Basic Concepts of Leverage Trading

What is Leverage?

Leverage refers to controlling larger amounts of trades with a small amount of capital.

Example:

You have $1,000

Using 10x leverage

You can control a $10,000 trade

Advantages and Risks of Leverage

Advantages:

- Higher returns with a small amount of capital

- Flexible use of funds

- Improved capital efficiency

Risks:

- Losses can also be magnified

- You may be liquidated

- Strict risk management is required

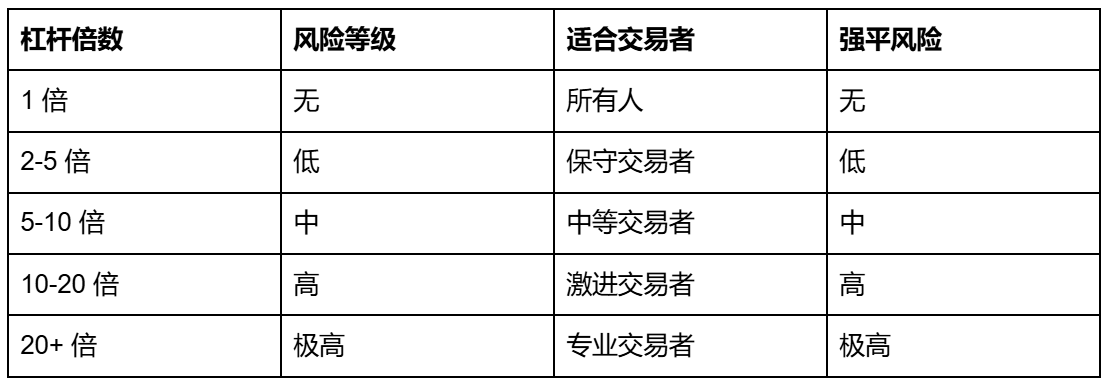

Choosing Leverage Multiples

Recommendation: Beginners should start with 2-5x and gradually increase.

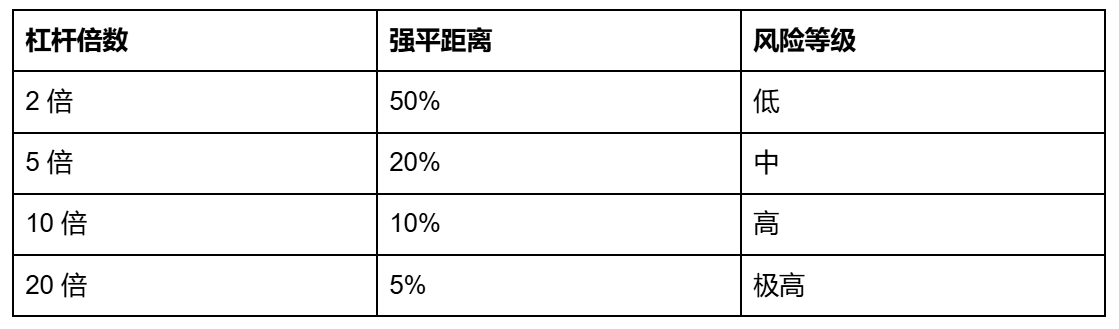

Liquidation Price Calculation

What is Liquidation?

When your losses reach the margin level, the position will be automatically liquidated. This is called liquidation.

Liquidation Price Formula

Long Liquidation Price:

Liquidation Price = Entry Price × (1 - 1/Leverage Multiplier)

Short Liquidation Price:

Liquidation Price = Entry Price × (1 + 1/Leverage Multiplier)

Calculation Example

Example 1: BTC Long

Entry Price: $80,000

Leverage: 5x

Liquidation Price = $80,000 × (1 - 1/5) = $80,000 × 0.8 = $64,000

This means:

- If BTC drops to $64,000, you will be liquidated

- Maximum loss: $80,000 - $64,000 = $16,000

- But you only invested $16,000 ($80,000 / 5)

Example 2: Silver Long

Entry Price: $82.33

Leverage: 10x

Liquidation Price = $82.33 × (1 - 1/10) = $82.33 × 0.9 = $74.10

This means:

- If silver drops to $74.10, you will be liquidated

- Maximum loss: $82.33 - $74.10 = $8.23

- Your margin will be entirely lost

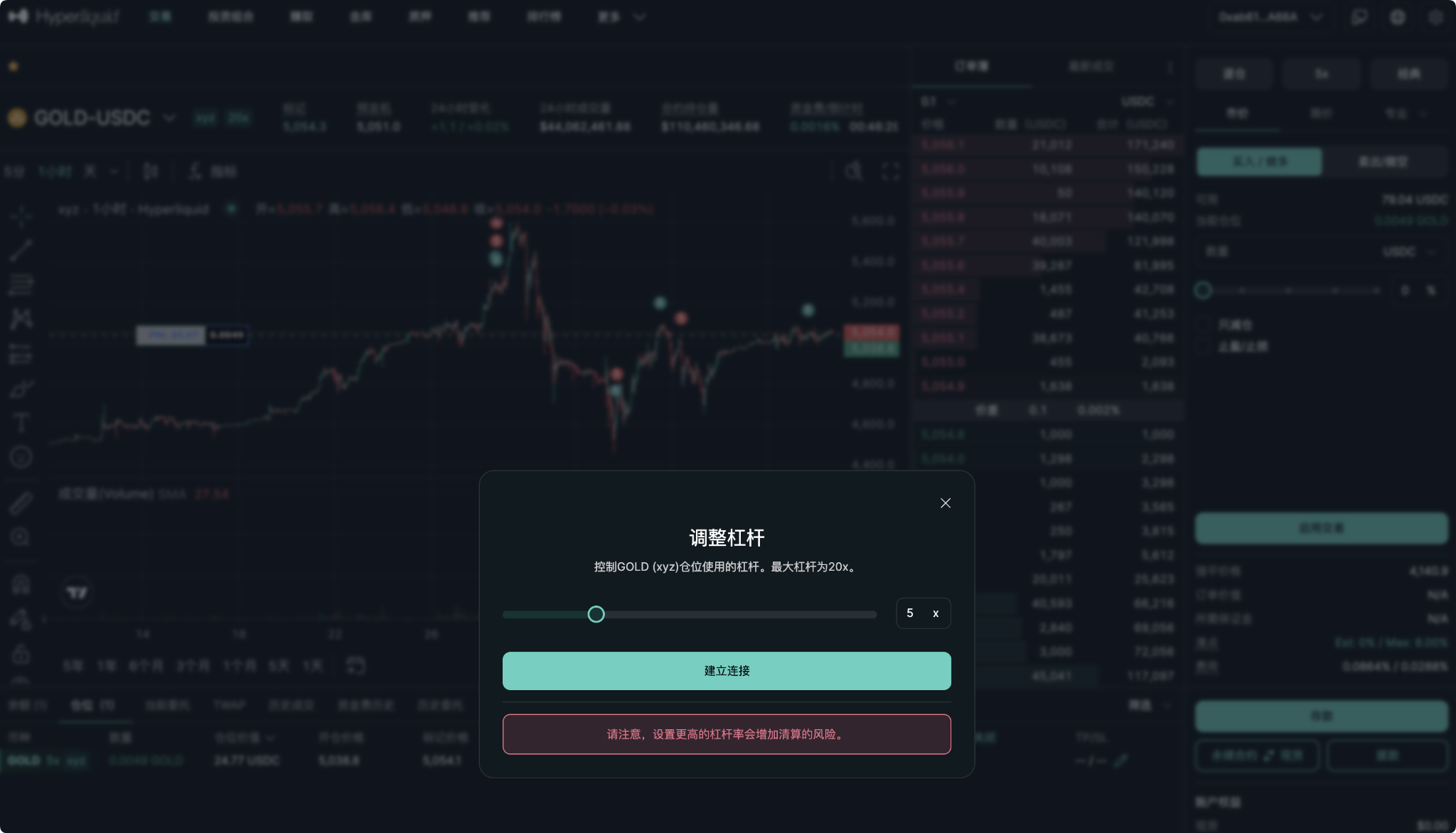

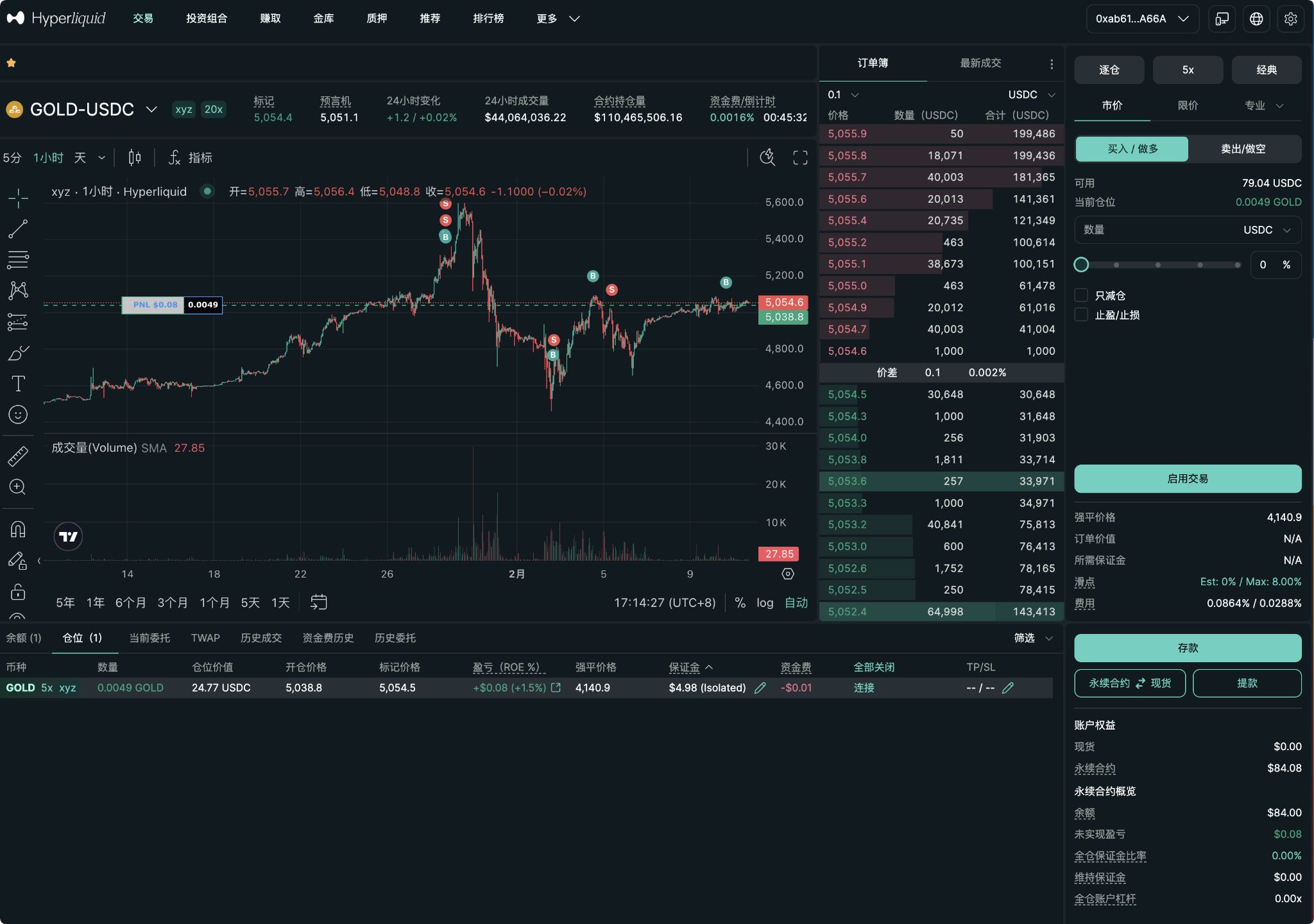

Example 3: Gold Short

Entry Price: $4,769.2

Leverage: 20x

Liquidation Price = $4,769.2 × (1 + 1/20) = $4,769.2 × 1.05 = $5,007.66

This means:

- If gold rises to $5,007.66, you will be liquidated

- Maximum loss: $5,007.66 - $4,769.2 = $238.46

