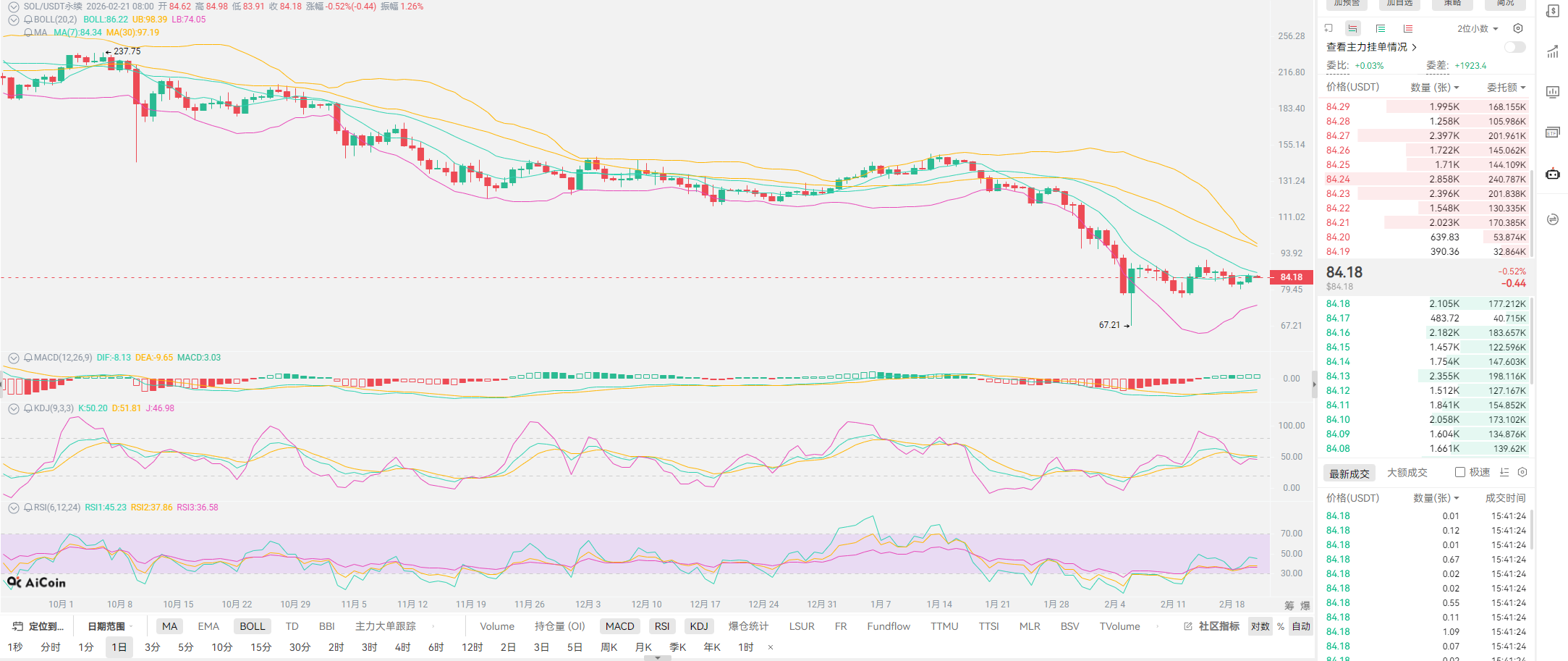

From the movements of the giants in the crypto circle, Bitcoin's resistance to quantum computing optimization has been put on the agenda, Ethereum upgrades, SOL upgrades, and even the upgrades of last year's DOGE and OKB have all been completed. The giants have not completely abandoned this market; the crypto circle will not be crushed by narrative capability. Previously, MEME and DEFI smart contracts will basically see new concepts emerge every year; currently, however, the innovation capability is facing issues. Recently, it can be considered that a new concept appears to lead the direction of the crypto circle every two years. The innovation capability is not something we can question; everyone just needs to remember that once a new concept appears, there are currently only two usable channels: one is the Ethereum system and the other is the SOL system. The advantage of the Ethereum system lies in having more personnel to maintain it; the advantage of SOL is its low cost. When a small coin concept is born, the cost is often the fundamental reason they need to consider. Therefore, the priority of purchasing these two coins at this stage is above all else.

