I have always believed that the recent decline was due to institutions running out of money, as their cash reserves have repeatedly fallen below historical lows. In plain language, institutions no longer have sufficient capability to continue driving up prices, and without cash, the direct result of profits should be selling, at least passively reducing holdings.

Today, I saw the latest data from Bank of America (updated monthly), which indeed aligns with expectations: the cash holdings of institutions have increased from last month's historical low of 3.2% to 3.4%. Although it is still low, this is the first increase in the past seven months.

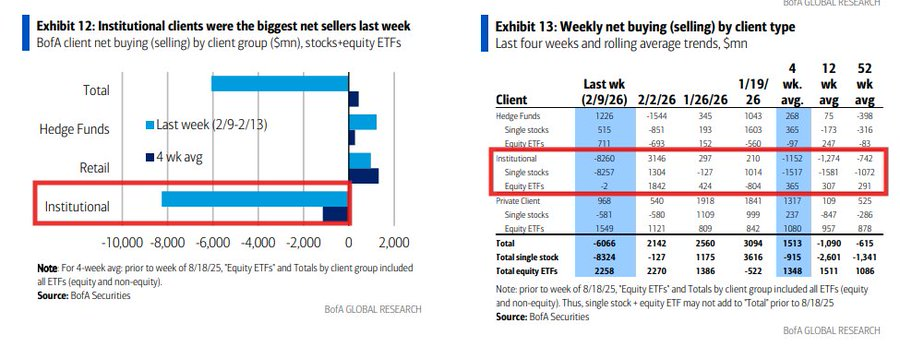

Furthermore, it is evident from the marked data that institutions have been clearly selling over the past month and even the past week, with only retail investors and hedge funds buying in. However, the buying volume is significantly lower compared to the selling by institutions, which is one reason why the price trend has not been good recently.

Additionally, at this point, the cash holdings of institutions are still at a very low historical position, suggesting that institutions are likely continuing to sell. This poses a danger to risk assets, including $BTC, unless there is a very clear favorable factor in the market that can enhance investor risk appetite. If such a situation occurs, it is likely that retail investors will be taking over.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。