- Your margin will be entirely lost

Importance of Liquidation Price

The closer the liquidation price is to the entry price, the greater the risk

Margin and Account Risks

What is Margin?

Margin is the funds you use to open a position.

Example:

Account balance: $10,000

Opened Position: $5,000 (5x leverage)

Margin: $1,000

Available Margin: $9,000

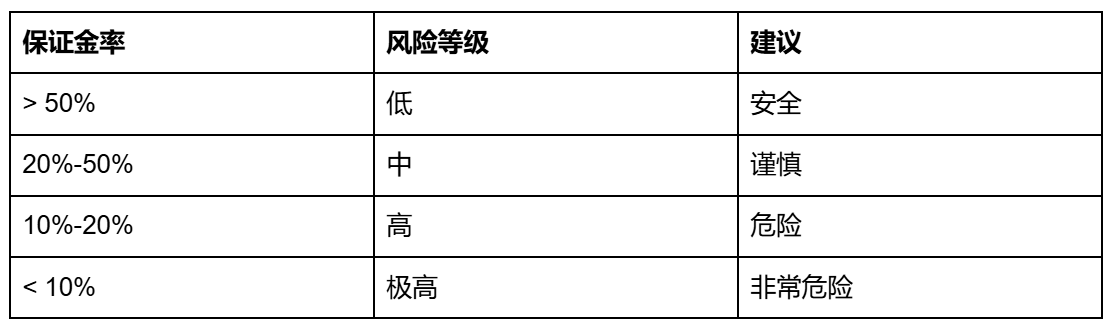

Margin Ratio

The margin ratio shows how much risk buffer your account still has.

