What trading pairs are available on Hyperliquid?

Hyperliquid offers over 50 trading pairs, covering various asset classes including cryptocurrencies, commodities, and meme coins.

Classification of Trading Pairs

Category 1: Mainstream Cryptocurrencies

- BTC-USDC

- ETH-USDC

- SOL-USDC

- XRP-USDC

- HYPE-USDC

Category 2: Commodities (Exclusive to Hyperliquid)

- GOLD-USDC (Gold)

- SILVER-USDC (Silver)

- COPPER-USDC (Copper)

Category 3: Ecosystem Coins

- LIT-USDC

- XYZ-USDC

- KPEPE-USDC

Category 4: Meme Coins

- PEPE-USDC

- DOGE-USDC

- SHIB-USDC

Liquidity Analysis

What is liquidity?

Liquidity refers to how many buyers and sellers in the market are willing to trade at prices close to the market price.

Characteristics of High Liquidity:

- Narrow bid-ask spread

- Orders executed quickly

- Stable prices

- Low slippage

Characteristics of Low Liquidity:

- Wide bid-ask spread

- Slow order execution

- High price volatility

- High slippage

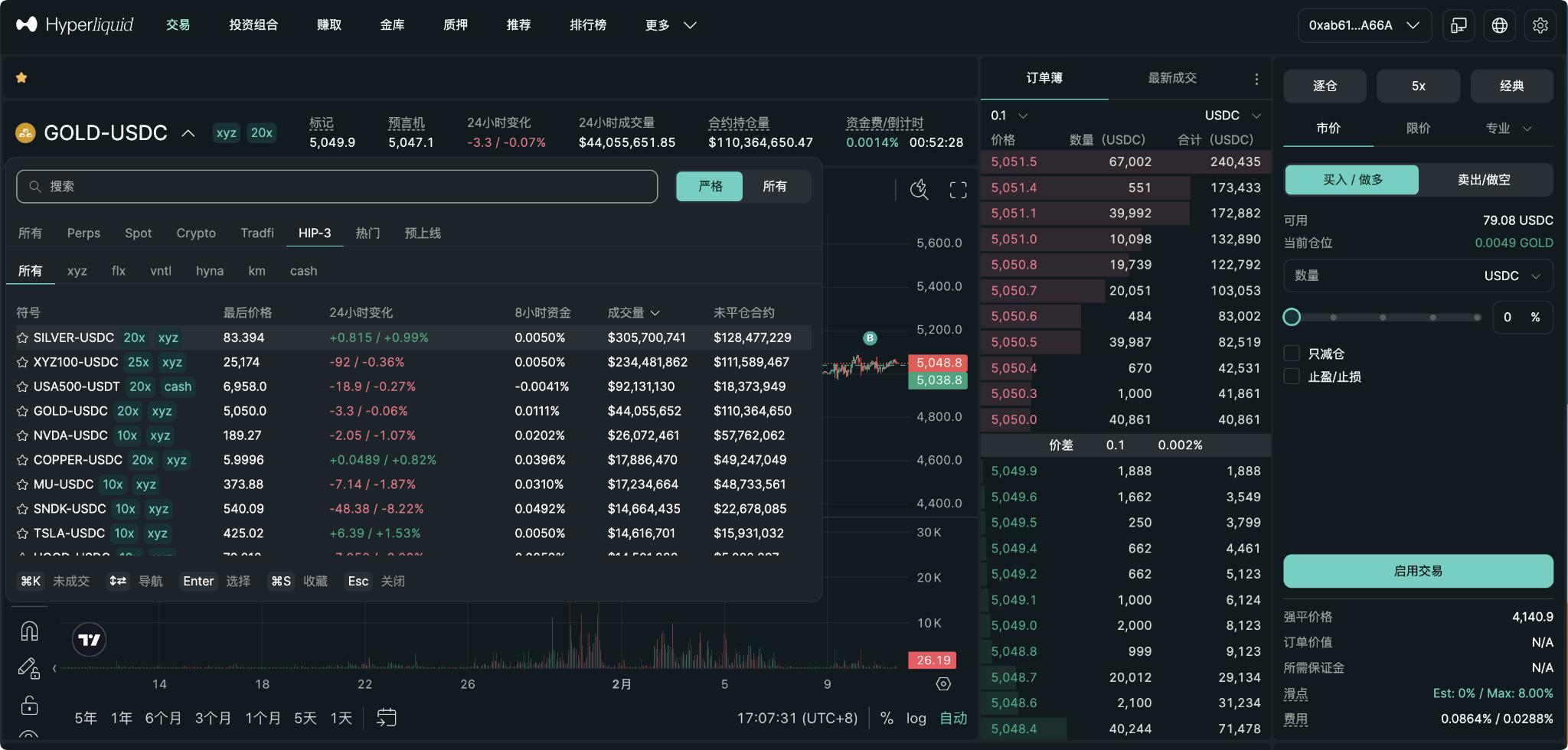

How to Evaluate Liquidity?