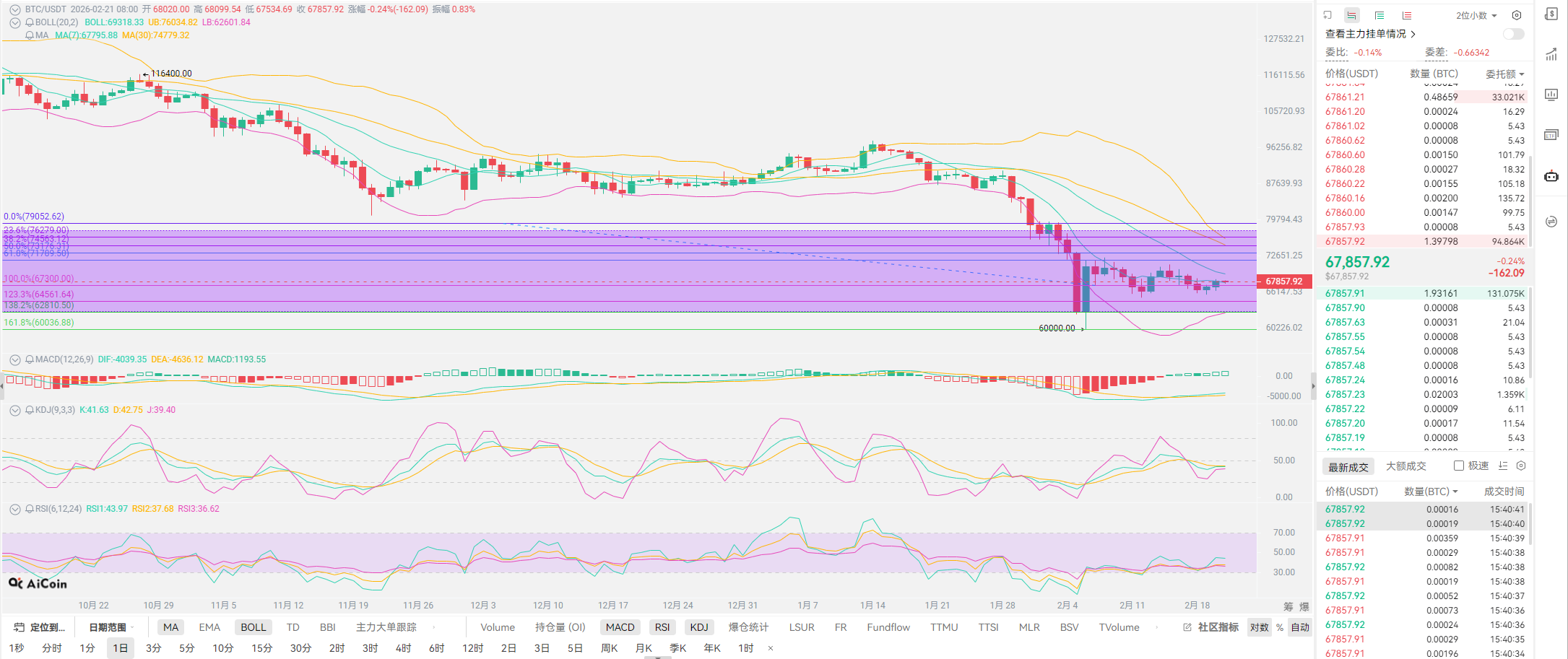

Lao Cui summarizes: Overall, I have aggregated the views of most analysts in the crypto circle; most can see Bitcoin declining below 55K. This probability has almost reached over 64%. If the market really moves in this way, one explanation is that the official intervention from the Americans is certain. And it will definitely be in the form of a spike, perhaps maintaining within a half-hour purchase window. The two key points summarized yesterday are one is the display of the Americans' official strategies (including military aspects), and the other is the issue mentioned today regarding the withdrawal of funds involved in the 1011 insider; will there be another wave of selling? Looking at the inflow situation of funds into Coinbase and a certain exchange, the gathering of BlackRock and insider funds has already created a significant backlog; will they choose to sell? This question is extremely worth everyone's attention because at present, both of these have not been staked and are still liquid funds. The entire market before June is hard to assess, but after June, it is undoubtedly on the rise. As for contract users, it is crucial to pay attention to support and resistance levels; the inflow of small coins is evidently showing a positive trend, especially the buying pressure of SOL has been very strong lately. The comprehensive indicators can only look at BTC!

Original content creator WeChat official account: Lao Cui Talks About Coins If you need help, you can contact directly.

Lao Cui's message: Investing is like playing chess; experts can see five, seven, or even ten steps ahead, while those with poor chess skills can only see two or three steps. The higher players consider the overall situation and the overall trend, not focusing on a single piece or area, but aiming to win the game in the end. The lower players fight for every inch, with frequent shifts in long and short positions, only competing for short-term trades, resulting in being frequently trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。