Formula:

Margin Ratio = Available Margin / Position Value × 100%

Example:

Account balance: $10,000

Position Value: $50,000 (10x leverage)

Used Margin: $5,000

Available Margin: $5,000

Margin Ratio = $5,000 / $50,000 × 100% = 10%

Margin Ratio Risk Levels

Recommendation: Keep the margin ratio above 30%.

Risk Management Strategies

Strategy 1: Position Size Management

Principle: The risk for each trade should not exceed 2% of the account

Calculation Method:

Account balance: $10,000

Maximum Risk per Trade: $10,000 × 2% = $200

If entry price is $80,000, stop loss price is $75,000

Loss per trade: $5,000

Maximum Position Size: $200 / $5,000 = 0.04 BTC = $3,200

Strategy 2: Setting Stop Loss

Why It Matters:

- Limit loss per trade

- Protect the account

- Avoid excessive losses

How to Set:

- Determine risk tolerance (e.g., 2%)

- Calculate stop loss price

- Set stop loss order on the platform

Example:

Account: $10,000

Risk per trade: 2% ($200)

Entry price: $80,000

Stop loss price: $75,000

Position size: $80,000 × 0.04 BTC = $3,200

Strategy 3: Setting Take Profit

Why It Matters:

- Automate profit-taking

- Avoid greed

- Lock in profits

How to Set:

- Determine target profit percentage (e.g., 5%)

- Calculate take profit price

- Set take profit order on the platform

Example:

Entry price: $80,000

Target profit percentage: 5%

Take profit price: $80,000 × 1.05 = $84,000

Expected profit: $4,000 (based on $80,000 position)

Strategy 4: Diversifying Positions

Principle: Do not invest all funds into one trade

Suggested Allocation:

Total Account: $10,000

Allocation Plan:

- BTC Spot: $3,000 (30%)

- BTC Perpetual: $2,000 (20%)

- Silver Perpetual: $2,000 (20%)

- Gold Perpetual: $1,500 (15%)

- Cash Reserve: $1,500 (15%)

Strategy 5: Dynamic Leverage Adjustment

Principle: Adjust leverage based on market volatility

Adjustment Rules:

Low Market Volatility (< 2%): Use 10-20x leverage

Medium Market Volatility (2-5%): Use 5-10x leverage

High Market Volatility (> 5%): Use 2-5x leverage

Common Risks and How to Avoid Them

Risk 1: Over-Leveraging

Symptoms:

- Using 20+ times leverage

- Liquidation price is very close to entry price

- Any small fluctuation results in loss

How to Avoid:

- Beginners use 2-5x leverage

- Intermediate traders use 5-10x leverage

- Only professional traders use 20+ times leverage

Risk 2: No Stop Loss

Symptoms:

- No stop loss set for trades

- Hoping for a market rebound

- Ultimately liquidated

How to Avoid:

- Set stop loss for every trade

- Ensure stop loss price is reasonable

- Strictly implement stop losses

Risk 3: Overextended Position Size

Symptoms:

- Investing all funds into one trade

- Single trade losses exceed 5% of the account

- Overall account risk is too high

How to Avoid:

- Limit single trade risk to no more than 2% of account

- Diversify positions

- Maintain cash reserves

Risk 4: Chasing Highs and Selling Lows

Symptoms:

- Chasing prices when they go up

- Panic selling when prices drop

- Frequent trading leads to accumulated losses

How to Avoid:

- Develop a trading plan

- Follow the plan strictly

- Do not be driven by emotions

Risk 5: Ignoring Fees

Symptoms:

- Frequent trading

- High accumulated fees

- Profits wiped out by fees

How to Avoid:

- Reduce unnecessary trades

- Utilize Maker fees (-0.02%)

- Calculate cost of fees

Start now, join Hyperliquid, and become part of the global capital market traders.

Quick Start (Save 4% on Trading Costs)

Use invitation code: AICOIN88

Website:

https://app.hyperliquid.xyz/join/AICOIN88

📖 Beginner’s Guide! Hyperliquid First Trade Detailed Illustrated Tutorial

https://www.aicoin.com/zh-Hans/article/510225

Join our community, let's discuss, and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。