Metric 1: Order Book Depth

- Shows how much liquidity is available in the order book

- The greater the depth, the better the liquidity

- Unit: USD

Metric 2: Bid-Ask Spread

- The difference between the highest bid price and the lowest ask price

- The smaller the spread, the better the liquidity

- Unit: percentage or USD

Metric 3: 24-Hour Trading Volume

- Total trading volume over the past 24 hours

- The larger the volume, the better the liquidity

- Unit: USD

Metric 4: Open Interest

- Total value of all open positions

- The greater the open interest, the better the liquidity

- Unit: USD

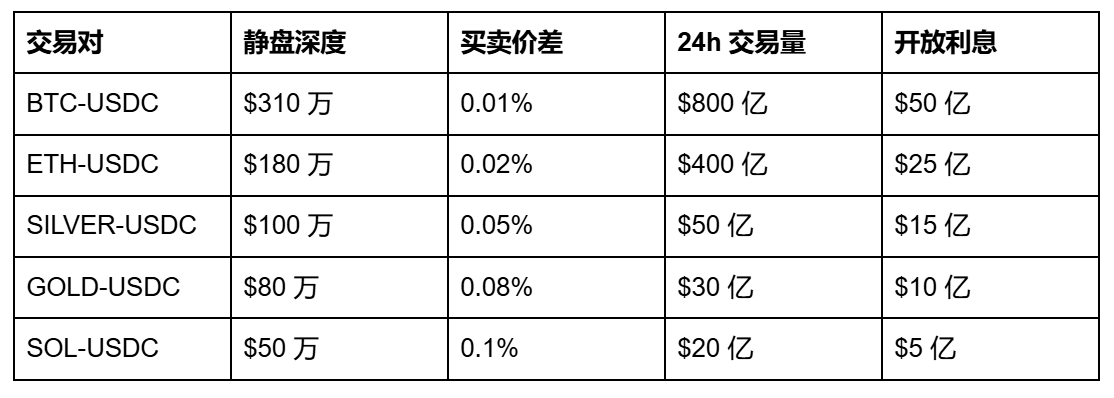

Comparison of Liquidity for Major Trading Pairs

Depth Analysis of Liquidity

What is "depth"?

Depth refers to how much liquidity is available within a certain price range.

Example: Depth of BTC-USDC

Asker (Ask):

Price $78,000: 50 BTC

Price $78,100: 100 BTC

Price $78,200: 200 BTC

Total ($78,000-$78,200): 350 BTC = $27.3 million

Bider (Bid):

Price $77,900: 50 BTC

Price $77,800: 100 BTC

Price $77,700: 200 BTC

Total ($77,700-$77,900): 350 BTC = $27.2 million

Total Depth: $54.5 million

Importance of Depth

The greater the depth, the lower the slippage

Slippage refers to the difference between your execution price and the market price.

Example:

Market Price: $78,000

You want to buy 10 BTC

If the depth is sufficient:

Execution Price: $78,010 (Slippage $100)

If the depth is insufficient:

Execution Price: $78,200 (Slippage $2,000)

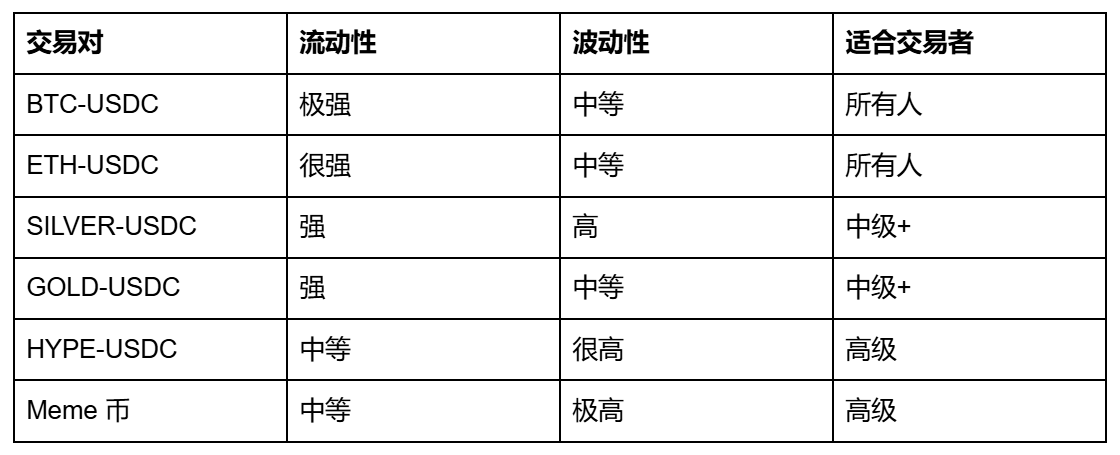

How to Choose Trading Pairs?

Considerations

1. Liquidity

- Choose trading pairs with high liquidity

- Avoid trading pairs with very low liquidity

- Check the order book depth and bid-ask spread

2. Volatility

- High volatility: High returns, also high risk

- Low volatility: Low returns, also low risk

- Choose according to your risk tolerance

3. Trading Hours

- Choose pairs that are traded 24/7

- Avoid pairs with trading time restrictions

4. Leverage

- Different pairs have different maximum leverages

- Choose leverage that suits your needs

Selection Recommendations

Beginner Traders:

- Choose BTC-USDC or ETH-USDC

- Highest liquidity

- Most stable prices

- Lowest risk

Intermediate Traders:

- Can try SILVER-USDC or GOLD-USDC

- Sufficient liquidity

- Moderate volatility

- Emerging trading pairs

Advanced Traders:

- Can try all trading pairs

- Choose flexibly according to market conditions

- Capitalize on liquidity discrepancies for arbitrage

Conclusion

Start now, join Hyperliquid, and become part of the global capital market traders.

Quick Start (Save 4% on Trading Costs)

Use invitation code: AICOIN88

Website:

https://app.hyperliquid.xyz/join/AICOIN88

📖 Beginner's Guide! Hyperliquid First Trading Super Detailed Visual Tutorial

https://www.aicoin.com/zh-Hans/article/510225

Join our community, let's discuss and become stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group Chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。